The SEC Doubles Down

Anybody want an existential crisis? Our latest pod with Eliezer Yudkowsky (now available for Bankless Premium members) should help you get there. In our conversation with Eliezer, we covered the light and breezy topics of digital superintelligence, AI’s near future, and the end of humanity 🫠 To get early access to the pod (and tons of additional exclusive content), upgrade to Bankless Premium. Dear Bankless Nation, Regulators are champing at the bit to bring crypto down, but the market don’t care. For our weekly recap, we dig into:

– Bankless Team 📅 Weekly RecapHere’s a recap of the biggest crypto news from the second week of January. 1. Regulators go after BUSDAfter the crackdown on Kraken last week, the SEC is turning its attention to the BUSD stablecoin. Branded under Binance but issued by Paxos, a New York regulated company, BUSD is the third largest stablecoin in DeFi at a ~$15B market cap, behind USDT (~$70B) and USDC (~$41B). The SEC is threatening to sue Paxos for failure to register BUSD as a security under federal securities laws. Why is a stable-value asset being targeted as a security anyway? Paxos issued a press release February 13th disagreeing with SEC’s stance, and reiterated that BUSD is fully backed 1:1 by $16B of US dollar-denominated reserves and segregated in bankruptcy accounts. New York financial regulators are saying that BUSD was “left open to use by bad actors” and ordered Paxos to stop all minting of BUSD. Paxos is complying with the regulatory action. Binance CEO CZ is now distancing itself from BUSD. In a Twitter Spaces, CZ reiterated that BUSD was merely branded but not created by Binance, and they would likely begin working with other stablecoin issuers USDC and USDT.

CZ 🔶 Binance @cz_binance

2/ We were informed by Paxos they have been directed to cease minting new BUSD by the New York Department of Financial Services (NYDFS). Paxos is regulated by NYDFS. BUSD is a stablecoin wholly owned and managed by Paxos.

9:40 AM ∙ Feb 13, 2023

2,566Likes259Retweets

Binance is even reportedly considering delisting all US-based cryptocurrencies, as reported by Bloomberg — though CZ denied it. As BUSD starts to wind down, market concentration in stablecoins is likely to increase and become less competitive. Not only has the SEC stifled existing market competition in favor of incumbents, it has also led potential competitors like PayPal to halt work on their own stablecoins. 2. Wen U.S. regulation?The SEC still hasn’t laid down any clear rules for crypto, but it is creating targeted, discriminatory rules by enforcement that present plenty of roadblocks for the industry. The SEC is in the midst of passing a new law that disqualifies crypto trading and lending platforms as “qualified custodians” of crypto, unlike chartered banks, or financial institutions registered under the SEC or CFTC.

Jake Chervinsky @jchervinsky

Today, the SEC proposed changes to the investment adviser custody rule that seem designed to prohibit US firms from investing in US crypto companies. This proposal would flagrantly violate the SEC’s mission by making investors *less* safe and by *discouraging* capital formation.

7:58 PM ∙ Feb 15, 2023

1,584Likes360Retweets

Danny Nelson @realDannyNelson

To understand why the SEC is pushing for strong crypto custodian rules for Registered Investment Advisers (RIAs), consider the plight of Galois Capital 1/n

11:16 PM ∙ Feb 17, 2023

10Likes2Retweets

“We should have come up with a working regulatory framework by now,” says, former SEC counsel TuongVy Le.

TuongVy Le 🗽🍎 @TuongvyLe12

Agreed. I was at the SEC and started working in crypto in 2017. Everyone was trying to wrap their heads around it then, including going after outright scams. It is now 2023. We should have come up with a working regulatory framework by now.

Justin Slaughter @JBSDC

Personally, I was pretty sympathetic to the SEC’s position five years ago (the questions posed by crypto are hard! Learning about a new space takes time), but have gotten less sympathetic since there’s been no progress on regulations over that time. 9:16 PM ∙ Feb 12, 2023

689Likes100Retweets

Meanwhile, Hong Kong is making regulatory progress. By June 1 2023, Hong Kong will officially legalize crypto purchasing and trading for all citizens.

Brian Armstrong @brian_armstrong

America risks losing it’s status as a financial hub long term, with no clear regs on crypto, and a hostile environment from regulators. Congress should act soon to pass clear legislation. Crypto is open to everyone in the world and others are leading. The EU, the UK, and now HK.

Crypto熊猫 @NoodleofBinance

On June 1st, 2023, Hong Kong will officially make crypto purchase & sell, trading, fully legal for all of its citizens Expect a huge influx of big money from the East Asian currency based stablecoin coming out of HK will be a certainty as well 2:17 AM ∙ Feb 16, 2023

8,114Likes1,690Retweets

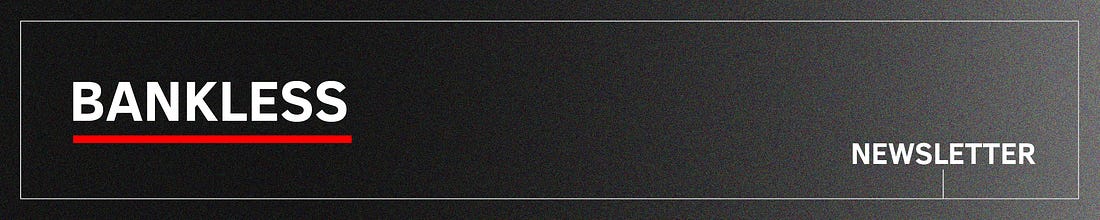

3. Blur chases OpenSeaOpenSea’s current most formidable competitor Blur finally dropped its BLUR token Tuesday.

Blur @blur_io

$BLUR is now LIVE All traders across all marketplaces in the last 3 months, Care Package holders, and Creators are eligible for the airdrop. You have 60 days to claim your BLUR ⏰

6:42 PM ∙ Feb 14, 2023

4,675Likes1,462Retweets

360M BLUR (12% of total supply) were distributed to holders. Over 50% of BLUR was claimed in the first hour, and gas fees rocketed to ~581 gwei on that day. BLUR started trading at $5, plummeted to $0.70 and has since straddled around $1.20. The third largest recorded claim got 2.5M BLUR (~$1.6M).

mannion.eth @MannionNFT

The current 3rd highest claimer of $BLUR (0x9e91F274F175388dd1950799Fa69e00d699ae2ee) only funded their wallet 111 days ago and got 2.5M tokens (~$1.6M) at a cost of under 30e. Incredible

9:06 PM ∙ Feb 14, 2023

282Likes25Retweets

Can Blur kill OpenSea? Blur’s trading volumes momentarily exceed OpenSea’s on the day of the airdrop, but it remains to be seen if this is sustainable. In a blog post, Blur founder Pacman is recommending that Blur enforces full royalties on collections for creators that block trades on OpenSea at the smart contract level. In response, OpenSea is dropping fees to 0%, implementing a 0.5% minimum creator earnings model, removing the blocklist on Blur.

OpenSea @opensea

We’re making some big changes today: 1) OpenSea fee → 0% for a limited time 2) Moving to optional creator earnings (0.5% min) for all collections without on-chain enforcement (old & new) 3) Marketplaces with the same policies will not be blocked by the operator filter

8:36 PM ∙ Feb 17, 2023

6,448Likes2,095Retweets

For more insights, see How Blur Can Win on the Bankless newsletter and our podcast interview with Pacman.

Bankless @BanklessHQ

🚨LIVESTREAM: $BLUR is LIVE, and so are we @PacmanBlur, Founder of @blur_io, joins the show to talk about the NFT marketplace’s long-awaited token airdrop! Show starts at 4:00pm PT / 7:00pm ET 👇Set a reminder👇

10:19 PM ∙ Feb 14, 2023

652Likes136Retweets

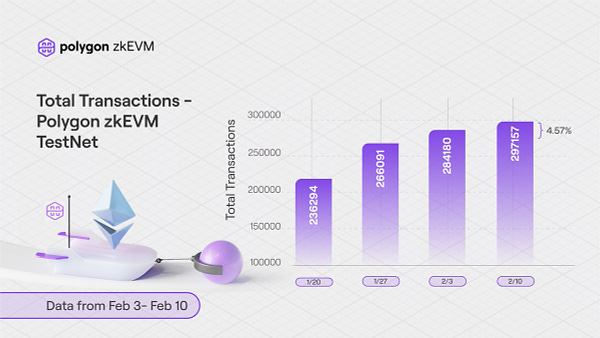

4. zkEVM wars are heating upThe EVM (Ethereum Virtual Machine) is great because it’s the most proven blockchain infrastructure in terms of network effects and uptime. And zero-knowledge rollups are great because they’re the one piece of tech that’s poised to greatly scale crypto without making a centralized tradeoff. Put EVM and zk-rollups together, and you have what everyone’s been raging about for the past half-year: the zkEVM. The race to the first zkEVM is heating up. After more than a year of R&D, Polygon has an official launch date for its zkEVM on March 27th. For the week of February 3rd, Polygon’s zkEVM testnet reached ~297K transactions, deployed 5.7K contracts, and generated 75K proofs. For all the data, check out the tweet below.

Polygon ZK @0xPolygonZK

The testnet *nearly* reached 300k transactions, a milestone for the future of scaling Ethereum, and a testament to the maturity of Polygon #zkEVM. Other BIG NEWS is coming soon. Until then, a quick rundown of all Polygon zkEVM metrics for last week, showing continued momentum 📈

8:47 PM ∙ Feb 13, 2023

326Likes89Retweets

Following closely behind is zkSync’s zkEVM “Era”. Over the past four months, Era reached ~9 million transactions and deployed 30K contracts over 497K active addresses.

zkSync∎ @zksync

The wait is over. All aboard zkSync Era∎ Mainnet! Today, Ethereum’s first zkEVM is: • Opening mainnet to builders 🥳 • Adopting a brand new name 🎈 • Open-sourcing its entire codebase 🎆 blog.matter-labs.io/8b8964ba7c59 1/8

blog.matter-labs.ioAll Aboard zkSync Era∎ MainnetThe first zkEVM on Ethereum is lifting the gates to let projects deploy….

3:01 PM ∙ Feb 16, 2023

6,246Likes2,247Retweets

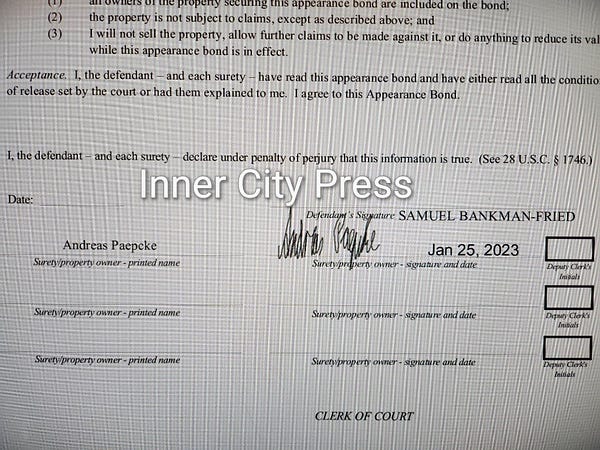

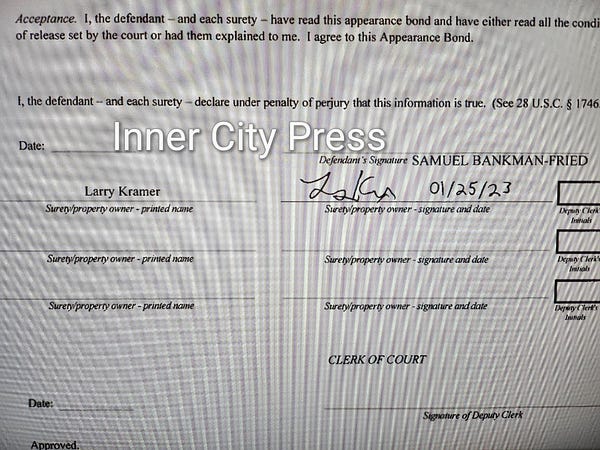

Projects can apply to deploy now and test their dapps on zkSync Era. 5. Cryptovillain updatesSam Bankman-Fried was released on $250M bail in December. The identities of his bond guarantors were revealed this week to be Larry Kramer, dean emeritus at Stanford Law School, and Andreas Paepcke, a senior research scientist at Stanford University. Sam’s parents Joe Bankman and Barbara Fried also hold positions on Stanford’s faculty. Looks like it wasn’t Mr. Wonderful after all.

Autism Capital 🧩 @AutismCapital

BREAKING: The two signers of Sam Bankman-Fried’s bond have been court order released. They are ANDREAS PAEPCKE (Stanford research scientist) and LARRY KRAMER (Former dean of Stanford law school) Source: @innercitypress

6:51 PM ∙ Feb 15, 2023

2,984Likes622Retweets

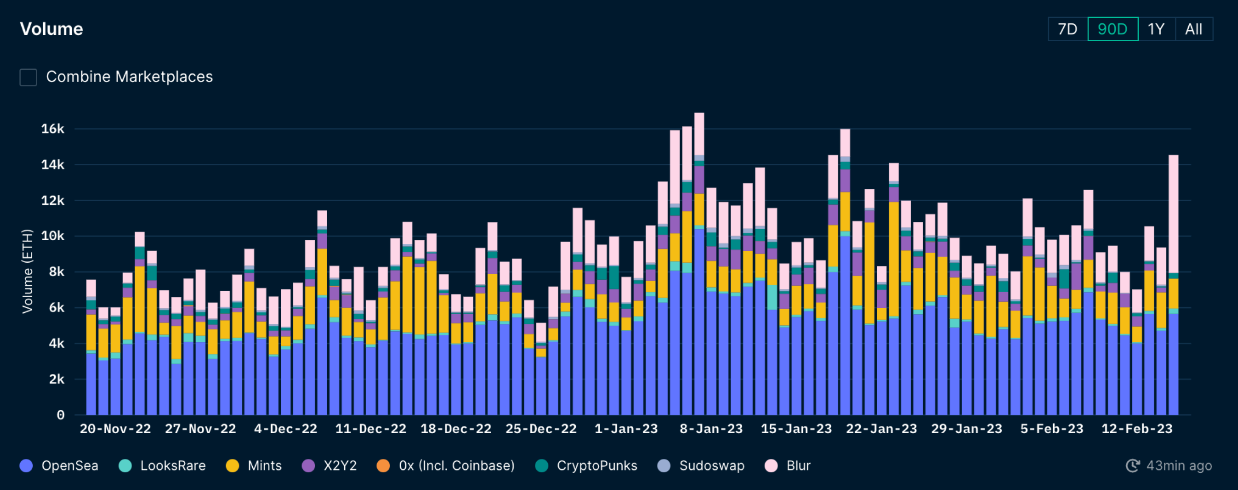

Celsius is reaching a sale plan for small debtors (below 5K) to recover 70% of their funds back, while larger debtors will receive 30-40%.

Celsius Official Committee of Unsecured Creditors @CelsiusUcc

1-Last night Celsius (with UCC support) selected NovaWulf to sponsor a reorganization plan that will distribute liquid crypto to all account holders, as well as create a litigation trust and provide creditors with common equity in a NewCo holding illiquid assets like mining.

1:47 PM ∙ Feb 15, 2023

240Likes55Retweets

Finally, remember Terra? The SEC is charging its figureheads. In the SEC’s words: “Terraform and Kwon raised billions of dollars from investors by offering and selling an inter-connected suite of crypto asset securities, many in unregistered transactions”. These “securities” include tokens that mirrored US stocks on the Mirror protocol, the UST algorithmic stablecoin, and the Anchor lending market for advertising UST as a yield-bearing stablecoin. Terraform and Kwon also “misled investors about the stability of UST”. The SEC also alleges that an unidentified U.S. trading firm helped rescue the peg of UST when it depegged in 2021. That firm is now being revealed to be Jump Trading.

The Block @TheBlock__

EXCLUSIVE ON THE BLOCK PRO: Jump is the unnamed ‘U.S. trading firm’ in SEC complaint against Do Kwon theblock.pro/news/post/2127…

4:40 PM ∙ Feb 17, 2023

134Likes25Retweets

Other news:

🙏 Together with ⚡️ACROSS⚡️Across is the bridge you deserve: fast speeds, low fees, great support, no hacks, and we love our users. Try it once and you’ll understand why Across users love us back and have bridged $billions with it. Yield farmers will also find attractive yields for providing bridge liquidity! 👀 👉 If you have questions, check Twitter or the Discord! 📅 Recap for the 3rd week of February, 2022READ 📚METAVERSAL 📚BANKLESS DAO 🏴WATCH 🔊GREEN PILL 🌳Weekly Subscriber Perks 🔥Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you. 🎙️NEW WEEKLY ROLLUPListen to podcast episode | Apple | Spotify | YouTube | RSS Feed Job opportunities 🧑💼✨See all listings on the Bankless Job Board✨ 🙏 Thanks to our sponsor MetaMask Learn👉 Add MetaMask Learn to your onboarding guides for your community ✨ Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto) Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2023 Bankless, LLC. |