Blockware Intelligence Newsletter: Week 155

Blockware Intelligence Newsletter: Week 155Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 11/16/24 – 11/22/24

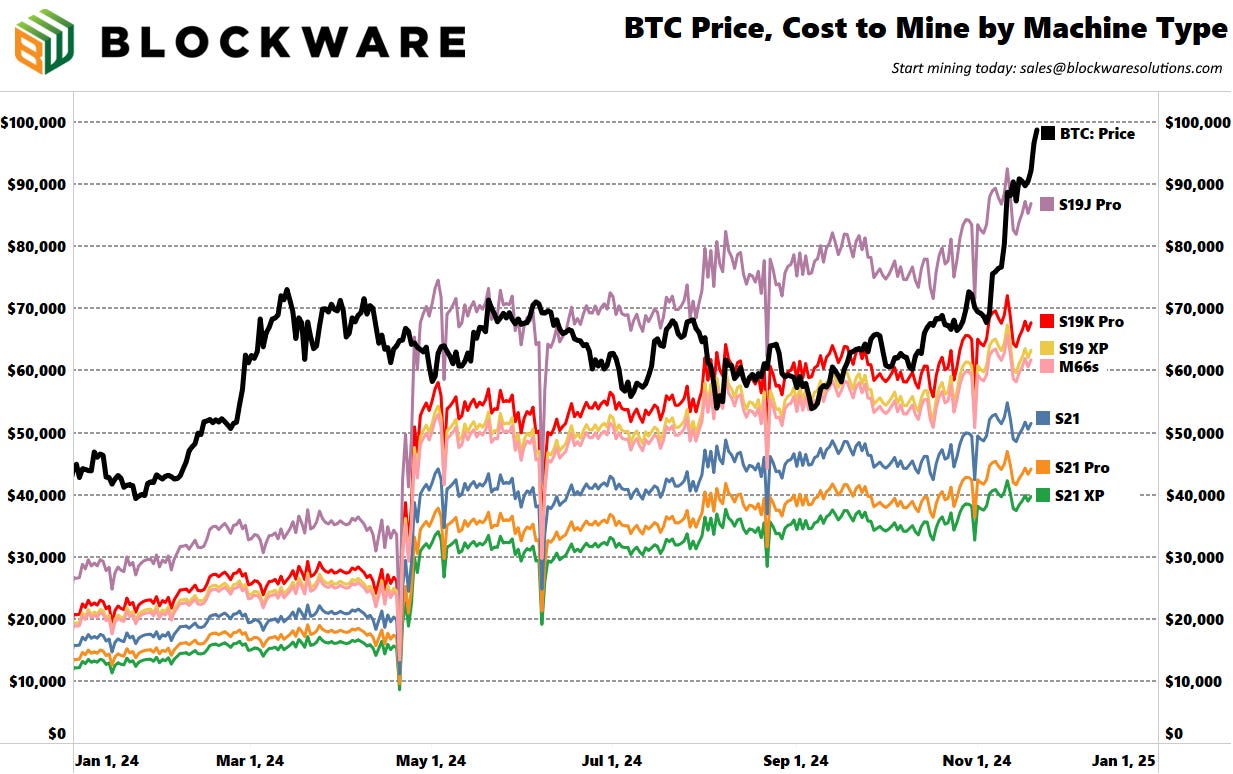

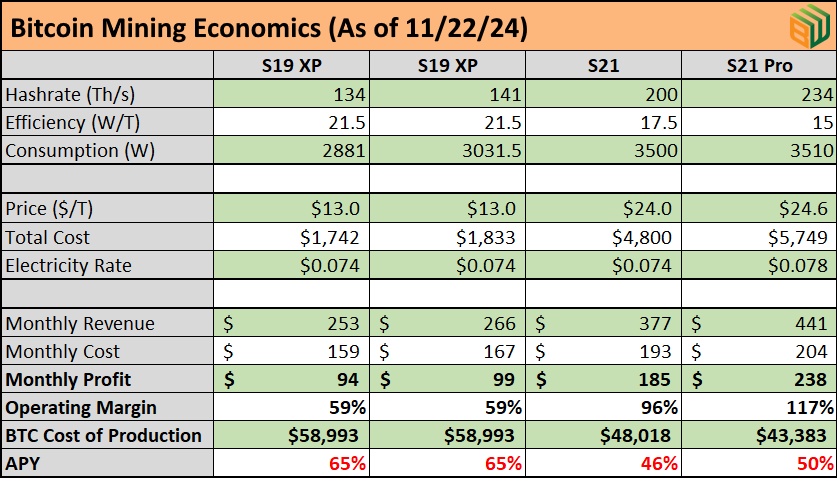

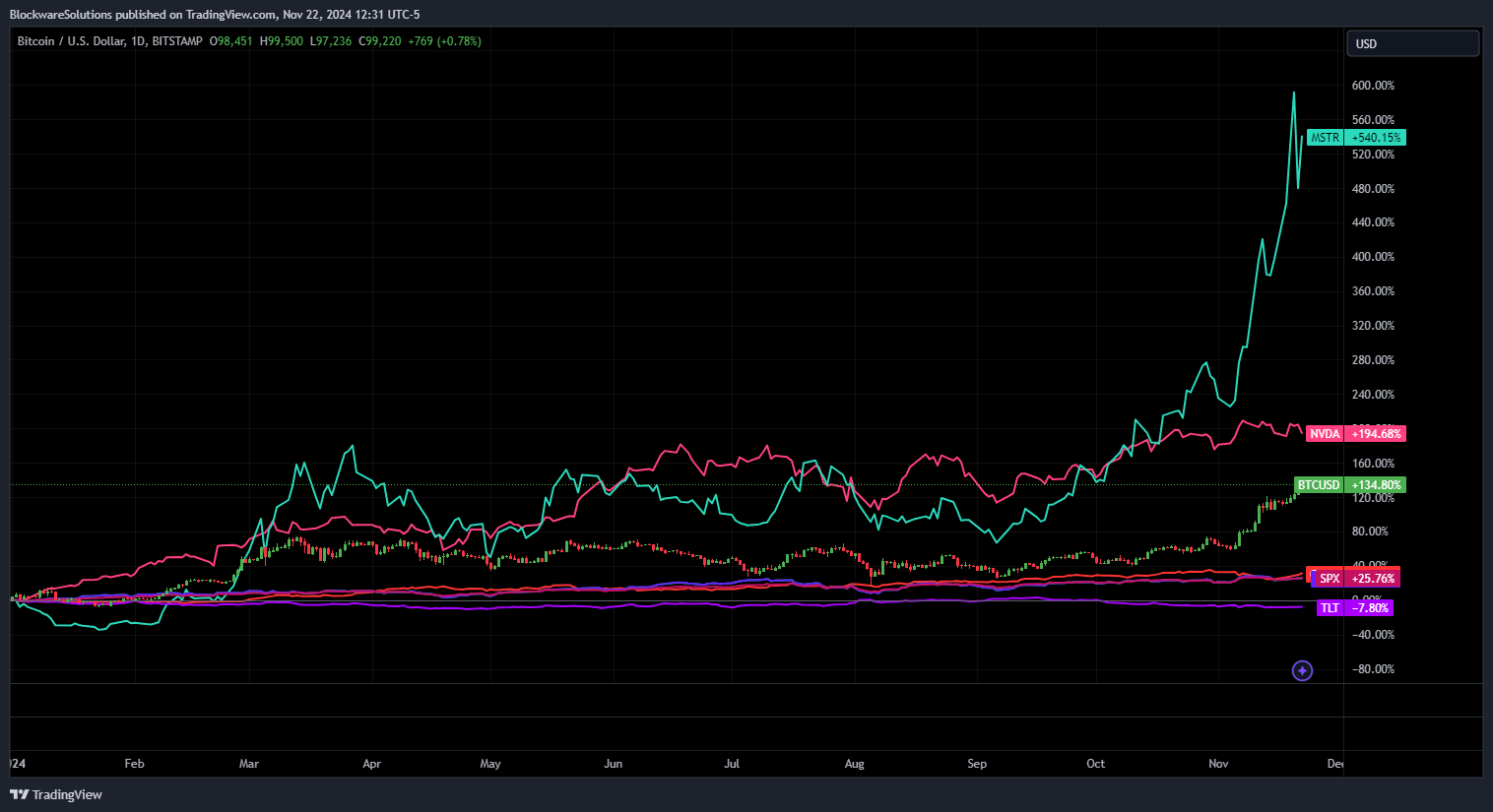

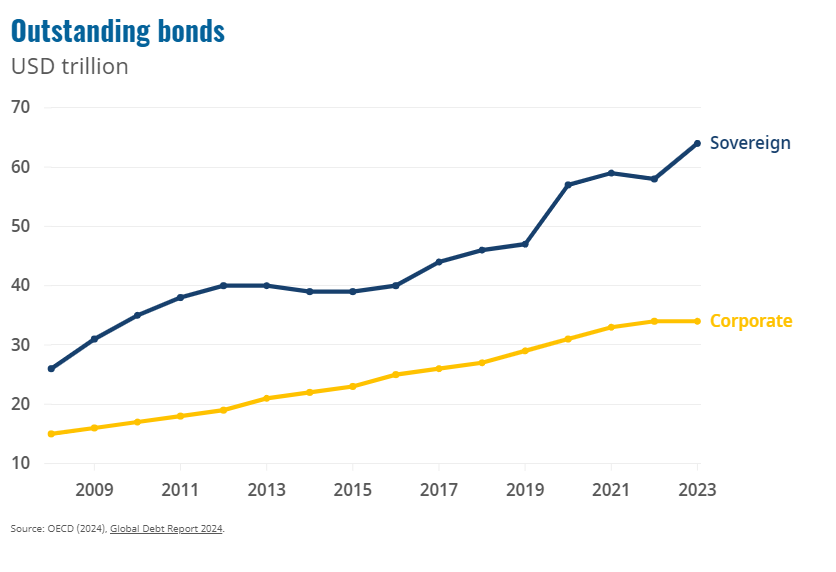

It costs $98,000 to buy 1 Bitcoin. It costs $40,000 to mine 1 Bitcoin. 🚨Discounted Bitcoin Mining🚨 From now until Black Friday (11/29/2024), Blockware is offering a discounted hosting rate of $0.074/kWh on miners located at our Iowa facility! We have 3-different model ASICs available at our Iowa Facilities: – S19 XP (134T) – S19 XP (141T) – S21 (200T) The table below shows the returns for each machine, juxtaposed with an S21 Pro hosted at our typical rate of $0.078/kWh. Contact sales@blockwaresolutions.com for more information. Bitcoin: News, ETFs, On-Chain, etc. 1. BTC on the Cusp of $100,000 +1,251% in the past five years +124% Year-to-Date +47% in the past month This is the 3rd consecutive Friday morning where I sat down to write this market update while absolutely dumbfounded by the price of Bitcoin. It’s not surprising though – we have been anticipating a Q4 move all year long. But nonetheless, it’s exciting to experience price appreciation of this velocity. 2. 2024 Scoreboard – $MSTR leads the way For as well as BTC has performed this year, there’s one name that is taking that cake and we all know who that is: MicroStrategy. $MSTR is up 540% year-to-date, and over 100% in the past month. There’s wildly different opinions on MicroStrategy – allow us to explain what is actually going on here… 3. MicroStrategy Explained The bond market is MASSIVE. It’s the largest financial market in the world. The global value of the bond market – including government bonds, corporate bonds, municipal bonds, and other fixed-income securities – is ~$130 trillion. Corporate bonds alone represent a ~$34 trillion market – approximately 17 times bigger than the market cap of Bitcoin. Investors purchase bonds because they don’t like volatility. They prefer downside protection even if it means less potential upside. How can this cohort of investors gain access to the upside potential of Bitcoin – the most important emerging asset class in the world – without exposing themselves to BTC’s notorious volatility? Enter: $MSTR convertible notes. It’s like purchasing a bond – the principle is protected. But embedded in the contract is the ability to – rather than get back the principle – convert into $MSTR equity at a predetermined strike price. It’s a bond with a call option embedded. The catch? The interest rate (or coupon) is low. In fact, for the most recent offering the rate is zero percent. Despite zero % interest, $MSTR convertible note offerings have been repeatedly oversubscribed. Bond investors could get 4.4% APY risk free on the US-10 year, and they are willing to forgo this for zero % interest because the $MSTR convert gives them BTC upside. There are trillions of dollars of institutional capital that have very tight restrictions on what they can invest in – Bitcoin, Bitcoin ETFs, and BTC exposed equities are out of the equation. But BTC bonds? That’s fair game. So what’s happening on the other side of this trade? MicroStrategy gets to borrow dollars for zero % interest – and they’re using the proceeds to purchase Bitcoin. This turns $MSTR equity into a levered play on BTC. But unlike the leverage offered to retail investors – high interest rates, margin calls, etc. – they have far more favorable terms. Low interest rates, multi-year payback periods, and the embedded call option means they may not even have to repay the principle at all. The net-effect, MicroStrategy strips the BTC volatility from the bond holders and gives it to the equity holders. Bond holders get less upside but zero downside. Equity holders get more downside but also more upside. They have positioned themselves as THE institutional Bitcoin trading vehicle. Any investor can utilize them to take a BTC exposed position. Long, short, bond, equity, hedging – they can grant any and all types of exposure. Theya – Simplified Bitcoin Self-Custody For secure, intuitive self-custody that fits seamlessly into your life, we recommend Theya. Theya is the simplest way to safeguard your bitcoin, whether you’re using their mobile app or their new web app. With flexible multi-sig and cold storage options, you choose how to hold your keys securely. Experience the ease of a true multisig solution, on your terms. Ready to secure your bitcoin? Click here to get started and enjoy 10% off an annual subscription! Click here to download the app and get 10% off an annual subscription! General Market Update 4. US Treasuries Continue to Underperform An interesting juxtaposition to the MicroStrategy conversation is the rise in yields on US Treasuries. Yields moved sideways this week but over the past month they are up significantly – which means the bonds themselves are down. It’ll be interesting to see how yields react after the inauguration of President-elect Trump. Tax cuts are a cornerstone of his platform – and it’s TBD if he and his team will be able to achieve an equal or greater cut in spending. If not, then the deficit will widen and the treasury will be forced to borrow more money at the higher rates. Treasury demand is drying up (relatively) in this high inflationary environment – with investors turning to harder assets like Bitcoin. If yields are unable to drop from real market demand, the Federal Reserve will have to be the buyer at some point, less the interest payments get out of control. 5. Gensler out as SEC Chairman A huge shakeup in the political regime took place this week as Gary Gensler – chairman of the Securities Exchange Commission – announced his departure from the position, effective January 20th. This was expected as President Elect Donald Trump vowed to fire Gensler back in July of this year. The broader “crypto” / digital asset ecosystem will thrive under the new administration as Gensler was notoriously hostile. However, this will have less of an impact on Bitcoin, which is a commodity, not a security. SVRN Energy SVRN is more than a premium energy drink! It’s your gateway to vitality and a future where every sip brings prosperity on your journey to sovereignty. Each can has a hidden QR code that could contain up to 1,000,000 sats! Use Code “BLOCKWARE” for 10% off. https://svrnenergy.com/?v=f24485ae434a Bitcoin Mining 6. Marathon Copies MicroStrategy Intelligent public corporations have seen the success of MicroStrategi’s playbook and replicated it themselves. Marathon Digital ($MARA) raised $850 million at zero % interest via convertible notes this week. MARA plans to use the proceeds to purchase more Bitcoin. 7. Bitcoin Mining Market Update November has been a fantastic month for Bitcoin miners. BTC is up more than 40% while mining difficulty is up ~10%. The Blockware Team recorded a podcast to deliver our thoughts on the current state of Bitcoin mining, revisit our predictions from earlier in the year, and discuss our expectations for 2025. Check it out here: Buy Bitcoin for $100,000. Mine Bitcoin for $40,000.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Blockware Intelligence Newsletter is free today. But if you enjoyed this post, you can tell Blockware Intelligence Newsletter that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

© 2024 Blockware Solutions |