Blockware Intelligence Newsletter: Week 170

Blockware Intelligence Newsletter: Week 170Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 3/29/25 – 4/4/25

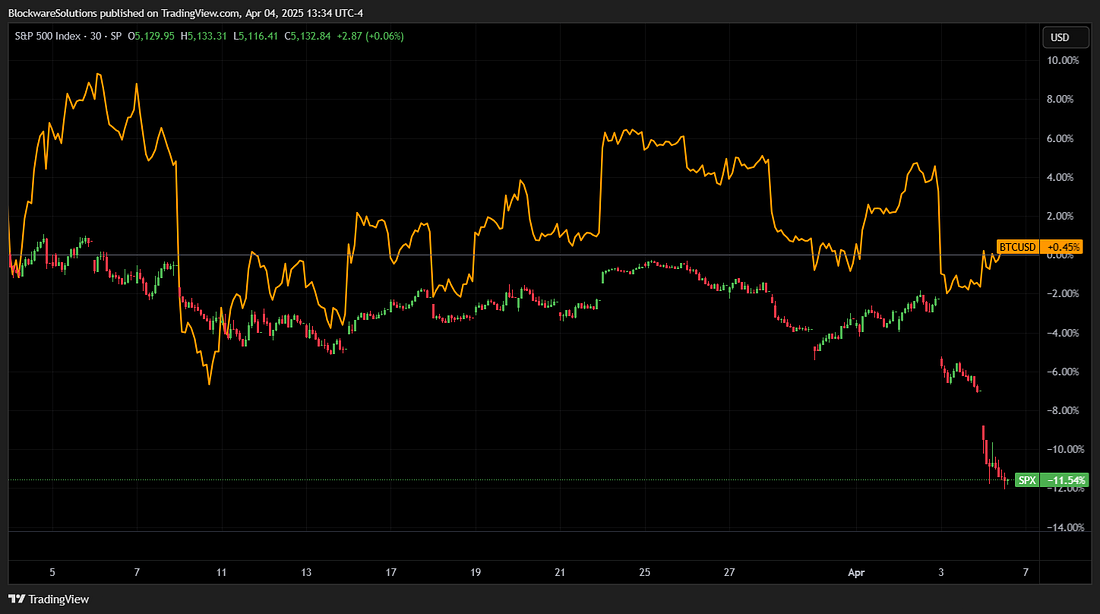

The Tariffs Heard ‘Round the WorldYour money can buy more Bitcoin than you think. Slash your trading fees on the biggest exchanges like Coinbase, Binance, Bybit + more. Blockware has partnered with REF to offer you incredible trading fee discounts. Get up to54% off when you join REF here: theREF.io/a/blockware S&P 500 vs BTC The S&P has taken its deepest dive since March 2020 and Bitcoin hasn’t even flinched. Over the past month the S&P 500 is down 11% while BTC remains flat around $84,000. Not to sound too dramatic, but this is unfathomably bullish. This price action is not indicative of a ‘highly volatile, risk-on asset’ as BTC is often characterized. What we’re seeing here is a strong, underlying demand for BTC that is agnostic to broader macroeconomic uncertainties. Subscribe to Blockware Intelligence Newsletter to unlock the rest.Become a paying subscriber of Blockware Intelligence Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

© 2025 Blockware Solutions |

Bitcoin’s Tariff Resilience

Bitcoin’s Tariff Resilience