Stock Investors Are Scared of Tariffs, But They Shouldn’t Be

To investors, Everyone is prepared for a volatile week as the reality of US tariff policy sets in. There have been plenty of negative reactions from investors and market participants, but it is important to stay focused on the signal, rather than the noise. We can start with Stanley Druckenmiller, one of the best-performing and well-respected investors in the world. He explained in a recent interview that tariffs are the lesser of two evils. Take a listen: Druckenmiller mentions that 10% tariffs would be the ideal level and we obviously have much higher tariffs announced at the moment, so I would expect intense negotiations between countries before the April 9th deadline for implementation. Regarding those negotiations, we learned that more than 50 countries have reached out to the White House to begin discussing potential solutions. And these countries are not showing up empty-handed to the negotiations. Take Taiwan as an example. The country is offering to remove all trade barriers with the US and commit to zero tariffs moving forward. Taiwan will also increase their investment in the United States, including purchases of agricultural products, industrial products, energy, and weaponry from America. No tariffs. No trade barriers. And more capital headed to the US. That seems like the ideal outcome, right? Speaking of ideal outcomes, Treasury Secretary Scott Bessent has been saying for weeks that the administration wants to get oil prices and the 10-year yield lower. Adam Kobeissi points out both of those have been happening in recent weeks. Adam writes:

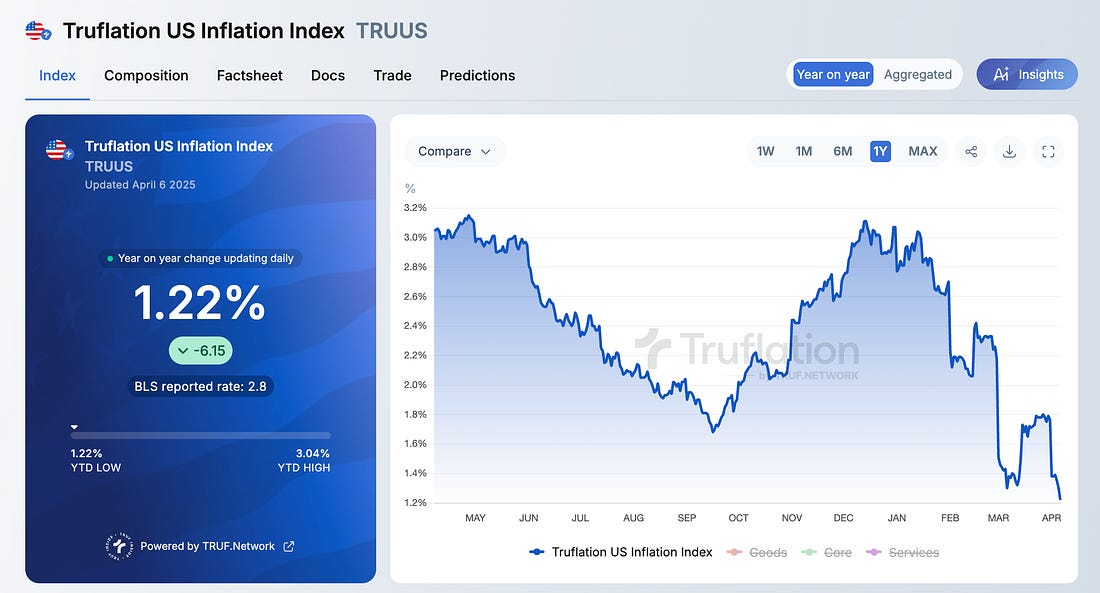

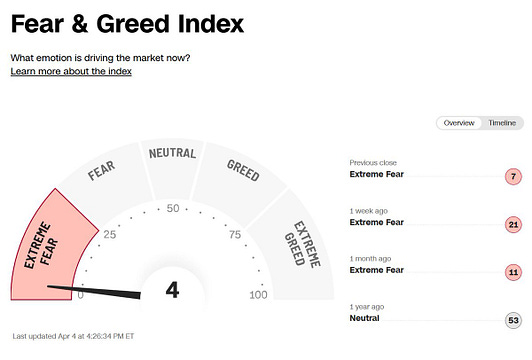

But oil prices and the 10-year yield are not the only things falling. We are also seeing inflation continue to crash lower over the last few weeks. Truflation shows inflation has gone from over 3% in December to 1.22% as of Sdun. This is the lowest level for inflation since November 2020. This inflation number is important to keep an eye on for two reasons. First, this is a good reminder that tariffs are not inflationary, they are deflationary. Remember the timeline of what has transpired. Perplexity, my favorite AI search engine, shows the initial 10% blanket tariff on China was put in place on February 4th and an additional 10% increase to the tariff was implemented on March 4th. The 25% tariffs were put in place on March 4th as well. So although the US implemented tariffs of at least 20% on three of our largest trading partners, inflation has been going down for months. The falling oil prices are helping drive inflation down, but ultimately tariffs are deflationary, not inflationary. Second, if inflation keeps falling this aggressively, the Federal Reserve may be forced to make an emergency interest rate cut. I am not predicting they are going to do that, but rather the odds increase as inflation falls further below their 2% target. The biggest issue the economy faces right now is economic slowdown. Odds of a recession are spiking, the Atlanta Fed’s GDPNow is falling, and investors are nervous — this all points to the importance of the Fed encouraging economic activity and employment by lowering interest rates. Maybe they do it in an emergency fashion, or maybe they do it in their next two meetings, but I expect interest rates to be lower by the end of the summer. Which brings me to the future — what do I think will happen over the coming weeks and months? Overall, I think we will look back at the fear in the market right now and realize it was an overreaction. Look at the fear and greed gauge sent out by BTIG. This is exactly what blood in the streets looks like when on a graphic. I believe we will see the tariff rates negotiated down closer to 10% globally. Some countries will be higher, some will be lower, and some countries will end up with zero tariffs against them. Most of these countries will have to remove all tariffs and trade barriers against the US in order to have tariff rates reduced. We will also see many countries commit to spending a large amount of money in the United States as well. Asset prices will bottom out in the coming month. We will likely see new all-time highs in stock prices and bitcoin before the end of the year. There will be no high inflation and we will not experience a crushing recession. Instead, this economic and global trade reset will lay the foundation for an economic boom. All Americans, both the wealthy and the working class, will get to participate. And the golden age of innovation and growth will be an incredible sight to see. It may be dark in the tunnel right now. But if you squint you can see the light at the end. Be patient and the light will get bigger in the coming days and weeks. Eventually we will be out of the tunnel and all will be good in the world. Study reflexivity. The faster we go down, the faster we go back up. It happened in 2020 during the pandemic and it is going to happen again this year. And before I let you go, you are going to hear lots of debate about free trade in the coming days. I believe the ideal situation is to have unfettered global trade between countries, which means no tariffs from either country in bilateral trade. The United States has been pretending for decades that free trade still exists. Other countries were more sober in their analysis and realized they could levy tariffs, subsidize their producers, manipulate their currencies, and gain an advantage over America. This means the US had two choices — (1) keep pretending the new game didn’t exist and let other countries take advantage of us or (2) learn to play the game better than anyone in the world. We are rightfully choosing the second option. Free trade doesn’t exist anymore. We can only hope that America can become so good at playing this new game that it allows us to dictate a reset of the rules back towards true free trade where our trading partners participate on a level playing field. Throughout history America has proven we can dominate any game we play. This may be the most important one yet. Hope you all have a great start to your week. I’ll talk to you tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Jordi Visser Breaks Down Stocks, Bitcoin, and TariffsJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we discuss all the chaos going on in the the market right now, tariffs, stock market, recession, what we expect other countries to do, interest rates, bitcoin, gold, and how to navigate uncertainty in this volatile market. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |