Gemini users want their money back

Gemini users want their money backWeekly Recap: Genesis still owes Gemini $900M, SBF was a Swiftie?

Do you work for a DAO? Get affordable, premium healthcare by signing up with Opolis. Dear Bankless nation, Crypto never stays boring for long. As the FTX contagion shakes out we’re learning about more and more companies exposed to SBF and Alameda. This week certainly had some shocks. For this week’s recap:

– Bankless team 📅 Weekly RecapHere’s a recap of the biggest crypto news in the first week of December. 1. Genesis owes GeminiGemini was lending to Genesis which was lending to FTX. FTX blew up, so Genesis is now somewhat insolvent, and owes Gemini money. A Financial Times article reports this week that the digital brokerage firm Genesis owes a whopping $900M to Gemini customers. Genesis announced Wednesday in a client letter that the issue will be resolved in weeks, not days. Genesis is also owed $575M from its parent company Digital Currency Group (DCG).

Ram Ahluwalia, crypto CFA @ramahluwalia

1/ Genesis is the only full-service prime broker in crypto. Genesis was a gem in the DCG portfolio. It plays an critical role in enabling large institutions to access & mange risk. The $1 Bn question – where does Genesis go from here? A thread on Prime brokers & Genesis

2:20 AM ∙ Nov 20, 2022

2,417Likes613Retweets

Gemini is an exchange. But it was lending to Genesis as part of its “Earn” program that promised yields to customer’s deposits. Earn was halted in November 16, shortly before FTX filed bankruptcy. Cameron Winklevoss reported that Gemini is in the process of coordinating with other creditors. Genesis tried to raise $1B before cutting it to $500M on November 21st. Is Genesis on the verge of bankruptcy? For the full story on Genesis’ troubles, see this analysis from Bankless analyst Jack Inabinet. 2. Just SBF thingsIt was another busy week for SBF (and those in his circle). FTX’s trading firm Alameda was reportedly secretly funding The Block. A sum of $16M went towards the purchase of a Bahamas apartment for Block CEO Michael McCaffrey. Chief revenue officer Bobby Moran is taking over as CEO.

Mike McCaffrey @McCaffrMike

1/ I have difficult news to share. I’m stepping down as The Block’s CEO. While it’s personally painful, it’s the right thing for The Block and the team.

7:56 PM ∙ Dec 9, 2022

379Likes114Retweets

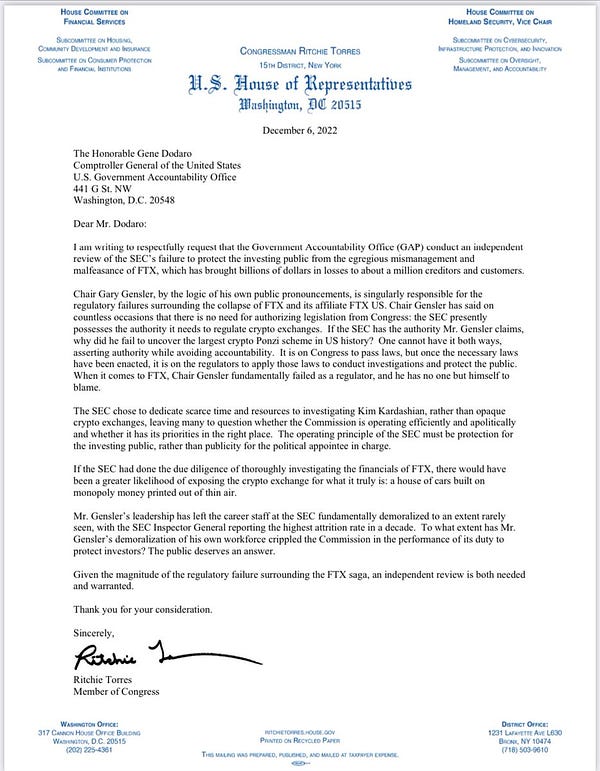

In “hiring news”, Sam has hired Mark Cohen as his attorney, a lawyer that has represented some high profile clients including drug lord El Chapo and Ghislaine Maxwell in her sex trafficking trial. FTX is also hiring forensic investigators from the AlixPartners consultancy – the firm hired in Bernie Madoff’s case – to trace the missing billions on FTX’s accounting sheet. Rep. Ritchie Torres (D-NY) is asking the U.S. Government Accountability Office to look into the SEC Chair Gary Gensler’s “failure to protect the investing public from the egregious mismanagement and malfeasance of FTX.”

Alexander Grieve @AlexanderGrieve

NEW this morning — Rep. @RitchieTorres (D-NY) calls on the Government Accountability Office (@USGAO) to investigate the SEC’s “failure to protect the investing public from the egregious mismanagement and malfeasance of @FTX_Official”

2:07 PM ∙ Dec 7, 2022

634Likes179Retweets

Finally, Sam was apparently trying to negotiate a sponsorship deal of ~100M that involved the use of NFTs for ticketing with… Taylor Swift. Some of FTX’s advertising deals featured Tom Brady, Larry David and Shaquille O’Neal. We wish them all the best in shaking FTX’s bad rep off.

RYAN SΞAN ADAMS – rsa.eth 🏴🦇🔊 @RyanSAdams

She knew Sam was trouble when he walked in

10:20 PM ∙ Dec 7, 2022

255Likes12Retweets

3. FTX contagion hits Maple lenderMaple Finance is DeFi’s largest undercollaterized lending platform. These protocols allow institutions to borrow crypto from DeFi users or other TradFi players without having to stake any capital as collateral. If it sounds risky, it is. What’s at stake with undercollaterized lending is the borrower’s reputation (and an off-chain binding legal agreement), typically TradFi firms who have been KYC’d and whitelisted by Maple’s credit analysts themselves. It’s more akin to “CeDeFi” with added transparency and avoidance of commingling of funds from the loans being on-chain in separate smart contracts. For more on this sector, see Bankless’ Ultimate Guide to Undercollaterized Lending. It turns out that one of Maple’s lenders, Orthogonal Trading, was “misrepresenting its financial position” in FTX contagion, leading Maple to sever ties this week. Orthogonal is a longtime borrower on the Maple platform and is defaulting on loans totaling $36M in two credit pools: M11 USDC and Maven M11 WETH. That makes up about 30% of loans on Maple Finance. The DeFi insurance protocol Nexus Mutual was also one of the lenders to the M11 WETH pool. Nexus is reporting $3M exposure, making up about 2% of its assets. 4. ZK-DeFi is taking offThe Aztec Network is leading frontier in DeFi privacy. It’s an Ethereum L2 chain powered by ZK-technology that lets users in DeFi bridge, stake and earn yield with complete privacy. See Bankless on how to use DeFi privately for more on Aztec. Aztec announced that more than 50K ETH ($60M) across 500K network transactions has been transacted on its platform since launch.

Aztec @aztecnetwork

Pleased to announce that Aztec Connect has crossed 50,000 $ETH shielded since launch. That’s $60m+ of $ETH now being sent and earning yield privately.

9:45 PM ∙ Dec 5, 2022

255Likes37Retweets

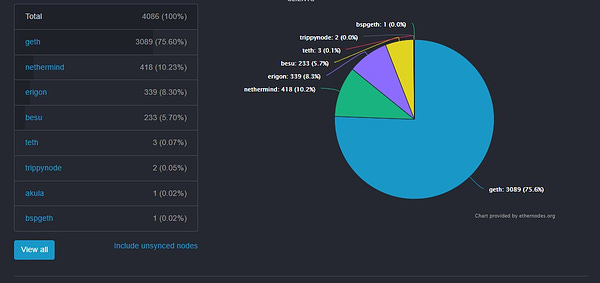

A new dashboard at tornado-warning.info lets you track all Tornado Cash transactions that are processed through non-censoring relays. 5. Good things ahead for EthereumEthereum’s next major network upgrade is the Shanghai hard fork. In a developer call this past Thursday, developers are targeting the upgrade for March 2023. The Shanghai hard fork aims to achieve a variety of technical improvements that upgrade the Ethereum Virtual Machine. But the key change that everyone has their eyes on is the opening up of staked ETH withdrawals from the Beacon Chain. More good news: Ethereum client diversity is improving. Nethermind is seeing an uptick to 10% usage from 5.7% in October, while Geth has dropped from 81% to 75.6%.

Tomasz K. Stańczak @tkstanczak

10% of Ethereum mainnet nodes running @nethermindeth ! what an effort from the team, congrats! they gave all they had through the Merge and after, legends users keep pushing – it is getting better every day thanks to you!

11:42 PM ∙ Dec 6, 2022

210Likes40Retweets

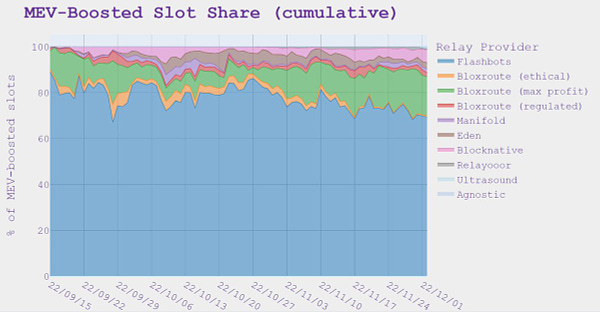

Relayer diversity is also improving, with Gnosis and Ultrasoundmoney launching their own relays. If you’re new to the MEV topic, see Bankless’ A Beginner’s Guide to Ethereum Censorship.

Toni Wahrstätter 🦇🔊 @nero_eth

The Flashbots relay dropped to <80% market share while @bloXrouteLabs max-profit is slowly catching up. In the meantime, we saw two new relayers (of @GnosisDAO and @ultrasoundmoney) launching. Relay diversity improving, check.

1:20 PM ∙ Dec 5, 2022

135Likes21Retweets

(Bonus) DeFi for good2022 has kind of been a series of disasters for crypto. Our friends at Bankless DAO are reminding those of us in developed nations this week why crypto is a humanitarian force in the developing world. Tap into the full Bankless DAO article DeFi for Good 👈 article here, and check out a few of the takeaways below. Crypto is a lifeline for the average Argentinian living in an inflation-rampant economy:

Millions are using crypto for fast and cheap remittances:

Crypto is economic freedom for Greece:

Other news:Here’s what we have lined up next week.

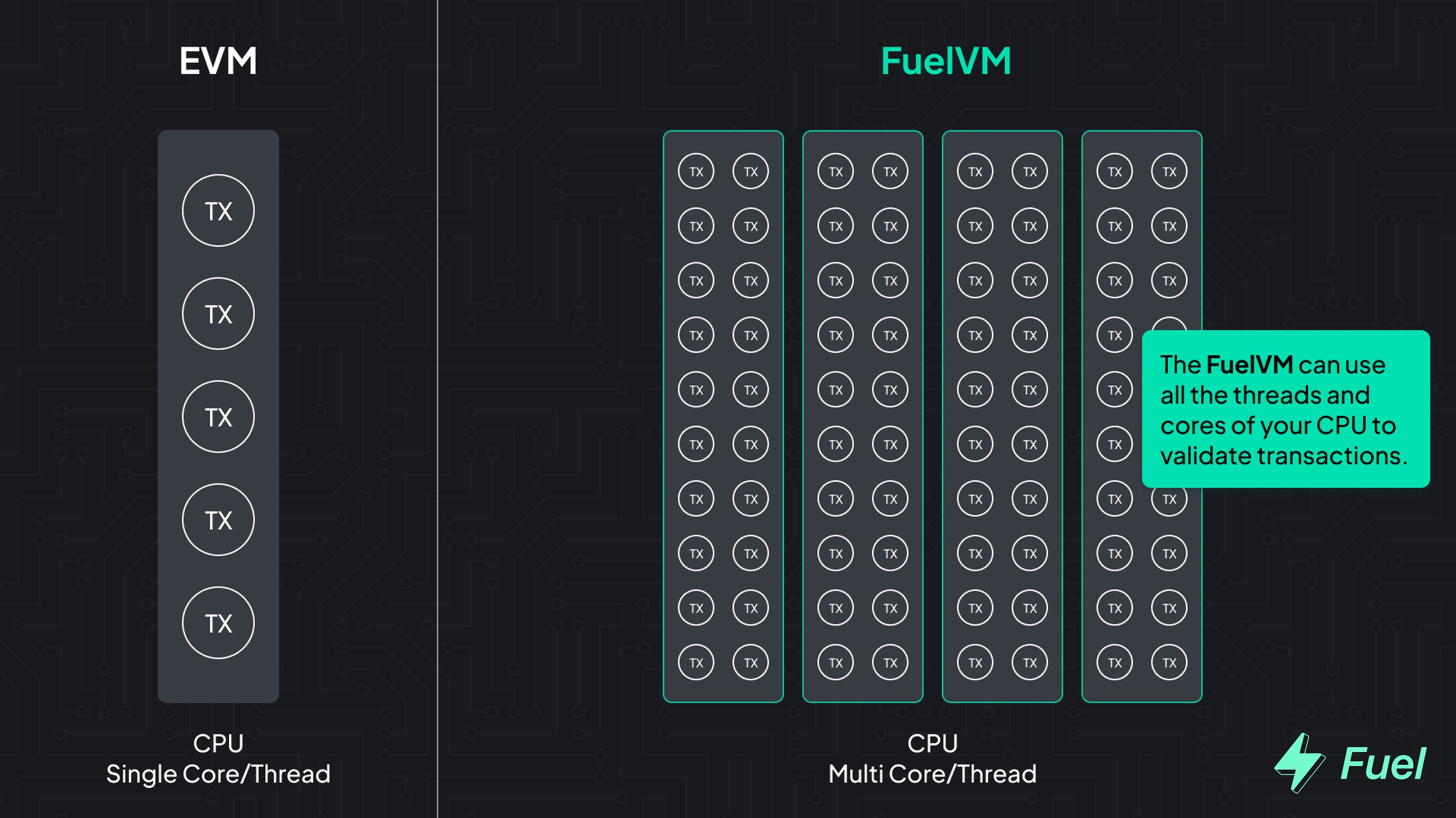

– Bankless team 🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! 📅 Recap for the week of December 10th, 2022READ 📚WATCH 🔊METAVERSAL 🧙♂️BANKLESS DAO 🏴GREEN PILL 🌳Weekly Subscriber Perks 🔥Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you. 🎙️ NEW WEEKLY ROLLUPListen to podcast episode | Apple | Spotify | YouTube | RSS Feed Jobs opportunities 🧑💼✨See all listings on the Bankless Job Board✨ Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto) 🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2022 Bankless, LLC. |