Volatility Rules The Day Now

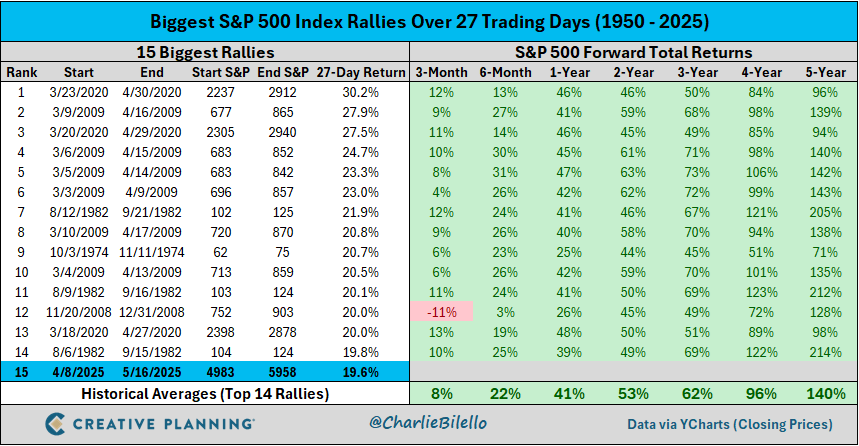

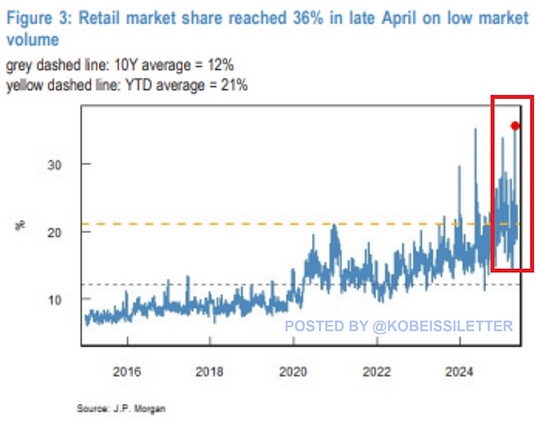

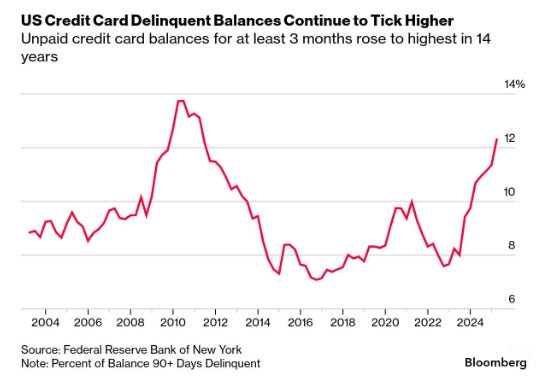

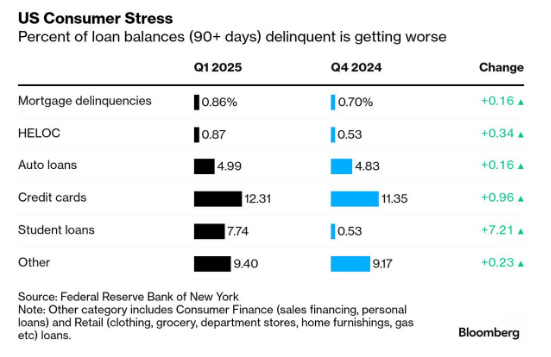

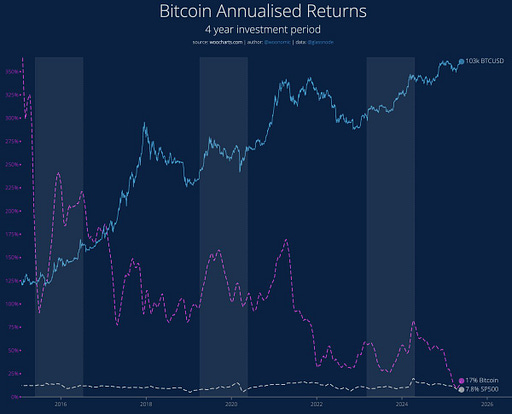

🚨 New Product Launch: Introducing Silvia, your new personal CFO. We built this product for me and now we are opening it up for everyone else. The product uses AI models to track your net worth, analyze your portfolio, answer any questions you have about your finances, and make suggestions on how you can improve. You can text, email, or call the CFO too which is really cool. The video below has a live demo of the product. Silvia currently has more than $1.1 billion of assets connected to the platform from every major financial institution. Sign up now: https://www.cfosilvia.com/ To investors, Volatility is the name of the game in financial markets for the foreseeable future. You will likely struggle if you don’t know how to invest in uncertain and chaotic times. Take the last few weeks as a perfect example. Creative Planning’s Charlie Bilello highlights “the S&P 500 is up over 19% in the last 27 trading days, one of the greatest comebacks in market history.” It hasn’t just been the S&P though. Zerohedge shows the Nasdaq 100 went from oversold to overbought in a single month — insane! Up, down. Up, down. Welcome to the new normal. We live in a world where information can spread like a digital virus infecting the minds of millions within minutes. Fear is contagious, but so is enthusiasm. Once an emotion starts to take over it can be spread on social media in a way financial markets have never seen before. And don’t forget that retail investors are increasingly taking market share in public markets. Adam Kobeissi writes “retail investors’ stock market share hit a record 36% in late April, according to JPMorgan. This is more than TRIPLE the 10-year average of 12%…Retail investors have bought a record $50 billion in equities since April 8th. Retail is stronger than ever.“ These retail investors are allocating to markets at the same time they are under attack in other parts of their life. Look at the 30-year mortgage as a good example — the 30-year mortgage rate hit 7.4% this week, which according to Barchart is near its highest level since 2000. The same team shows that “Serious Credit Card Delinquencies (unpaid balances for at least 90 days) just hit their highest level in 14 years.” But it is not just credit card delinquencies that Americans need to worry about. We also see Mortgages, Home Equity Credit Lines, Auto Loans, Credit Cards, and Student Loan delinquencies rising as well. So on one hand we have the average American under pressure in their financial life, but an increasing number of them are looking to financial markets for relief. They are literally trying to use stocks, gold, and bitcoin to increase their net worth so they can keep up with inflation and the ever-expanding wealth inequality gap. Which speaking of bitcoin, the digital currency is up 13% year-to-date, 58% over the last 12 months, and the asset has appreciated more than 10x in the last 5 years. Not bad, right? Well, before you get too excited, remember that bitcoin’s compound annual growth rate has been dropping aggressively. This is not something to worry about, but it is worth paying attention to — Willy Woo said it best when he wrote:

Volatility will rule the day. Stocks, bitcoin, gold or any other asset can not hide. Investors must get comfortable dealing with uncertainty and chaos, because neither of those are going away. But the real secret of investing is that the best investors seek out volatility. They know this is where opportunity lies. And it looks like we are going to get the opportunity of a lifetime in the coming years — just make sure you don’t miss it because you got nervous with rapid change. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Jordi Visser Talks Bitcoin, Tariffs, Bull Markets, and Artificial IntelligenceJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we evaluate economic data, bitcoin, stocks, inflation, acceleration of AI, and the global economy. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |