NBA Valuations Reach $4.4 Billion As The Focus On Real Estate Development Intensifies

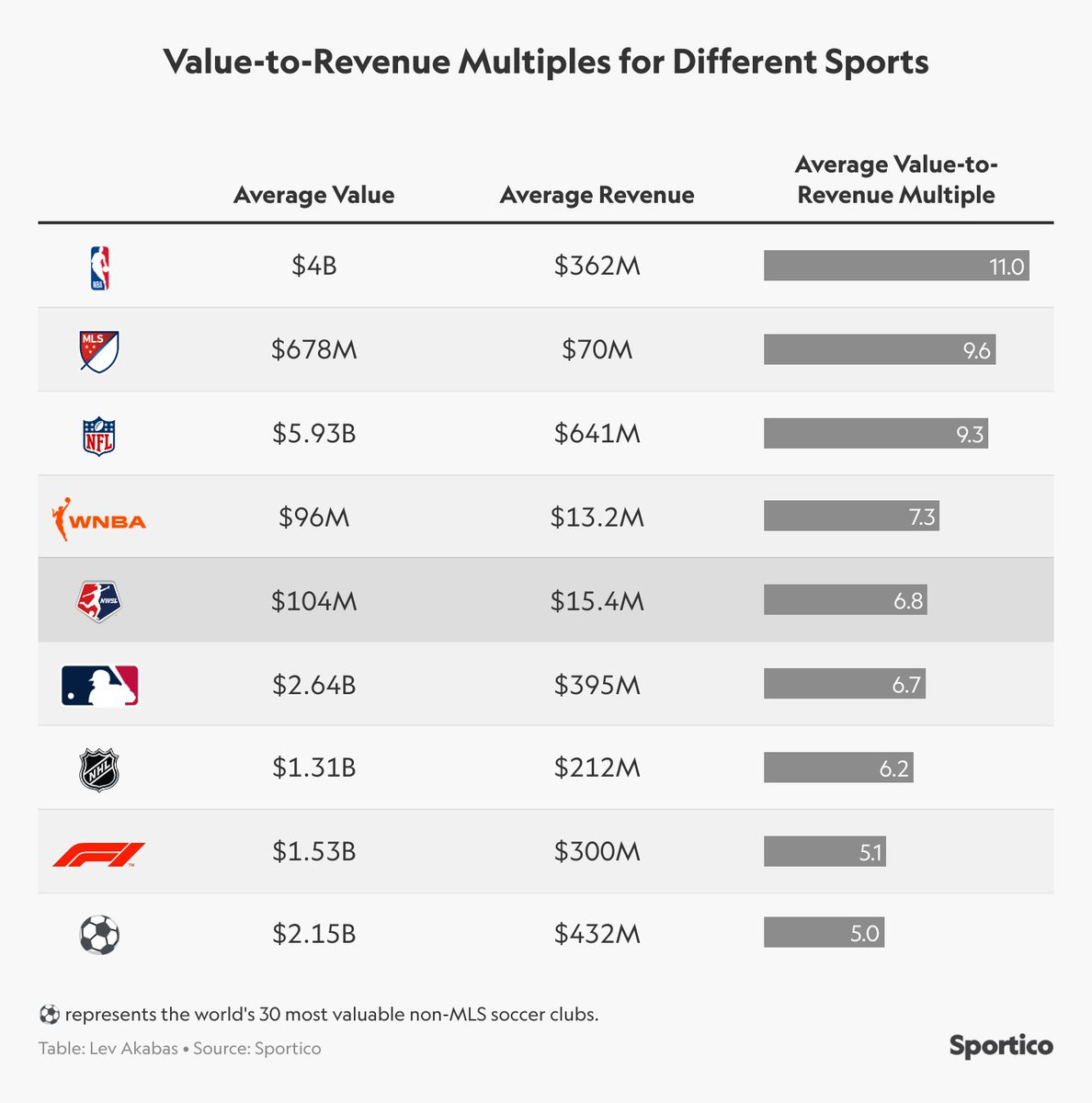

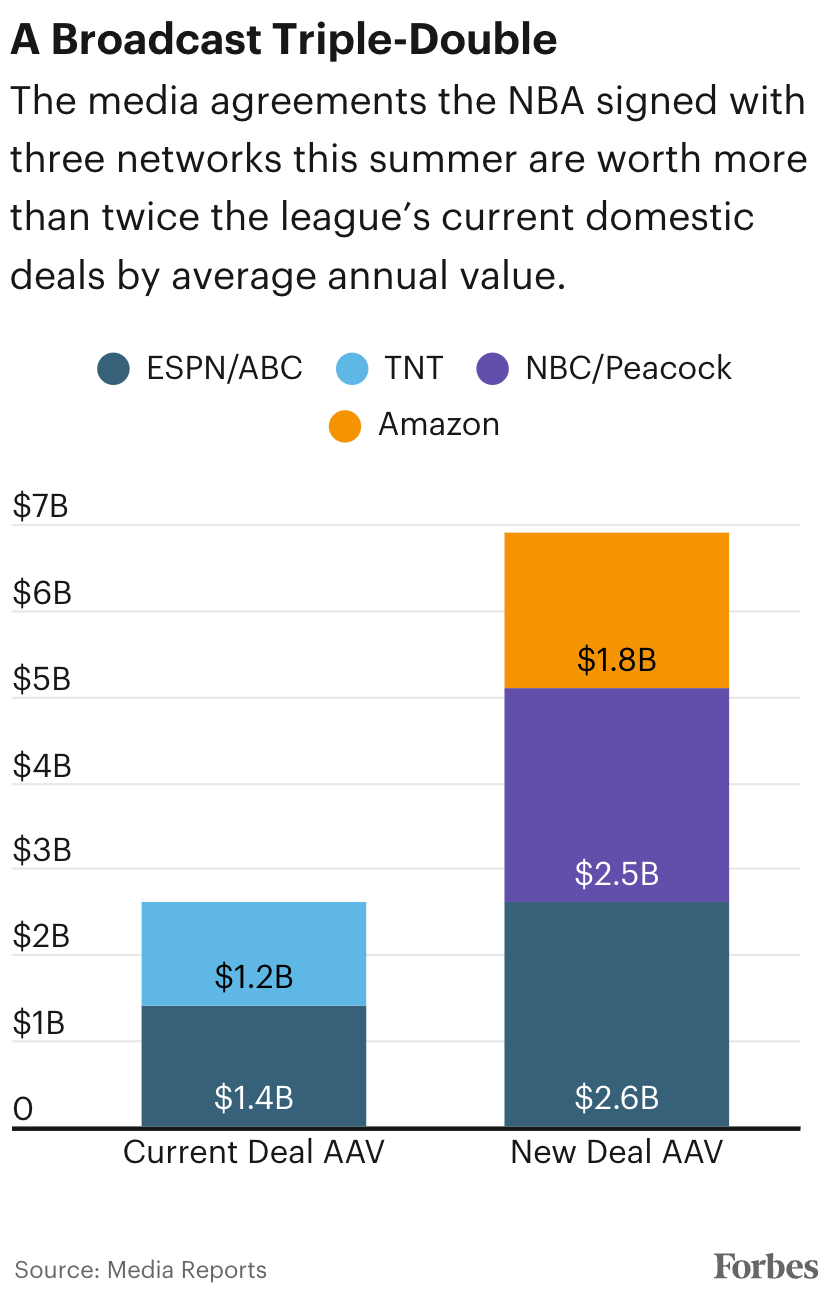

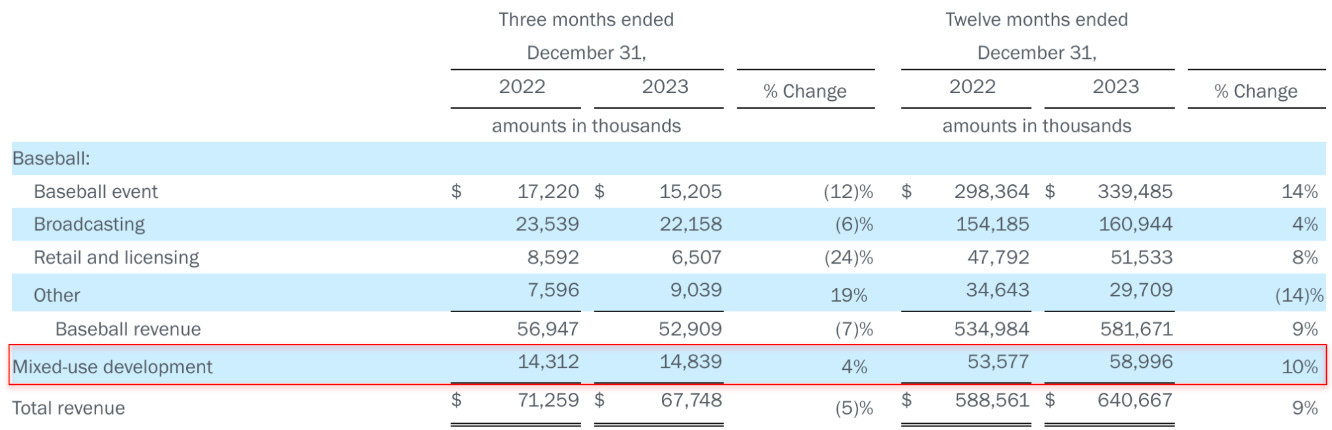

Last week, Forbes released its 2024 NBA franchise valuations. The Golden State Warriors topped the list at $8.8 billion, up 14% from 2023. The top five also included the New York Knicks ($7.5 billion), Los Angeles Lakers ($7.1 billion), Boston Celtics ($6 billion), and Los Angeles Clippers ($5.5 billion). And even the NBA’s least valuable teams — the Memphis Grizzlies, New Orleans Pelicans, Minnesota Timberwolves, Orlando Magic, and Charlotte Hornets — are all now worth $3 billion or more. One thing that might surprise people is that every NBA team now trades at a 10x revenue multiple or higher, with the average NBA revenue multiple hitting 11.7x this year, a sizable increase from the NBA’s 10.9x average revenue multiple last year. This revenue multiple is higher than any other major professional sports league, meaning investors are paying a premium (based on revenue) to the valuations seen in the NFL, MLB, NHL, MLS, WNBA, NWSL, Formula 1, and top European soccer clubs. This is a story that I will be watching over the next several years. On the one hand, the NBA is firing on all cylinders, setting records in league-wide revenue ($13 billion) and attendance (22.5 million fans in 2023), and everyone knows they recently signed a $76 billion media rights deal that is worth 2.7x more in average annual value than the last. This media rights deal will lead to 1) higher player salaries via a big jump in the salary cap and 2) larger annual revenue distribution checks for NBA owners. So, it makes sense that investors are placing a premium on that growth (because it’s a certainty). However, on the other hand, there are also concerns. NBA viewership remains significantly below what it was several decades ago, and some of the league’s most financially-savvy owners have started to offload their equity positions over the last few years, including people like Mark Cuban, Marc Lasry, and Chamath Palihapitiya. Through conversations with current and former NBA owners over the years, this offloading of equity positions isn’t so much that owners think valuations will go down; it is more the fact that there has been a shift in the league’s risk-reward profile. The best way to explain this is that NBA valuations grew a lot from around 2010 to today because media rights exploded. This was primarily because cable companies had to increase their bids to maintain an asset that slowed churn while tech companies armed with cash, like Amazon, drove the price of media rights higher. However, now that the NBA’s media rights are settled for the next decade, many people wonder where the next stage of growth will come from, especially since it’s unclear what the sports media environment will even look like 11 years from now. Tickets? Many NBA arenas are already at capacity, and there is a limit to how much fans can afford to pay. Sponsorships? It’s not a big enough revenue bucket, and there is only so much inventory on a nightly basis. And the same principles apply to other line items, like merchandise, concessions, parking, concerts, and naming rights. This is why you have seen many of the smartest sports owners start building out mixed-use developments. These projects are often outside their area of expertise, but it has become the most obvious way to drive growth in today’s environment. In the simplest terms, mixed-use developments are just real estate projects that, in this case, surround a sports venue. They typically include a mix of bars, restaurants, shops, hotels, and office space, and there are several ways to structure these deals, like owning the property outright, leasing the space, and collecting monthly rent checks. Examples of these projects include Patriots Place in New England, the Deer District in Milwaukee, Texas Live in Arlington, and Ballpark Village in St. Louis. Some of these projects are privately funded, while others use taxpayer money, and the Battery in Atlanta is now the MLB team’s third-largest revenue-generating line item, bringing in nearly $60 million in revenue last year and growing at 10% year-over-year. It’s not the sexiest thing to talk about with fans, but private equity investors love these deals because it gives them predictable real estate exposure with the added upside that comes with the NBA’s international growth strategy. So, yes, while the NBA has started to allow private equity funds to purchase minority stakes in teams as a way to artificially increase demand while enabling current owners to access liquidity, many NBA owners are bringing on private equity partners so they can use their cash and expertise to develop more mixed-use development projects. Not every NBA team can do this, as some teams don’t own their own arena or can’t easily purchase/develop real estate around the venue. But that’s precisely why we will start to see division between those who can employ this strategy and those who can’t. In fact, Mark Cuban specifically mentioned this as one of the reasons why he sold a portion of his stake in the Dallas Mavericks to casino experts, the Adelson family. “When I first bought [the Dallas Mavericks] in 2000, I was the tech guy in the NBA. I was the media guy. I had every edge and every angle. Now, fast forward 24 years later, in order to sustain growth, to be able to compete with the new collective bargaining agreement, you have to have other sources of revenue. And so you see other teams, in all sports, talking about casinos, talking about doing real estate development. That’s just not me. I wasn’t going to put up $2 billion to get an education on building. If we’re able to build a Venetian-type casino in Dallas with an American Airlines center in the middle of it, then the valuation is $20 billion. But I [still] own 27% of that.” The truth is that sports teams have become a much bigger business. Winning is still essential and franchises aren’t all that valuable without fan interest and TV demand. But given the current revenue multiples that these teams are trading at, owners either need to get creative via real estate or they may be better off investing somewhere else. If you enjoyed this breakdown, share it with your friends. Join my sports business community on Microsoft Teams. Huddle Up is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber. You’re currently a free subscriber to Huddle Up. For the full experience, upgrade your subscription.

© 2024 |