The MarLago Accord

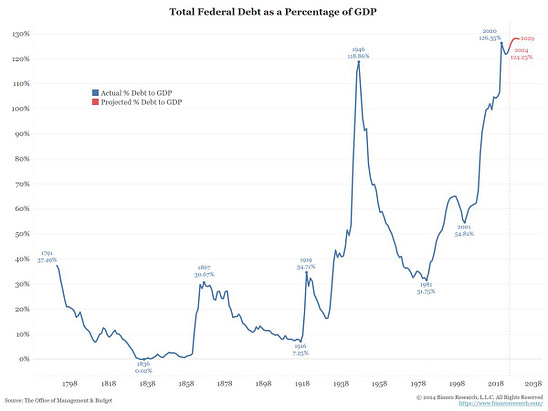

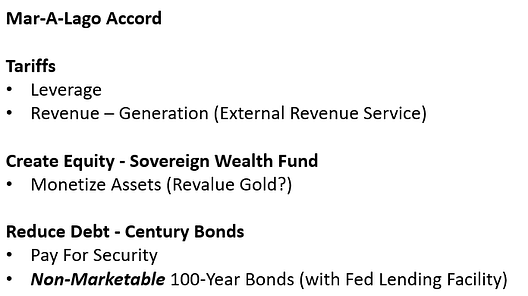

To investors, I remember sitting in economics class during college wondering what it would have been like to live through Bretton Woods or the Plaza Accord. Both events had significant impacts on national currencies, asset prices and the macro environment. But we should be careful what we wish for. Jim Bianco has recently popularized the idea of a “Mar-a-Lago Accord” that is already being put into motion. He says you should take this idea (and President Trump) seriously, but not literally. We may not see photos from a big meeting at Mar-a-Lago, but we are virtually watching the economic machine evolve into something different. First, you have to accept that the US dollar is overvalued. This is creating problems for the United States and many trading partners around the world. Jim points out that Fed Chairman Jerome Powell said on Dec 4, 2024 – “the U.S. federal budget is on an unsustainable path. The debt is not at an unsustainable level, but the path is unsustainable, and we know that we have to change that.” Jim’s response was “we can no longer do nothing. That will result in disaster. Something has to change. And that is not trying harder to raise taxes and cut spending. Insanity is doing the same thing over and over expecting a different result. New approach is needed (Mar-a-Lago Accord).” This is where things get interesting. What is the new approach? According to Jim, we are watching this new economic system roll out in front of our eyes. This approach includes the following: This is not a potential idea — Jim Bianco says the plan is already in motion.

Many people I know are not taking any of these developments seriously. They thought the tariffs were merely a negotiating point. They currently think the sovereign wealth fund is a random announcement that will never get implemented. And the thought of the US demanding payment for security of other nations makes them want to scream in rage. But every investor has a choice to make — you can ignore what is happening or you can adapt your perspective as new information is presented. The goal of these various programs according to Bianco is to “reduce the debt burden, lower the dollar and bring down interest rates.” Majority of investors agree those three outcomes would be good things. The controversy and debate comes from disagreement on whether the Mar-a-Lago Accord can actually accomplish these desired results. Here is my biggest takeaway though — whether you believe the desired outcomes can be achieved or not, you have to accept the fact that the new administration is going to use these programs and tools to attempt it. Tariffs are being implemented. The sovereign wealth fund is real and will be created. Europe is going to pay a higher price for the security agreement as well. Those are facts that can’t be ignored. Market participants are going to wager trillions of dollars on the outcome of this new “Accord.” The good news is that American citizens will be better off if the plan succeeds. The important question is whether asset prices will benefit or not. Interest rates coming down should be a tailwind. Debt reduction could be a short-term headwind. And a weaker dollar should drive asset prices higher. Those three statements mean the situation is complex, but I am in the camp that we would see a net positive for asset prices. Ultimately, assets like bitcoin or tech stocks will go the way of global liquidity. The Mar-a-Lago Accords idea is fun to think about, but everything you need to know will be told by the liquidity charts. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Will Bitcoin Generate Yield?Anthony Pompliano joins Squawk Box to talk bitcoin, regulation, current macro environment, memecoins, and where bitcoin could be headed next. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |