Bitcoin’s Network Poised For The Bull Market

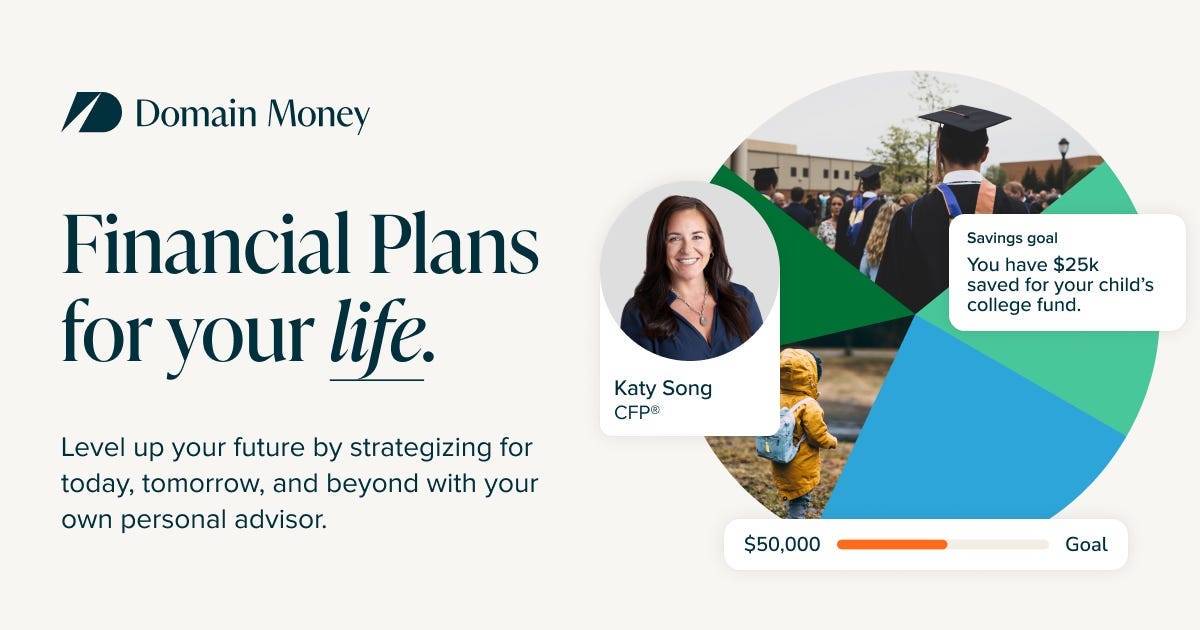

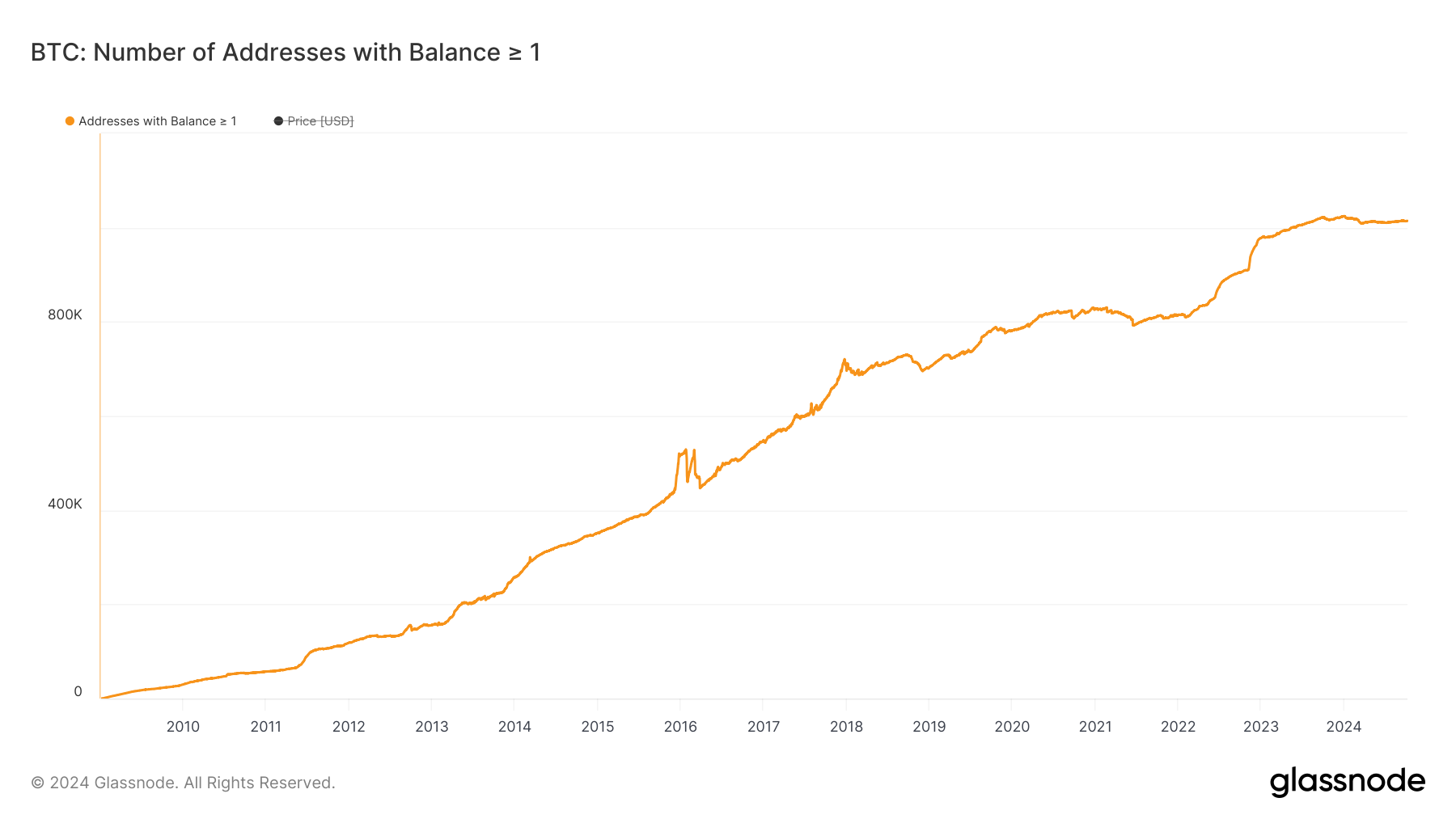

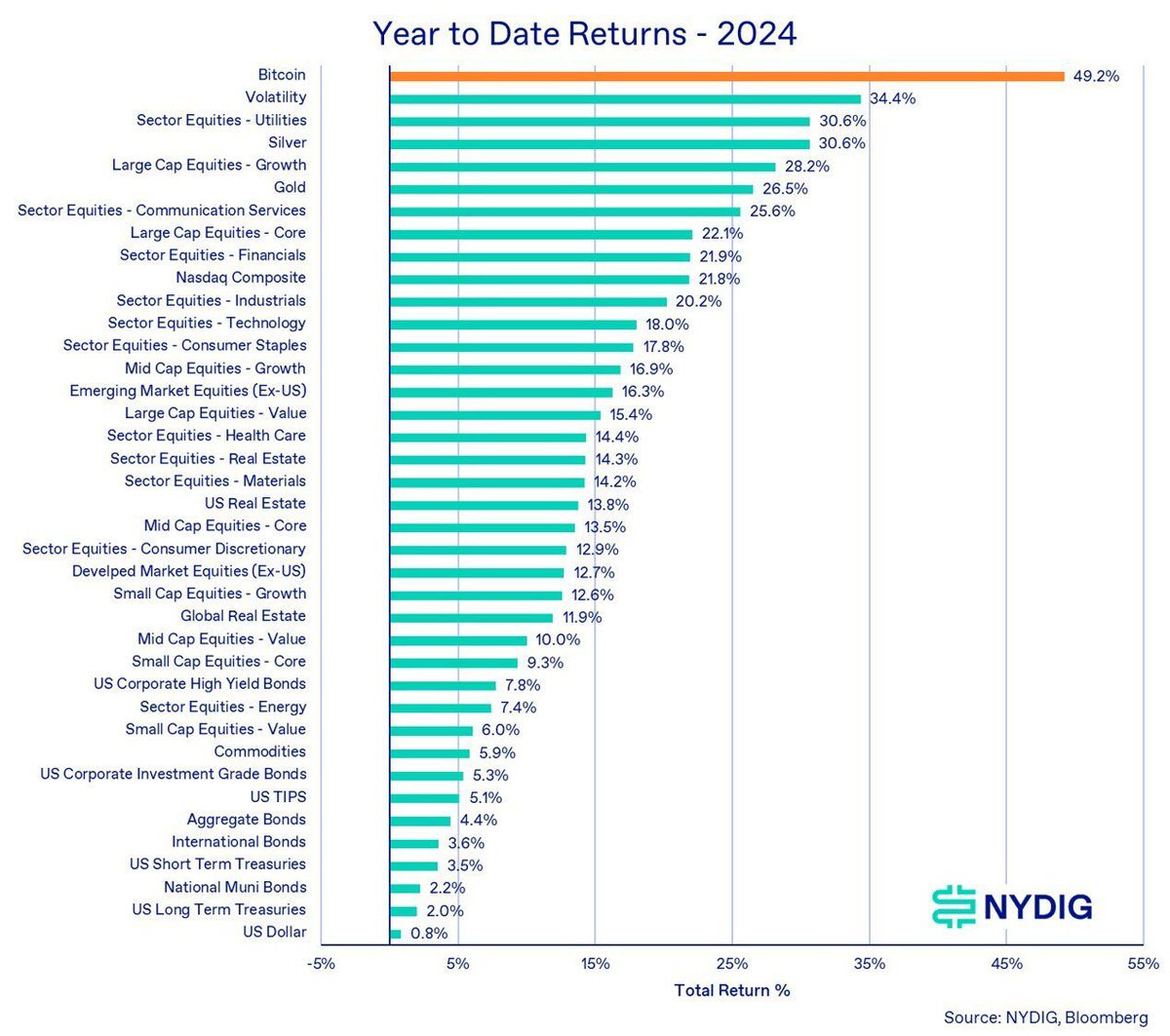

Today’s letter is brought to you by Domain Money!If you’re reading this right now you don’t need financial advice, if you did you would use Domain Money, a company of flat fee financial planners that craft you a personalized, in-depth plan with unbiased, straightforward, and real sound advice based on your values and goals, but you are all better than that. You know about money. That’s why you’re here. If you had questions, you’d use Domain Money. See Disclaimer below¹ Book A Free Strategy Session Today To investors, Bitcoin has been trading sideways for the entire summer. Many people have been lulled to sleep by the lack of upside volatility. Don’t be one of those people. My expectation is we are entering an exciting bull market. There should be price movement between now and mid-November. It is always hard to predict the severity of the move, so I will leave that to someone smarter than me. The 4th quarter of halving years are known for starting the move upwards. I don’t anticipate this one will be any different. Given that context, lets take a look at the health of the bitcoin network. First, we have seen active addresses drop after the first quarter of 2024. We should expect lower address volume when price is sideways or down, so this isn’t very surprising. But it gives us a good sense of how much volume can come back on-chain if price begins to rise. Next we see that the number of bitcoin on-chain addresses with at least 1 full bitcoin has been sideways for most of the summer. The same is true about addresses with non-zero balances, 0.01 bitcoin, and 0.1 bitcoin balances. We can also see that the total bitcoin held on crypto exchanges has been flat since January 2023. That is a long time to go without much change and the fact holders are not moving their bitcoin onto exchanges should signal majority of people are not willing to sell at current prices. Hashrate has also been sideways for the last few months. This follows the parabolic rise in recent years. Bitcoin remains the strongest computer network in the world, but there is heavy debate over which data point is the leading indicator — bitcoin’s price or hash rate. One of the most important data points is that 65% of all bitcoin in circulation have not moved in the last 12 months. This has come down slightly from the 70% in December 2023, but it remains very healthy. The more long-term holders with bitcoin in their wallet, the less liquidity for the circulating supply — this means it takes less net new interest to move the price higher. If you double the time frame to 2 years, more than 50% of all bitcoin in circulation have not moved. This is true despite the price of bitcoin tripling during that period. The funny thing about all this data? Bitcoin is still the best performing asset class in 2024. In conclusion, the sideways summer is almost over. Bitcoiners are holding their assets for the long-term. It will take just a little bit of new interest to move the illiquid circulating supply higher. It should start getting fun again in the next month or two. Lets see what happens. Hope you all have a great day. I’ll talk to you tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management 🚨 Talk or Hang Out With Anthony Pompliano 🚨I want to meet you. In order to get the meeting scheduled, you have to purchase a certain amount of my new book, How To Live An Extraordinary Life. You can do one of the following:

You can use this link to purchase up to 100 books and then use this link for a discount on bulk buys over 100 books. Here is how it works:

I have already done a few calls with people and spoken at different events. It is just as fun for me as for you, so I look forward to meeting many of you as well. Phil Rosen, the Co-Founder of Opening Bell Daily, and and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss interest rates, port strike, reactions to the VP debate, bitcoin, asset performances, and future outlook. Listen on iTunes: Click here Listen on Spotify: Click here The US Economy Was Being Held Hostage By Dock WorkersPodcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. 1 While I am not a financial advisor and can’t give financial advice, Domain Money has board-certified CPAs who can give you financial advice and keep you on track to reach your goals. As always, doing your own research before purchasing any product/service is important. View this important disclaimer so you know exactly what to expect. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2024 |