The Fed locked us out of the housing market, Satoshi gave us a new set of keys.

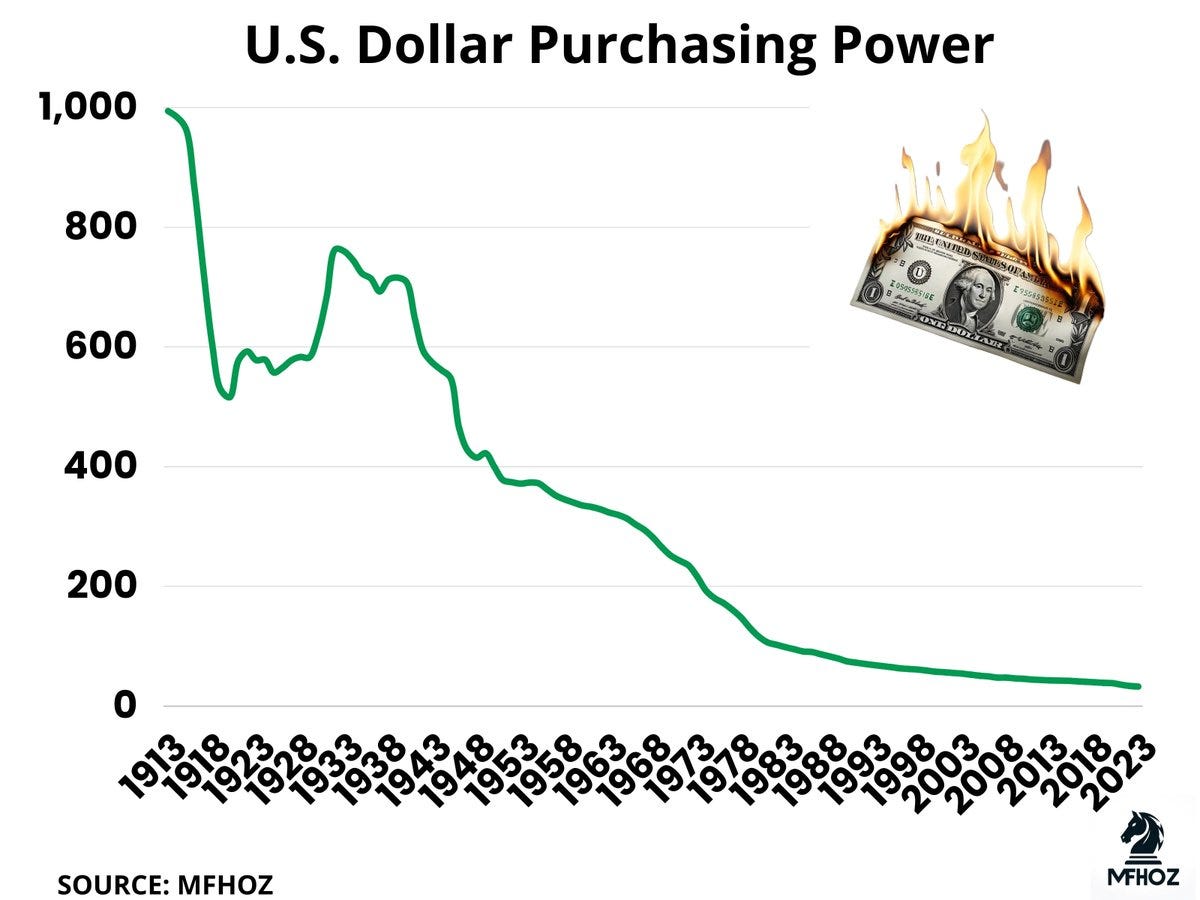

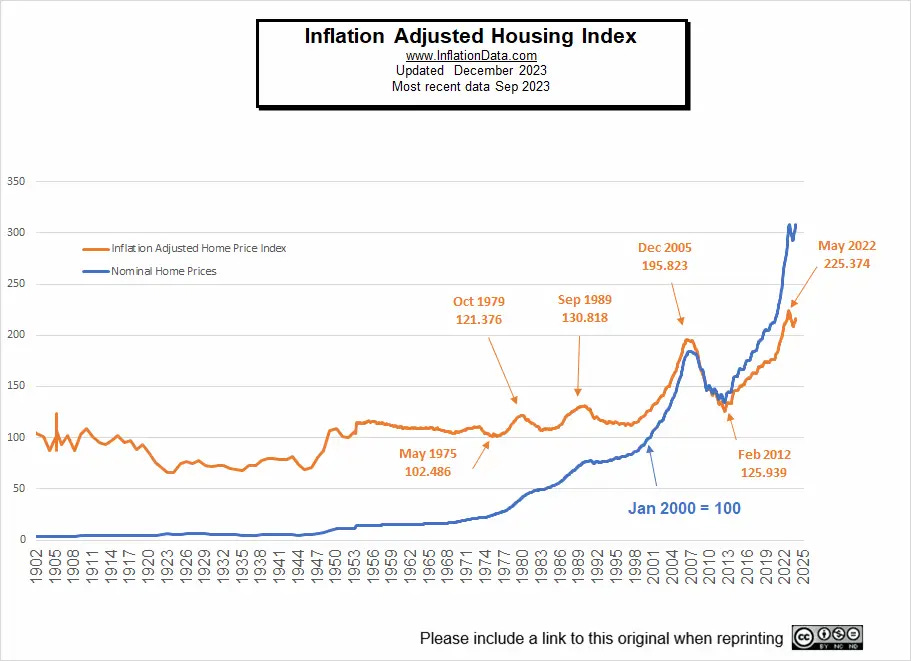

To investors, Bitcoin’s rise in popularity can partially be described as the counterweight to the unaffordable housing market. To understand why this is happening, we have to take a look at the past. Baby boomers own approximately 40% of all homes in the United States. This home ownership has allowed these individuals to build wealth by simply holding an asset that benefits from a US dollar that is being debased. We can see that the US dollar has seen a ~ 90% reduction in purchasing power since the 1970s. During this same time period, home prices have exploded higher. The blue line below shows nominal home prices and the gold line shows inflation-adjusted home prices. You can see that nominal home prices have been pushing higher since the 1980s, but there was a considerable increase in home values starting in the early 2000s. This is important because it means that people under the age of 40 years old came into the workforce when home prices were growing at the fastest rate in the last century. How could someone early in their career afford a home? The short answer is they couldn’t. But unfortunately, even as this cohort of people made more money, they still could not afford a home because affordability spiked the worst level in four decades. The opposite was true for baby boomers — it is estimated that 40-50% of baby boomers’ net worth comes from their primary residence. So young people couldn’t afford to buy the asset that the previous generation had used to generate approximately half of their wealth from. That is a very big problem. Thankfully, bitcoin stepped in as a solution. Rather than having to produce large down payments, qualify with a bank for a mortgage, or overcome burdensome monthly carrying costs, young people were able to start dollar cost averaging into a digital asset that allowed purchases of any amount. The bitcoin generation realized that real estate and bitcoin both appreciated when the dollar was debased. The former was unaffordable for a large portion of the population, so many individuals decided to start allocating to the latter asset. Quite literally, bitcoin became the store of value asset that many young people needed. Millennials are by far the largest renters by generation and millennial home ownership has been falling by 20% over the last decade, rather than growing as we have seen in older generations. The Fed locked us out of the housing market, Satoshi gave us a new set of keys. I now believe this will be one of the most important stories over the next 20-30 years as I have thought about this phenomenon in more depth. Citizens need a store-of-value asset to protect their hard earned wealth. Boomers had housing, millennials have bitcoin. What a time to be alive. Hope you are each having a great weekend. I will talk to you on Monday. -Anthony Pompliano Founder & CEO, Professional Capital Management Anthony Pompliano on Fox Business Discussing The Bitcoin Strategic ReserveEnjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2024 |