Monday Mining Metrics: Miners Thrive as BTC Breaks $86,000

Monday Mining Metrics: Miners Thrive as BTC Breaks $86,000Bitcoin Mining Update – 11/11/2024

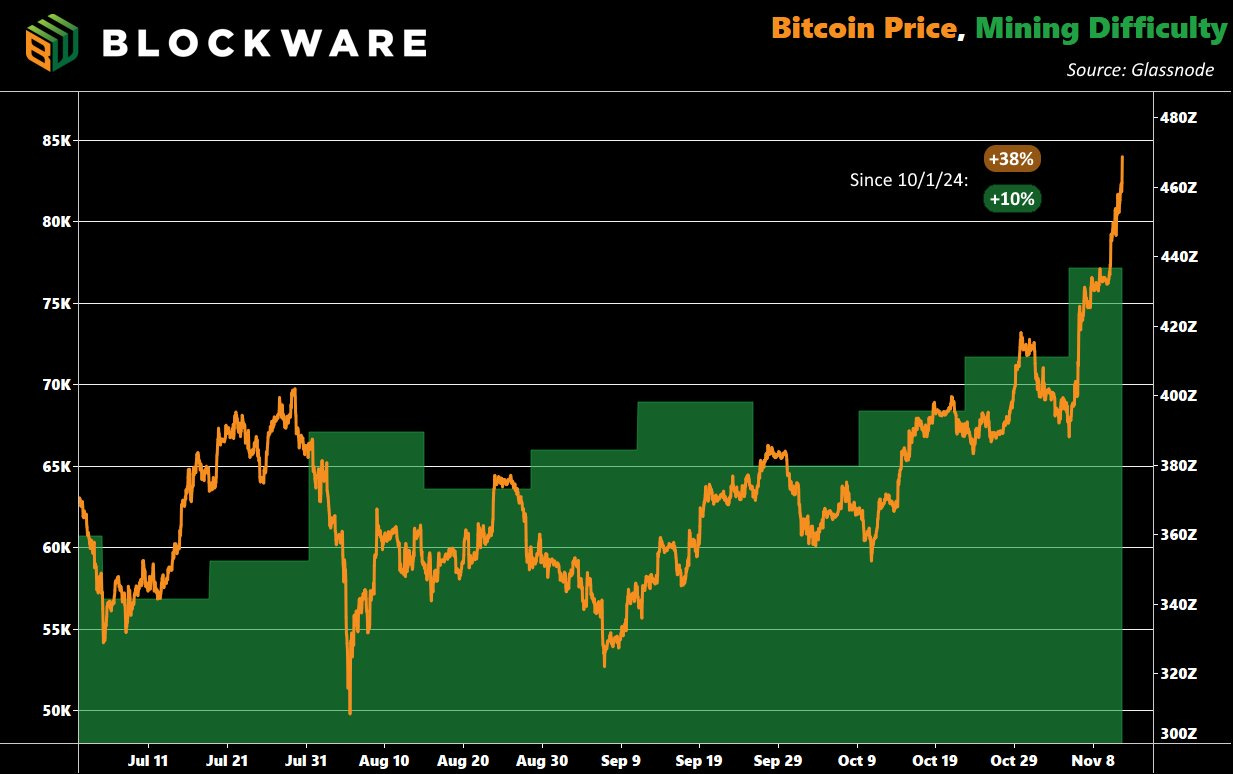

Hashrate is Ripping All year long we have been talking about how the Bitcoin price will outpace mining difficulty/network hashrate during the bull market. The thesis is playing out right in front of us. Over the past month:

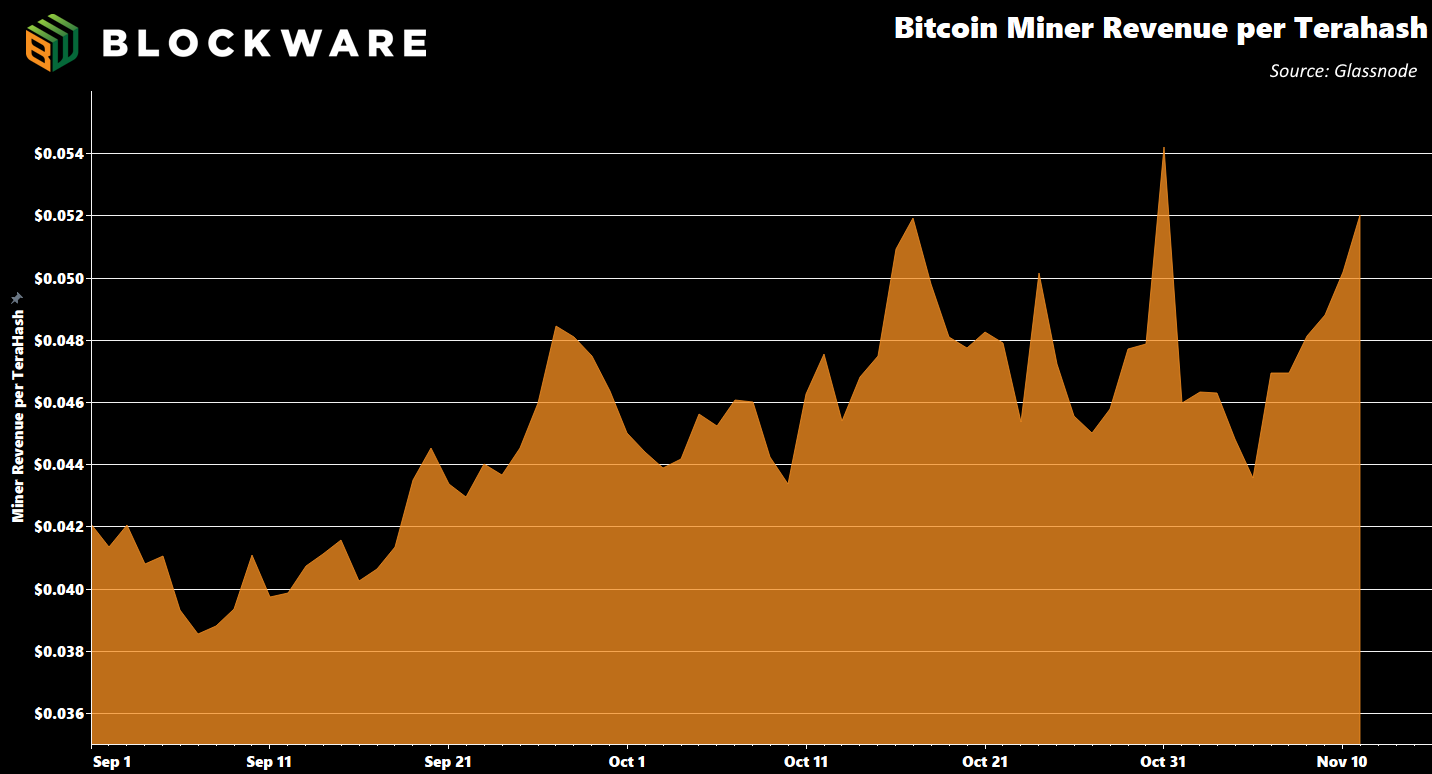

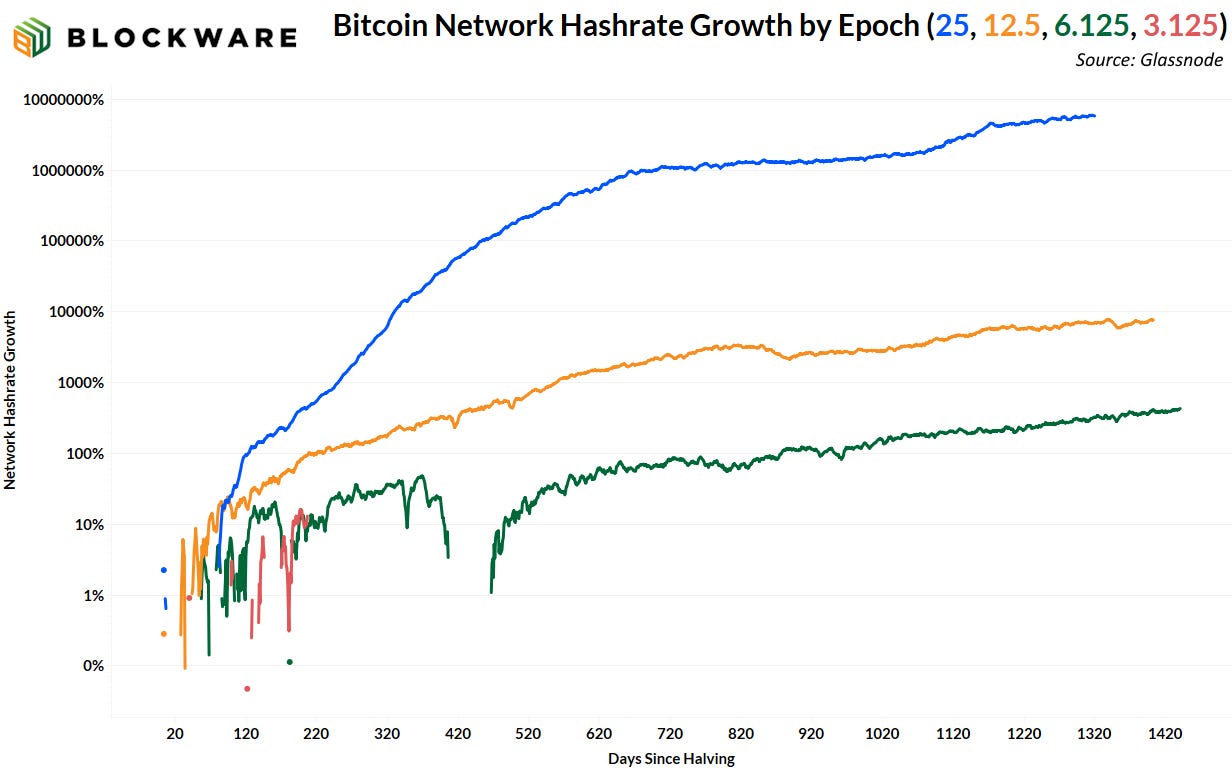

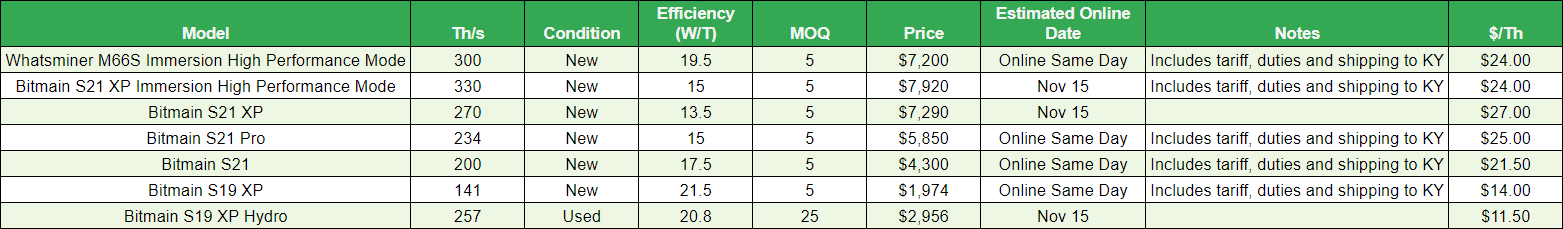

Profit margins for Bitcoin miners have risen significantly, and they will likely continue to do so throughout 2025. Miners that are hashing right now will benefit the most. For more on this specific topic, check out this Blockware report. If you’re interested in mining yourself, fill out this form here and a member of the Blockware team will reach out to you. We have miners available with zero lead time. You could be hashing as soon as today. Hashprice ($/Th/Day) Miners are now earning $0.052 per terahash per day. For context, this means that a single S21 XP miner (270 Th) is earning ~$14 in BTC per day (270 * .052). Over the course of a month this adds up to $452. The cost in electricity to run one of these machines, with a $0.078/kWh electricity rate, is ~$211 per month. So under current market conditions, here is the breakdown of an S21 XP: Monthly Revenue: $452 Monthly Cost: $211 Monthly Profit: $241 As you can see, miners with new-generation machines (>200 TH/s and < 21 W/Th) are thriving when hashprice is above $0.05. Should the bitcoin price continue to surge in 2025, we will likely see hashprice push $0.10. Mining Stocks vs BTC The public Bitcoin mining equities are being re-priced aggressively. $WGMI, the Bitcoin miner ETF, is up ~67% over the past month on the back of Bitcoin’s ~40% increase. Large, public miners are simultaneously benefiting from the fact that energy prices will likely decline during the Trump administration. Moreover, many of these businesses are pivoting to a dual strategy of Bitcoin mining + AI/HPC. This will bode well for retail / hosted Bitcoin miners because the large operators will dedicate less resources to Bitcoin mining than they otherwise would. Hashrate Growth by Cycle To further elaborate on the bullish case for retail / hosted miners, the growth rate of hashrate/mining difficulty has dropped by multiple orders of magnitude in each of the past cycles. > Law of Large Numbers > ASIC Commoditization > Pub Co. Pivot to AI … all of these will lead to network hashrate growing by a smaller % over the coming years than it has historically – in spite of the fact that the mining industry as a whole is growing. To learn more about Bitcoin mining with Blockware, fill out this form on our website. The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here. If you’re looking to purchase individual machines, you can use our self-service marketplace to pay with BTC and start mining immediately! All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Blockware Intelligence Newsletter is free today. But if you enjoyed this post, you can tell Blockware Intelligence Newsletter that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

© 2024 Blockware Solutions |