Best of Bankless 2022

Best of Bankless 2022Our favorite Bankless shows and posts from this weird, wild year

Born in 2011, Kraken is the industry-leading crypto exchange in security and transparency. Verify the backing of Kraken’s reserve assets thanks to regular Proof of Reserves audits. Dear Bankless nation, It’s almost the end of 2022, and we’re feeling sentimental. This year was huge. Bankless surpassed 30 million downloads and more than a quarter-million newsletter subscribers. It was a big year for Bankless — and for crypto. There were certainly plenty of dark spots, but Bankless nation stuck together while bringing on plenty of new recruits. Today, we’re reflecting on some of our favorite conversations from the year and some of the best newsletter pieces we published in 2022. Here’s to an even brighter 2023, we’ve got some massive things planned 😎 – Bankless team Best of Bankless 2022This year, we brought the heat 🔥🔥🔥 We tried our hardest as a team to narrow down a few of our best podcast conversations and newsletter posts from the year. But what does “best” really mean? Some of these episodes/posts were way ahead of their time, others captured the moment better than anyone else did, other posts were the moments in and of themselves. Others we just liked a lot. Below are the Top 5 Bankless Shows and Top 5 Bankless Newsletter pieces of the year, with some favorites from the community thrown in too 😁 🎙️ Bankless ShowsThe top 5 Bankless episodes from 2022. 🏅 1. Endgame | Vitalik ButerinIt’s Vitalik Buterin laying out the Endgame roadmap for the most important multi-asset decentralized ledger of record in the world. Need we say more? The Merge gives Ethereum proof-of-stake. But what is the Surge, Verge, Purge and Splurge that comes after? How does Ethereum plan to scale with rollups and sharding? To achieve full censorship-resistance? How does Ethereum plan to democratize validator access to something as simple as a phone? Take it all from the man himself. 🏅 2. How Do We Regulate Crypto? | Erik Voorhees vs SBFIn October, Sam Bankman-Fried laid out a proposal on how to regulate DeFi that urged regulatory licensing of DeFi’s frontend. That meant subjecting Uniswap and Aave to regulatory licensing like in TradFi and crippling access of DeFi to billions outside the first world. Hell nah. Erik Voorhees of ShapeShift made that point forcefully when he came on the Bankless pod for a debate with Sam that crypto roundfully considers to have been won by Voorhees. This podcast preceded the downfall of FTX by just nine whole days, offering a glimpse into the mind of a crypto shark that sought to sell out DeFi for his own gain. It’s one of Bankless’s most popular podcasts of 2022, watched by crypto and Washington policymakers alike. We’ll be remembering this one for a long time. 🏅 3. How to Own The Internet | Li JinLi Jin is a co-founder at Variant, a crypto fund whose investment thesis revolves around what is being called the “Ownership Economy”. Unlike the Big Tech walled gardens of today, blockchain technology is accelerating a change that empowers users and content creators to own their own social capital, rather than be subject to the rules of Facebook and Twitter. This podcast with Li Jin was an unexpected hit, and is constantly cited by many Bankless fans as the podcast that made them discover crypto as much more than a speculative mania. 🏅 4. UST: New Paradigm or Ticking Time Bomb? | Jordi vs JoseThe disasters of 2022 all go back to Terra’s implosion in May. Months leading up to the dramatic depeg of UST, crypto endlessly debated the sustainability of Terra’s design, particularly its algorithmic stablecoin that was tied to 20% APYs on the Anchor protocol, a Terra money market. In this Bankless classic, Jordi Alexander of Selini Capital went up against Jose Macedo of Delphi Digital, a Luna Foundation Guard advisor and known Terra-bull. This episode offered a prescient look into Terra’s demise before-the-fact. Terra-skeptics were right all along the way, demonstrating the need for crypto to have less religious cheerleaders and more healthy skepticism. Asking the right questions in the face of adversity matters, and this episode embodied that spirit. 🏅 5. Ethereum Uncensored | Justin DrakeWhen the U.S. Treasury sanctioned Tornado Cash in August, Ethereum validators plugged into regulatory-compliant relayers that censored the protocol’s transactions. Centralized exchanges and DeFi protocols immediately blacklisted wallet addresses associated with the privacy mixer, and Tornado Cash developer Alexey Pertsev was arrested and still remains in jail today. If Ethereum cannot withstand the whims of government bureaucrats, then it is failing its core vision and has no right to call itself a decentralized world computer. Ethereum researcher Justin Drake comes onto the Bankless pod and provides a 360° view of the many ways Ethereum is building to be more censorship-resistant. This is a fairly technical podcast but an absolute must-listen for anyone trying to understand the meaning of decentralization, and the broad vision for Ethereum and crypto. For an article distillation of the podcast, tap into Bankless’ A Beginner’s Guide to Ethereum Censorship. 👈 📖 Bankless NewsletterThe top 5 Bankless newsletter articles in 2022. 🏅 1. The Ethereum Watershed | David Hoffman

The machinations of Ethereum at the protocol layer are dry, technical and hard to understand. But if you’re in crypto for the long haul, then you need to know something about what’s going on here. It’s the magic under the hood that makes Ethereum the best performing Layer-1 blockchain today. The Ethereum Watershed is a bona fide Bankless classic by David Hoffman that distills the technical layers of Ethereum into a fun and easily-understandable format. From the time you click “send” on a DeFi frontend, how it travels through the mempool, to the point it emerges as an immutable transaction in an on-chain block, David tells a story of how Ethereum functions as a self-perpetuating ecosystem like a watershed cycle. 🎯 Other hits from the same author: 🏅 2. Is Solana Dead? | Ben Giove

Solana was “the FTX chain”. Alameda not only controlled a huge stake in SOL as an early investor, but was also the builder behind many core primitives like Solana’s primary wrapped BTC/ETH bridges and the Serum DEX. When FTX went down, Solana got pummeled. Will Solana ever bounce back from its current predicament? That was the question on everybody’s minds (then and now), and Ben’s on-chain analysis of Solana’s future was an exceptional deep dive into rough times ahead for the so-called “ETH killer” chain. 🎯 Other hits from the same author: 🏅 3. The Decentralized Identity Revolution | Donovan Choy

Any project that deals with public networks needs to confront the annoying problem of identity. Whether it’s to distribute an airdrop, or to create censorship-resistant social media, you won’t get far without a Sybil-resistant identity primitive. Web3 already has many identity solutions from Proof of Humanity and soulbound tokens to verifiable credentials. How do they differ? What are they best suited for? Is there a “best” digital identity? Donovan breaks down everything you need to know about the decentralized identity meta in one Bankless article. 🎯 Other hits from the same author: 🏅 4. Five Steps to Starting Your Crypto Career | William Peaster

One of the more common questions we get at Bankless is: “I love crypto but I’m no techie — can I still get a job?” The answer is yes. Opportunities are everywhere in Web3 (even in this bear!) but you have to be smart about it. Out of the more than 150 articles that William Peaster (AKA the one-man machine behind the Bankless Metaversal newsletter) wrote in 2022, Five Steps to Starting Your Crypto Career remains one of Bankless’ most revisited and shared articles for young bucks everywhere looking to get their start in this crazy industry. 🎯 See also other hits from the same author: 🏅 5. Fixed Rate Yields That Outperform ETH Staking | Jack Inabinet

Investing is difficult. The average person doesn’t want to rush to check their portfolio every single time Crypto Twitter blows up. They want fixed-rate yields so they can spend their time on their day jobs and loved ones and sleep easy at night. And DeFi has no end of fixed-rate products to hedge against the crazy turbulence of crypto markets. They’re all trying to out-compete the granddaddy fixed-rate of them all: ETH staking. Do any of them do so successfully? From yield splitting and interest rate swaps and structured tranches to fixed rate lending, Jack drops the most comprehensive analysis of this sector in this Bankless classic. 🎯 See also other hits from the same author: 🏴 Bankless Community Picks📖 Newsletters🎙️ PodcastsAction steps

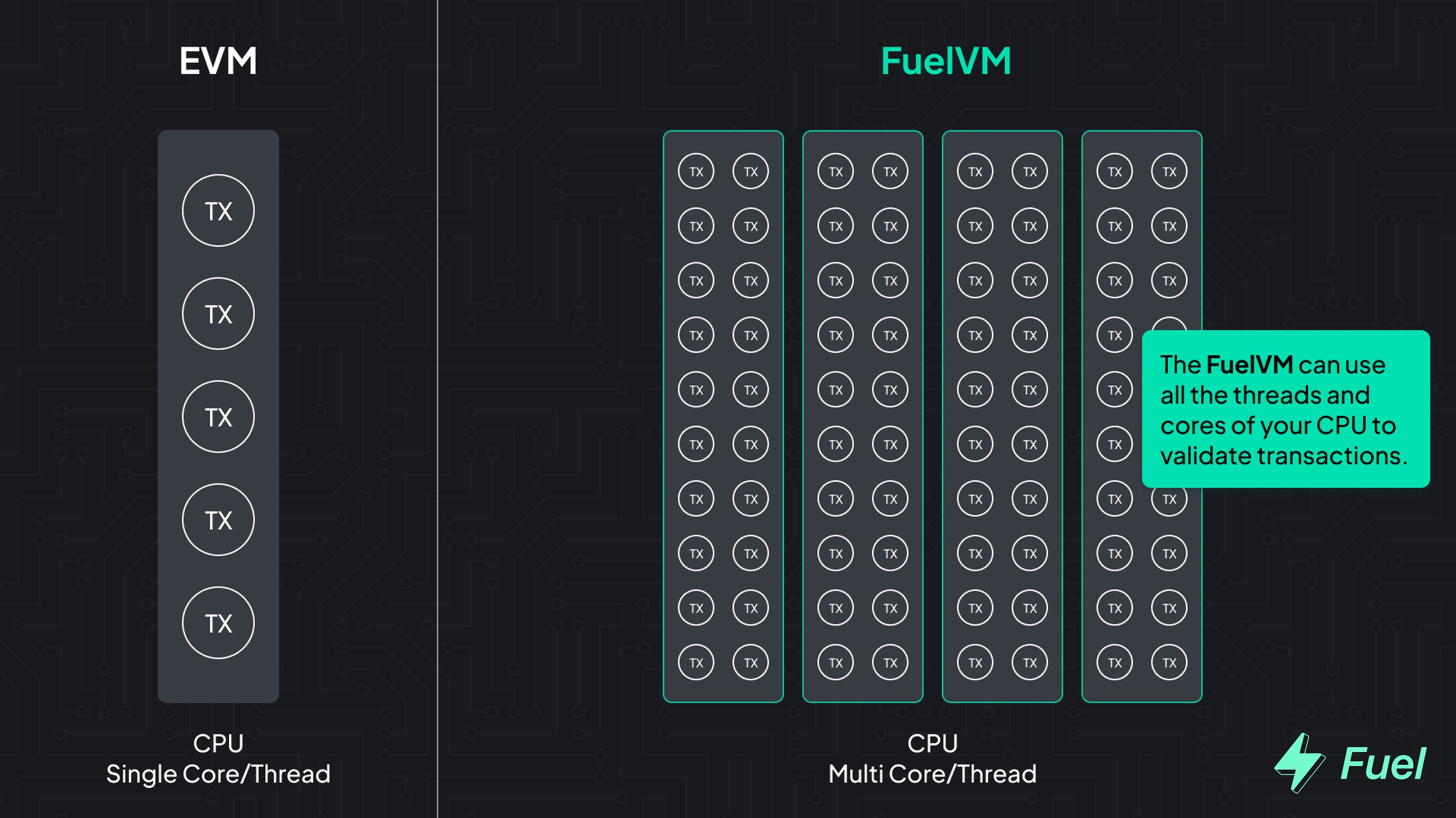

🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2022 Bankless, LLC. |