Blockware Intelligence Newsletter: Week 151

Blockware Intelligence Newsletter: Week 151Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 10/18/24 – 10/25/24

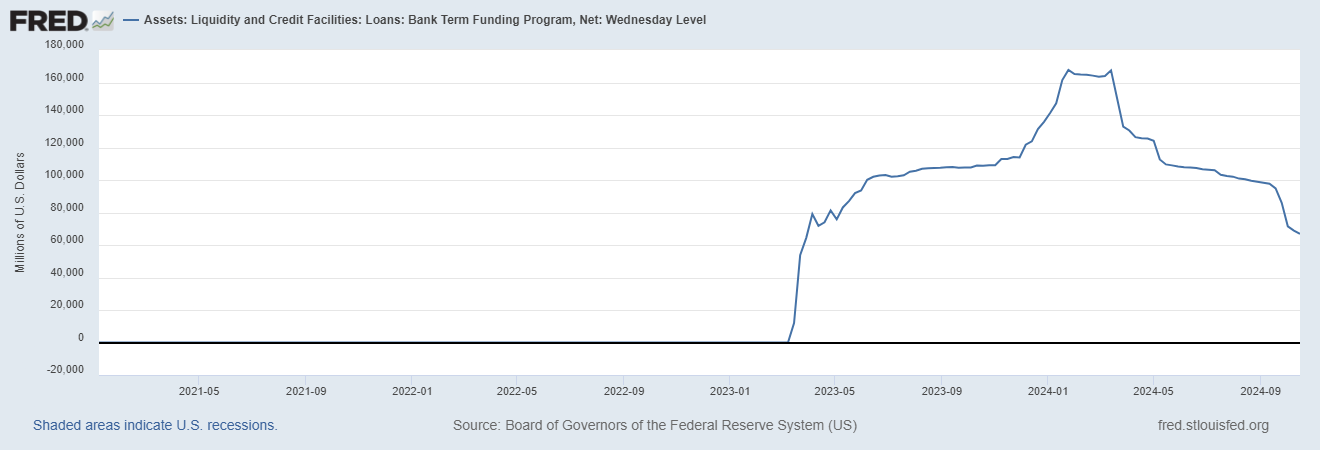

🚨Buy & Sell ASICs on the Blockware Marketplace🚨 The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain. Click here to sign up for the Marketplace and start mining Bitcoin. General Market Update 1. Long Duration Bonds Take a Hit Treasury yields declined across the board this summer during the build up to the highly anticipated start of the Fed cutting cycle. However, yields have ripped (bonds have dumped) in the aftermath of the cut – especially on the long end of the curve. The 10-year yield is up to 4.22% while the 30-year yield is up to 4.52%. The Fed may be speaking and acting as if the war against inflation has been won, but clearly bond investors feel differently. A reluctance to bid yields down here for long-duration bonds is a strong signal that investors are fearful of higher inflation in the future. $TLT, the 20+ Year Treasury Bond ETF, is down nearly 10% since the Fed meeting, putting it’s YTD return at negative 6.3%. 2. Bank Term Funding Program You may recall that negative returns on long-duration treasuries are what spurred last year’s banking crisis. The Fed was able to band-aid over this via the “Bank Term Funding Program”, which functioned similarly to a bridge loan, allowing otherwise insolvent banks to remain operational by letting them borrow against their underwater treasuries at par value rather than market value. The Fed launched this as a 1-year program, likely with the expectation that Fed Funds rate cuts would bring treasury rates down and bring the underwater bonds back into the green. Prior to the closing of this facility we saw a large jump in usage as banks got one last hit off the liquidity pipe. Now that the banks are paying back the borrowed capital with rates remaining where they are at, this could begin to spell trouble. The response from the Fed will almost undoubtedly be to re-open this facility and provide banks with as much liquidity as needed – which is bullish for risk assets. This is something we will keep an eye on over the coming months. 3. Paul Tudor Jones Bullish on Bitcoin Speaking of long bonds, in an interview with CNBC, legendary investor Paul Tudor Jones parroted a talking point that Bitcoiners have been hammering for years: “all roads lead to inflation.” And he is 100% correct. PTJ went on to say that Bitcoin belongs in a well-constructed portfolio and that he has zero exposure to fixed income right now. If you’re a reader of this newsletter, there’s a good chance you agree with that and have constructed your portfolio similarly. The reason this is noteworthy is because it:

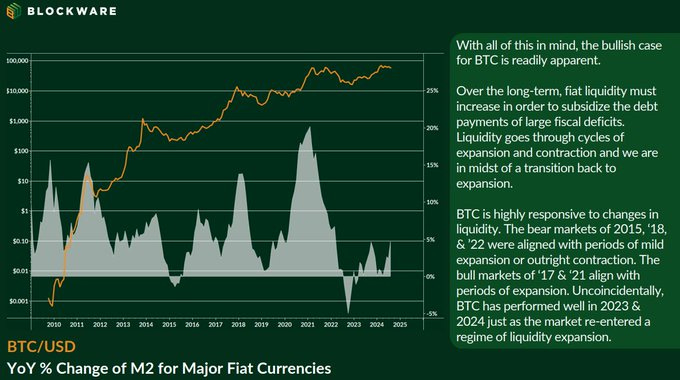

Below is an excerpt from our Q4 Market Update where we articulate the exact same point as Paul Tudor Jones. For secure and easy-to-use self-custody, we recommend Theya: Theya is the world’s simplest Bitcoin self-custody solution. With their modular multi-sig and cold storage vaults, you decide how to hold your keys. Theya offers effortless multisig experience like never before! Click here to download the app and get 10% off an annual subscription! Bitcoin: News, ETFs, On-Chain, etc. 4. BTC on the Cusp of a Breakout After putting in another ‘higher-high’, BTC sentiment online has become increasingly bullish. The chart below shows how the current halving epoch stacks up to previous epochs. The current cycle appears to be lagging slightly, but we are right around the point where BTC began to rip in previous cycles. It has been our view – and still is our view – that after the 2024 US Presidential election is when BTC will start to pick up steam. With deficit spending & rising liquidity being the primary catalyst for bullish BTC price action (check out our latest report for more on this), we believe that BTC will perform well in 2025 regardless of which candidate gets elected. However, markets despise uncertainty – and the leadup to this election is a huge moment of geopolitical uncertainty and the market will appreciate this being in the rearview mirror. 5. Michael Saylor Self Custody Comments Everyone’s favorite Bitcoin savant found himself, yet again, under the microscope of the online Bitcoin community. In a recent interview, Michael Saylor appeared to downplay the importance of self-custody by using the phrase “paranoid crypto anarchists.” However, anyone who listened to the interview within context – and anyone who has listened to many of Saylor’s past interviews – understands that this is a gross misinterpretation of his position. While self-custody should be the preferred choice for most retail investors, as Saylor points out, it is not the optimal custody solution for everyone. Moreover, ETFs and custodians help to “demystify” Bitcoin for traditional institutions preparing to deploy large pools of capital into BTC. 6. MicroStrategy Speaking of Saylor & MicroStrategy, $MSTR has been able to hold its ground following its latest rally. The premium to NAV of their Bitcoin holdings is still around 2.6x – and Saylor is likely to tap into this premium with an ATM stock offering to accumulate more BTC. While a few copycats of this strategy have emerged (which we have closely documented and are bullish on), few things are as interesting as seeing the pioneer at work. For more analysis on MicroStrategy and how they are accumulating BTC on behalf of their shareholders, check out this podcast featuring BritishHODL and Blockware Head Analyst, Mitchell Askew. SVRN Energy SVRN is more than a premium energy drink! It’s your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats! Use Code “BLOCKWARE” for 10% off. svrnenergy.com/?v=f24485ae434a Bitcoin Mining 7. Energy Gravity At a typical hosting rate today, new-gen Bitcoin ASICs require ~$61,806 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig.The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below. Read the Energy Gravity report here. All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Blockware Intelligence Newsletter is free today. But if you enjoyed this post, you can tell Blockware Intelligence Newsletter that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

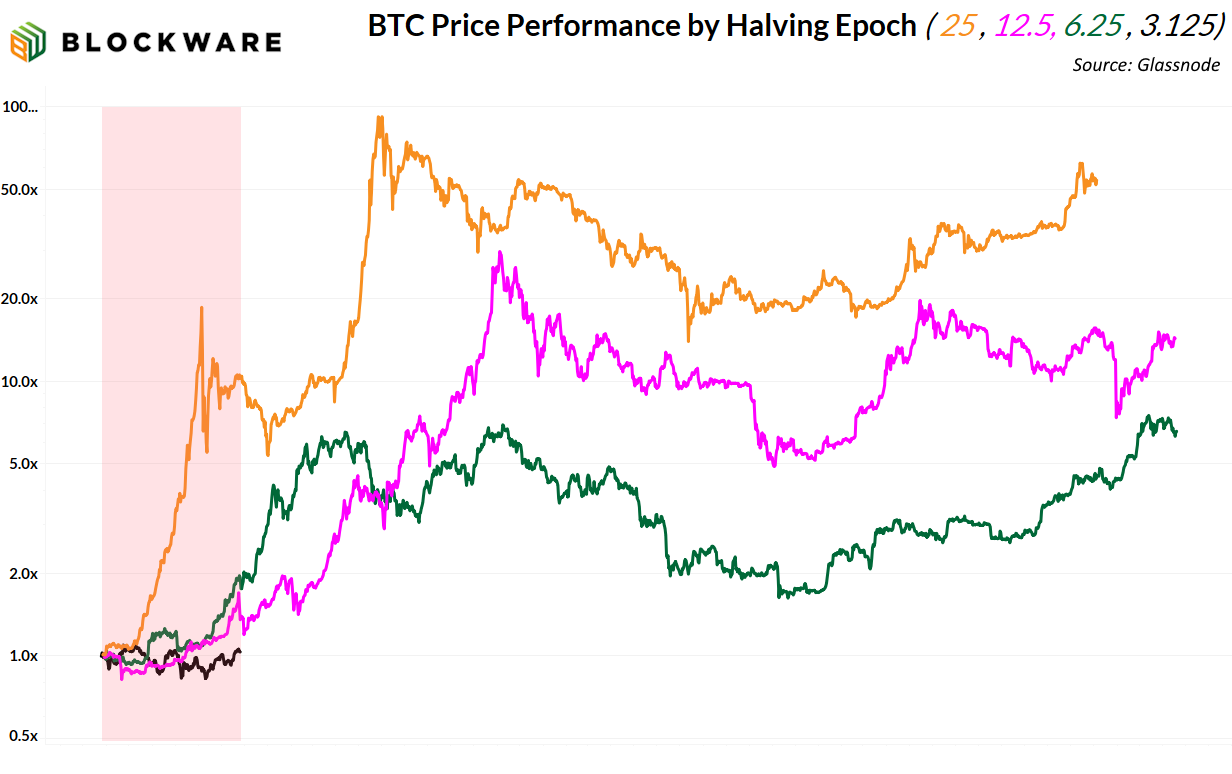

© 2024 Blockware Solutions |