Investors Are Being Forced To Care About Politics

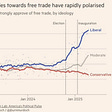

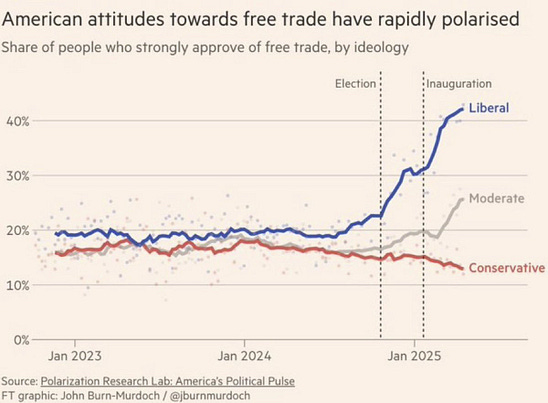

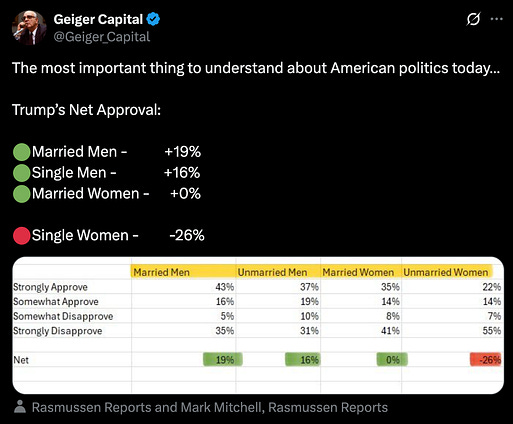

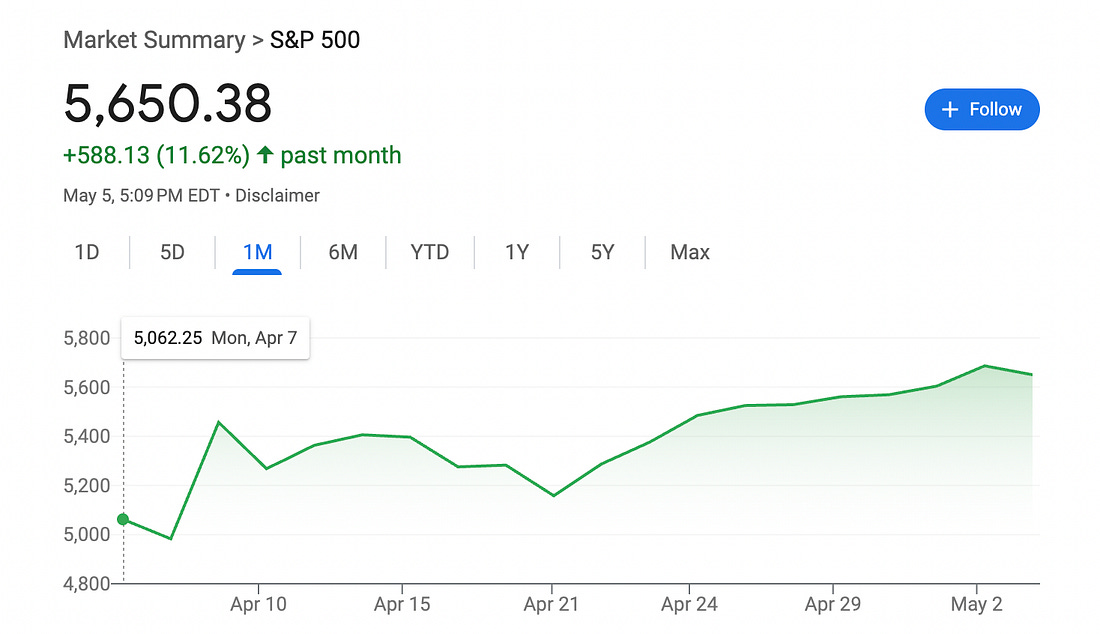

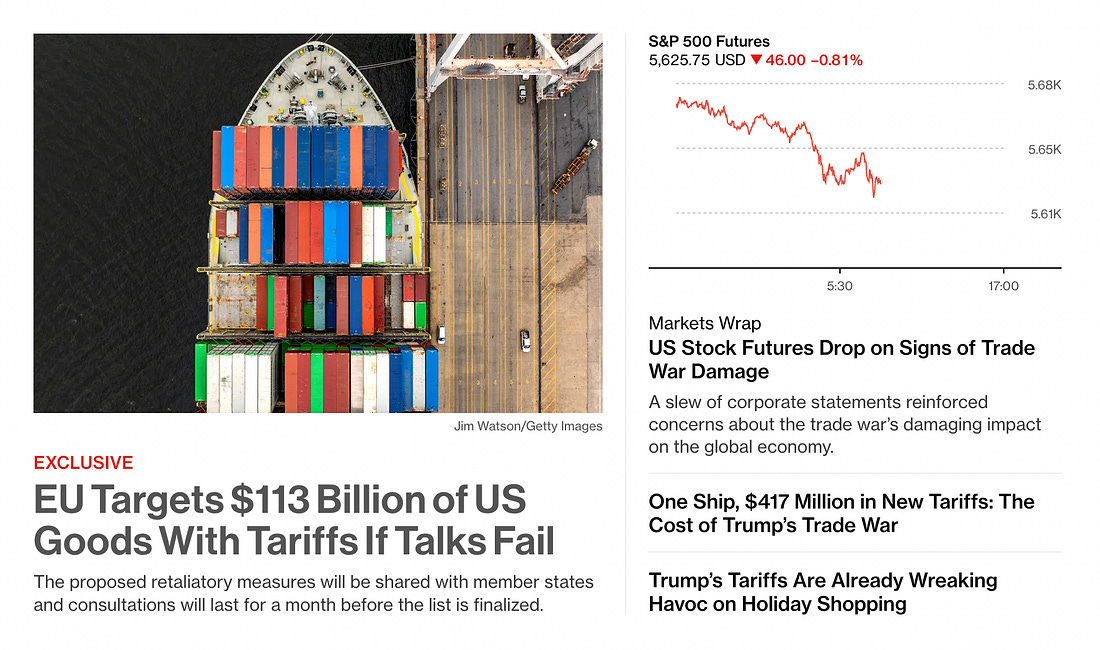

To investors, Growing up most of us were taught to never talk about politics at work, but that is no longer possible — politics and investing is so intertwined that you have to evaluate the totality of the situation. If you ignore one or the other, you will end up uninformed. Let me give you a few examples. First, we can look at tariffs. There is new data out suggesting a massive shift in the attitude of Americans towards free trade. It appears that liberals and moderates significantly changed their position as President Trump and his administration spoke more about tariffs and related economic policies. It is not every day that you see a chart where one side of the political aisle doubles the percentage of people who believe in an idea right after an election. But we are not living through some random time. We are living through a re-ordering of the global monetary order and that calls for significant changes in various parts of our lives. Another area where you can see the data telling us a story worth paying attention to is around who supports the economic policies of this administration. Our friends at Geiger Capital say this is the most important thing to understand about American politics today: Every category of men or women, except for single women, are neutral to positive on the President. Single women are vehemently opposed to him and have a negative 26% approval of him. Now why is this political talk important for investors? Most of us don’t want to sit around thinking about politics all day, so why should we care about this data? Simply, the politics of the conversation lead to a public narrative that is highly detached from reality. Take the S&P 500 as a great example — the index is down less than 4% to start the year. And the same index is up more than 11% in the last month. So all you had to do was buy the dip earlier this year and you are doing great. It ain’t rocket science, folks. Of course, the story is even better when you look at gold or bitcoin. Bitcoin is positive on the year and up nearly 50% over the last 12 months. Gold is up 26% year-to-date and up 45% in the last year. These are not numbers you see from financial assets in Great Depressions or massive recessions. Instead, these are numbers you see from assets when we are in the normal ebb-and-flow of financial markets. They go up and down in the short term, but long term asset prices go up and to the right. Don’t take my word for it though — Treasury Secretary Scott Bessent recently said “the entirety of our economic history can be distilled in just five words: Up and to the right.” Compare that to the mainstream media this morning — Bloomberg’s top 5 headlines on their website are all some version of fear porn. US stock futures drop, The cost of Trump’s Trade War, Wreaking Havoc on Holiday Shopping. This is all insane. The economy is creating jobs. People are spending money. Stocks are going back up aggressively. And significant business transactions are being done, including Bill Ackman’s Pershing Square investing $900 million in Howard Hughes Holdings, OpenAI buying Windsurf for $3 billion, and Google buying Wiz for tens of billions of dollars. This brings me back to where we started. Financial markets are based on math. Prices go up when there are more buyers than sellers. Prices go down when there are more sellers than buyers. But the conversation around financial markets is no longer based on logic and reality, instead it is rooted in politics. If you like the current administration you see a bright future ahead. If you don’t like the administration, you see pain and destruction on the horizon. The truth is probably somewhere in-between. These economic policies will lead to some positive impact and other things will be negatively affected. The world is not binary, especially with the complex economic machine operating globally. So make sure you are paying attention to what is happening. Everyone was talking about the world becoming financialized in the last decade, but I would argue the world also became politicized. And now politics and finance are married for the long-run, so I don’t see us going back to the world we once knew. Hope you all have a great day. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Darius Dale Explains Why Bitcoin & Stocks Look Better Than You ThinkDarius Dale is the founder & CEO of 42Macro. In this conversation we discuss why the economy is more resilient than most think, stock market, gold, bitcoin, DOGE, government spending, tax cuts, and his future outlook. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |