Why Did Warren Buffett Retire?

To investors, Warren Buffett held his annual conference this year and it did not disappoint. The event has become the Woodstock of Capitalism. More than 40,000 Buffett disciplines make the trip to Omaha as if they are visiting Mecca to hear from their prophet. There are parties, there are side events, and there is a lot of worshiping of one of the greatest investors of our lifetime. And this year was extra special because Warren Buffett announced his retirement as CEO of Berkshire Hathaway, which should happen later this year. He will become Chairman of the company and promises he will still go to the office every day. The reason there is so much attention on Buffett’s annual meeting is because of his stellar performance over the years. Adam Kobeissi points out:

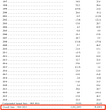

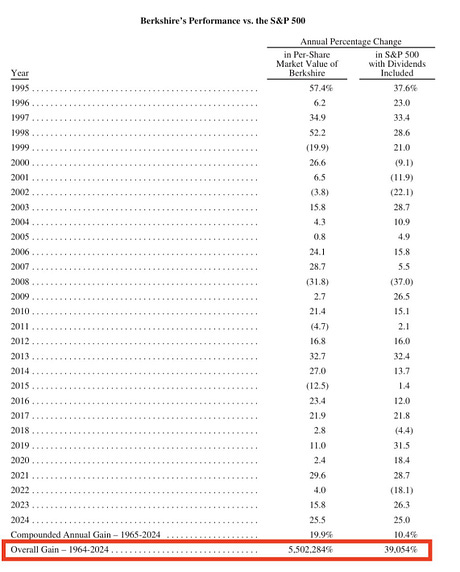

Berkshire Hathaway’s compound annual growth rate is approximately 20% since 1965 when Buffett took over — this is ridiculous performance compared to the S&P’s compound annual growth rate of about 10% during the same timeframe. Maybe the most impressive part of this performance is that Berkshire Hathaway has achieved this track record while holding an insane amount of cash on their balance sheet. As of March 31st, the cash pile now stands at $347 billion. It is hard enough to drive outperformance in the market. But imagine doing it while holding hundreds of billions of dollars in cash — this makes the track record even more impressive. So what did Buffett have to say during this year’s meeting? What does the GOAT of investing have on his mind? First, Buffett and I agree that the recent market volatility is a nothing burger. All the fear-mongers and doomsday predictors look ridiculous. Buffett said “What has happened in the last 45 days, 100 days, whatever you want to pick up, whatever this period has been, it’s really nothing.” Then Warren Buffett went on a heater and laid out the perfect argument for bitcoin: Buffett says he is worried about fiscal policy. He says governments devalue currencies at rates that are breathtaking. Buffett even calls out the printing of money as a major cause for concern. Now everyone knows that he doesn’t like bitcoin. He even called it rat poison. But at least we have confirmation that the Oracle of Omaha understands the value proposition better than people thought. So what do I think of Warren Buffett, one of the greatest investors of our generation, stepping down? I think people underestimate how impactful the passing of Charlie Munger likely was to this decision. If you work with someone for over 50 years, they become a friend and confidant. I can’t imagine it is the same to go to work every day without that person there. It isn’t as fun anymore. I doubt Buffett is stepping down exclusively because Munger passed, but it is hard to argue that the absence of Munger had no effect. Additionally, there is one more argument that no one wants to say — maybe Buffett is stepping down because he wants to claim victory while he can. The more than $300 billion on the balance sheet suggests Warren can’t find good enough deals, or large enough deals, to do anymore. You can’t buy companies worth $1 billion – $10 billion because it will have no impact. I won’t be inflammatory and argue that Buffett has lost his touch, especially given Berkshire hit a new all-time high last week, but I don’t think it is crazy to argue Buffett could be stepping down because he doesn’t know what else to do with the money. So regardless of whether you like Warren Buffett or not, the man has an incredible investing track record. He is stepping away as one of the best to ever do it. There will be plenty of people vying to replace him on the Mount Rushmore of current investors, but my bet is the next Warren Buffett will look nothing like the current one. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Jordi Visser on Why Bitcoin Could Double In Price This YearJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we discuss what is happening in the economy, monetary global policy, bitcoin, gold, financial assets, and handicapping the odds that bitcoin will win. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |