Solana is in trouble

Born in 2011, Kraken is the industry-leading crypto exchange in security and transparency. Verify the backing of Kraken’s reserve assets thanks to regular Proof of Reserves audits. Dear Bankless Nation, There’s never a dull week in crypto, even in the last week of the year. For our very last newsletter of 2022 (we’ll return to our Saturday delivery of Weekly Recap next week), we look at the turbulent fall of Solana, an SBF-ordained “Ethereum killer,” which is gasping for breath as many in the space predict a complete collapse. We break down other troubles from the week including: 1. Solana in Trouble? – Bankless team PS: Tune into our new episode with Erik Voorhees which just dropped in Early Access for Premium Subscribers. “Why are we here? | Erik Voorhees“ 📅 Weekly RecapHere’s a recap of the biggest crypto news from this past week. 1. RIP Solana?

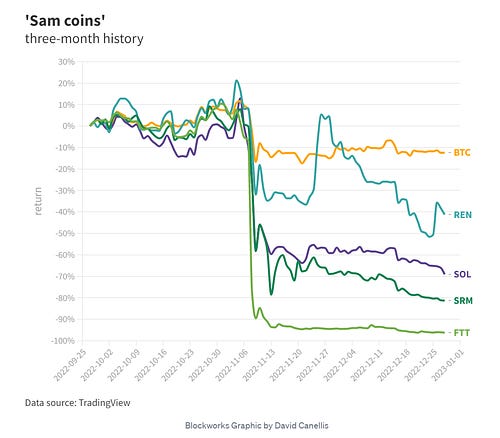

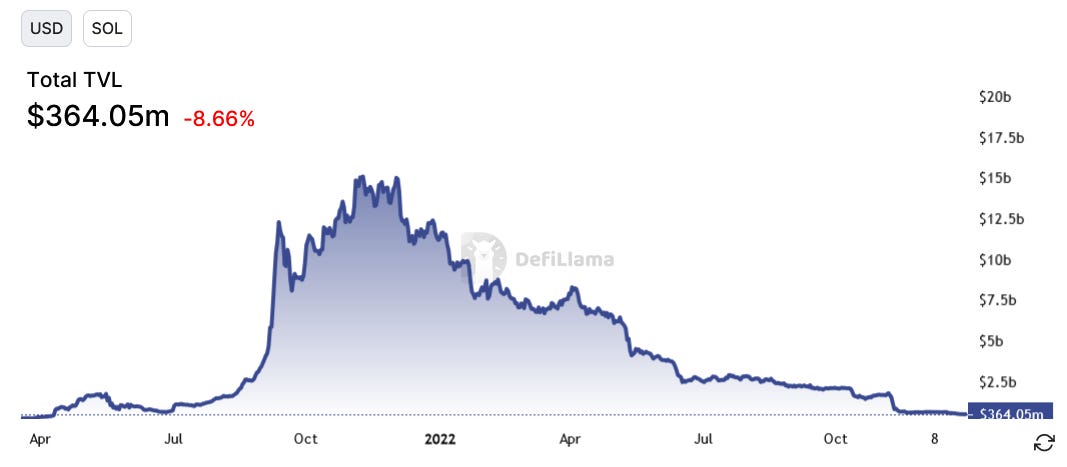

The talk of the town this week is the predicament facing Solana, once known as the “ETH killer” chain. The knock-on effects of FTX’s implosion continues to ripple through the Solana ecosystem. Why? FTX was a significant investor in Solana. Alameda bought ~58M SOL in 2020-2021, about 10.8% of SOL’s total supply. DeFi projects on Solana like the Serum DEX, the brokerage network Oxygen and Maps.me – the so-called “Sam coins” that were lost in FTX – also enjoyed FTX’s backing. The ongoing storm around FTX is bad news for Solana as public perception around the company is in the gutter right now. SOL is down 23% in the past 7 days, and down 95% YTD. DeFi TVL on Solana is down 96.8% YTD from $11.2B to $364M today, putting Solana as the 10th largest chain just behind Fantom and Cronos. Meanwhile, two of Solana’s top NFT projects – DeGods and y00ts – are also calling it quits on Solana this week, with planned migrations to Ethereum mainnet and Polygon respectively. Can Solana bounce back? Vitalik is optimistic.

vitalik.eth @VitalikButerin

Some smart people tell me there is an earnest smart developer community in Solana, and now that the awful opportunistic money people have been washed out, the chain has a bright future. Hard for me to tell from outside, but I hope the community gets its fair chance to thrive🦾🦾

10:32 PM ∙ Dec 29, 2022

29,348Likes7,146Retweets

David has some qualms.

DavidHoffman.bedrock 🏴🦇🔊🏴 @TrustlessState

In $ETH’s $80 moment, it wasn’t directly associated with the largest fraud since Madoff FTX’s involvement delegitimizes the adoption Solana got from $SOL’s price performance A large part of Solana’s growth was propped up by a fraudulent supporter, now in jail.

4:13 AM ∙ Dec 30, 2022

62Likes3Retweets

Plenty of others also seem ready to deliver Solana’s eulogy. Solana co-founder Raj Gokal is seeing this episode as a purge of Solana’s “mercenaries and grifters”. Ryan Shea of Solana Labs sees this as an opportunity to rebuild Solana’s culture from the ground up. Contrary to popular belief, there is recent survey evidence that Solana developers are not leaving in droves. Solana’s exposure to FTX might also be overstated as 72% of Solana teams reported themselves not being directly impacted by FTX. 2. Misadventure CapitalVCs were geniuses during the bull run but as the bear market rears its head, professional investors aren’t getting the same acclaim. A leaked investor statement from Multicoin Capital is making the rounds on Twitter this week. In the letter, the fund’s founders Kyle Samani and Tushar Jain disclosed the fund’s impact from direct exposure on FTX and FTT, as well as indirect exposure from SOL (its largest position) and SRM. It ain’t pretty.

Soldman Gachs @DrSoldmanGachs

I finally received my Nov investor statement from Multicoin Capital. Over the past 11 months the hedge fund is down a whopping 90%, and they’re still holding a bag of toxic shit. Time to close the fund down guys? Oh, and congrats on barely outperforming your benchmark $SOL 🙄

Soldman Gachs @DrSoldmanGachs

Multicoin Capital letter to LPs regarding FTX (1/4) https://t.co/L0EYiafylF 11:12 PM ∙ Dec 27, 2022

1,259Likes229Retweets

3. CryptovillainyWe are almost at the end of the Sam Bankman-Fried saga. “How many years in prison will he get?” – is the question on everyone’s minds. Sam is soon to be arraigned on January 3 after a change in judges due to a conflict of interest with previous judge Ronnie Abrams whose husband had advised FTX in 2021. U.S. District Judge Lewis Kaplan will now be overseeing the biggest financial scandal since Bernie Madoff. Meanwhile, Alameda-tagged wallets were noted Thursday trading ~$1.7M of CRV, ETH, USDC and DAI for USDT, before being converted to BTC through mixers like ChangeNOW and FixedFloat.

Arkham | Crypto Intelligence @ArkhamIntel

Sharp-eyed users may have noticed a number of interesting movements from Alameda wallets in the past 24 hours. These wallets had been inactive for multiple weeks before they ‘woke up’ last night. Over $1M has been sent through crypto-mixers by Alameda wallets. What gives? 👇

8:55 PM ∙ Dec 28, 2022

201Likes59Retweets

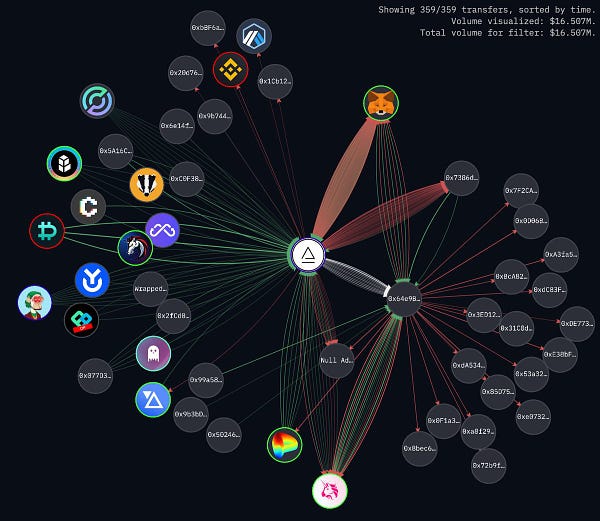

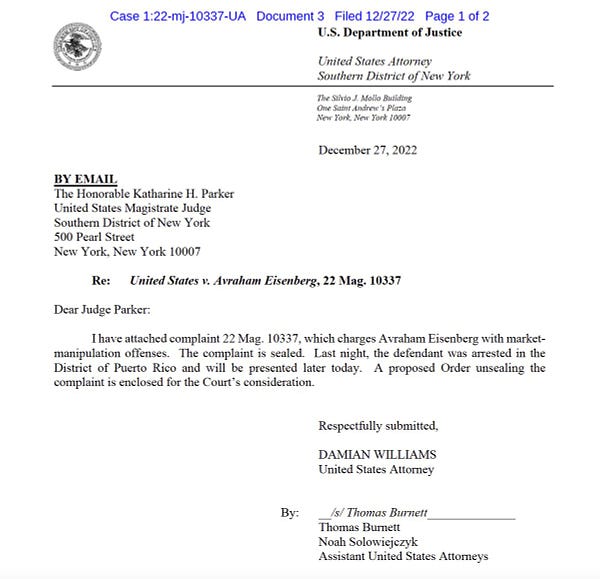

Elsewhere, Avraham “Avi” Eisenberg, the infamous figure behind the Mango Markets attack in October and the Curve/Aave attack in November was arrested in Puerto Rico this week and charged with market manipulation offenses.

Summers @SummersThings

Avraham “Avi” Eisenberg @avi_eisen was arrested yesterday in Puerto Rico and charged with market manipulation offenses.

10:12 PM ∙ Dec 27, 2022

3,297Likes674Retweets

4. Here Come the Lawsuits

Gemini is being sued in a class-action lawsuit for its mid-November halt of the Gemini Earn program, an interest-earning product that offered 7.4% APYs for lending crypto. Troubled lender Genesis, which powered the program, still owes Gemini customers more than $900 million. Impacted customers charge that Gemini failed to register their interest-bearing accounts as securities and didn’t communicate risks to its customers. 5. China launches NFT marketplaceThe People’s Republic of China is launching a NFT marketplace on 1st January named the “China Digital Asset Trading Platform”. Yes, you read that correctly. The underlying Layer-1 will be a heavily regulated chain called the “China Cultural Protection Chain”. The platform, run by state-owned entities and the private company Huban Digital Copyrights, lets users trade intellectual property like digital copyrights on top of digital assets. We don’t think OpenSea is losing any sleep over this. Elsewhere in NFT land, Pudgy Penguins are mooning.

LooksRare @LooksRare

Pumping Penguins 📈📈📈 Last 30 days: 🐧 Pudgy Penguins 3 ETH ➡️ 6 ETH (+100%) 🐥 Lil Pudgys 0.16 ETH ➡️ 0.65 ETH (+306%) 🎣 Pudgy Rods 0.2 ETH ➡️ 0.63 ETH (+215%) So, how many Pengs ya got?

1:50 PM ∙ Dec 27, 2022

254Likes48Retweets

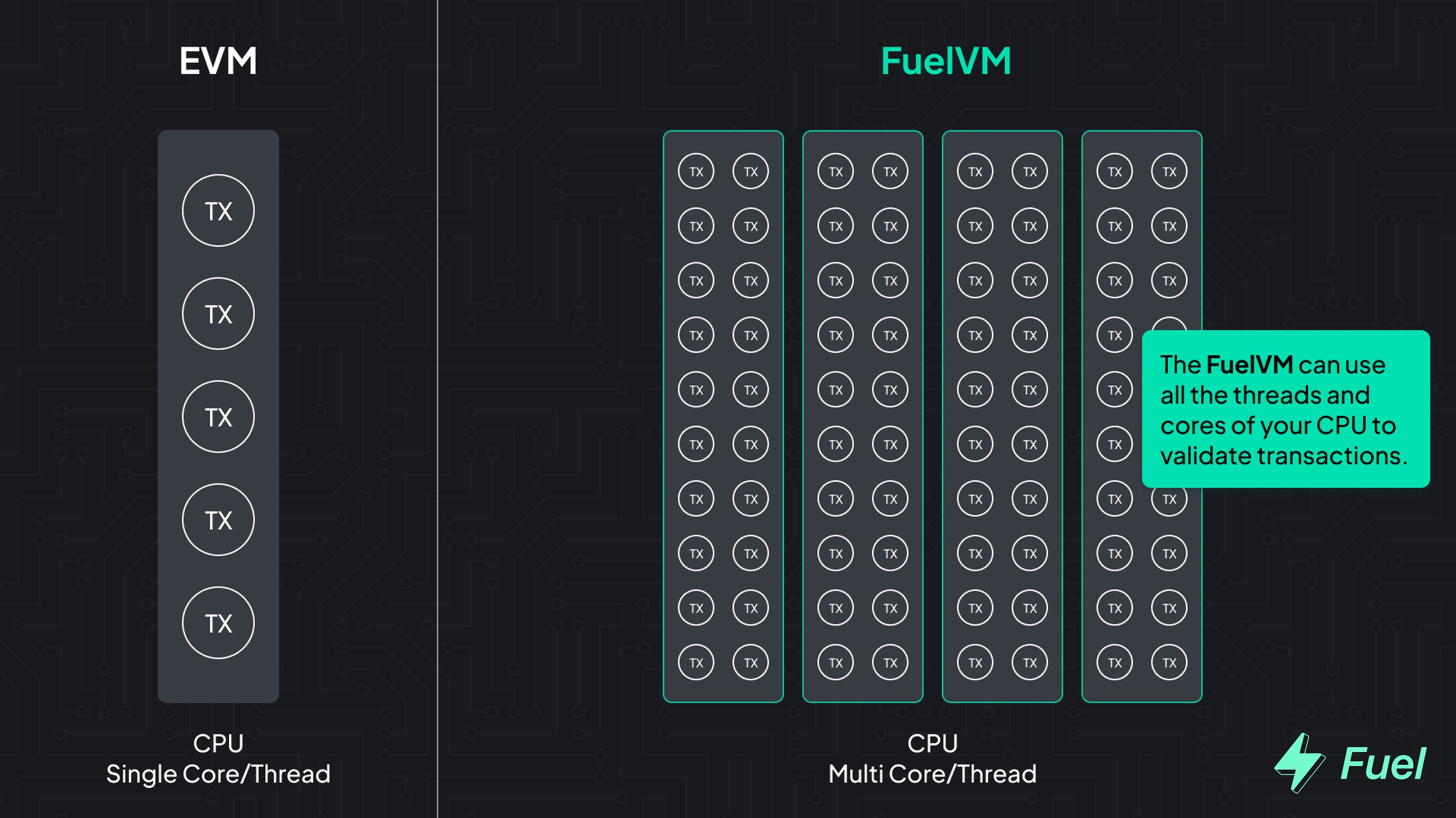

Other news:🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! 📅 Recap for the week of December 26th, 2022READ 📚WATCH 🔊OVERPRICED JPEGS 🖼️

GREEN PILL 🌳Weekly Subscriber Perks 🔥Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you. 🎙️ NEW WEEKLY ROLLUPListen to podcast episode | Apple | Spotify | YouTube | RSS Feed Jobs opportunities 🧑💼✨See all listings on the Bankless Job Board✨ Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto) 🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2022 Bankless, LLC. |