Blockware Intelligence Newsletter: Week 152

Blockware Intelligence Newsletter: Week 152Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 10/26/24 – 11/1/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨 The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain. Click here to sign up for the Marketplace and start mining Bitcoin. Bitcoin: News, ETFs, On-Chain, etc. 1. BTC Cracks $70,000 “Uptober” did not disappoint. Despite little-to-no fanfare outside of the niche corners of the internet where Bitcoin enthusiasts reside, BTC has resurfaced above its 2021 high. From open to close, the net gains for October were +10.8%. When pumps such as this take place, people often search for a single catalyst to credit. There’s not one specific reason to point to as an explanation, but rather a culmination of various dynamics:

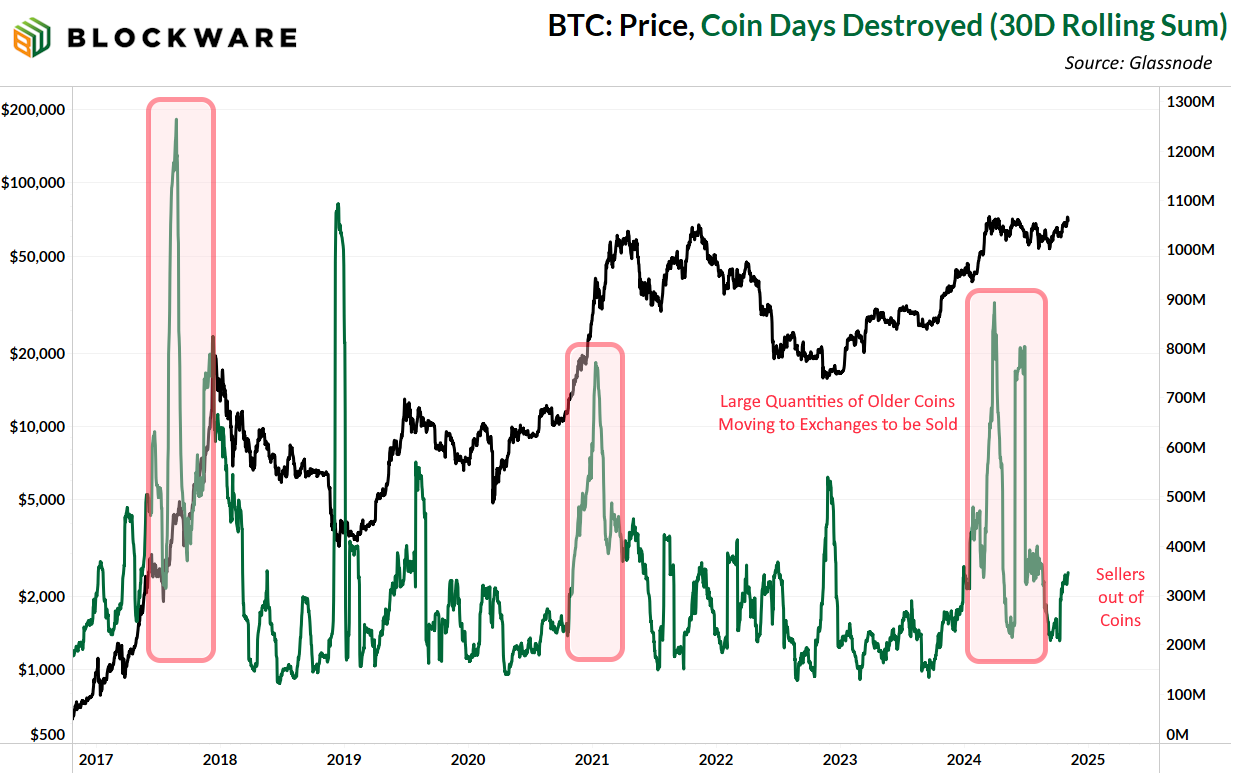

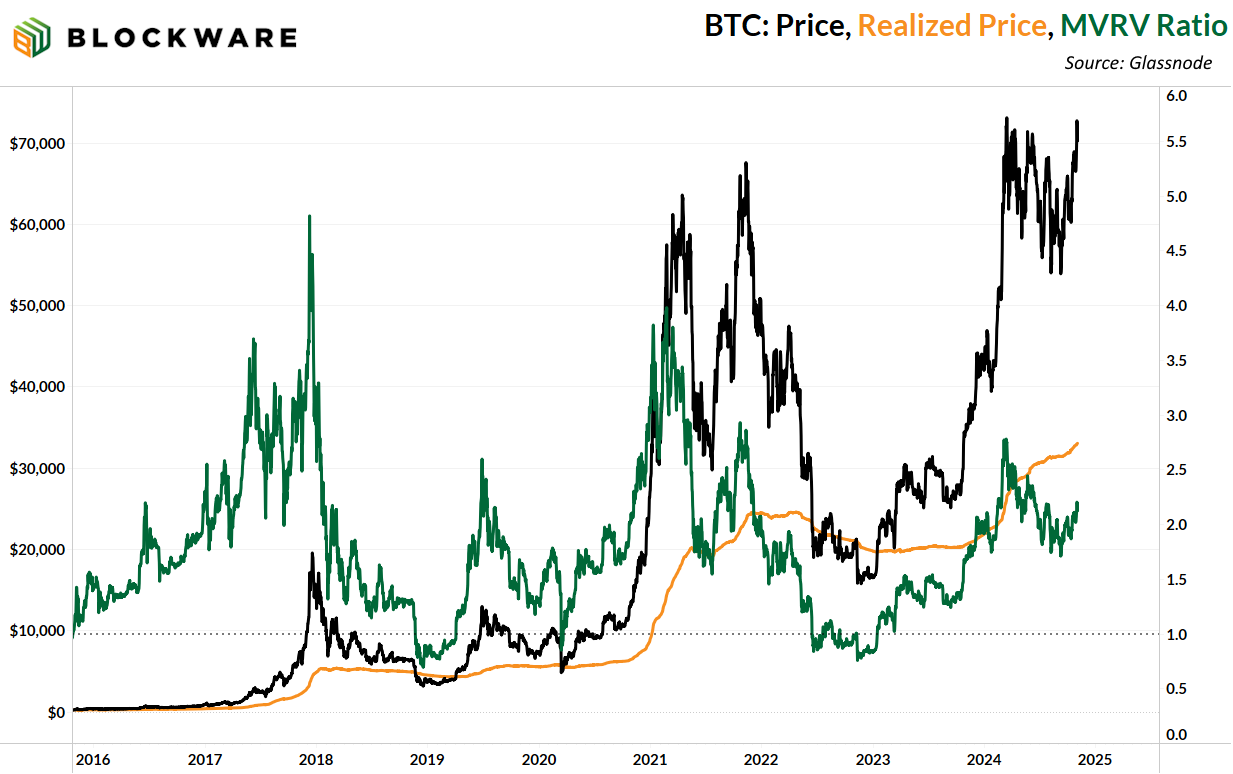

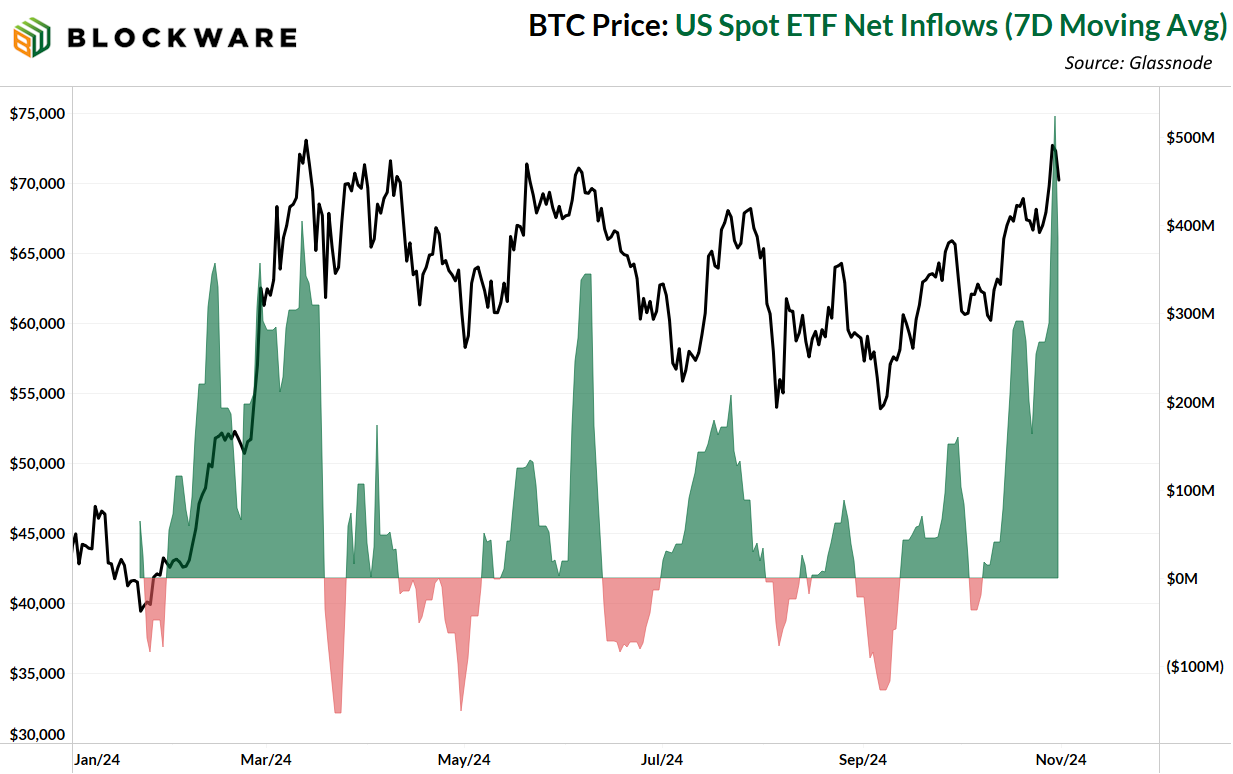

An argument could be made that 1 & 2 are the reasons BTC traded sideways this summer while stocks & gold rallied – now that two BTC-native sources of sell pressure are absent, price was able to adjust upward. 2. Coin Days Destroyed (30-Day Rolling Sum) In reference to OG Holders selling coins, the chart below shows on-chain volume weighted by the length of time since each coin last moved. You can see spikes in Coin Days Destroyed during periods of rising price action, as those who have held BTC for a while move a portion of their holdings to exchanges to be sold. When BTC made new highs in Q1, we saw the most amount of coin days destroyed in a 30-day period since the panic sell-off in 2018. There’s been a rise in this metric alongside the recent move up in price – but on a relative basis, it’s almost nothing. The investors willing to sell at this range are essentially out of coins to sell. This is bullish. 3. Realized Price / MVRV Ratio There’s much more room for BTC to run now compared to when it was at $70K back in Q1. The “realized price” – which is the aggregate cost basis of the market (average price at the time each coin was last moved on-chain) – has risen from $26,000 to $33,000. This may not seem like much, but there’s now far fewer unrealized profits outstanding in the market. The MVRV-Ratio measures this, and it’s down from 2.6 to 2.2 – 40% less in aggregate returns. The closer the market price is to the realized price, the less likely it is for the BTC price to decrease. This is pretty intuitive – if there’s a large amount of unrealized gains in the market, then the incentive for holders to sell some coins is going to be stronger. 2025 has a strong possibility of bringing a bitcoin bull market, so we’ll be looking at the MVRV Ratio closely to see if the market may be getting frothy. In the past two cycles, the MVRV Ratio peaked at over 3 during the top. 4. Spot ETF Net Flows (7-Day Moving Average) This week saw the highest amount of net inflows into spot ETFs since the initial launch – with Tuesday & Wednesday both racking more than $800,000,000 in net inflows. For the most part those using the ETFs have been net-buyers. While it would be naive to expect this cohort of BTC investors to be entirely robotic, unemotional, and immune to market psychology (panic selling & FOMO buying), they are showing to be slightly more sophisticated than the average retail investor. Funds and institutional money managers are coming – but right now most of the ETF buyers are retail investors. As the former cohort slowly dips their toes deeper into the asset class, it’s likely that ETF flows will be steadily positive as these types of investors tend to buy and hold assets for long periods of time

5. Election Impact on BTC & Crypto On the front of many investors’ minds is how Tuesday’s US Presidential Election will impact markets. We interviewed VanEck’s Head of Digital Asset Research, Matthew Siegel, to get his thoughts on this very topic. Matthew made a splash this week when he went on CNBC and said that his team believes BTC could hit $3,000,000 by 2040. Check out this 30-minute discussion to hear his detailed analysis. 6. Florida CFO Pushes for BTC Position in State Portfolio Here’s a real-world example of how institutions are approaching Bitcoin and the ETFs. The Chief Financial Officer for the state of Florida, Jimmy Patronis, penned a letter to the State Board of Administration urging them to add BTC to the ‘Florida Growth Fund.’ Read here: https://t.co/RfQT9IpuyJ Retail acts fast, and institutions act slow. While to the seasoned reader of this newsletter bitcoin’s value proposition (life raft against perpetually rising fiat liquidity) is readily apparent, organizations with many decision-makers are not so quick to figure this out, let alone deploy capital. While Florida’s CFO has it figured out, he must get others on board before a move can be made. Some institutions, like the Wisconsin State Pension Fund, have been quick to take action. But most are going to need more education, more validation from other traditional institutions, and a higher BTC price before they make a move. Gradually, then suddenly… 7. MicroStrategy $42 Billion BTC Buy Michael Saylor announced the largest ATM (at-the-market) offering in the history of financial markets. Over the next three years MicroStrategy plans to raise $21 billion through equity and $21 billion through debt in order to acquire more BTC. Everything that conventional wisdom teaches about finance would lead you to believe that a move like this would be detrimental to their stock price. But what makes MicroStrategy so brilliant is that their issuance of new stock, a move that is traditionally dilutive to investors, is actually accretive, in BTC terms, because they use the newly raised capital to acquire BTC. $MSTR didn’t even flinch with this announcement – still holding strong around ~$238 per share. Theya – Simplified Bitcoin Self-Custody For secure, intuitive self-custody that fits seamlessly into your life, we recommend Theya. Theya is the simplest way to safeguard your bitcoin, whether you’re using their mobile app or their new web app. With flexible multi-sig and cold storage options, you choose how to hold your keys securely. Experience the ease of a true multisig solution, on your terms. Ready to secure your bitcoin? Click here to get started and enjoy 10% off an annual subscription! Click here to download the app and get 10% off an annual subscription! General Market Update 8. Poor Treasury Performance Continues Bond yields rose again this week as inflation concerns linger. The 10, 20, & 30-year yields are now at 4.35, 4.66, and 4.55% respectively. The juxtaposition of the poor treasury performance with MicroStrategy’s 21/21 plan paints a telling picture: fixed income as we know it is changing. MicroStrategy is able to borrow money at lower interest rates than even the US Government, because the structure of these notes provides upside on their stock and by proxy, upside on Bitcoin. Standard fixed income has negative real returns in a high inflationary environment. However, many capital allocators have tight portfolio restrictions, with bonds as a required asset class. Purchasing MicroStrategy’s bonds allows them to meet those requirements while still gaining exposure to assets that can protect against inflation. 9. Core PCE on the Rise Core Personal Consumption Expenditure came in at 2.7% – above expectations of 2.6%. This is a measure of inflation that excludes food & energy prices. The knee-jerk response to that is “why would you want to exclude those? Everybody uses food and energy, all the time.” This is useful because it allows you to get a better look at how dollar liquidity is affecting prices. Food & energy can be impacted by other variables and are thus more volatile. While it would be unwise to use PCE to measure the actual change in a household’s purchasing power, it does give a good glimpse into the effects of monetary and fiscal policy. With that in mind, what is this telling us? It’s telling us the same thing the bond market is telling us: inflation is sticky. Prices are not only rising, but with core PCE up relative to the summer (although only marginally) the rate at which prices are rising is increasing too. An increase in energy production (likely under a Trump administration) would bode well for the price of goods and services in the short term. But over the long term, the simple fact that the amount of dollars in the system is rising endlessly (due to perpetual fiscal deficits) will prove to be more impactful on aggregate prices. Asset prices are already responding to this dynamic. (BTC, stocks, gold, RE up) (Bonds down) Inflation will be high through the rest of this decade and investors need to acquire scarce assets to protect their wealth. SVRN Energy SVRN is more than a premium energy drink! It’s your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats! Use Code “BLOCKWARE” for 10% off. svrnenergy.com/?v=f24485ae434a Bitcoin Mining 11. Mining Difficulty Soaring We alluded to this in the beginning of the newsletter – but Bitcoin miners are showing signs of strength. After two capitulatory periods in the past six months, difficulty is about to rise by more than 8%! Miners are deploying additional, more energy-efficient machines in preparation for the bull market. We’ll discuss this in more detail in Monday’s newsletter which focuses specifically on the Bitcoin mining industry. So make sure to stay tuned so you don’t miss that! 11. Energy Gravity At a typical hosting rate today, new-gen Bitcoin ASICs require ~$61,500 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig.The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below. Read the Energy Gravity report here. All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Blockware Intelligence Newsletter is free today. But if you enjoyed this post, you can tell Blockware Intelligence Newsletter that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

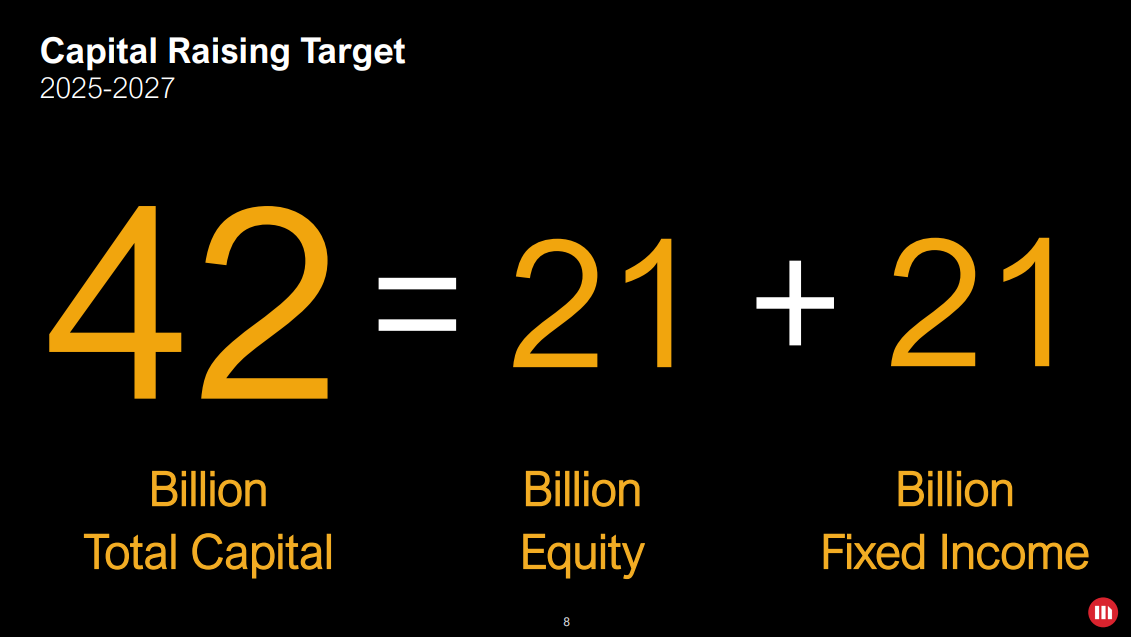

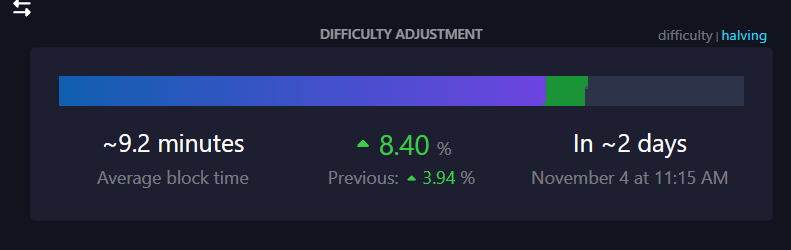

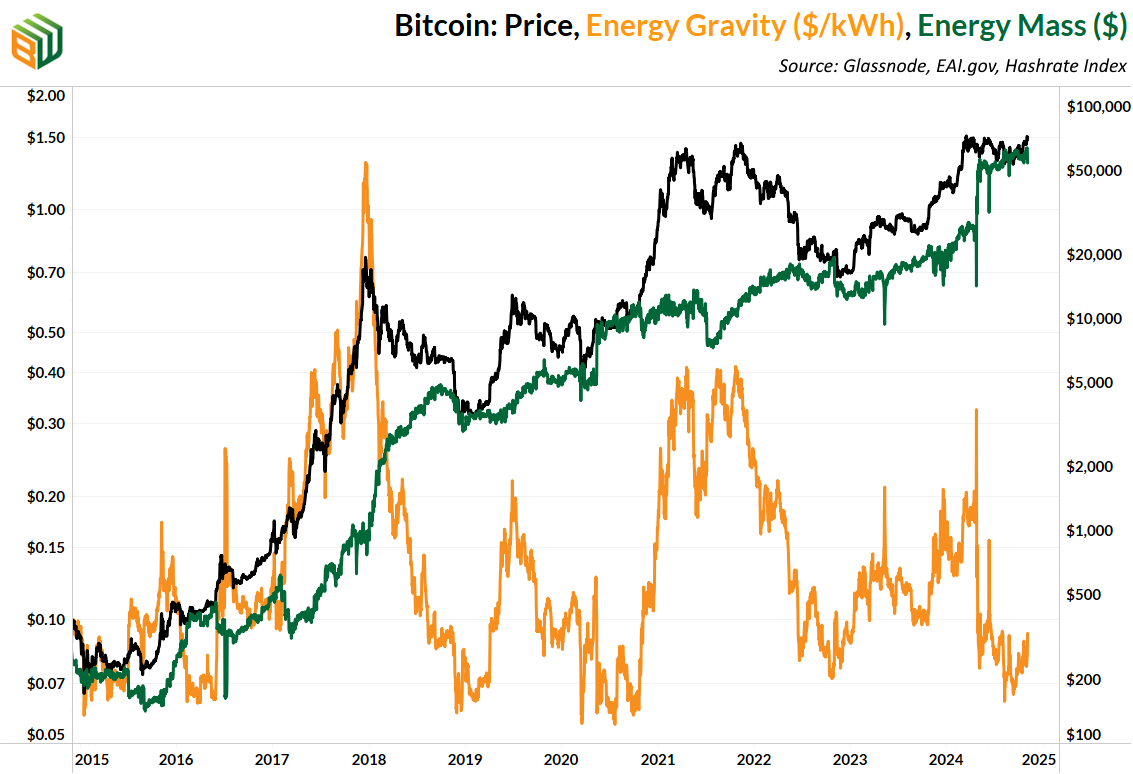

© 2024 Blockware Solutions |