The Next Stage of Crypto Airdrops

Powered by Axelar, Osmosis is an interchain DeFi hub & DEX for universal cross-chain swaps. Bridge your assets with Osmosis ⚗️ Dear Bankless nation, Everybody loves an airdrop, after all who doesn’t like freebies? But from a project perspective, getting the token distribution right or wrong is what can make or break a community. Today, we hear from a web3 marketing guru who has plenty of insights on how airdrops are evolving. – Bankless team 🙏 Together with ⚡️ACROSS⚡️Across is the bridge you deserve: fast speeds, low fees, great support, no hacks, and we love our users. Try it once and you’ll understand why Across users love us back and have bridged $billions with it. Yield farmers will also find attractive yields for providing bridge liquidity! 👀 👉 If you have questions, check Twitter or the Discord! The Next Stage of Crypto Airdrops

Airdrops are a native web3 marketing strategy. When done properly, they can help drive new user growth, retention and TVL. With this in mind, we spent time researching past airdrops like UNI, HOP, ENS, 1INCH, Mooncats and Optimism to determine how effective airdrops really are. The results of airdrops in their current approach are not great: Retention as low as 1%, four year marketing paybacks, everyone dumps, and less voting than my neighborhood board. Crypto needs to to revisit our approach to airdrops. Why Are Airdrops Important?First, it’s important to understand why airdrops are so important to web3 today. Two reasons:

What Do Airdrops Look Like Today?Every project using an Airdrop is using it as a web3 marketing tool to get new users. Yes, they also want it to form a community, keep users using the product, and hope that users hold instead of dump. The challenge, as we’re seeing, is that this is rarely the case. Let’s look at the two types of Airdrops we see today: Push AirdropsThis is when a legitimate token or an NFT “magically” shows up in your wallet — usually through a full-on drop, or at times with a claim. Push Airdrops generate new customers for projects when a wallet owner discovers what showed up in their wallet, and tries out the dapp. Unfortunately today, most Push Airdrops are used as scam tactics. Pull AirdropsThis is when you actively need to claim your reward. Most projects fall into this category, such as Uniswap, ENS, 1INCH, and Cow Swap. Pull airdrops are often the result of when a project teases the fact that they are going to reward usage of their project, most commonly by token or less frequent by NFT. The intent here is also to help the project get new customers. What exactly the criteria is for claiming the reward is often secret, like a sort of “nuclear launch code” of the project, as to avoid people gaming the system. While mechanically both of these approaches work, the analysis we’ll go through next shows they’re generally failing to create sustainable growth. The Challenge of Airdrops TodayThe wizards at Dune analytics did a wonderful deep dive on the UNI airdrop, along with a quick look at a few other airdrops. Given we recently wrote about the tracking of other important web3 project health metrics to monitor, we wanted to correlate Dune’s analysis to some of those metrics like Customer Acquisition Cost, Payback Period, Retention, and Customer Lifetime Value. These metrics give us a base level understanding of the sustainability and health of a project. Analyzing these metrics against airdrops results will help us understand how effective airdrops are as a sustainable web3 marketing and growth tool. First, what was the structure of the UNI “Pull Airdrop”?

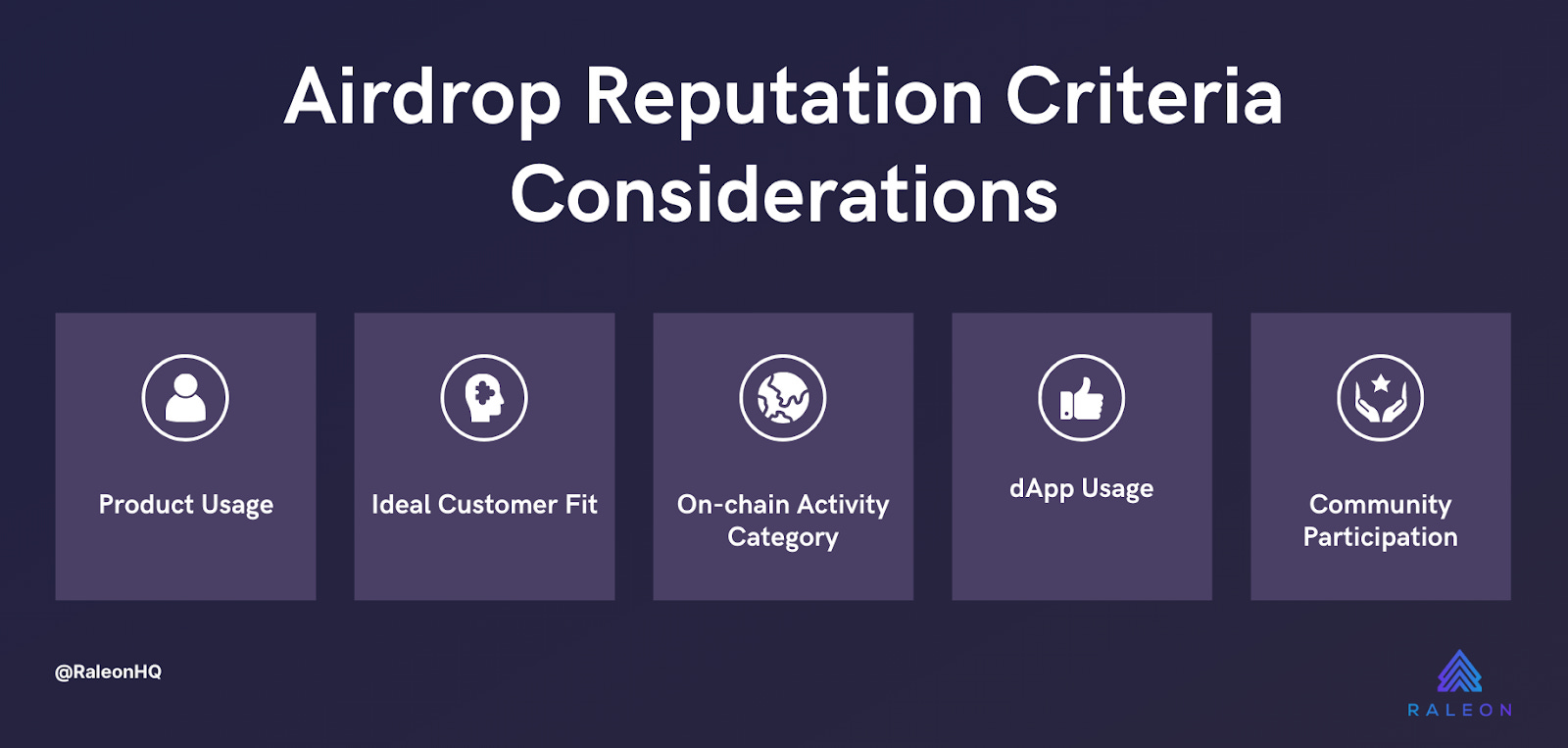

How did the Airdrop go? In the case of most projects today, a good portion of users come in anticipation of an airdrop – hence part of its benefit as a marketing tool. Given the Uniswap airdrop was closer to the first of its kind, that was less the case. Had it been more anticipated, however, it could have acquired far more users If you’d like to see an even deeper analysis on some of the above metrics, Tomasz Tunguz does a comparison of web2 and web3 CAC with these numbers. Also dig into this data in the Dune query yourself to see how we came to some of these numbers. What does this tell us? Airdrops in their current form are loss-leaders to growth hack a project’s user base. For Airdrops to be more effective to projects, and to drive sustainable growth, we need to move them to where the CAC of an airdrop is less than the CLV of a project’s user. Making Airdrops More Effective – A FrameworkWhile airdrops in their current form are continuing to be seen as less effective than desired, we still see projects allocating ~44% of their supply to the community. While a part of this is certainly intended to incentivize work, much is often also allocated to marketing efforts like incentivizing usage, or airdrops. The good news is, there are a few things we’re seeing projects experiment with that we believe will take us closer to the next evolution of more effective airdrops. 1. Encourage The Behavior LoopWhen considering Pull Airdrops, their criteria today largely falls into a generic category of “used a product”. While generous to the user, airdrops today are ungenerous to the project itself because it doesn’t actually “hook” the user to the product. An example of a good behavior hook from web2 is Twitter. It might look something like the above. Considering the behavioral loop also has the added benefit of both identifying who your ideal users are, and what actions you think may “hook” them. This effort will have a downstream impact on getting new users and keeping them through other marketing efforts. When considering Push Airdrops, you won’t likely have interaction yet with your project, so the criteria that you’re looking for is going to be behaviors and reputation with similar projects, or projects that represent similar buyers. 2. Reputation-Based AirdropsThe criteria for who gets an airdrop needs to get upgraded to a “Reputation Criteria” as projects move away from the equivalent of going on a blind date to finding a match-maker. Think about it this way. General Criteria: You have a pizza place that’s had 500 customers in the last month. You could give each of those customers $50 and hope they come back. Reputation Criteria: You give $50 to customers that you know spent 50% of their food budget on pizza, have been to your store 5 times each month, regularly stop by your pizza place for music night, and visit your competitors on occasion. Having a Reputation Criteria used to almost be impossible. Today, it’s one of many tactics my company Raleon is using to help projects improve their marketing by helping them figure out which wallets to target. 3. Airdrop “Waves”Blur and Optimism have done this well. As opposed to Airdrops being massive, one time events, creating a schedule of “waves” of airdrops on a more focused criteria will be effective for two reasons:

Airdrop waves create a process by which a project sets their reputation criteria, performs an airdrop, monitors the results, and then uses those results to improve the next airdrop. 4. Create Project Loyalty To Keep UsersLoyalty is important not just because of how much marketing dollars you spent to acquire the customer, but also because returning customers spend 67% more than new customers (using web2 as a proxy). Looking again at the Dune analysis, whether it’s UNI, 1INCH, or others, it’s not surprising that retention is so low when most users dump after the airdrop, and 98% of airdropped users did not participate in any UNI voting. Governance and pure financial benefits such as staking are not proving to be the most effective means of encouraging user retention. We need to look for new ways to create loyalty. If we look at some of the most successful web2 and web3 brands, they create loyalty through:

A Case Study:What Might a Next Gen Airdrop Look Like in Practice?We don’t have a crystal ball, but we know projects are already experimenting with some of the ideas mentioned above, along with other tactics like airdrop vesting. We’re big fans of testing, using data to track results, and sharing, so here’s an example of what an Airdrop 2.0 plan might look like. Project type: DEX Behavioral Goal: We believe our “sticky” hook is strongest when a user becomes a liquidity provider (LP), which makes our second hook actually swapping on the DEX. Your behavioral goal may also depend on what you’re wanting to optimize for. You should be optimizing for what drives the most value to your project and the best reward for the user (your hooks). Reputation-based Airdrop criteria: Since we’re improving our airdrop criteria, we’re going to consider our behavioral goal in it, in addition to reputation indicators. We also know it often takes 7 – 15 interactions to create a behavioral habit, so we’ll include that consideration as well. Airdrop Waves: Remember, with airdrop waves, part of what we’re doing is monitoring results – effectively creating airdrop “cohorts”. By monitoring the results, it will let us know just how we might need to tweak future waves.

Next Steps in Planning Your AirdropIf you’re thinking about doing a push or pull based airdrop for wallet marketing, the framework above should start you down the path of improved results. We believe the future of airdrops depends on identifying your best users and incentivizing them to power your sustained growth over the long term. If you’re interesting in hearing more about how the Raleon team is thinking about the future of airdrops, reach out to us on Twitter. You can also poke around our no-code web3 marketing platform to see how it can help you with your airdrop targeting and tracking. 🫡 Action stepsAuthor BioNathan is co-founder and CEO of Raleon, a web3 marketing toolkit that helps growth teams acquire and retain users. Prior to Raleon, Nathan was cofounder of nCino, a fintech company that went public in 2020 at a ~7B valuation. Nathan is an angel investor, and advises tech companies in different sectors. You can find him on Twitter at @NathanSnell Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor ACROSS👉 Across.to is the bridge you deserve! Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2023 Bankless, LLC. |