Blockware Intelligence Newsletter: Week 149

Blockware Intelligence Newsletter: Week 149Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 9/28/24 – 10/3/24

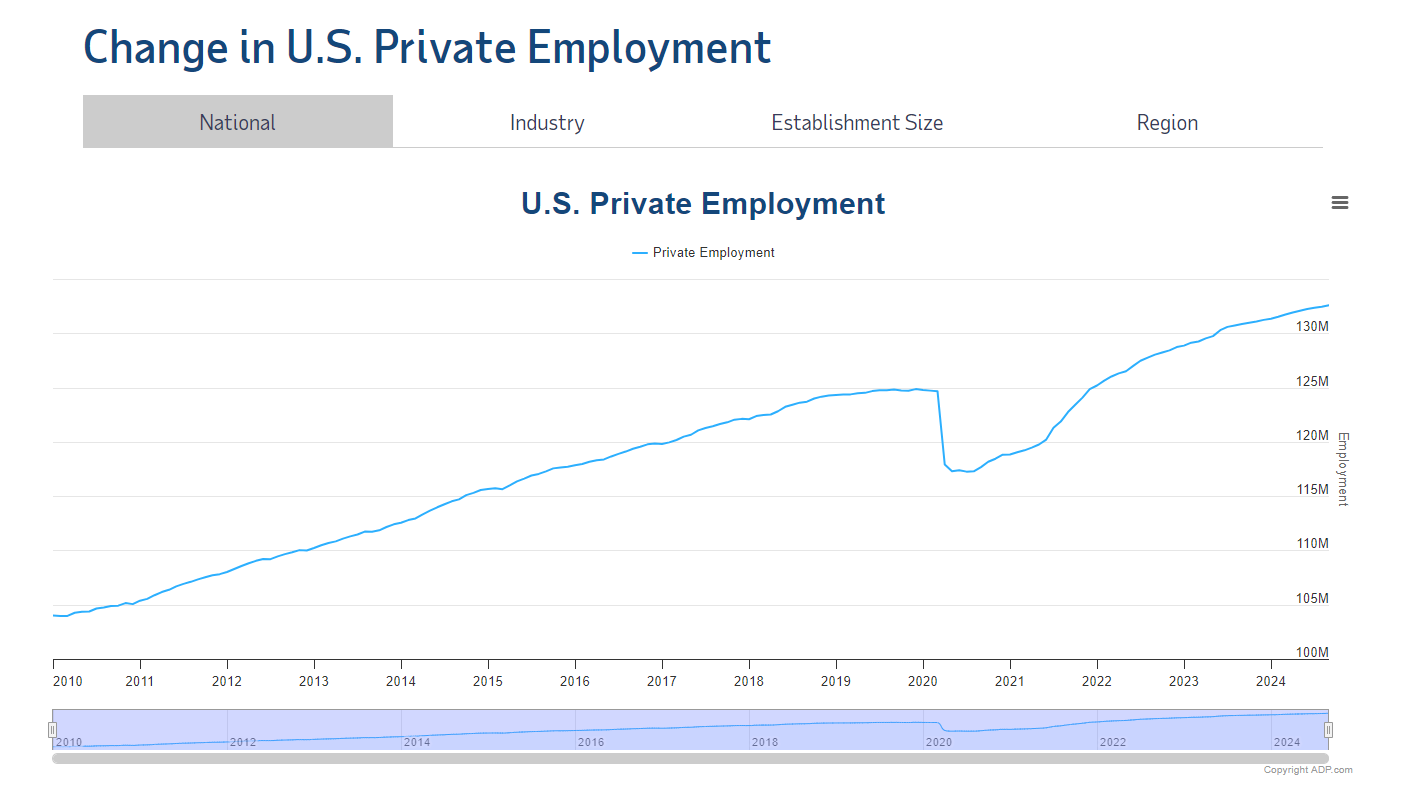

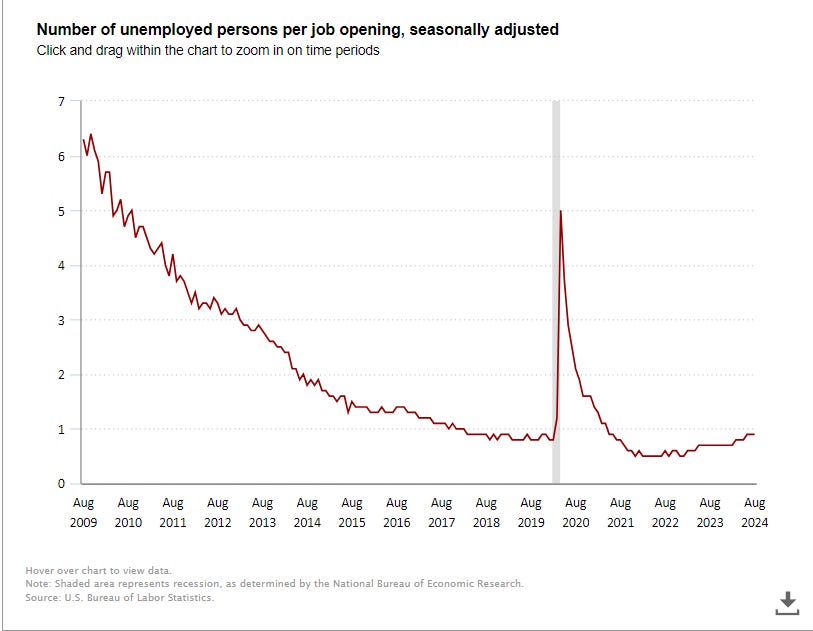

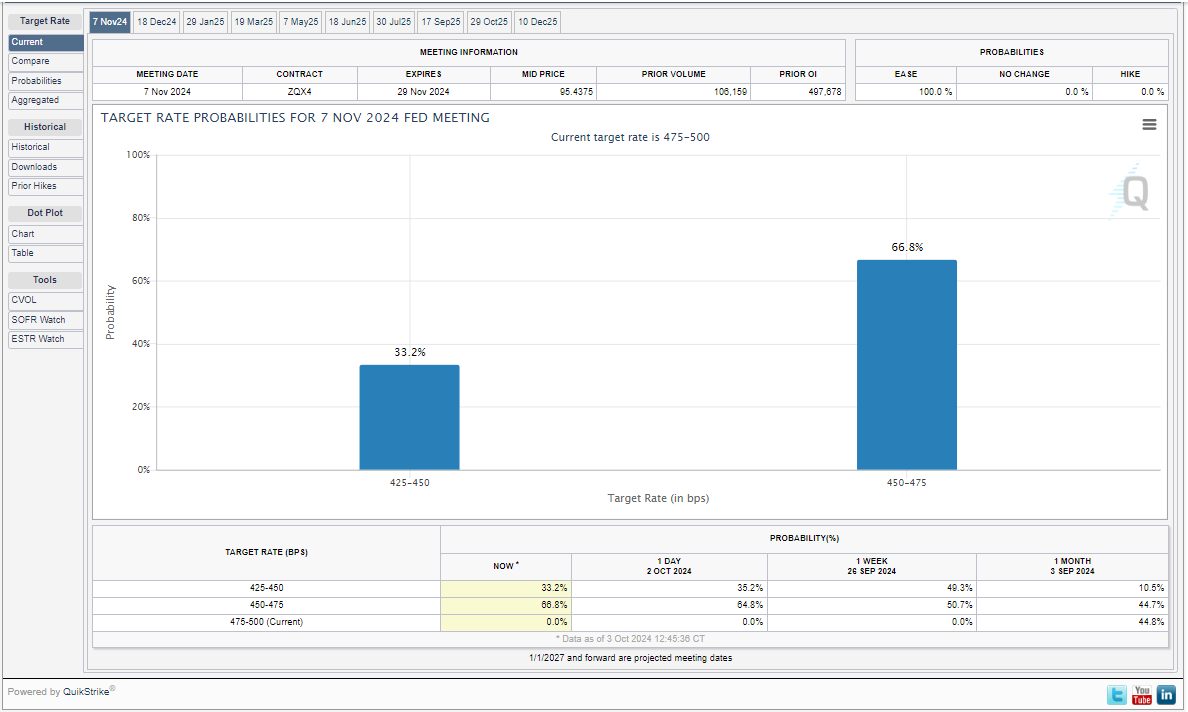

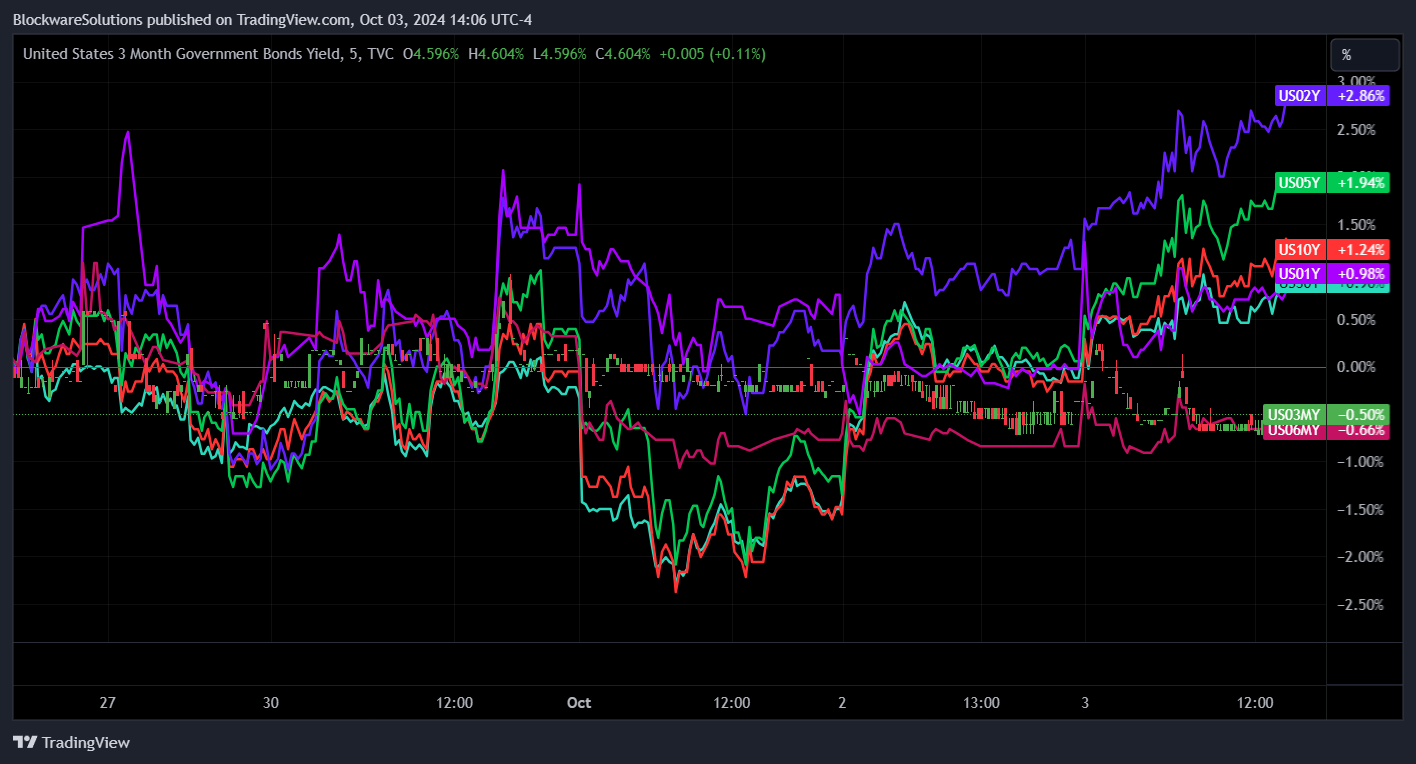

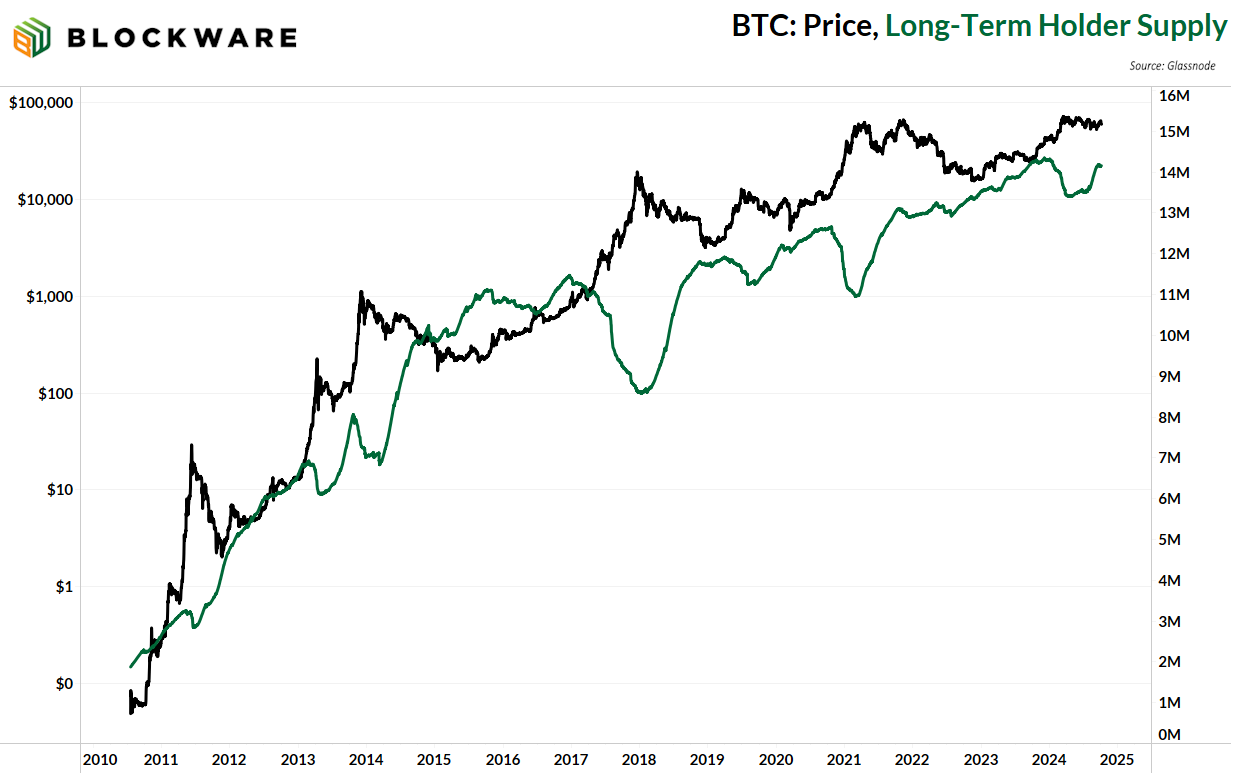

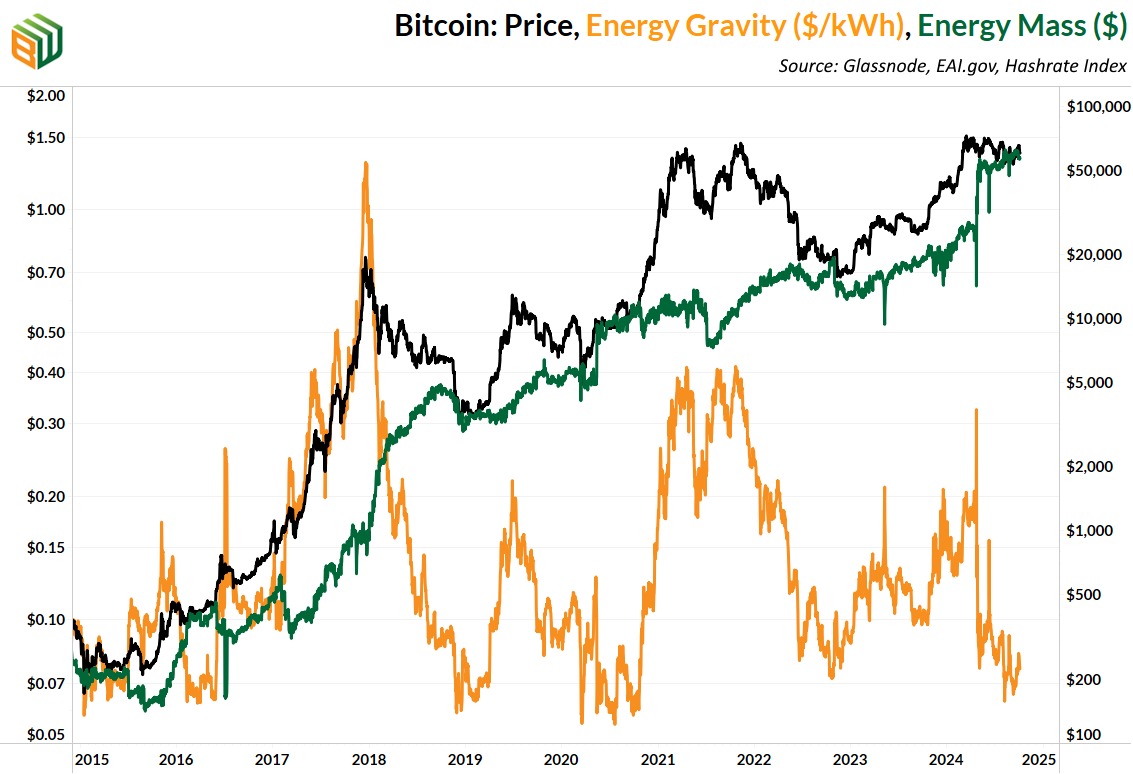

🚨Buy & Sell ASICs on the Blockware Marketplace🚨 The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain. Click here to sign up for the Marketplace and start mining Bitcoin. General Market Update 1. ADP National Employment Report The ADP National Employment Report for October 2, 2024, revealed a larger-than-expected increase in private-sector job growth, signaling continued resilience in the U.S. labor market. This early glimpse into employment conditions offers valuable insights before the official government jobs report, highlighting that hiring remains robust despite uncertainties in the economic outlook. The report is closely watched by markets, as it often serves as a precursor to the broader employment figures released by the Bureau of Labor Statistics (BLS). Multiple data points this week indicated a stronger-than-expected labor market – which has the market now expecting a 25bps cut from the Fed at the next meeting rather than another 50bps cut. 2. Job Openings and Labor Turnover Survey (JOLTS) (Oct 1, 2024) The JOLTS data for August also indicates a resilient labor market with a steady number of job openings, hires, and separations. Job openings remained elevated, suggesting that employers are still competing for talent despite concerns about economic softening. 3 . ISM Manufacturing Index The employment component of the ISM Manufacturing index came in unchanged month-over-month at 47.2 Values under 50 indicate contraction in the manufacturing sector. However, the grim look in this sector is not indicative of the economy as a whole as manufacturing represents just 11% of the US economy. 4. Fed Funds Futures As mentioned, the futures market is now expecting less aggressive rate cuts from the Fed on a going-forward basis – with a 67% chance of a 25bps cut in November. This is certainly subject to change if/when economic data changes. Powell commented this week that the Fed is not in a hurry to cut rates aggressively. This language indicates that “pauses” – meetings in which no cuts happen – are not out of the question if the data calls for it. The market will likely react negatively in the short-term to less dovish policy from the Fed, but in the long-run, rate cuts, even if laced with pauses, are positive for liquidity and asset prices. 5. Market Reaction As mentioned, the surprisingly decent employment data tampering rate cut expectations resulted in a short-term sell-off from risk assets as investors previously expected continually aggressive cuts (which could still happen btw). $SPX, $NDQ, and BTC are all down on the week. 6. Treasury Market Response The bond market continues to tell us that long-term inflation is a primary concern. Yields on the 3 & 6-month treasuries have fallen (perhaps a slower cutting cycle is not in the cards after all), while yields on longer-duration treasuries rose this week. Clearly there is less demand for the long-term stuff, indicating that 4% annual yields are not going to cut it for some investors. The US national debt grew by ~$500 billion in September alone. Investors are not oblivious to the fact that devaluation of the dollar will be needed in order to service the ever-growing debt. For secure and easy-to-use self-custody, we recommend Theya: Theya is the world’s simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before! Click here to download the app and get 10% off an annual subscription! Bitcoin: News, ETFs, On-Chain, etc. 7. BTC Holds the line at $60,000 Despite a slight drop this week, BTC is still holding strong above $60,000. It has successfully achieved a higher high and is in the process of forming a higher low. With bullish macro tailwinds afoot and a healthy short-term technical structure, BTC is poised to make a move up in Q4. 8. Long-Term Holder Supply While Bitcoin has traded sideways since March, long-term holders have been accumulating coins. The supply of BTC that has not moved in six months or longer is at near all-time highs with ~14.1 million coins not moving on-chain. SVRN Energy SVRN is more than a premium energy drink! It’s your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats! Use Code “BLOCKWARE” for 10% off. https://svrnenergy.com/?v=f24485ae434a Bitcoin Mining 9. Different ASICs Explained We published a new video to our YouTube channel – part of our ‘Blockware Learn‘ initiative. Our goal is to provide free education to everyone on Bitcoin & Bitcoin mining. This video explains the trade-offs of different Bitcoin mining rigs. We focus primarily on the differences between new-generation machines and old-generation (legacy) machines. Choosing which machine is right for you depends on your risk tolerance, available capital, and market expectations. Click here to learn more. 10. Energy Gravity At a typical hosting rate today, new-gen Bitcoin ASICs require ~$57,473 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below. Read the Energy Gravity report here. All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Blockware Intelligence Newsletter is free today. But if you enjoyed this post, you can tell Blockware Intelligence Newsletter that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

© 2024 Blockware Solutions |