Blockware Intelligence Newsletter: Week 174

Blockware Intelligence Newsletter: Week 174Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 4/26/25 – 5/2/25

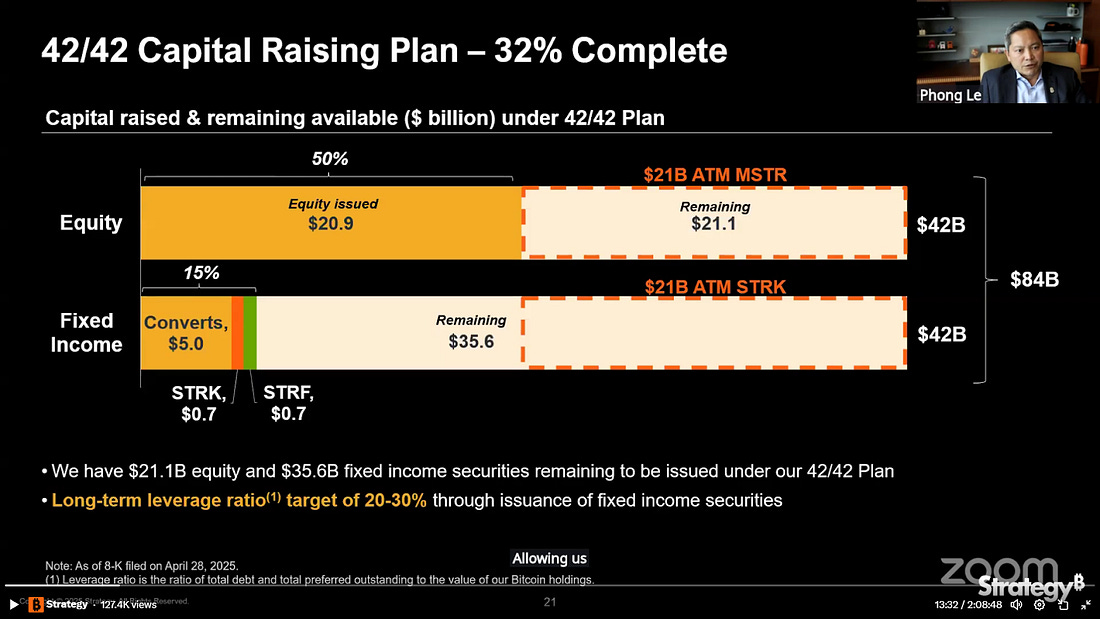

Your money can buy more Bitcoin than you think. Slash your trading fees on the biggest exchanges like Coinbase, Binance, Bybit + more. Blockware has partnered with REF to offer you incredible trading fee discounts. Get up to 54% off when you join REF here: theREF.io/a/blockware Strategy Q1 Earnings Call It turns out that raising $42 billion wasn’t ambitious enough for Saylor and the Strategy team. In their Q1 earnings call Thursday night they revealed a revision to their 21/21 plan – it’s now the 42/42 plan. They plan to raise $42 billion through ATM offerings (issuing new shares of $MSTR common stock) and $42 billion through fixed income offerings. Confusion remains abundant in online financial circles; specifically as it pertains to the nature of the equity issuance. While dilutive in the traditional sense, Strategy’s goal is to increase BTC per Share of Common Stock — and these ATM offerings accomplish that. If you’re a strategy shareholder, this is exactly what you want to see. While the equity issuance will likely hurt the stock performance in the short-term, increasing BTC per Share will result in $MSTR having an even higher Beta to BTC performance, which should result in superior long-term returns. The graphic below is the simplest explanation of what Strategy is doing. Their products ($STRK, $STRF, Convertible Notes, etc.) provide a bridge for capital in fixed income (the largest market in the world) to get exposure to Bitcoin. The US credit market is worth $100 Trillion, Bitcoin is worth just $2 Trillion. There’s incredible asymmetry right here that will get rebalanced over the coming years. We are early. Subscribe to Blockware Intelligence Newsletter to unlock the rest.Become a paying subscriber of Blockware Intelligence Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

© 2025 Blockware Solutions |