6 Charts To Explain The Fed Standoff With Inflation

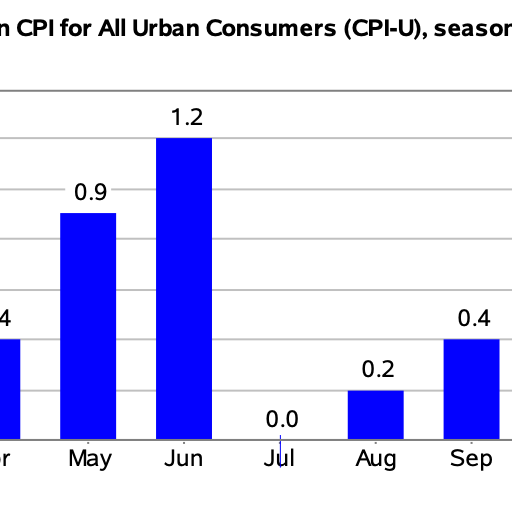

To investors, The month of March marks the one year anniversary since the Federal Reserve started aggressively hiking interest rates. Inflation remains persistently high at 6.4%, so it is hard to argue that the tighter financial conditions have had the intended impact. As I dug into the data this morning, I found a few things that were interesting. First, January’s 0.5% acceleration in the CPI was the most since October 2022 (also 0.5%) and you have to go back to June 2022 for a higher monthly acceleration. The general consensus is that higher rates should lead to lower inflation. This means the 2-year inflation expectations in the market should be declining as the Fed gets more aggressive, but as Lisa Abramowicz pointed out this morning, inflation expectations in the market have actually been increasing over the last 6 months.

Lisa Abramowicz @lisaabramowicz1

U.S. 2-year inflation expectations have surged over the past six months, despite tighter Fed policy.

1:16 PM ∙ Mar 2, 2023

86Likes35Retweets

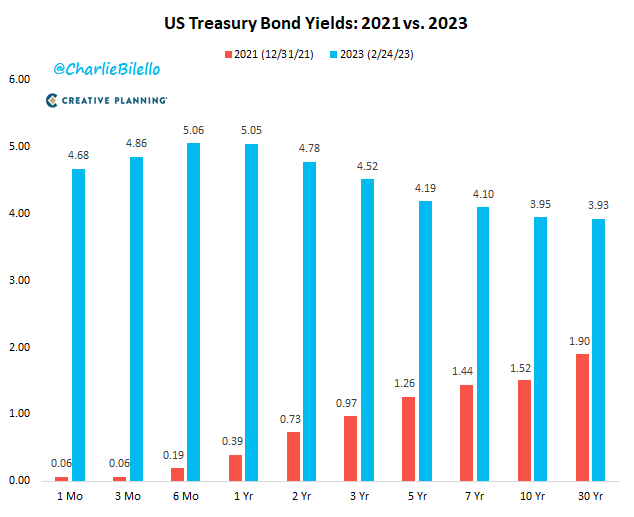

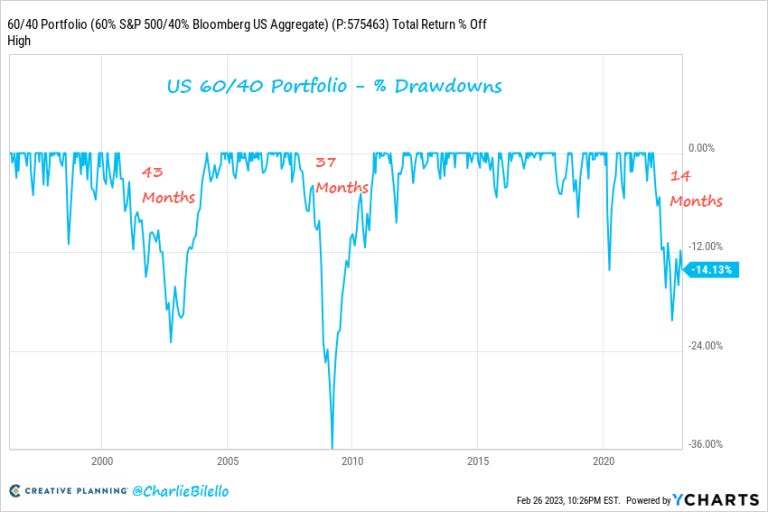

Inflation expectations are not the only place where the market is being distorted by this central bank intervention though. Charlie Bilello points out that US Treasury yields have gone from historic lows to 16-year highs in just over a year. Charlie goes on to highlight the Fed’s tightening has had on the classic 60/40 portfolio. He writes “a US 60/40 portfolio is currently in a 14-month drawdown, 14% below its high. This is now the longest drawdown for a 60/40 portfolio since the financial crisis (37 months) and before that the dot-com bubble (43 months).” As we see the standard portfolio allocation crashing in value, and the depletion of individual’s savings, we know credit card debt has been rising. Couple that rising debt with increasing interest rates and you would expect delinquencies on this debt to be increasing as well…… Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

© 2023 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||