Why Disney Failed At Sports Ownership

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. Subscribers include investors, professional athletes, team owners, and casual fans. So if you are not already a subscriber, sign up and join 83,000+ others who receive it directly in their inbox each week — it’s free. Today At A Glance:Sports valuations have dramatically increased over the last two decades. The average NFL, NBA, MLB, and NHL team is now worth more than ten figures, and virtually all ownership groups have made a ton of money — except The Walt Disney Company. So today’s newsletter explores Disney’s ownership tenure in professional sports, including why the entertainment conglomerate failed to live up to its expectations. Today’s Newsletter Is Brought To You By Goldin!The world’s top 500 sports cards have an ROI of 855% over the last 15 years, compared to just 175% for the S&P 500 — and there is no better place to start or build your collectible portfolio than Goldin. Goldin is the leading and most trusted destination for some of the most significant pieces of sports and pop culture collectibles. Their marketplace is open 24/7, they have weekly auctions starting at just $5, and there is something for every collector. And here’s the best part: Goldin is currently offering all sellers up to 50% off marketplace fees when you sell your items before February 17th. So use the link below to check ’em out — I’m a big fan of the product, and I think you will be too. Friends, After announcing plans to explore a sale of the Los Angeles Angels in August, billionaire owner Arte Moreno officially ended the exploratory process last week and now plans on keeping the Major League Baseball (MLB) team beyond the 2023 season. This was a surprise. The Angels have struggled on the field and haven’t made the playoffs since 2014 despite having Mike Trout & Shohei Ohtani. But Moreno reportedly received bids near $3 billion (an all-time MLB record) and would have made a hefty profit on his initial $183.5 million purchase of the team in 2003. Los Angeles Angels Valuation

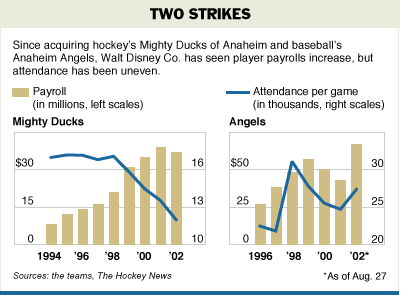

But this got me thinking about the Angels’ previous owner: Disney. The mass media and entertainment conglomerate is most famous for its parks, experiences, and products today. But they also owned professional sports franchises throughout the late 90s and early 2000s. And while virtually everyone else has made a killing from ownership, Disney’s results were less than stellar. So let’s dial back the clock and explore what went wrong for Disney. The Mighty Ducks: A Movie Becomes An NHL TeamDisney’s initial interest in sports ownership started in 1993. The Walt Disney Company had just released “The Mighty Ducks,” and the film was a huge success, bringing in more than $50 million in box office revenue off of a $14 million budget. So Disney had an idea: What if they could build a professional sports empire and use those assets to create synergies and cross-promotion opportunities across its theme parks, movies, animations, products, merchandise, and more? Well, that’s precisely how the Mighty Ducks were born — because in 1993, The Walt Disney Company won the bid for an NHL expansion franchise that became the Mighty Ducks of Anaheim, a play-off the popular Mighty Ducks film franchise. Hockey was catching fire in Southern California. Wayne Gretzky’s trade from the Edmonton Oilers to the LA Kings helped. And Gary Bettman — who had a reputation for expanding hockey to non-traditional markets like Arizona, Florida, and Texas — signed off on the deal and became NHL Commissioner just a few months later. Disney paid a $25 million expansion fee to the NHL and $18 million to their new market neighbor LA Kings, and joined the NHL for a total price of $43 million. And things got off to a great start. The Mighty Ducks negotiated a favorable deal with the newly built and empty Anaheim Arena, giving the company a high percentage share of advertising signage and luxury suites. And before the Mighty Ducks even played a game, the team was already worth $100 million. The Mighty Ducks then made $10 million in its first season (1993-94) and between $3 million to $7 million for the following three seasons. They also sold out 90 of their first 93 home games, including 51 games in a row at one point. But things started to deteriorate at the end of the 1997 season. Head coach Ron Wilson was fired after constantly butting heads with Disney’s management team, and the Mighty Ducks had a winning percentage at or below .500 from 1997 to 2001. Disney then fired team president Tony Tavares in the early 2000s, and even though the team reached the Stanley Cup Final in 2002-03, Disney’s stock price was down about 50% from its all-time high, and they decided it was time to move on. So on February 26, 2005, the Anaheim Mighty Ducks were sold to billionaire Henry Samueli and his wife Susan amid the NHL lockout for $70 million. But that’s only half the story. The Angels: Disney Takes Its Second Swing On MLBWhether it’s theme parks, movies, or merchandise, The Walt Disney Company doesn’t do anything small. So it should be no surprise that The Mighty Ducks were just step one in the company’s plan to build a money-making professional sports empire. For example, just three years after purchasing an NHL expansion team and two years after releasing the movie “Angels in the Outfield,” Disney ventured into baseball. In 1996, The Walt Disney Company purchased a 25% controlling stake in the California Angels of Major League Baseball. They then changed the name of the club to the Anaheim Angels in 1997, and purchased the rest of the franchise from the family of Gene Autry for a total of $150 million in 1998. But Disney struggled to make the club appealing to fans. For example, the Angels had winning records in 1997, 1998, and 2000, but by 2002, their attendance had declined by almost 4,000 fans per game and the team was struggling to break even financially. So even though the Angels went on to win the World Series in 2002 — they beat the San Francisco Giants in 7 games after compiling a 99-63 regular season record — Disney sold the team to outdoor advertising mogul Arte Moreno for $183.5 million. So, Why Did Disney’s Team Ownership Ultimately Fail?It’s easy to look back and call Disney’s tenure of professional sports ownership a failure. But, objectively speaking, they left a lot of money on the table. For example, Disney purchased the Mighty Ducks and Angels for $193 million and sold the two franchises for $253.5 million. That sounds good, right? Well, yes. But it ignores the fact that Disney invested $100 million into Angel Stadium, and the two franchises are probably worth a combined $4 billion today.

So while virtually every other owner across US professional sports over the last 20+ years has made a killing, Disney underperformed and lost more than $100 million. But, like most things, it’s more complicated. Other media companies like News Corporation (LA Dodgers) and AOL Time Warner (Atlanta Braves, Hawks, and Thrashers) were selling their teams at the time, and Disney’s plan to start a regional sports network under the ESPN banner never came to fruition. The underlying fundamentals weren’t that exciting at the time either. For example, even as Disney started to spend more money on player payrolls for both the Angels and Mighty Ducks ($130 million in long-term contract money specifically just for Angels’ free agent targets after 1998), the team still saw a decline in attendance. But the real reason why Disney failed at professional sports ownership is the same reason why only a few sports assets are publicly traded today: shareholders. Sure, Disney had some management mistakes, and there are undoubtedly things they would like to do over. But ultimately, Disney’s sports portfolio conflicted with its duty to deliver shareholder value, and it ended up materially impacting its bottom line. The company’s stock, for example, was trading at 8-year lows of $13 to $14 per share in the Summer of 2002 when Disney started to contemplate selling the teams. “All owners pick their poison and decide which is more painful, losing money or losing games,” said billionaire and Dallas Mavericks owner Mark Cuban in 2002. “When your stock is being driven to new lows, the win-loss record of one of your holdings is probably not at the top of your shareholders’ minds.” So while synergies were evident at the time — the Mighty Ducks accounted for 80% of the NHL’s $1 billion in merchandise sales in 1997 — Disney found itself in a lose-lose situation: maximize profit and upset fans, or spend money to win at all costs and upset shareholders. And that dilemma still exists today. If you enjoyed this breakdown, please consider sharing it with your friends. I hope everyone has a great day. We’ll talk on Wednesday. Enjoy this content? Subscribe to my YouTube channel. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. Subscribers include investors, professional athletes, team owners, and casual fans. So if you are not already a subscriber, sign up and join 83,000+ others who receive it directly in their inbox each week — it’s free. Huddle Up is free today. But if you enjoyed this post, you can tell Huddle Up that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

Read Huddle Up in the app

Listen to posts, join subscriber chats, and never miss an update from Joseph Pompliano.

© 2023 |