How Cadillac Secured Its Spot As F1’s 11th Team

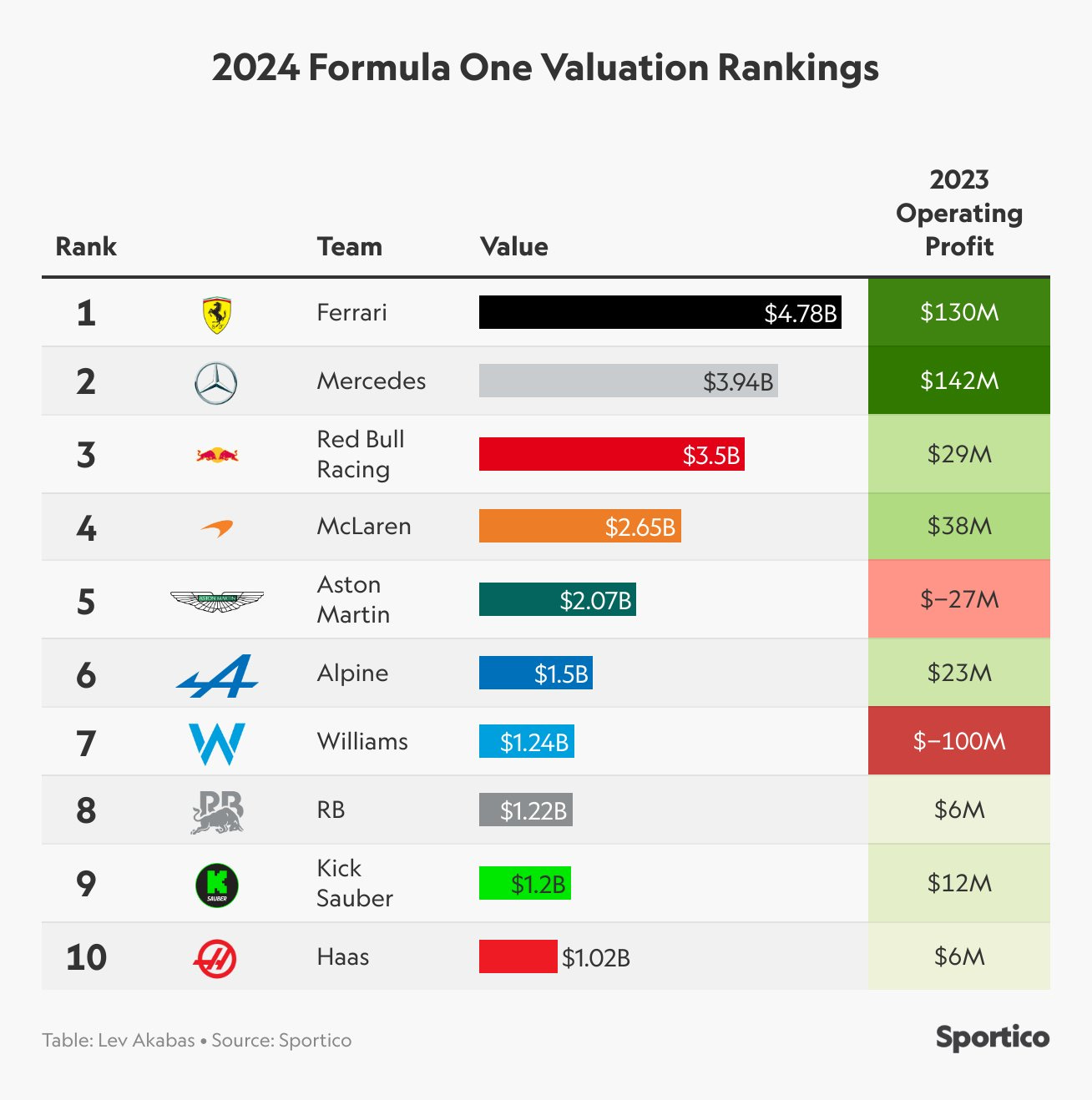

It’s no secret that Formula 1 is having a moment. The world’s largest motorsport series now averages more than 1.5 billion global viewers per season. Top drivers like Max Verstappen and Lewis Hamilton are making over $50 million annually in salary alone, and every single F1 team is now worth more than $1 billion — an unthinkable outcome considering Red Bull paid just $1 for the Jaguar F1 team two decades ago. This success has primarily been driven by Liberty Media. The U.S.-based company purchased the sport at an enterprise value of $8 billion in 2017. However, after spending the last few years making some drastic changes, from partnering with Netflix on its “Drive to Survive” series to introducing a cost cap, Formula 1 now trades at an enterprise value of $20 billion, and everyone wants a piece of that growth. Following a year of endless rumors and speculation, Formula 1 officially announced last week that it was adding an 11th team. This team will be run by General Motors and its Cadillac brand. They will pay hundreds of millions for the opportunity to spend billions. And when they line up for their first race in 2026, GM’s Cadillac brand will be the first U.S.-based automaker team to compete in a Formula 1 race in 50 years. But how much will it cost General Motors to join Formula 1? Who will they hire to drive? Will they even be competitive? And considering how much Formula 1 is already growing, why did the sports governing body decide to add another team now? The expansion process in professional sports is often more complicated and confusing than it needs to be, and Formula 1 is no exception. After spending the last year reading about Michael Andretti’s bid to buy a team, many Formula 1 fans were shocked to see a press release that didn’t even mention the American’s name. Think of this as a revised bid. Andretti’s bombastic approach to securing an expansion team rubbed people the wrong way, and Mercedes team principal Toto Wolff publicly talked about how Andretti’s bid didn’t add enough value to the sport. So, Formula 1 essentially told Andretti that if he wanted to see an 11th team added to the grid, he needed to remove himself from the equation and find a bigger partner. This is where General Motors comes into play. Adding GM makes a lot of sense since its Cadillac brand was already included in the initial bid. Michael Andretti is also no longer involved after stepping down from his lead executive role at the Andretti Global racing team earlier this year. However, that situation is a bit murky, as the investment firm that owns and operates Andretti’s racing team, TWG Global, is still partnering with GM on its new F1 team, providing Andretti some backdoor linkage. For context, TWG Global is Mark Walter’s personal investment vehicle and holding company. Walter is the CEO of Guggenheim Partners, an asset manager with $335 billion in AUM. Bloomberg says Walter is one of the world’s 200 richest people, worth an estimated $13 billion, with Walter using that wealth to invest in several sports franchises, including the Los Angeles Dodgers (MLB) and Chelsea (Premier League). General Motors and TWG Global must now pay a substantial fee to become F1’s 11th team. This is called an anti-dilution payment. The easiest way to think about it is that since all F1 teams share in the revenue of the sport, a new team must pay a large enough fee to warrant existing teams adding them to that revenue-sharing agreement. The 2020 Concorde Agreement among F1 teams stipulates that any new team must pay a $200 million entry fee to join the grid. But with F1 growing so much over the last few years and a new agreement expected to be in place by the time Cadillac lines up for its first race in 2026, BBC is reporting that General Motors and TWG agreed to pay an anti-dilution fee of $450 million to secure the team’s entry into Formula 1. This $450 million fee will then be split evenly among F1’s ten teams. Each team will receive a $45 million payment in exchange for adding Cadillac to its broader revenue-sharing agreement, which includes things like international media rights and league-level sponsorships, but not team-specific sponsorships or branded merchandise sales. It’s worth noting that Formula 1’s parent company paid out $1.2 billion to its ten teams in 2023. That’s $120 million each, and if that number were to be divided among eleven teams instead of ten, it would have come out to just over $109 million each. So, the idea is that Cadillac’s $450 million payment will help offset that initial decrease in revenue and eventually lead to higher league-wide revenues in the future. However, it’s not like Cadillac just pays $450 million and then reaps all the financial rewards. The reason Red Bull was able to buy the Jaguar F1 team for just $1 back in the day is because the deal required hundreds of millions in additional investment. Huddle Up is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber. Cadillac is expected to start its F1 journey by purchasing engines from Ferrari. But the General Motors-owned brand will eventually be a works team, meaning they will be responsible for designing, building, and supplying their own cars and engines. General Motors got a head start on this process because Andretti Global’s parent company, TWG, invested significant money to show F1 it was submitting a serious bid. This included TWG hiring technical employees from teams like Renault and Williams to start the initial car design. TWG also built out a satellite office near Silverstone Circuit in the UK, the same place where Mercedes and Aston Martin currently operate their F1 teams. And TWG has even been using Toyota’s wind tunnel in Germany to start performing aerodynamic and crash tests for its earliest F1 designs. General Motors and Cadillac haven’t announced their driver lineup for 2026, but it’s widely expected that F1’s newest team will try to pair a veteran driver with a rookie. Race-winning drivers like Daniel Ricciardo and Valtteri Bottas make a lot of sense for the former, while someone like IndyCar driver Colton Herta might make sense for the latter. This would provide Cadillac with valuable intel into how top teams operate, and it would also help them take advantage of the sport’s immense growth in the US. The American aspect is a big part of this. In fact, Formula 1 has been pretty open that they probably wouldn’t be adding another team if it were just another European brand. That’s because Formula 1 now has three races in America, with Miami, Austin, and Las Vegas on the annual calendar. No other country hosts more than two Formula 1 races, and Liberty Media knows that expanding the American market is the only way to double the sports enterprise value — from $20 to $40 billion — over the next decade. But similar to how Liberty Media expects to make money, so does General Motors. We have frequently discussed how international brands use Formula 1 as a marketing platform. With roughly 75 million people from around the world watching each race, companies like Mercedes, McLaren, Ferrari, and Red Bull use that valuable television time to build brand affinity, eventually translating to more car and energy drink sales. All of these teams used to operate in the red, with some losing hundreds of millions each year. However, with Formula 1 introducing a cost cap in 2021, designed to even the playing field by limiting how much teams could spend in a given year, eight out of Formula 1’s ten teams now turn an annual profit, and bigger teams like Ferrari and Mercedes brought in more than $130 million in operating profit last year alone. This has turned what was once considered an expensive marketing exercise into a profitable operation. Ferrari would never sell its team, but they are now valued at $4.8 billion, and every other F1 team is worth at least $1 billion, according to Sportico. General Motors is hoping to capture some of this magic with Cadillac. It was impossible to determine the public market’s reaction to Cadillac’s F1 news because President-elect Donald Trump announced major tariffs on the same day General Motors announced its Formula 1 deal, driving the stock a few percentage points lower. However, Cadillac is already spending about $300 million annually on marketing. So, they can potentially shift some of that money towards F1 and reap a bigger reward. The 102-year-old American car brand sells around 390,000 cars each year. But most of those sales come through the United States and Canada, and deepening its roots in more F1-minded European countries could provide Cadillac with valuable upside. Cadillac will never sell as many cars as Mercedes (2 million), but they do significantly more volume than luxury brands like Ferrari (13,000). And increasing the brand’s international penetration by even a few percentage points would yield big results. The reality is that you can no longer think about these decisions solely through marketing. It will always be part of it, for sure, but the average Formula 1 team is now bringing in $376 million in annual revenue and trading at a 6.1x revenue multiple. These are legitimate businesses. They have thousands of employees and dedicated management teams. It should be looked at no differently than buying an NBA or MLB expansion franchise, and whether General Motors ends up selling more road cars or not, their Formula 1 team should end up being a profitable asset entirely on its own. If you enjoyed this breakdown, share it with your friends. Join my sports business community on Microsoft Teams. Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not a subscriber, sign up and join 125,000+ others who receive it directly in their inbox each week. You’re currently a free subscriber to Huddle Up. For the full experience, upgrade your subscription.

© 2024 |