Monday Mining Metrics: The Capitulation is Over

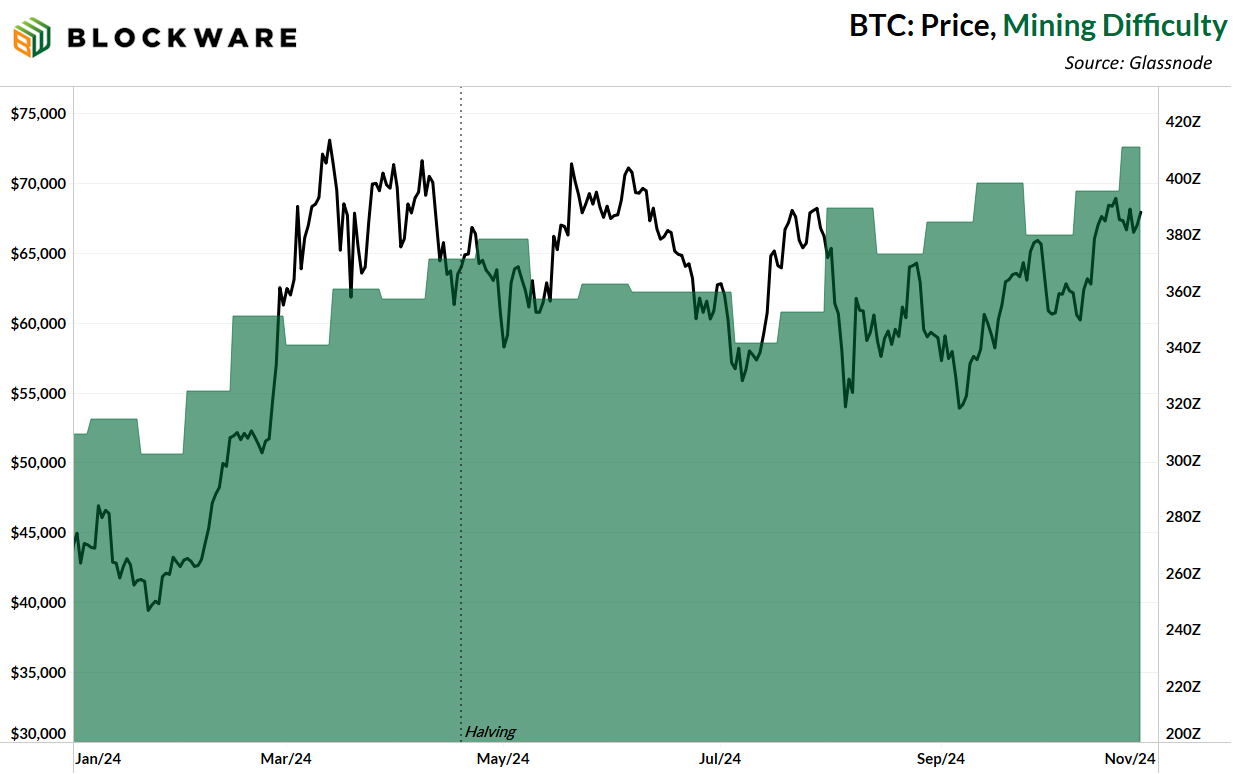

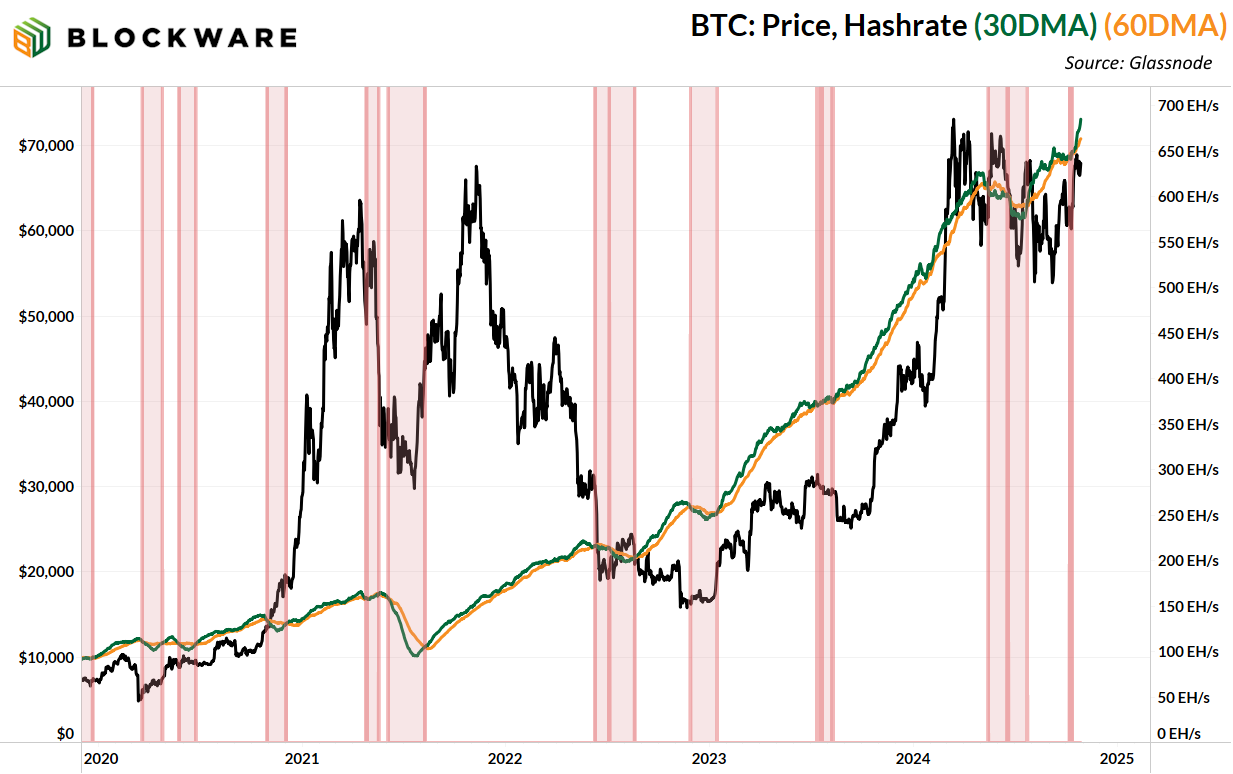

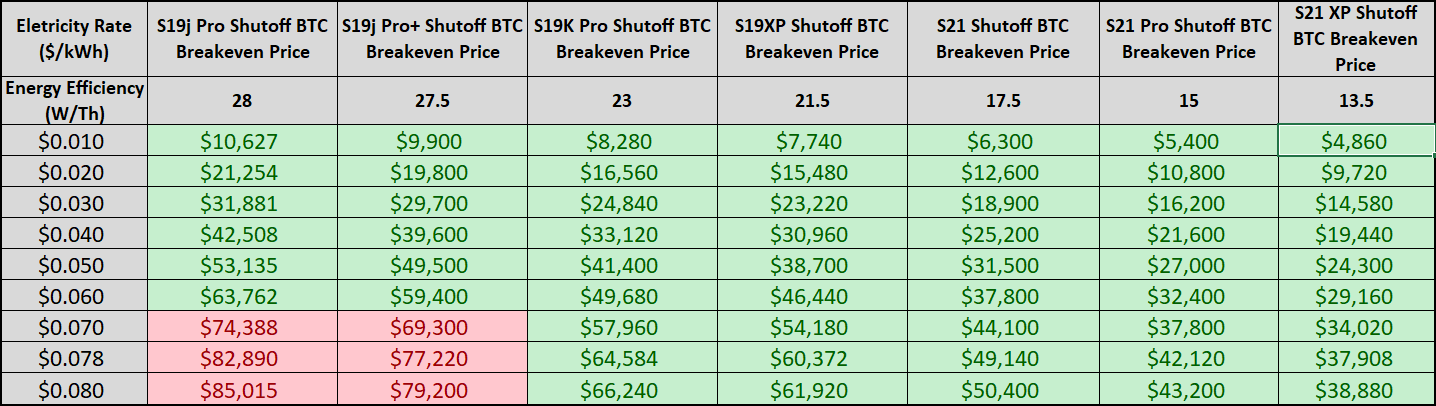

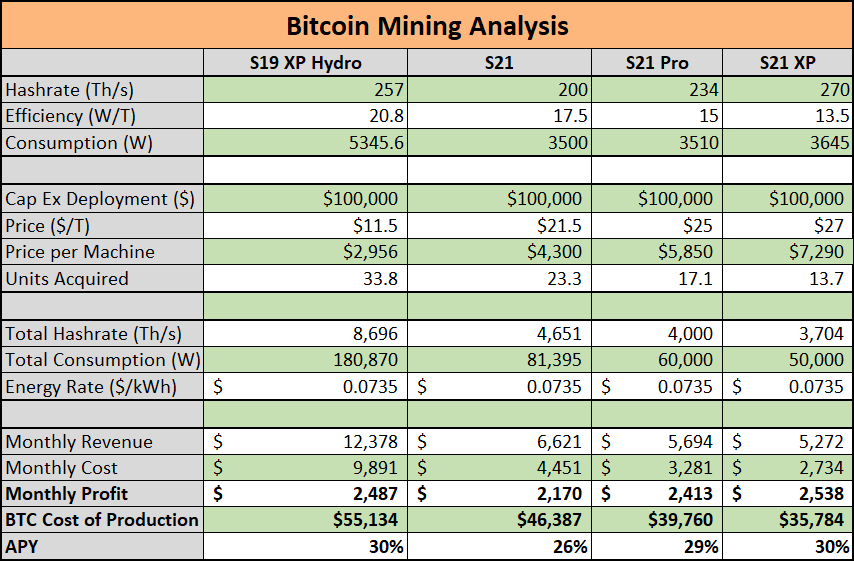

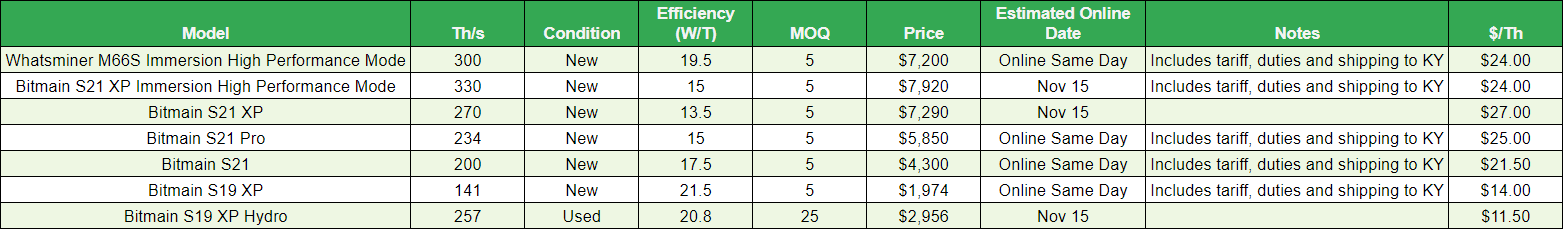

Mining Difficulty Mining difficulty increased by 4% last week and is on pace for a third consecutive positive adjustment (projected ~6%). While rising difficulty works against the profitability of Bitcoin miners (more competition for the 3.125 BTC Block Subsidy), it is a bullish signal for BTC price action, which is the most important variable for mining profitability. Hash Ribbon The ‘Hash Ribbon’ indicator flashed in earlier this month but has since closed. This occurs when the 30-day moving average of hashrate crosses below the 30-day moving average. Or in other words, Bitcoin miners are unplugging machines in the aggregate. Hash Ribbons have a high success rate of marking local bottoms because it means that unprofitable miners are being forced to capitulate. Prior to capitulation, these miners were a significant source of sell pressure (selling all the BTC they mine + depleting treasury reserves); so the relief of this sell pressure is bullish for price action. The sequence playing out this year is similar to what happened after the 2020 halving. After the second post-halving hash ribbon in November 2020, BTC went from under $20,000 to over $60,000 in the span of a few months. 2020: Halving → Miner Capitulation → Second Capitulation → Bull Run 2024: Halving → Miner Capitulation → Second Capitulation → ??? Cost to Mine 1 BTC The table below shows the breakeven Bitcoin price for different ASICs based on electricity rate. Or in other words, how much in electricity does it cost to mine 1 BTC. Miners with older hardware are hanging on by the skin of their teeth, while miners with newer-generation equipment (S21 or greater) have healthy profit margins even when mining at higher electricity rates. An S21 XP mining at 7c/kWh is able to mine 1 BTC for ~$34,000 in electricity. Here’s a table juxtaposing the economics of a $100,000 deployment into BTC mining based on different machine types. The projected APY ranges from 26% to 30% for each of the models shown. The newer, more efficient models provide more downside protection as they have lower BTC breakeven prices. However, the oldest model shown (S19 XP Hydro) – which is still more efficient than the fleet average for many public mining companies mind you – has a higher break-even price, but you’re able to acquire more hash power per $ spent. This ultimately results in a higher net return under current market conditions, as well as in the event of continued appreciation in the BTC price. To learn more about Bitcoin mining with Blockware, fill out this form on our website. The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here. If you’re looking to purchase individual machines, you can use our self-service marketplace to pay with BTC and start mining immediately! All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Blockware Intelligence Newsletter is free today. But if you enjoyed this post, you can tell Blockware Intelligence Newsletter that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

© 2024 Blockware Solutions |