Monday Mining Metrics: Impact of Tariffs on Bitcoin Miners

Monday Mining Metrics: Impact of Tariffs on Bitcoin MinersBitcoin Mining Update – 4/7/2025

Government takes, Blockware gives. Between now and Tax Day (April 15th), use the code ‘TD2025’ at checkout for $50 off on the Blockware Marketplace. The $50 credit will be applied to your next month’s hosting bill for each miner purchased. There are no limits to the amount of times you can use this code. You will receive the $50 discount for each miner you purchase between now and April 15th. Happy Mining ⛏️ Impact of Tariffs on the Bitcoin Mining Industry The 54% net-tariff on Chinese imports is already causing ripple effects throughout the Bitcoin mining industry. Should this tariff hold, we expect the following second order effects:

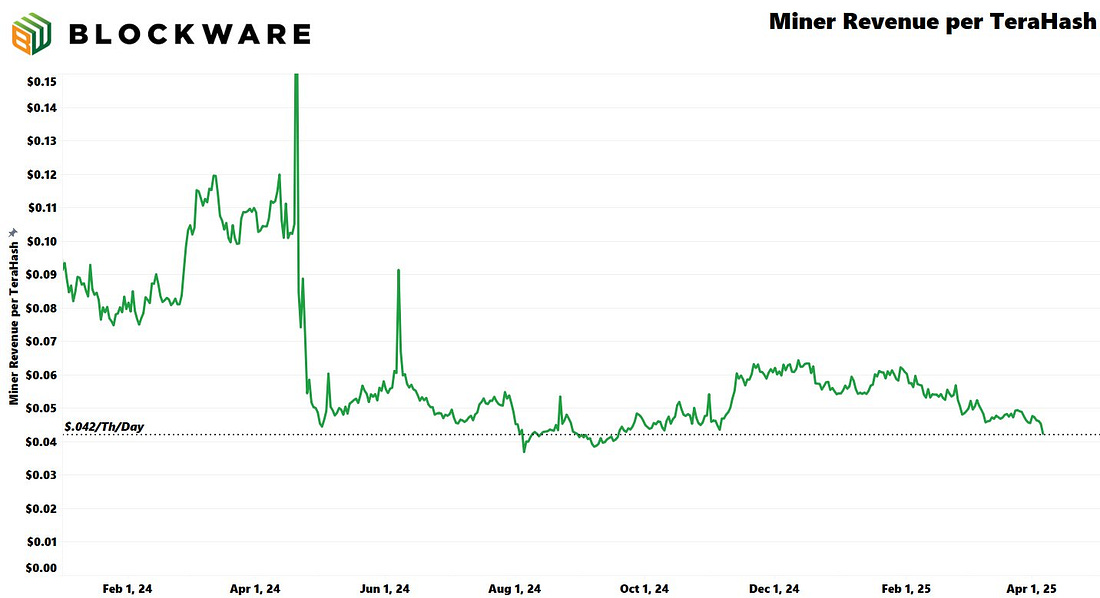

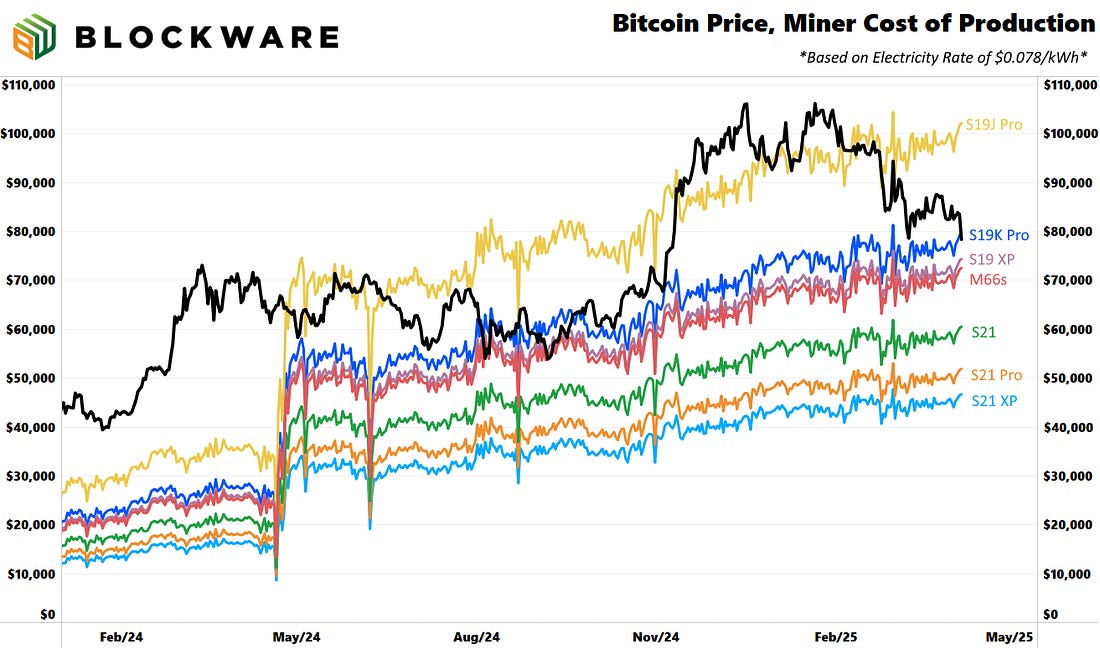

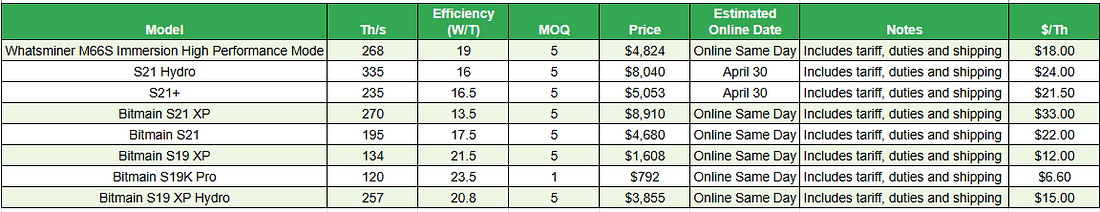

The duopoly of Chinese ASIC manufacturers Bitmain and MicroBT will almost certainly result in the import tax being passed onto the consumers (US-based miners). ,Consequently, prices are rising even for machines ~already located in the United States.~ In fact, US-based machines already carry a price premium (less time between purchase and hashing), and tariffs are going to cause this premium to expand. Moreover, tariffs are likely to cause a slowdown in ASIC orders from the manufacturers – which in turn will lead to a slowdown in the growth of the Bitcoin network hashrate / mining difficulty. Check out this YouTube video on the Blockware channel for an in-depth explanation: Hashprice Reaches Lowest Level Since Q3 2024 Miner Revenue per Terahash (hashprice) is now at ~$0.042/Th/Day – the lowest level since September. During this market environment it’s crucial for miners to use the most efficient machines possible. Combined with the tariffs on China, this creates an environment that will likely result in an increase in ASIC prices. BTC Miner Cost of Production Here’s the current ‘cost of production’ for various Bitcoin mining machines (based on an electricity rate of $0.078/kWh). Margins are getting crunched for mid-generation machines. However, the S21 series remains highly profitable despite the drop in hashprice. As mentioned earlier, the comparative advantage of next-generation machines could result in an even higher $/Th premium for these machines as miners look to unload older hardware and purchase the more efficient miners. Blockware’s Mining-as-a-Service enables you to start mining Bitcoin, without lifting a finger. Blockware handles everything, from securing the miners, to sourcing low-cost power, to configuring the mining pool – they do it all. With multiple data centers across the US, Blockware is the most reliable mining partner in the industry. Click here to check out our Marketplace where you can see real-time analytics on our miners, and make an immediate purchase using BTC or fiat. If you’d like a more hands-on mining experience, fill out this form on our website. One of our Account Executives will be in touch and they can walk you through our entire product and service offerings! The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here. All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does not consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. You’re currently a free subscriber to Blockware Intelligence Newsletter . For the full experience, upgrade your subscription.

© 2025 Blockware Solutions |