How LAFC Became Major League Soccer’s First $1 billion Franchise

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. Subscribers include investors, professional athletes, team owners, and casual fans. So if you are not already a subscriber, sign up and join 84,000+ others who receive it directly in their inbox each week — it’s free. Today At A Glance:The average MLS franchise is now worth $579 million, and Los Angeles FC is the first club to reach a $1 billion valuation, according to Forbes. But the LA-based club only did $8 million in operating income last year — so today’s newsletter breaks the numbers, including the past, present, and future of MLS franchise valuations. Today’s Newsletter Is Brought To You By Goldin!The world’s top 500 sports cards have an ROI of 855% over the last 15 years, compared to just 175% for the S&P 500 — and there is no better place to start or build your collectible portfolio than Goldin. Goldin is the leading and most trusted destination for some of the most significant pieces of sports and pop culture collectibles. Their marketplace is open 24/7, they have weekly auctions starting at just $5, and there is something for every collector. And here’s the best part: Goldin is currently offering all sellers up to 50% off marketplace fees when you sell your items before February 17th. So use the link below to check ’em out — I’m a big fan of the product, and I think you will be too. Friends, Major League Soccer is having a moment. According to Forbes, the average MLS club is now worth $579 million — that’s a 1,464% increase from 2008 and an 85% increase from the last time Forbes released MLS valuations in 2019. Average MLS Valuation

For context, the average NFL franchise has increased by 329% over the same period (2008 to 2023), and the average NBA franchise has increased by 670%. MLS has added 10 expansion teams over the last decade alone and now has 29 teams spread across the United States and Canada. The league signed a 10-year, $2.5 billion media rights deal with Apple last year, becoming the first major sports league to go all-in on streaming, and LAFC is the first franchise to reach a $1 billion valuation. Top 5 Most Valuable MLS Clubs

But here’s the craziest part — LAFC finished 2022 with just $8 million in operating income (the amount of money left over after deducting expenses). And a $1 billion valuation makes the LA-based MLS club more valuable (on paper) than 14 of the 20 Premier League Clubs, including West Ham, Everton, Leeds, Aston Villa, and Fulham. Top 10 Most Valuable Premier League Clubs

But these valuations aren’t black-and-white. There is a lot of financial engineering going on behind the scenes, and our hot-take culture has led many people to jump to conclusions, saying, “MLS is the next major sports league” or “MLS is so overvalued.” Of course, the truth is more nuanced and somewhere in the middle. So today’s email will explain what MLS is doing right and where there might be some concern. Enjoy! The MLS Origin StoryMajor League Soccer was founded in 1993 as a men’s professional soccer league intended to represent the sport’s highest level in the United States and Canada. The United States had just been awarded the right to host the 1994 World Cup, and US Soccer promised FIFA officials that they would create a Division 1 professional soccer league in the United States as a condition of the deal. The first MLS season kicked off in 1996 with just ten teams. MLS then added two more teams within the first two years — but the league was losing a lot of money in the early 2000s, and a couple of teams ended up folding after the 2001 season. Still, Major League Soccer has rebounded. The league now has 29 teams — 26 in the United States and 3 in Canada. The average MLS game has more than 21,000 people in attendance (more than the NBA), and the league has a long list of celebrity investors. MLS Celebrity Owners

And according to Forbes, 19 billionaires (or members of billionaire families) also have significant ownership stakes in MLS teams, including Robert Kraft (New England Revolution), Philip Anschutz (LA Galaxy), David Tepper (Charlotte FC), Joe Mansueto (Chicago Fire FC) and Ryan Smith (Real Salt Lake). But assembling a list of celebrity investors isn’t what made MLS valuations rise so much, so fast — that has more to do with how MLS decided to expand the league. How MLS Teams Make MoneyThe dirty secret behind MLS valuations is that most MLS clubs don’t actually make any money. For example, the average MLS club currently produces about $55 million in annual revenue, but more than half of the teams still lose money each year. Furthermore, according to Forbes, the 23 teams that played in MLS during 2018 combined for $100 million in losses — and only 7 of the league’s 23 teams turned a profit, with just 3 franchises turning a profit of $1 million or more. Take New York City FC, for example. Forbes says they are the 4th most valuable team in MLS at an $800 million valuation. But the NYC-based club only brought in $55 million in revenue last year and lost about $12 million after accounting for expenses. So why are franchise valuations increasing so much? Well, the truth is that MLS has been artificially inflating franchise valuations through expansion. For example, Major League Soccer has added 13 new franchises over the last decade, including teams in New York City, Orlando, Atlanta, Minnesota, Los Angeles, Cincinnati, Miami, Nashville, Austin, Charlotte, and St. Louis. And these teams have been paying an increasingly larger expansion fee each time — from the $100 million that New York City FC paid to join MLS in 2013 to the $325 million Charlotte FC paid to join the league in 2019. MLS Expansion Fees

These expansion fees are then divided and distributed throughout the league, artificially inflating league-wide and individual team revenue. Take 2018, for example. MLS clubs reported total revenue of about $800 million that year, but they made almost half of that from expansion fees in 2019 alone. But why is it artificial? Well, because expansion can’t go on forever. MLS recently added St. Louis City SC as its 29th team, and the league has already said it won’t expand past 30 or 32 teams. Number Of Teams By League

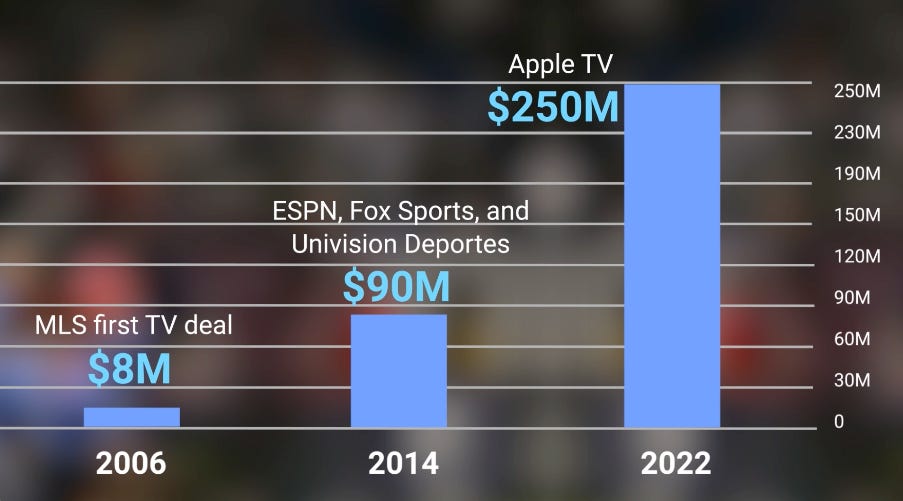

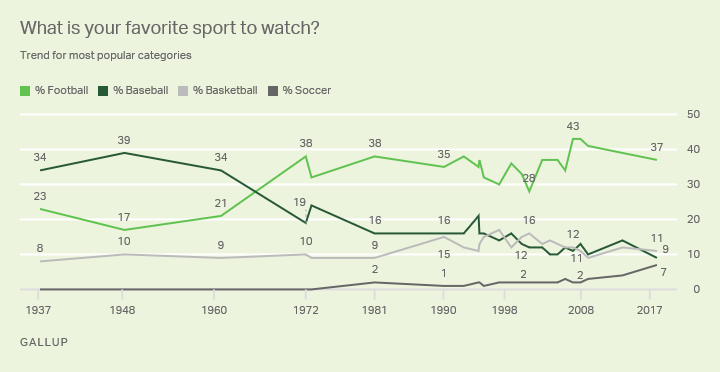

Remember, every additional franchise that MLS adds not only dilutes each team’s share of league-wide revenue, but it also reduces the level of competitive talent — for a league that is already struggling to catch up to its international counterparts. And when you look at Los Angeles FC, the underlying metrics that make up their valuation are even more interesting. For example, LAFC’s $1 billion valuation represents a 125x multiple on the club’s $8 million operating income last year. That’s objectively absurd — but Forbes is able to justify the valuation because the team owns its $350 million stadium, recently signed a 10-year, $100 million stadium naming rights deal with BMO, and MLS teams trade at a 10x revenue multiple. For context, despite reporting just $8 million in operating income last year, LAFC reportedly brought in $116 million in revenue — that’s 2x the league-wide average. But just because MLS teams seem overvalued today, it doesn’t mean league-wide valuations won’t continue to grow over the coming years. In fact, you could argue that MLS has set itself up to be one of the world’s fastest-growing sports leagues over the next decade — let me explain. The Future Of MLS ValuationsI wrote an article over two years ago titled “Major League Soccer: Billion Dollar Franchises Are Coming.” The average MLS team was worth just $313 million at the time, and more than half the league was losing money on an annual basis. But several macro-related tailwinds were approaching, and the league’s future was starting to look increasingly attractive from an investment perspective. For example, MLS was looking to sign a new media rights deal, which they did last year when they agreed to a 10-year, $2.5 billion deal with Apple TV. This increased their annual payment from $90 million to $250 million, and it made them the first major sports league to go 100% exclusive with a single streaming service. Soccer is also seeing a massive increase in interest across the United States. For example, nearly 20 million people watched the USA-England match at the most recent World Cup, making it the most-watched men’s soccer match in US television history. And 8% of Americans now say soccer is their favorite sport to watch, according to a poll from The Washington Post. That is significant because soccer never rose above 0.5% from 1937 to 1972 in previous poll data and only crossed 2% in 2007. So while soccer has always been the least favorite sport to watch among Americans, the sport has gained significant traction and now rivals basketball and baseball. Furthermore, the 2026 World Cup will be held across North America, with the majority of matches (60 out of 80) taking place in the United States. FIFA is projecting that about 5.5 million fans will attend the 2026 World Cup, handily beating the record 3.6 million supporters who attended games in 1994 — and the tournament is expected to deliver $5 billion in economic value to North America. For context, that’s about a 50x more significant economic impact than the Super Bowl. 2026 World Cup Host Cities

MLS is also partnering with Mexico’s Liga MX to host the Leagues Cup, a month-long tournament that includes every team from the MLS and Liga MX — the most-watched soccer league in the United States. But ultimately, one reason stands above the rest when it comes to why some of the world’s smartest and richest investors are betting on Major League Soccer. You see, MLS is a closed league, like the NFL, NBA, MLB, and NHL. This means that all teams participate in the league’s growth — splitting media rights, national sponsorships, and more — regardless of individual performance. This is something Americans have become accustomed to — the worst team gets the first draft pick and tries to improve — but it’s drastically different from the promotion-relegation system in European football today. For example, a team that gets relegated from the English Premier League loses more than $200 million, mainly from a massive decrease in TV revenue. This closed-league structure may upset traditional football fans, but it enables investors to hedge their downside and place a more directional, macro-related bet on the growth of soccer in the United States overall — and that’s what is ultimately driving revenue and valuations higher. If you enjoyed this breakdown, please consider sharing it with your friends. My team and I work hard to create high-quality content, and every new subscriber helps. I hope everyone has a great day. We’ll talk on Wednesday. Enjoy this content? Subscribe to my YouTube channel. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Extra Credit: My Interview With Duke Legend Jay Williams Is Live!Jay Williams was the 2nd overall pick in the 2002 NBA Draft and is an NBA analyst and radio host for ESPN. We talk about his daily schedule at ESPN, the motorcycle accident that forced him to retire from the NBA, his battle with depression, the future of sports media, and more. Enjoy! Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. Subscribers include investors, professional athletes, team owners, and casual fans. So if you are not already a subscriber, sign up and join 84,000+ others who receive it directly in their inbox each week — it’s free. Huddle Up is free today. But if you enjoyed this post, you can tell Huddle Up that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

Read Huddle Up in the app

Listen to posts, join subscriber chats, and never miss an update from Joseph Pompliano.

© 2023 |