What Is Bitcoin Telling Us As It Goes Higher?

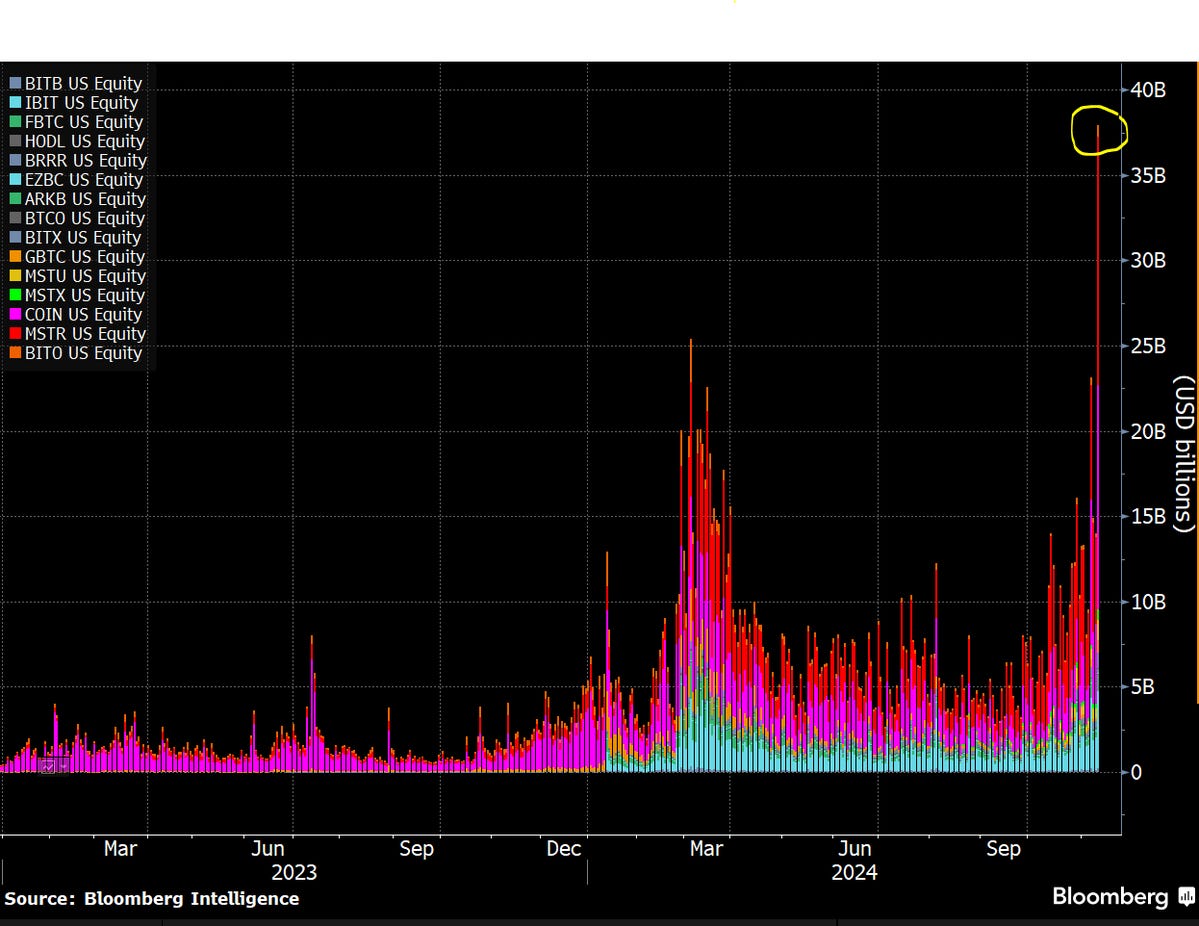

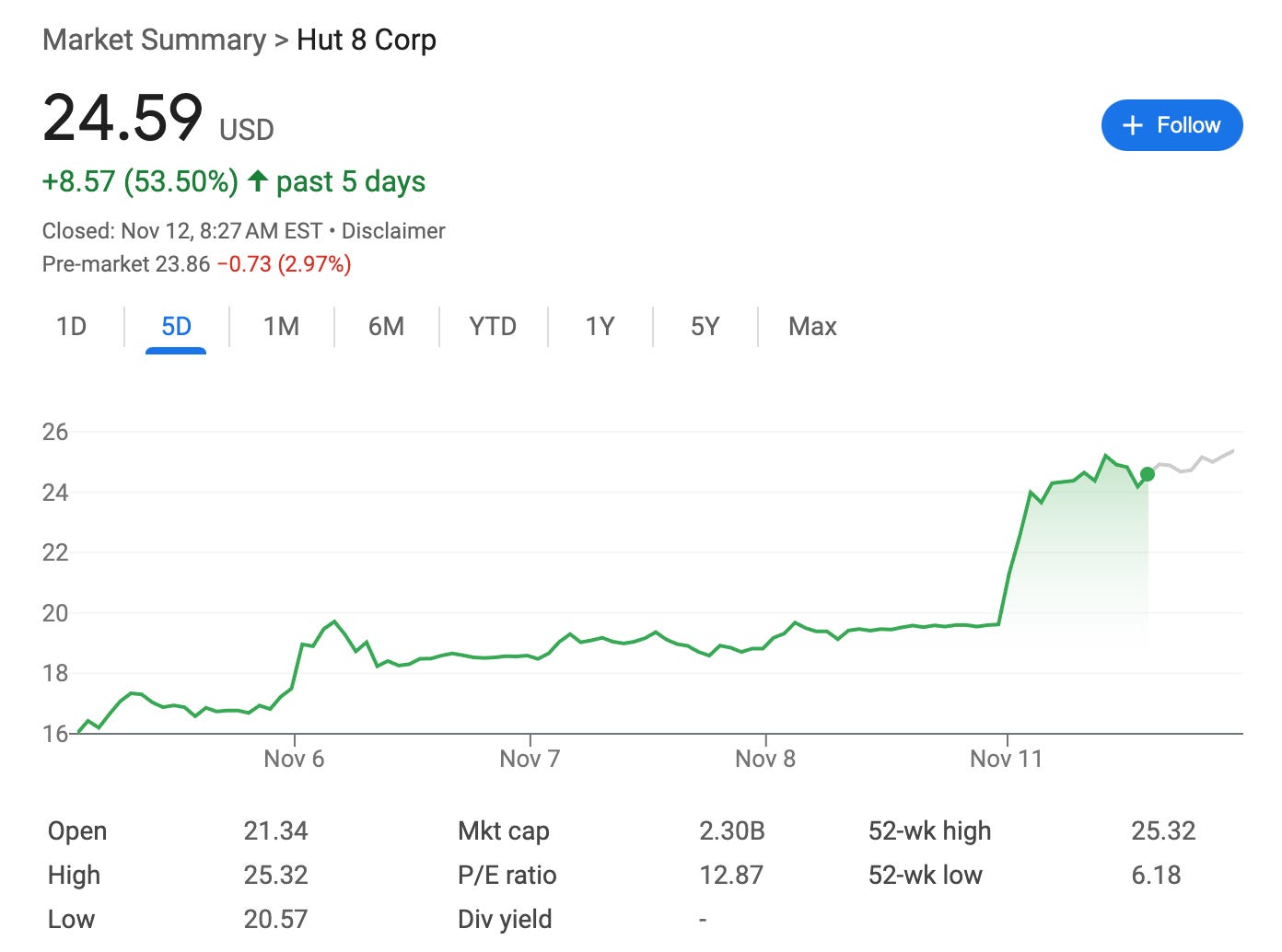

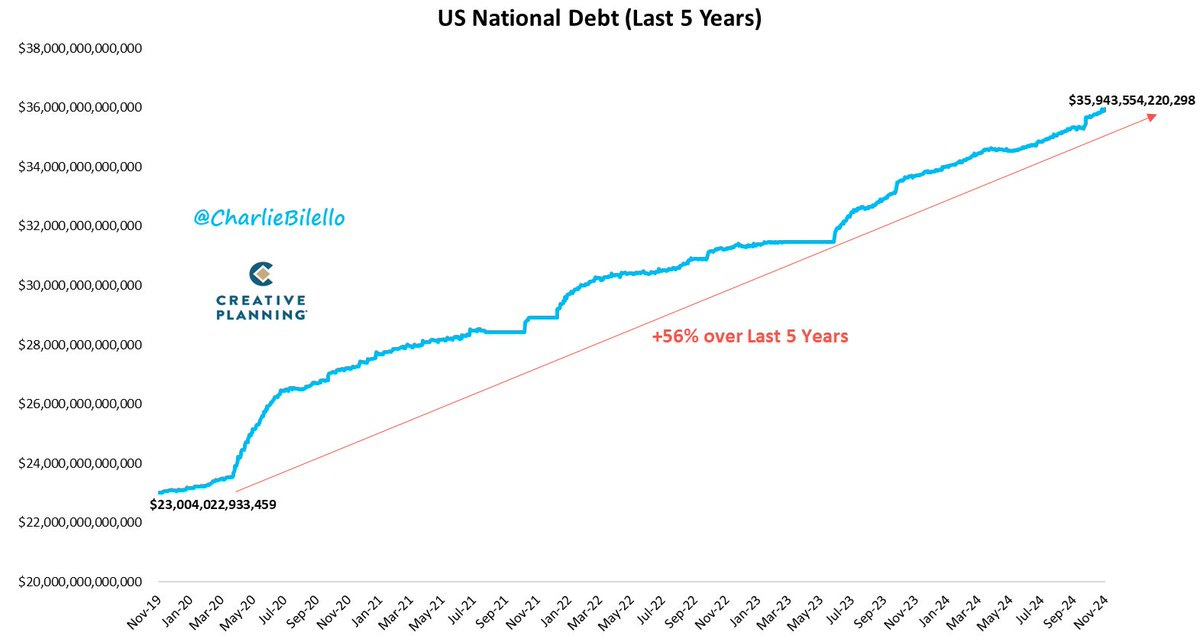

To investors, Bitcoin had one of it’s most impressive days in history yesterday. The asset was up more than 13% and nearly hit $90,000 on the day. There was a lack of substantive news, so I believe the price action was merely Wall Street realizing they were under-allocated to bitcoin. For example, bitcoin was trading around $76,000 on Friday afternoon when the stock market closed. The asset had appreciated and was trading around $82,000 when the stock market opened Monday morning. This means Wall Street investors were boxed out of the market all weekend while bitcoin was running. As soon as the market opened on Monday morning, there was a gap up and it was obvious that bitcoin was going to have momentum for the day. I usually don’t care about day-to-day price action, nor do I consider myself a trader or technician, but this market structure is important to understand because one of the largest pools of capital interested in bitcoin can only buy the asset during stock market open hours. The US stock market is closed more hours a week than it is open. Yet bitcoin still has performed well while the stock market is closed, so there is an interesting memetic response from Wall Street when the stock market opens. You can see this dynamic playing out elsewhere in the market too. Bloomberg’s Eric Balchunas writes “The Bitcoin Industrial Complex (ETFs + MSTR, COIN) saw $38 billion in trading volume today, lifetime records being set all over the place, including IBIT, which did $4.5 billion, which points to a robust week of inflows. Just an insane day.“ It is very clear that Wall Street wants bitcoin and bitcoin-related companies. Take a look at Hut 8, which provides power for bitcoin mining and artificial intelligence use cases (I am an advisor). The company has seen the stock price increase by more than 50% over the last 5 days. This is interesting because Hut 8 ($HUT) sits at the intersection of energy and bitcoin. We know there is a pro-bitcoin President coming to the White House, but one of the other core Trump policies is to deregulate the energy industry. This feels like 1 + 1 = 5. Anywhere that bitcoin intersects with other Trump policies, we should see value being created for investors. This brings us back to bitcoin. What if the asset is not only going up because of Wall Street FOMO? What else could it be? I think bitcoin is screaming a message to us — we just have to listen. The US national debt has exploded in the last month. Charlie Bilello points out:

During the last 3-months, bitcoin has added more than $26,000 to the price. That is a 44% increase at the same time the national debt increased by $850 billion. Maybe bitcoin is acting as the alarm bell? Could it be attempting to draw our attention to the acceleration in uncontrolled spending? I wouldn’t bet against it. Bitcoin has become a great hedge against currency debasement. The higher the national debt goes, the more the government will need to inflate their way out of it. Everyone has their eyes on Wall Street FOMO, but maybe bitcoin is actually pointing us to the politicians. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Anthony Pompliano Explains Why The Recent Bitcoin All-Time High Signals An Incoming Bull RunAnthony Pompliano records a solo episode as bitcoin smashes through $80,000. He explains how we got here, and personal thoughts on where we are going. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2024 |