No Bailout for SBF

Do you work for a DAO? Get affordable, premium healthcare by signing up with Opolis. Dear Bankless nation, This week, justice came for SBF who was arrested by police in The Bahamas and is facing extradition after a laundry list of charges were filed by U.S. authorities. It’s about time. Crypto supporters were skeptical Sam would get his comeuppance due to his political connections, but it appears the government is ready to throw the book at the FTX founder. What charges, if any, await his FTX co-conspirators might be a different story. Read along for more details, and other news highlights from the week. – Bankless team p.s. Premium Subscribers can listen to our interview with Vitalik on the future of Ethereum in Early Access now. 📅 Weekly RecapHere’s a recap of the biggest crypto news from this past week. 1. Steal Customer Funds? Right to JailThe U.S. is filing formal criminal charges of wire fraud and securities conspiracy against Sam this week, so the Bahamas Police Force arrested Sam this Tuesday in anticipation of a formal extradition request. Here’s the footage of police escorting a suited-up Sam.

Magus Wazir || The One Who Rings 🔔 @MagusWazir

BREAKING: Footage of SBF arrest in the Bahamas.

9:23 PM ∙ Dec 16, 2022

21Likes2Retweets

Sam has been denied bail as the “risk of flight is so great… [and Sam] ought to be remanded in custody”, said Bahamian chief magistrate Joyann Ferguson-Pratt. The Commodity Futures Trading Commission (CFTC) is also charging Sam, FTX and Alameda on eight separate charges including wire fraud, commodities fraud, money laundering and campaign finance violation. A choice quote:

In a hearing with FTX CEO John Ray, Congressman Tom Emmer beseeches the public to understand the FTX debacle as fundamentally a “failure of centralization and business ethics” that decentralized, immutable blockchain technology seeks to solve. He also comes with some tough questions around the relationship between FTX and the SEC: On the other side of the coin, Kevin O’Leary of Shark Tank fame is arguing in a formal testimony that FTX’s failure stemmed from Binance “intentionally” putting it out of business. Make of this what you will.

Watcher.Guru @WatcherGuru

JUST IN: Kevin O’Leary testifies at Senate hearing and says #Binance intentionally put FTX out of business.

4:40 PM ∙ Dec 14, 2022

17,817Likes3,803Retweets

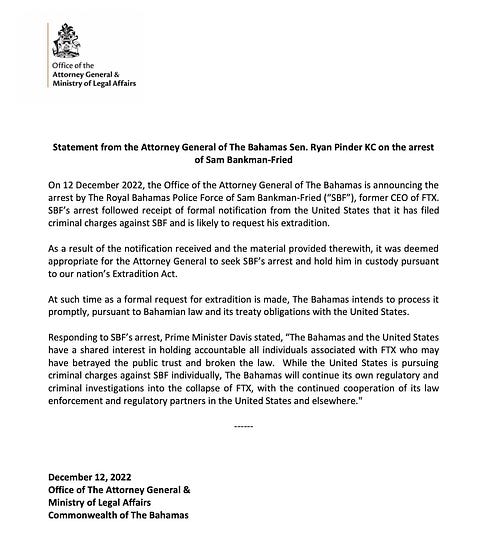

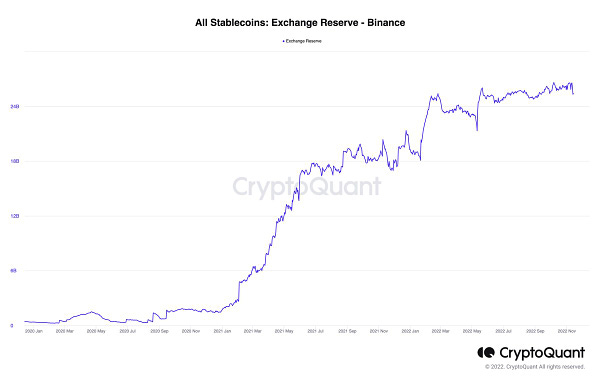

2. Binance Raises EyebrowsWhile crypto tries to mentally move past the FTX blow-up, people have been putting a more skeptical eye on another massive central exchange. Binance saw a significant outflow of ~$5-6B in funds earlier this week. What’s the reasoning this time around? Binance released a half-baked 5-page “proof-of-reserves” audit from auditing firm Mazars earlier this week that set off Crypto Twitter’s bullshit meter. The “audit” excluded all other cryptoassets and looked only at Binance’s Bitcoin assets and liabilities. Even Mazars themselves issued strong disclaimers around the methodology of the audit in the report:

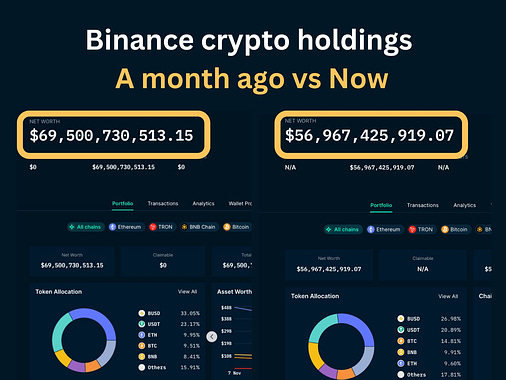

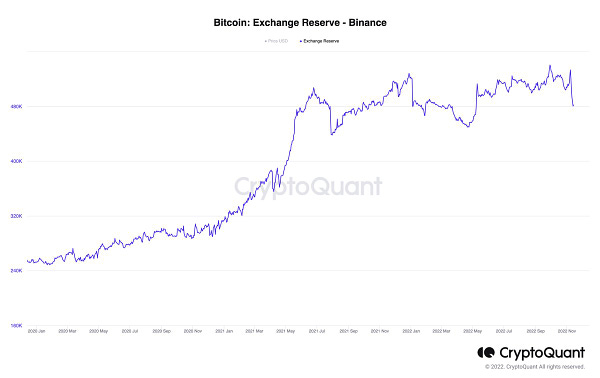

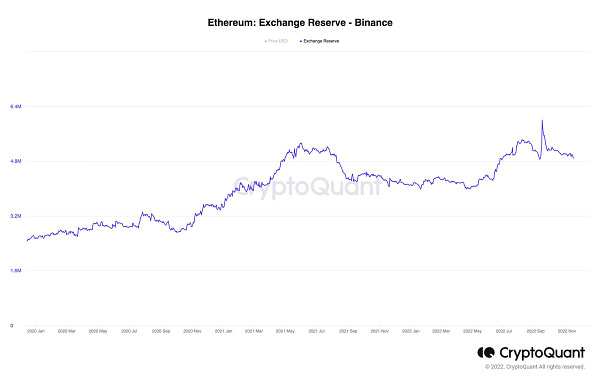

As of Friday, Mazars has reportedly stopped all work with crypto companies for proof-of-reserves. But even though the words “bank run” are being thrown around a lot, Binance’s solvency situation may be less grim than you think. Binance’s proof-of-reserves as captured on a Nansen dashboard 24 hours ago still showcases a war-chest of $57B, down from $70B a month ago.

More on this on our Monday newsletter next week.

GPT-nic @nic__carter

this is the ‘bank run’ at Binance you’re all hyperventilating about (data @cryptoquant_com @ki_young_ju)

6:04 PM ∙ Dec 14, 2022

1,099Likes183Retweets

Finally, the U.S. Justice Department is also reportedly closing in on charging Binance for “possible money laundering and criminal sanctions violations” as part of a multiyear-long investigation since 2018, according to Reuters. 3. Spicy NFT HappeningsA class-action lawsuit is being launched against Yuga Labs. The charge? Celebrities that were scooping up Bored Apes in the past year didn’t really buy it on their own accord, but were secretly paid by Yuga as part of an orchestrated scheme through the crypto payment firm MoonPay to inflate its price, create ApeCoins “out of thin air” and “mislead” retail buyers into buying “losing investments at drastically inflated prices.” The Bored Apes floor price is down ~56% to 69 ETH from an all-time-high of 158 ETH in April 2022. Some of the celebrities in the lawsuit include Jimmy Fallon, Justin Bieber, Madonna, Paris Hilton, Kevin Hart, Snoop Dogg, Post Malone and more. Elsewhere, the 45th President of the United States of America Donald J. Trump is dropping his own NFT collection on Polygon. All for the price of $99 per card. The collection has a larger than ordinary supply of 45,000 images of Trump wielding boxing gloves, cowboy hats, rugby balls, semi automatic rifles… you get the idea. And — of course — the collection sold out in hours.

CollectTrumpCards @CollectTrump

SOLD OUT IN HOURS. WE MADE HISTORY! Thank you! @realDonaldTrump #MajorAnnouncement #TrumpCard

5:21 AM ∙ Dec 17, 2022

264Likes64Retweets

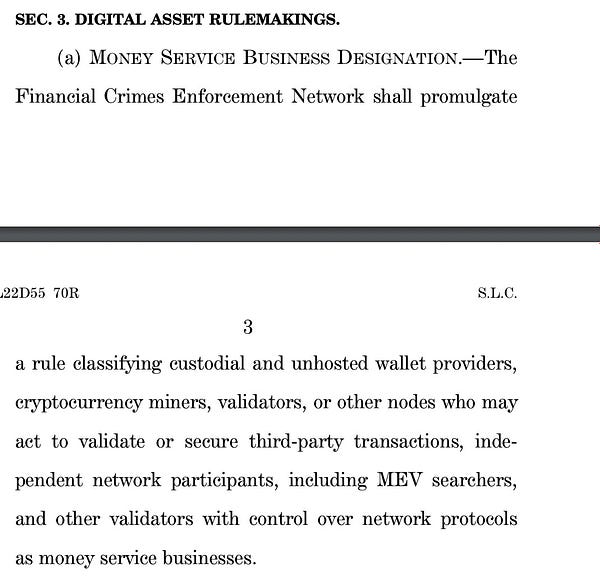

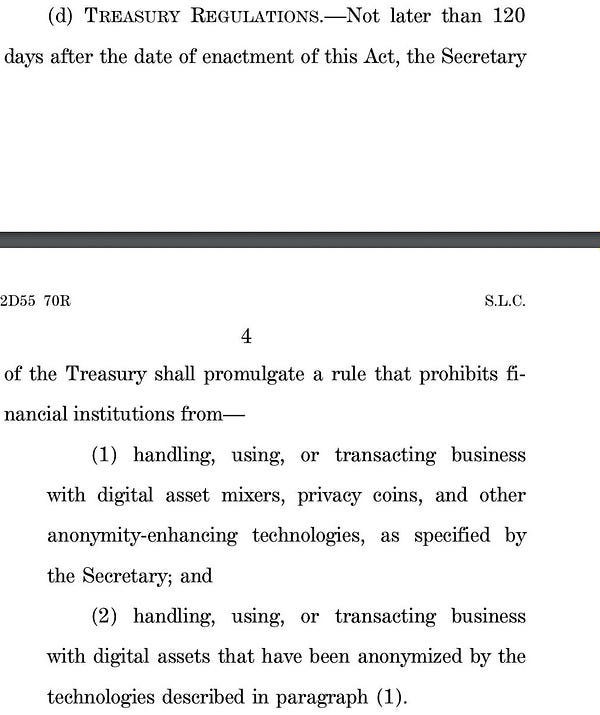

4. Politicians Gonna PolitickElizabeth Warren is trying to introduce a bill – Digital Asset Anti-Money Laundering Act – that would effectively create AML/KYC rules around wallet providers, block validators/miners, MEV searchers and more. Jake Chervinsky seems to think the bill is more of a political stunt than anything, so there’s that.

RYAN SΞAN ADAMS – rsa.eth 🏴🦇🔊 @RyanSAdams

This bill by @SenWarren and @RogerMarshallMD is the most significant attack on digital freedom i’ve ever seen. It turns validators into money services businesses It bans financial privacy It turns America into a full on surveillance state This is how western democracies die

3:43 PM ∙ Dec 14, 2022

1,512Likes420Retweets

5. PayPal x MetaMaskConsenSys is announcing a huge collaboration with PayPal this week that lets retail buy crypto directly via MetaMask.

MetaMask 🦊💙 @MetaMask

Our US users will now be able to fund their wallet with ETH via @PayPal! 🦊 Rolling out in the next weeks in the US, excl. Hawaii, through our mobile app (make sure to update to v5.13.0)🧵👇 consensys.net/blog/press-rel…

consensys.netConsenSys Teams with PayPal for A New Way To Buy Crypto in MetaMask | ConsenSysPayPal will seamlessly integrate within the MetaMask wallet, providing customers with a simple and convenient way to buy Ethereum with …

6:00 PM ∙ Dec 14, 2022

4,618Likes1,253Retweets

If you’re thinking that this isn’t decentralized at all – you’d be right. PayPal still controls who has access to its payment rails, so it’s not a DeFi product. The second way to look at this is: it’s still an improvement on the status quo. With everything that’s been going on around crypto this past year, centralized exchanges have been increasingly treated as a vehicle merely meant for on and off-ramping from TradFi into the trustless rails of DeFi. In that CeDeFi layer of the crypto world, more competition in centralized onramping is a huge plus, particularly for one of the largest and efficient payment processors of the world. And what better way but to ramp directly onto crypto’s biggest non-custodial wallet? More on crypto on/off-ramps in one of next week’s newsletters. 👀 Other news:

Here’s what we have lined up next week.

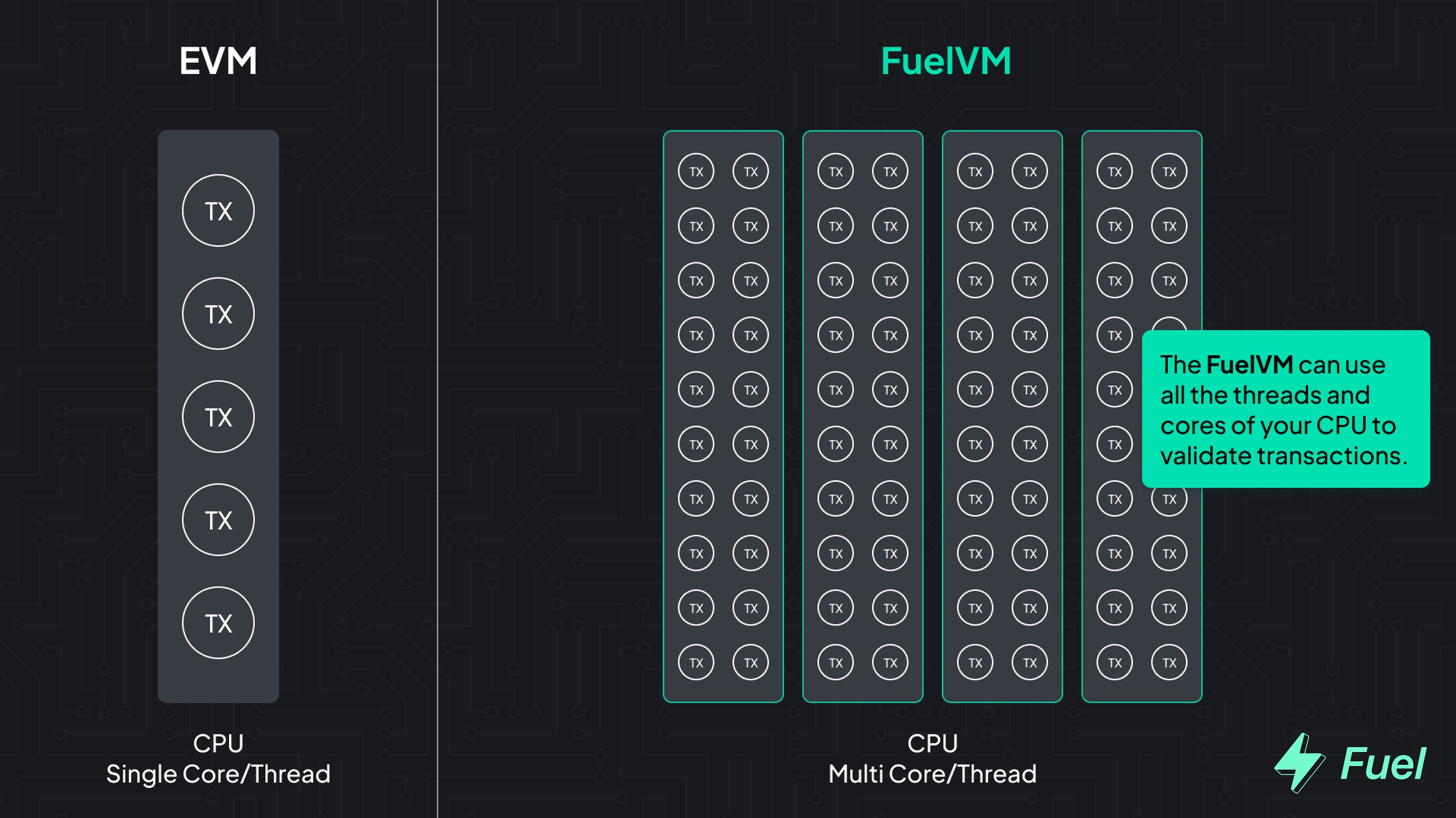

🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! 📅 Recap for the week of December 10th, 2022READ 📚WATCH 🔊METAVERSAL 🧙♂️BANKLESS DAO 🏴GREEN PILL 🌳Weekly Subscriber Perks 🔥Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you. 🎙️ NEW WEEKLY ROLLUPListen to podcast episode | Apple | Spotify | YouTube | RSS Feed Jobs opportunities 🧑💼✨See all listings on the Bankless Job Board✨ Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto) 🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2022 Bankless, LLC. |