The Fed Has A Shotgun, Not A Sniper Rifle

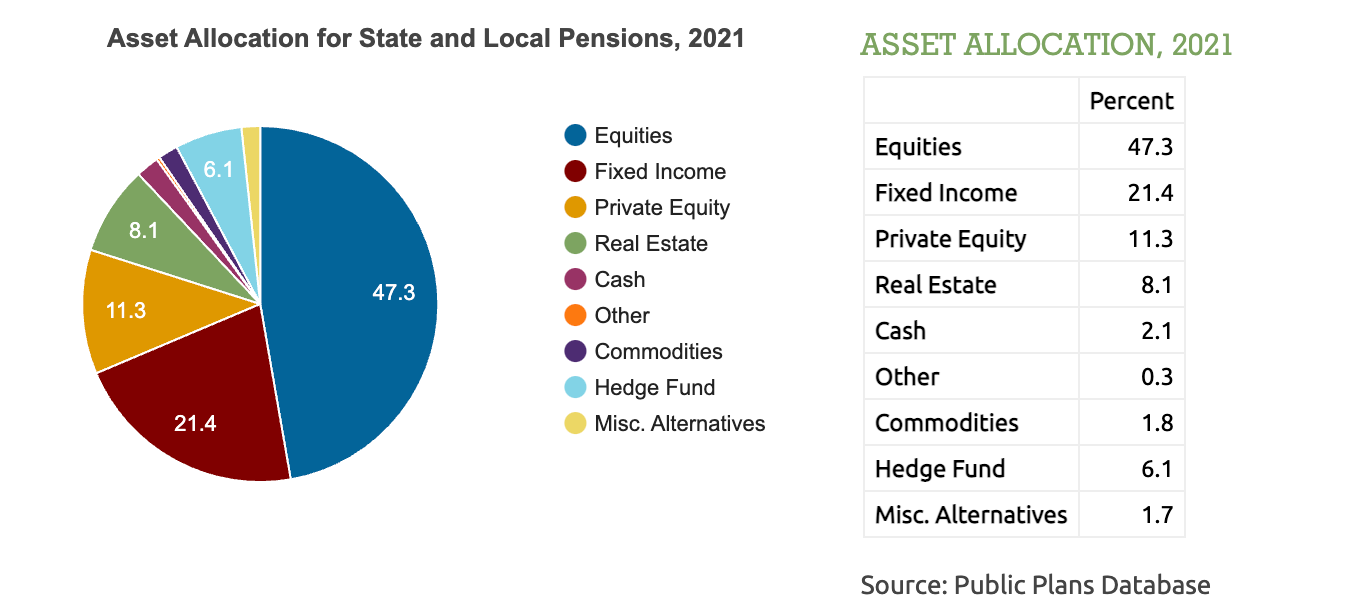

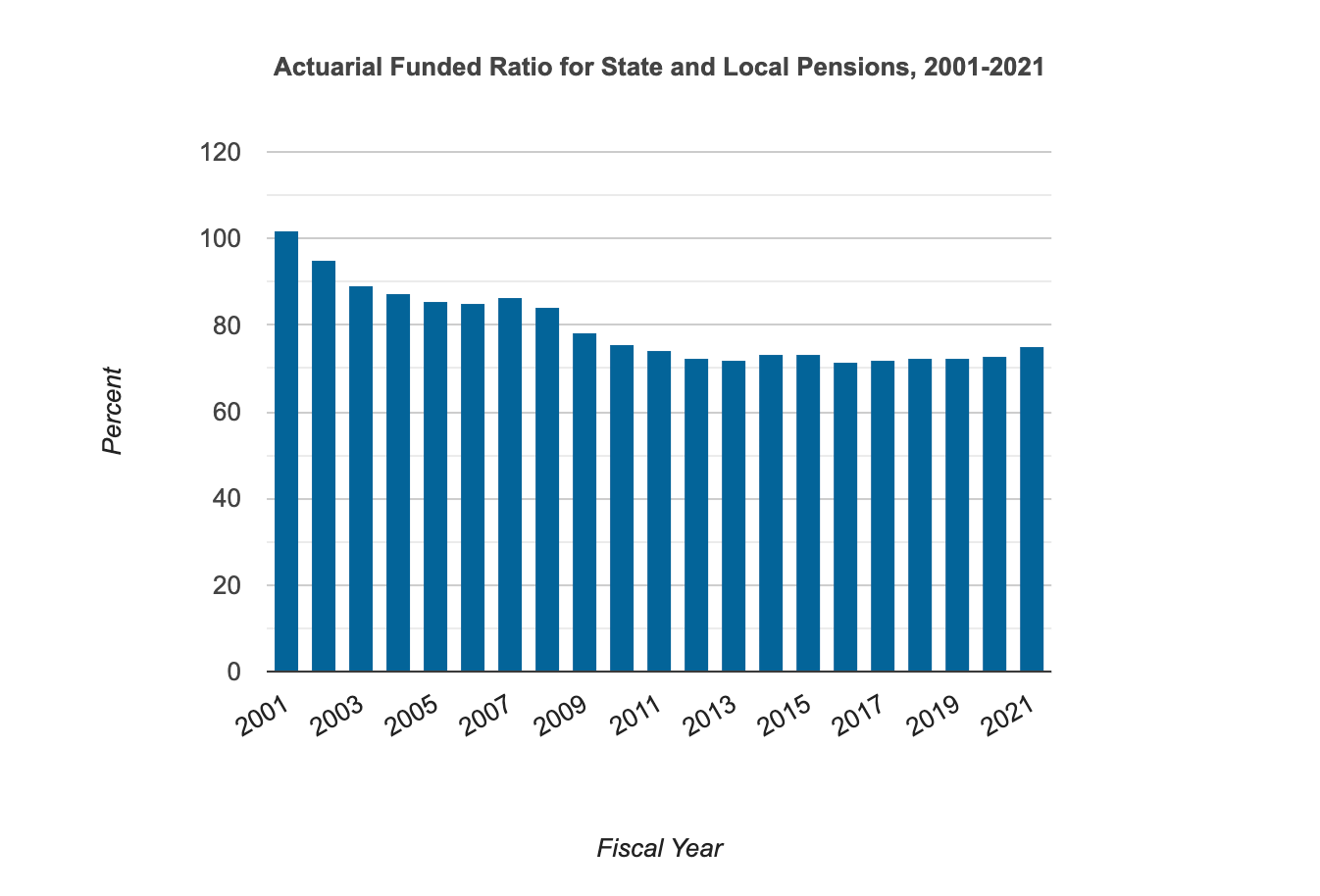

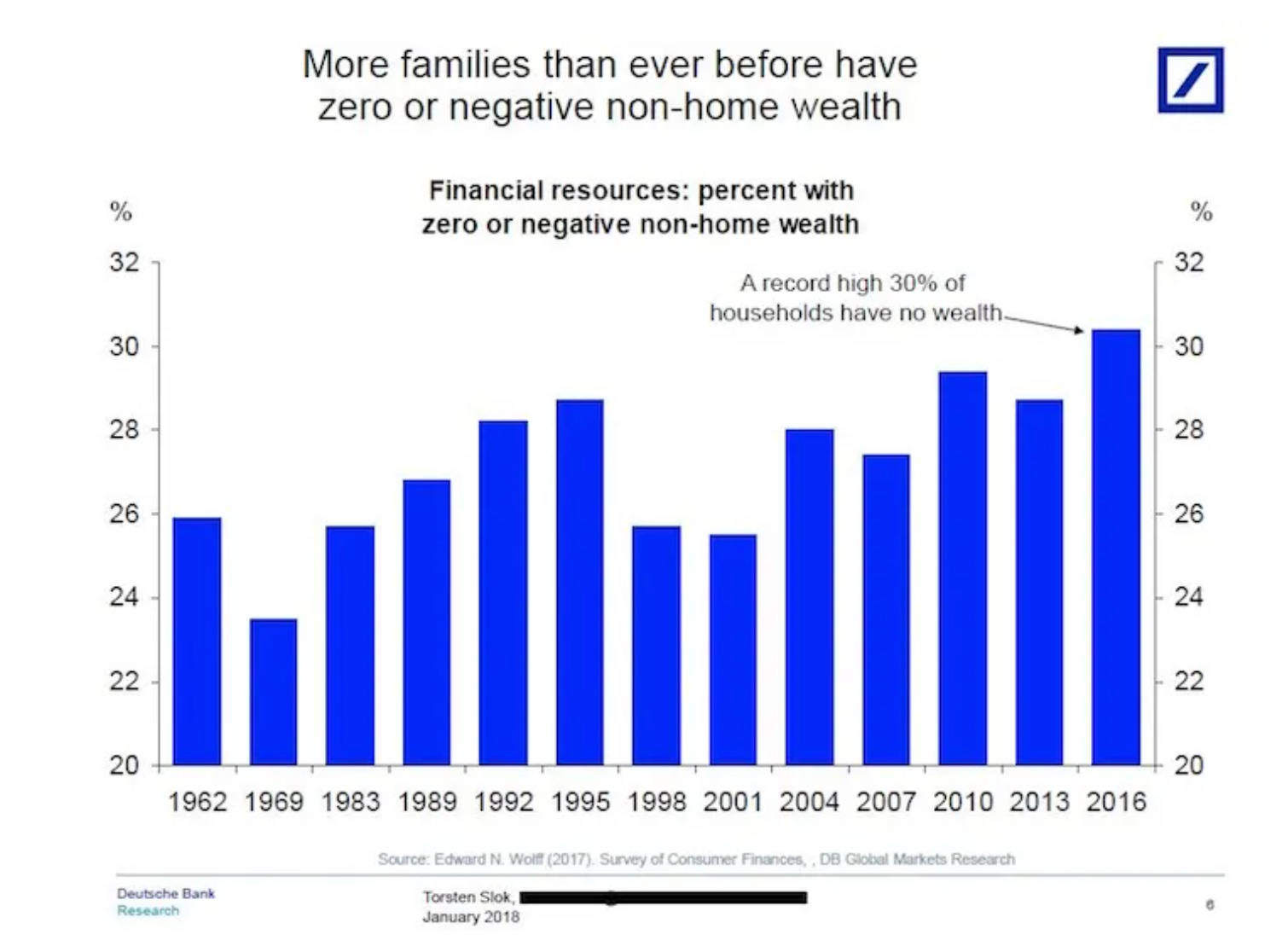

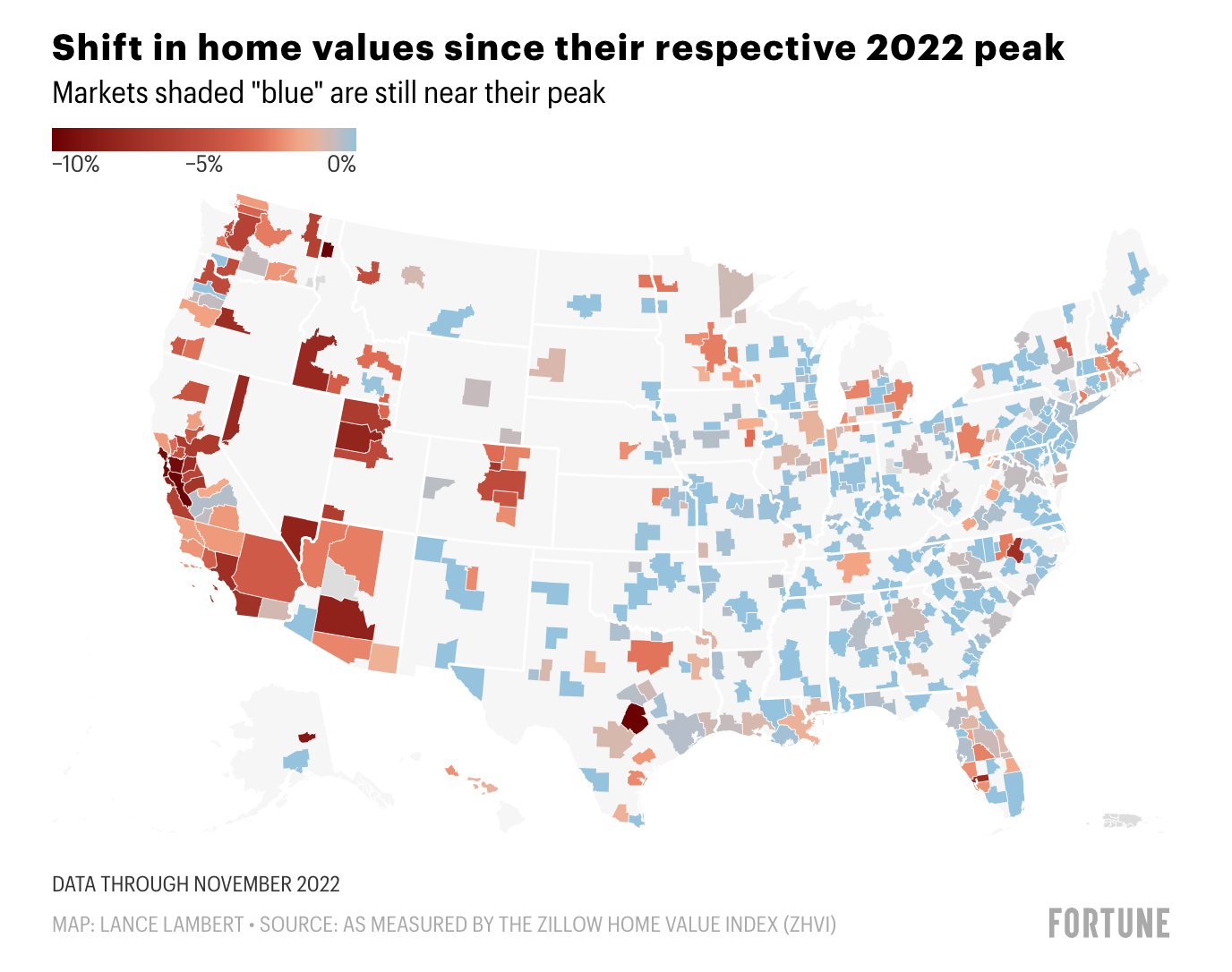

To investors, The Federal Reserve used low interest rates and quantitative easing to create one of the largest asset bubbles of our lifetime. They didn’t do it on purpose, but they were the leading contributor. In an effort to redeem themselves, and bring inflation under control, the US-based central bank has been on a mission of destruction for over a year now. The goal is to destroy demand from consumers. If consumers are still buying houses, cars, products, and services, then inflation will persist. No economy can thrive in a meaningful way if the official inflation metrics are compounding annually at 7%+. There is a big problem though — the Federal Reserve only has two major tools in their toolbox. They can manipulate interest rates and they can buy or sell assets off their balance sheet. These tools are more like shotguns, than sniper rifles. Although you can point the tool in the right direction, you can’t guarantee pinpoint accuracy. Here is an example: the Fed would love to get consumer spending to cool off. If there is less demand for general products and services, then market forces take over and price increases start to slow down. It doesn’t mean that the aggregate prices will return to their previous levels. The year-over-year price increases will slow though, which is ultimately the metric that the central bank will measure their success. The Fed is leveraging both tools — interest rate hikes and quantitative tightening — to “destroy demand.” As I mentioned, this shotgun approach can’t be applied with any level of precision in the economy. The tighter financial conditions hit the entire economy like a sledge hammer. This is why you see asset prices falling across markets. There is carnage everywhere. The Fed claims to not care about asset prices, especially the equities market, but their change in policy has led to immense demand destruction among investors. The S&P 500 is down 20% over the last 12 months. The QQQ is down 33% in the same timeframe. So why does this matter? Real people are hurt when equity prices fall. Let’s take a look at public pension funds in the United States. They collectively hold over $4.5 trillion with just under 50% of those assets invested in equities. Of the more than $2 trillion that is invested in equities globally, the majority is invested in the US stock market as well. This means that US public pension funds, and the pension recipients who are counting on these funds, are losing 20-30% on their multi-trillion dollar exposure to the US stock market. That is an unintended consequence of the Fed’s pursuit of getting inflation under control. The Fed would bring inflation down and prevent pain for pension funds if they could. They don’t have that ability though. Remember — shotgun, not sniper rifle. This issue is compounded by the fact that public pension funds in America are less than 80% funded compared to where their actuarial expectations are for funding future obligations. Not a good situation. It is easy for people to gloss over the connection between the Fed’s monetary tightening and pension recipient pain because there is a long time frame until the damage is realized. Additionally, the pension recipients aren’t holding these assets directly so they likely aren’t paying too much attention on a day-to-day basis. This brings me to my second example — US home prices. It is estimated that the average American citizen has upwards of 70% of their net worth tied up in their home. More than 30% of Americans have a net worth of zero or negative if you were to remove their home equity from their personal balance sheet. The easy way to think about this is when home prices go up, the average American becomes wealthier. When home prices go down, a significant number of Americans become drastically worse off financially. So how has the Fed’s tighter financial conditions affected home prices in America? The short answer is that it is complicated. Lance Lambert from Fortune put it well when he wrote:

It is obvious to most that the number of transactions, and mortgage applications, have been falling aggressively, but the actual home prices have held up decently well considering the environment. Some critics of this view will argue that the national average is skewed due to some markets being more popular than others, so here is a breakdown of the various cities and regions as well. As a friend told me this morning, this chart simply shows that people are leaving the West Coast for the East Coast. He was kidding but it made me laugh 🙂 The fact that transactions are falling and home prices are holding steady tells us that the market has very little liquidity. Robert Frank over at CNBC has a new article out this morning about the “frozen market” of Manhattan apartment sales. The city saw a 30% drop in transactions during Q4. So why am I writing about public pension equity exposure and US home prices? The Federal Reserve continues to reaffirm their goal of bringing inflation under control. Although they have raised interest rates at a historic pace, inflation has been much stickier than they anticipated. The tighter financial conditions become, the more pain that investors will feel. One of the big questions for 2023 is whether US home prices, which make up a majority of US citizen net worth, will follow the 2022 trend of US stocks? If we see the current 2-3% drop extend to 10% or more, there will be immense pain ahead. There is already talk of a “lost decade” in the stock market (where the next 10 years won’t produce any meaningful returns due to the stagflation environment we are experiencing). It is unlikely that a lost decade would occur in real estate, but it is more possible today than in previous years. Lastly, some investors are warning of future inflation spikes due to the central bank intervention being executed right now. Michael Burry, the investor from the movie Big Short, put it bluntly:

Cassandra B.C. @michaeljburry

Inflation peaked. But it is not the last peak of this cycle. We are likely to see CPI lower, possibly negative in 2H 2023, and the US in recession by any definition. Fed will cut and government will stimulate. And we will have another inflation spike. It’s not hard.

4:24 AM ∙ Jan 2, 2023

30,413Likes4,800Retweets

Hopefully Burry is wrong. History tells us that free markets do a better job of finding equilibrium points and solving problems. It is hard to argue that the US economy, and the related asset markets, are free markets at this point. The old adage “don’t fight the Fed” has stuck around for a reason. The Federal Reserve is in control. They are intervening with the hopes of creating solutions. Unfortunately, they may actually be doing the opposite. No one can tell the future, but let’s hope they know something we don’t. -Pomp Reader Note: It feels good to be back writing longer letters to each of you. I have set up my personal schedule in 2023 to spend more time each morning putting these together. We have also made a number of changes to the audio podcast and YouTube videos that we put out as well (see video below). My goal is to provide the highest quality information and content possible. I don’t aspire to merely regurgitate the news you can read elsewhere, but rather present unique ideas and opinions that will make you think more critically about various business and investment topics. If you are interested in reading these letters more often, and want to support the work that our team does, please consider subscribing as a paid member of The Pomp Letter. We appreciate you reading. Have a great day.

Pomp 🌪 @APompliano

I am removing all advertisers from the audio podcast and YouTube videos. Sometimes you just follow your heart and figure it out as you go. Love you all. Excited to learn with you in 2023 🙏🏼

1:51 PM ∙ Jan 3, 2023

4,526Likes188Retweets

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2023 |

|||||||||||||||||||||||||||||||||||||||||||||||||