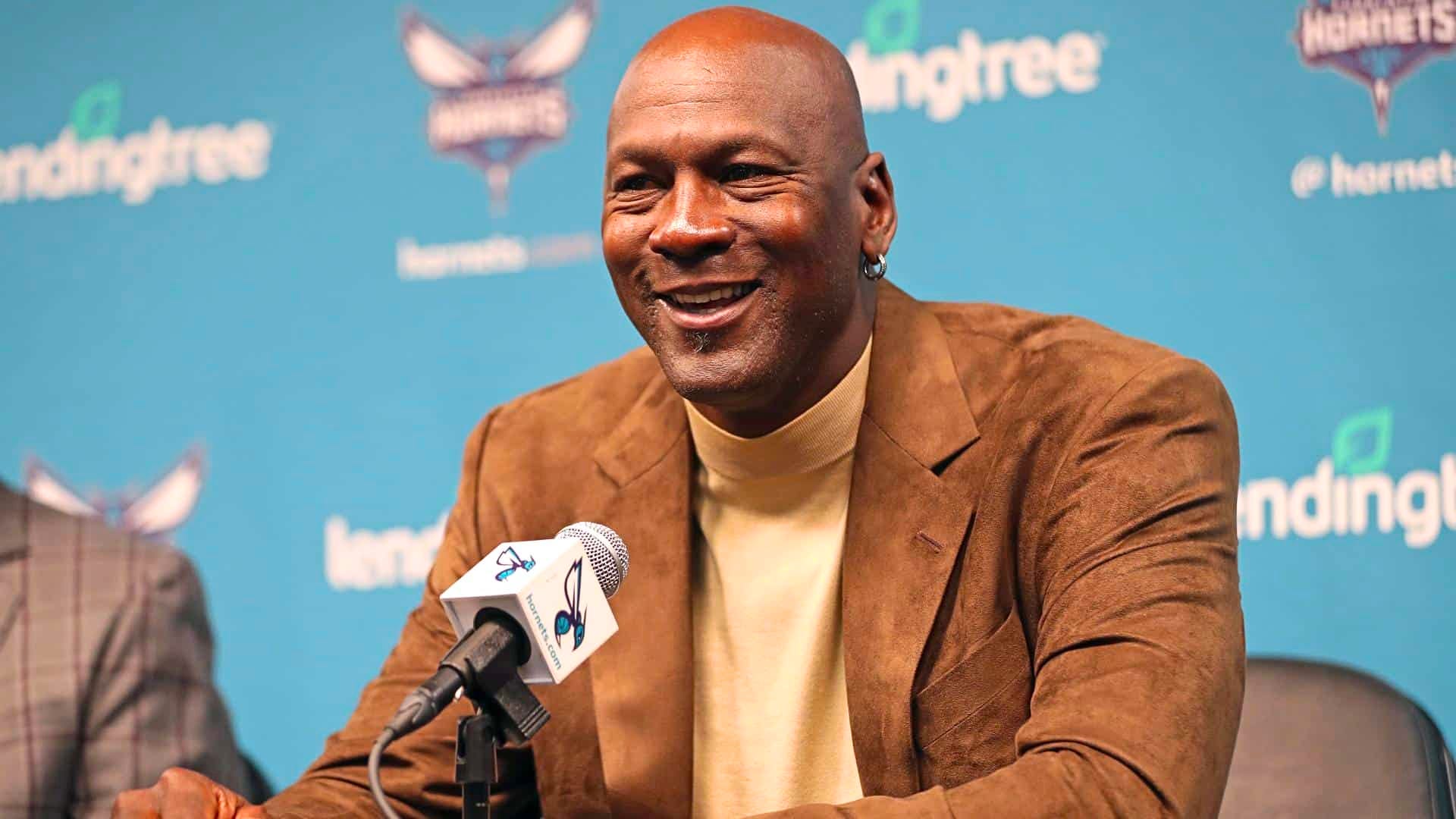

How Michael Jordan Turned $25 Million Into $3 Billion By Buying The Charlotte Hornets For Pennies On The Dollar

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 100,000+ others who receive it directly in their inbox each week. Today At A Glance:Michael Jordan shocked the sports world last week when he announced that he was selling his controlling stake in the Charlotte Hornets at a $3 billion valuation. So today’s newsletter breaks down how Michael Jordan acquired the team for pennies on the dollar, why they have performed so poorly on the court, and how he’s set to make more money on this one deal than his 40-year partnership with Nike. This newsletter is also available via podcast on Apple or Spotify. Enjoy! This Newsletter is Sponsored By ButcherBox!I’ve been ordering from ButcherBox for a few years now, and it’s the single best solution I’ve found to save time while guaranteeing the quality of your food. ButcherBox delivers 100% grass-fed grass-finished beef, free-range, organic chicken, humanely raised pork, and wild-caught seafood directly to your doorstep. Yes, it’s literally that easy — and it tastes incredible! So ditch the butcher lines today and guarantee the freshness of your meat with ButcherBox. And here’s the best part: If you sign up today, ButcherBox is offering all Huddle Up readers 2 lbs of ground beef for FREE every time they order over the next year. So sign up using the link below, and everyone in your household will thank you later. Friends, Michael Jordan’s partnership with Nike is the best sports business deal in history. We all know the story by now: MJ loved Converse coming out of UNC. But when the brand said they would treat him just like any of their other superstars (Magic Johnson, Larry Bird, etc.), Jordan reluctantly signed with a young company called Nike. Nike’s basketball business was nonexistent at the time. So they offered Jordan a massive 5-year, $500,000, all-cash deal that could potentially reach $2.5 million in total compensation through the launch of his own signature shoes, clothing, and more. But since this deal was 4-5x larger than other NBA players were getting at the time, and Jordan still hadn’t played a single NBA game yet, Nike gave themselves an out. If Michael Jordan didn’t become an NBA All-Star, win Rookie of the Year, average 20 points per game, or sell $4 million in shoes within the first three years, Nike could exit the deal without paying him the remaining amount of money on the contract. Well, that didn’t happen — because in addition to Michael Jordan becoming an NBA All-Star, winning Rookie of the Year, and averaging 29 points per game, Nike also sold $125 million in sneakers his first year, shattering their initial $4 million goal. And the rest is history. MJ later signed a royalty deal with Nike that pays him about five percent of all Jordan brand sales. And with the Jordan Brand passing $5.1 billion in revenue last year, Michael Jordan earned $255 million in royalties alone. For context, that’s nearly 3x more than his entire NBA career earnings of $93.7 million. But the story gets even crazier — because despite earning nearly $2 billion from Nike over the last 40 years, MJ just closed an even bigger deal with his Charlotte Hornets. Robert Johnson might be worth more than $500 million today, but he is also probably the only person in history to lose money while owning an NBA franchise. In 2002, the BET Network founder paid $300 million to obtain the rights to the NBA’s expansion franchise Charlotte Bobcats. Johnson then pledged to invest an additional $30 million on top of that, and he laid out a master plan that involved launching a regional sports network with the team’s television broadcast rights. But none of that worked, to say the least. Johnson’s regional sports network failed after just one year, causing him to agree to a below-market distribution deal with Time Warner Cable that also gave them the arena naming rights for free. Furthermore, the Charlotte Bobcats lost $25 million per year during the first four years of Johnson’s ownership tenure. And Johnson gutted the entire marketing and operations department in 2006, firing more than 40 employees in a single month and leaving behind a skeleton crew of empty cubicles and overworked employees. Still, Robert Johnson downplayed what was going on in Charlotte, telling fans, “If you’re able to put together a winning combination on the court, it’s going to have an impact on your ability to sell tickets, attract sponsorships and advertisers.” So Johnson went out and found the best person he could to build a winning team: Michael Jordan. Jordan agreed to invest several million dollars for a small minority stake in the Charlotte Bobcats in exchange for complete control of all basketball decisions. It sounded like a good idea at the time. MJ might have failed running the Washington Wizards just a few years earlier. But he was the greatest basketball player ever, and many people assumed his knowledge alone would be enough to build a winning team. Well, not exactly. The Charlotte Bobcats spent hundreds of millions of dollars on free agents, fired and hired new coaches, and drafted several players in the Top 10 of the NBA Draft, including Adam Morrison (#3), Brandan Wright (#8), and D.J. Augustin (#9). But the Bobcats still didn’t make the playoffs a single time (or have a winning record) from 2005 to 2009. And their attendance actually dropped under Michael Jordan. Charlotte Bobcats Total Attendance

So with mounting debt and most of his cash tied up in illiquid private equity investments, Robert Johnson was forced to sell the team for pennies on the dollar. He initially wanted between $325 million and $350 million for the team. But with several million dollars in upcoming interest payments on the team’s $40 million in bank debt, Johnson sold the team to Michal Jordan at a reported $275 million valuation in 2010. But that’s only half the story — because Michael Jordan really only put down $25 million in cash on an equity valuation of $170 million, and the remaining $105 million of enterprise value was mostly comprised of existing debt on the team’s business. So, in simple terms, Jordan paid just $25 million out of pocket to buy the team. But fast forward a decade, and Michael Jordan’s ownership tenure is ending, too. On one hand, many people will say Michael Jordan failed as an NBA owner. They’ll point to the fact that the Bobcats (now Hornets) made the playoffs just 3 times under his 13 years as majority owner, never finishing higher than 6th in the Eastern Conference standings. They’ll say that the team never won a single playoff series and had the 5th-worst winning percentage with him as the owner. And they’ll also say the Hornets never ranked above 15th in NBA attendance, despite Charlotte consistently being ranked as one of the fastest-growing cities in the United States. And these people are technically correct. Although, MJ probably doesn’t care. That’s because Michael Jordan is selling his majority stake in the Charlotte Hornets at a $3 billion valuation. For context, that’s 2x more than the $1.5 billion valuation MJ commanded when he sold a 20% minority stake in the Hornets in 2020. Furthermore, it’s a 70% higher price tag than the $1.77 billion valuation Forbes handed the team just last year. And it’s also 11x the $270 million in revenue that the Charlotte Hornets brought in 2022, which is a substantially higher revenue multiple than what the average team across the NHL (5.0x), MLB (7.4x), NFL (7.6x), NBA (8.4x) and MLS (10.2x) would typically see on a sale. Top 10 Most Expensive Sports Franchise Sales Ever

*This valuation for the Milwaukee Bucks was established in a 25% ownership stake sale to the Haslam Sports Group in April 2023. And it’s not like these valuations are usually that far off. Take the Utah Jazz, for instance. When Ryan Smith bought the team for $1.66 billion in 2020, he literally pulled out his phone during negotiations, Google’d what the current Forbes valuation was, and then offered that number ($1.66 billion) to the current owner at the time. So rather than ask “Why did Michael Jordan sell the team for $3 billion,” the better question is “Why did Gabe Plotkin and Rick Schnall buy the team for $3 billion?” And that’s a much more complicated answer. Sure, there are some negatives to deal with, like the current destruction of regional sports networks or the $275 million renovation that is scheduled to be completed in the coming years on Charlotte’s arena. But there are also a lot of positives. Sports teams are intentionally scarce assets — there are only 30 NBA teams! The league is currently negotiating its next media rights deal, attempting to triple its current $25 billion deal to $75 billion. And with new NBA rules allowing private equity funds, pension funds, endowments, and even sovereign wealth funds (hello, Saudi!) to take minority stakes in individual franchises, many insiders believe NBA valuations could double again within the next 5-10 years. So in the end, this might end up being a great deal for all parties involved. If you enjoyed this breakdown, please consider sharing it with your friends. My team and I work hard to consistently create quality content, and every new subscriber helps. I hope everyone has a great day. We’ll talk on Friday. Interested in advertising with Huddle Up? Email me. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Want More Detailed Sports Business Breakdowns? Subscribe To JPS.The Joe Pomp Show is a 3x weekly podcast where I break down the business and money behind sports. Think of it as the same high-quality work you read here, just deeper. There are also exclusive interviews with people like Dana White, Lance Armstrong, and Troy Aikman, and you’re guaranteed to learn something new. Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 100,000+ others who receive it directly in their inbox each week.

© 2023 |