Blockware Intelligence Newsletter: Week 70

Blockware Intelligence Newsletter: Week 70Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 1/7/22-1/13/23

Blockware Intelligence Sponsors If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Summary

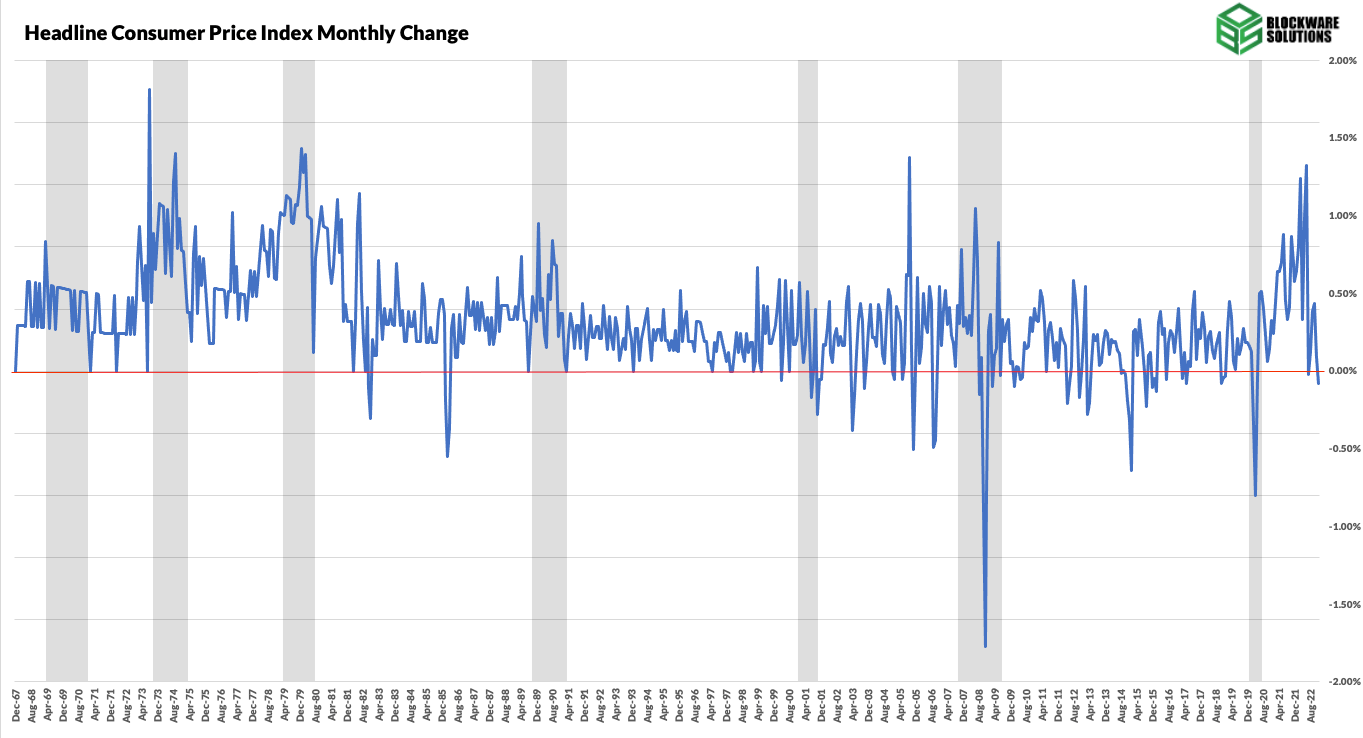

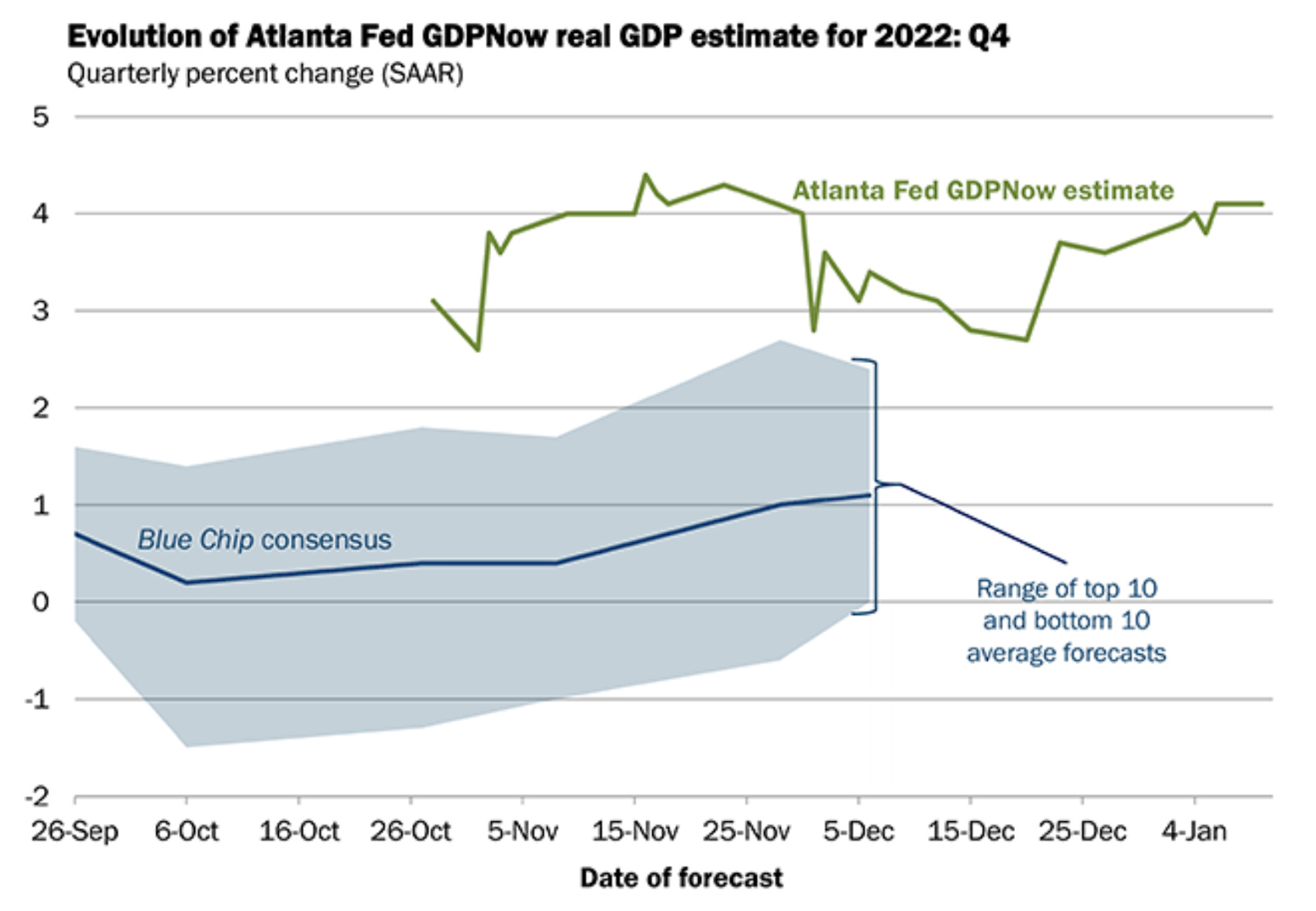

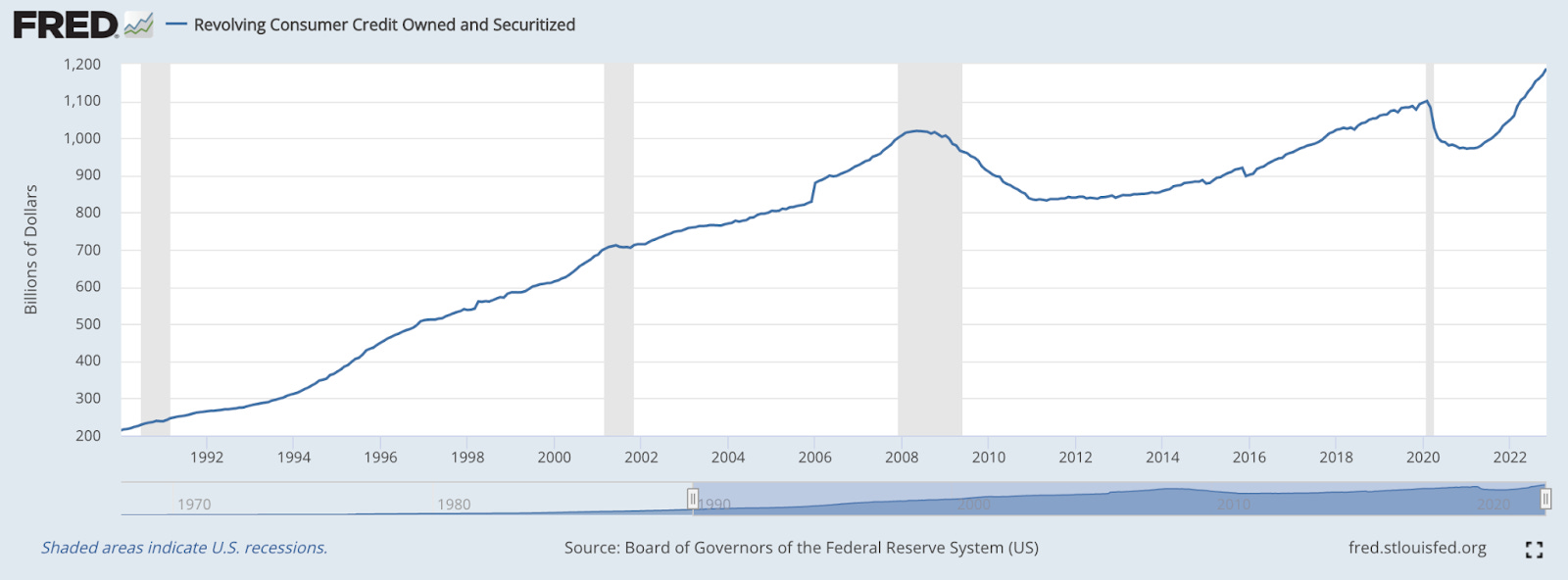

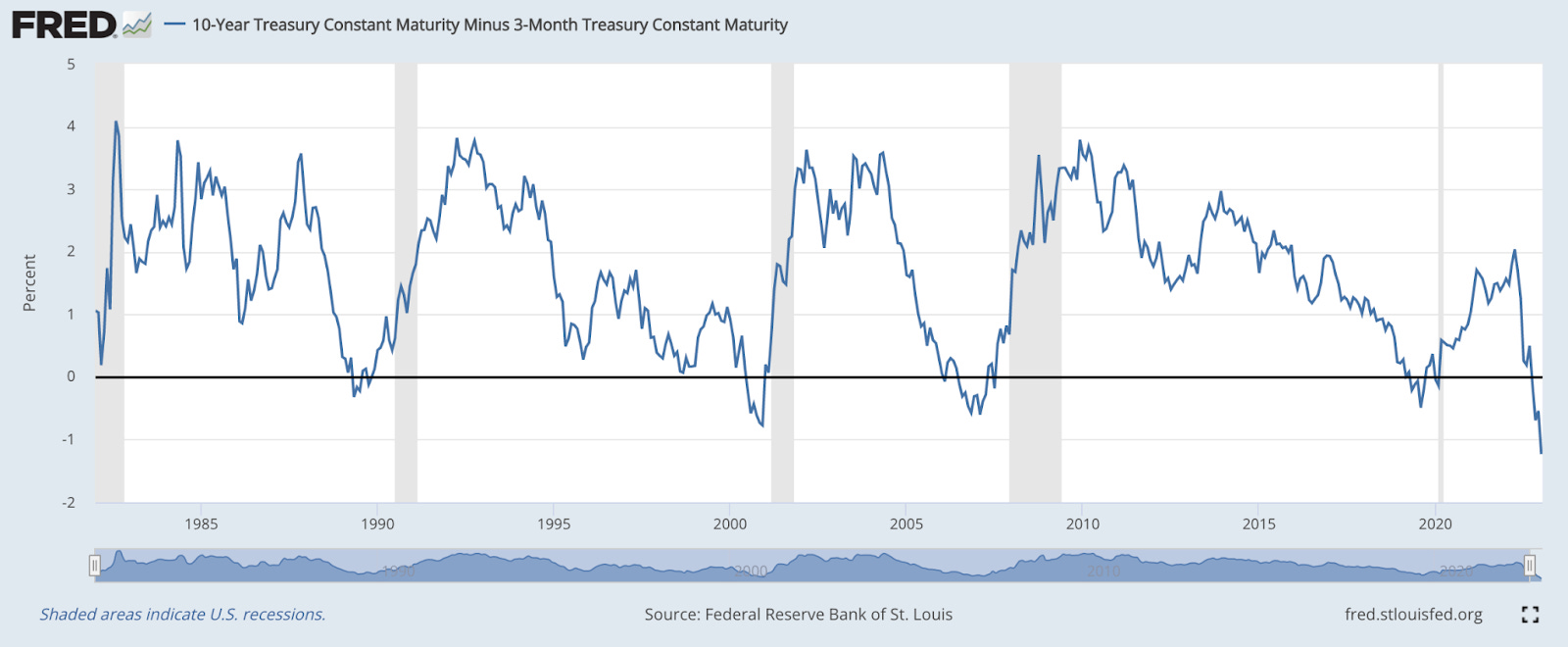

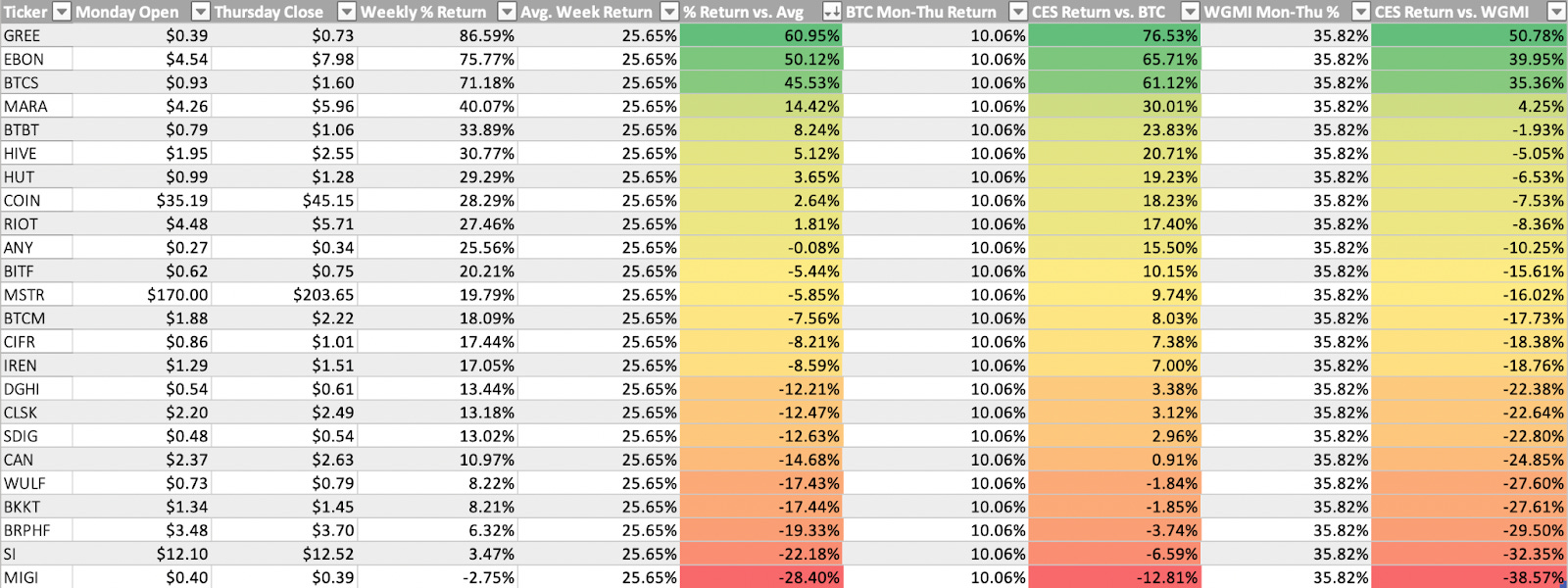

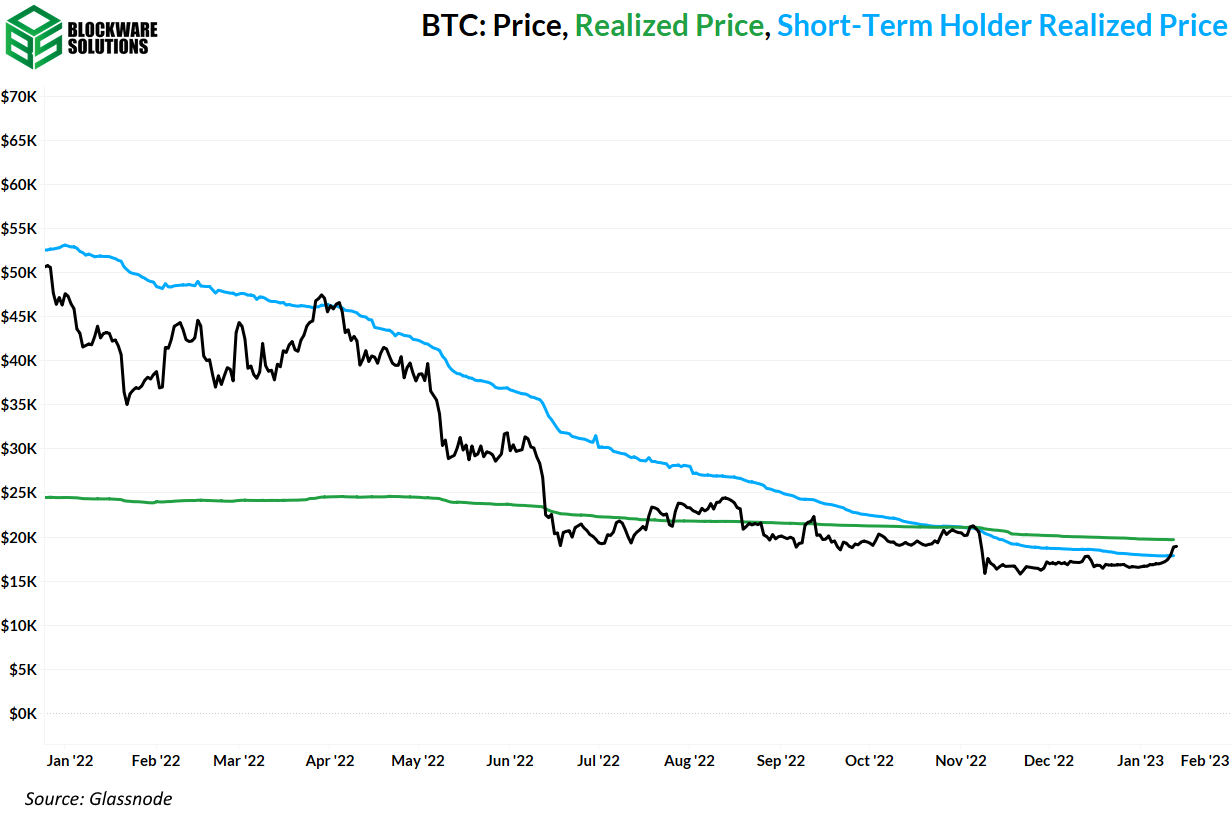

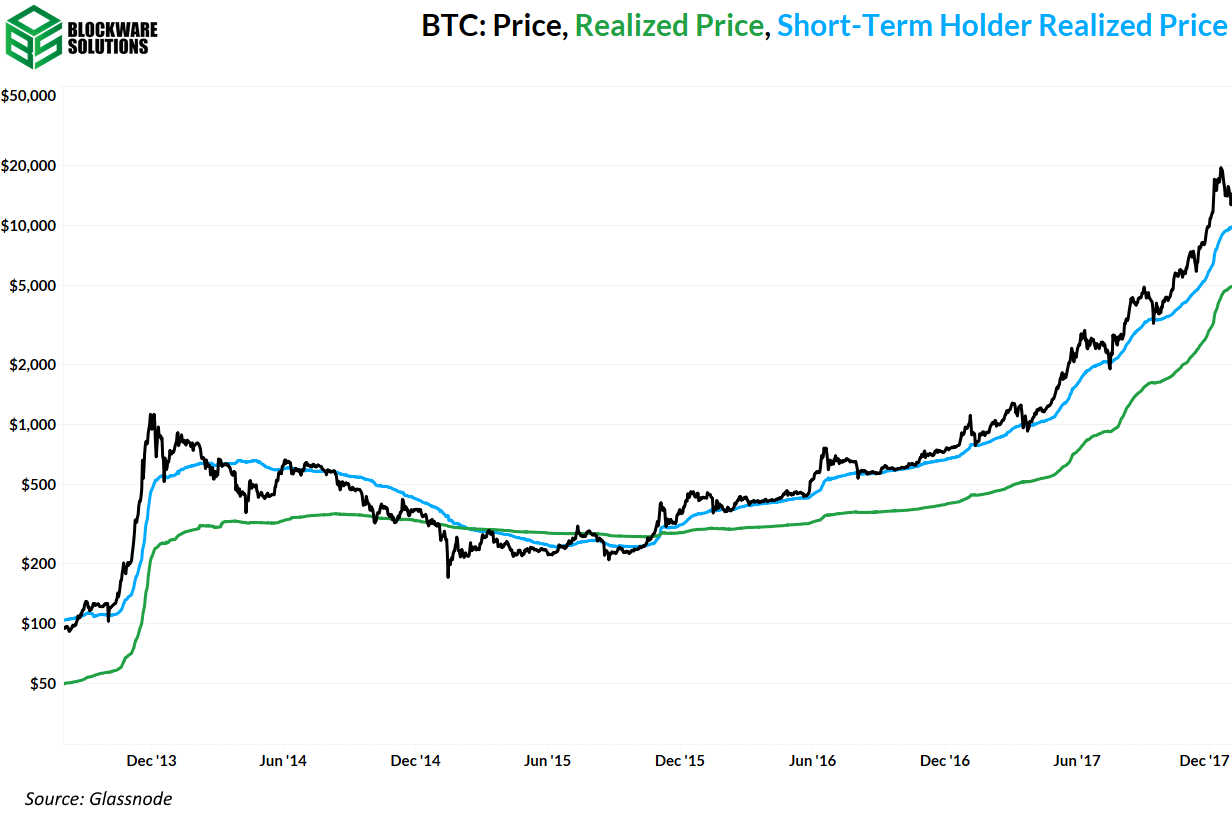

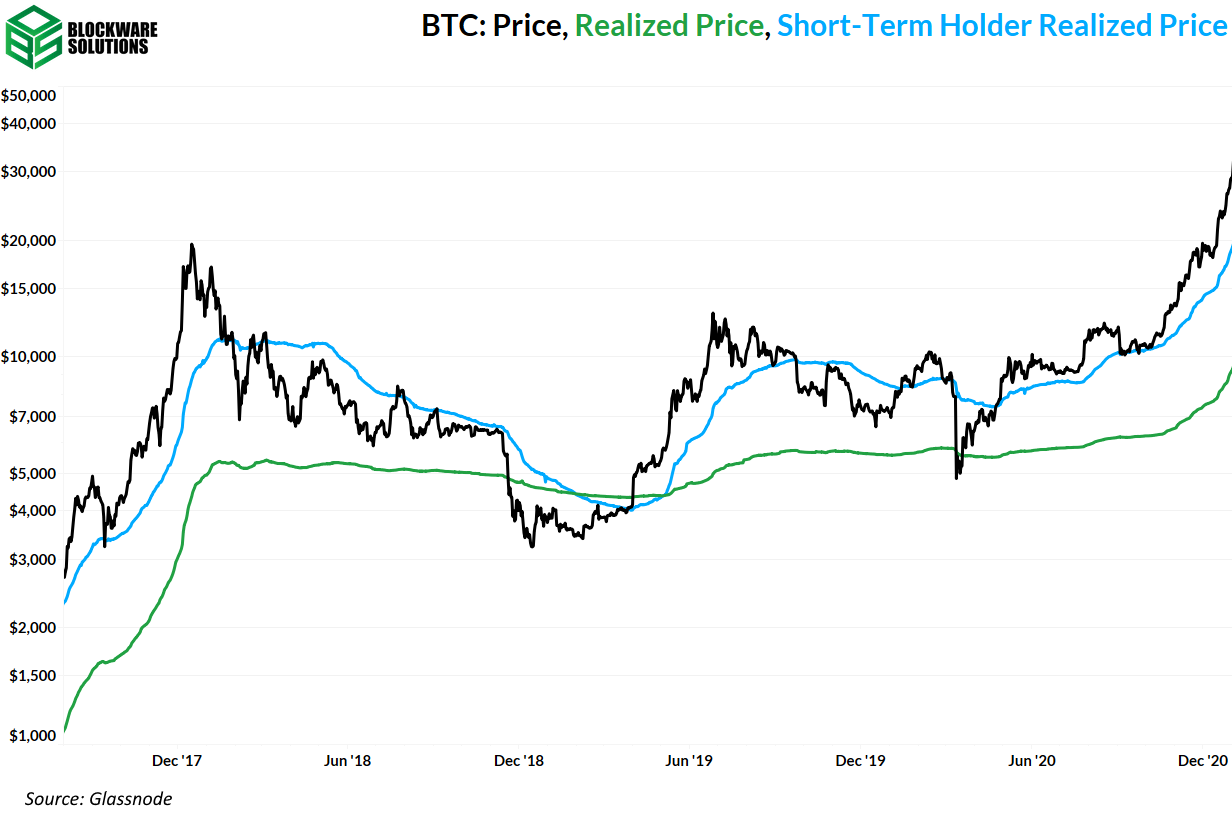

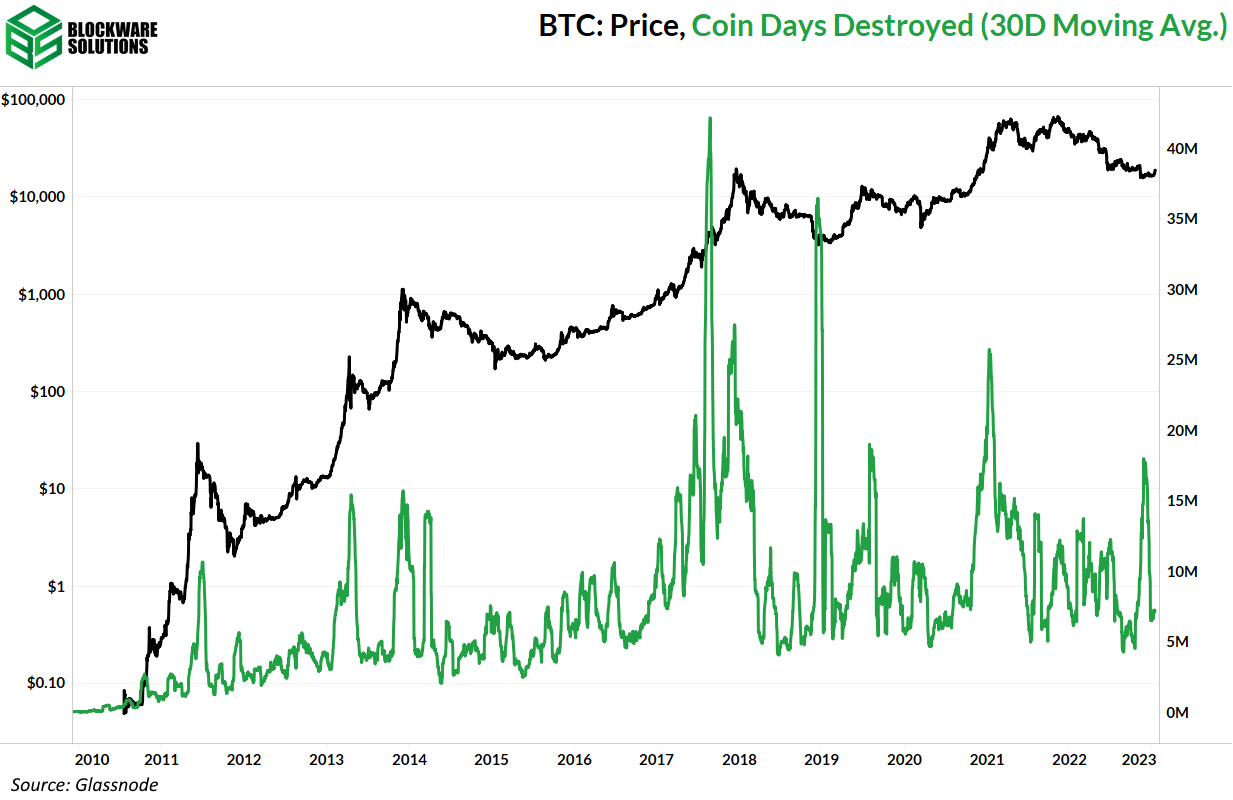

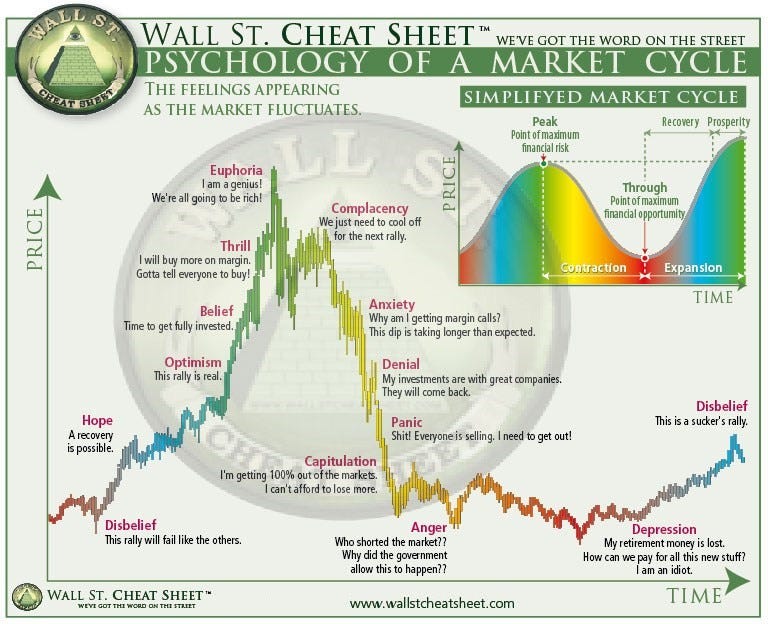

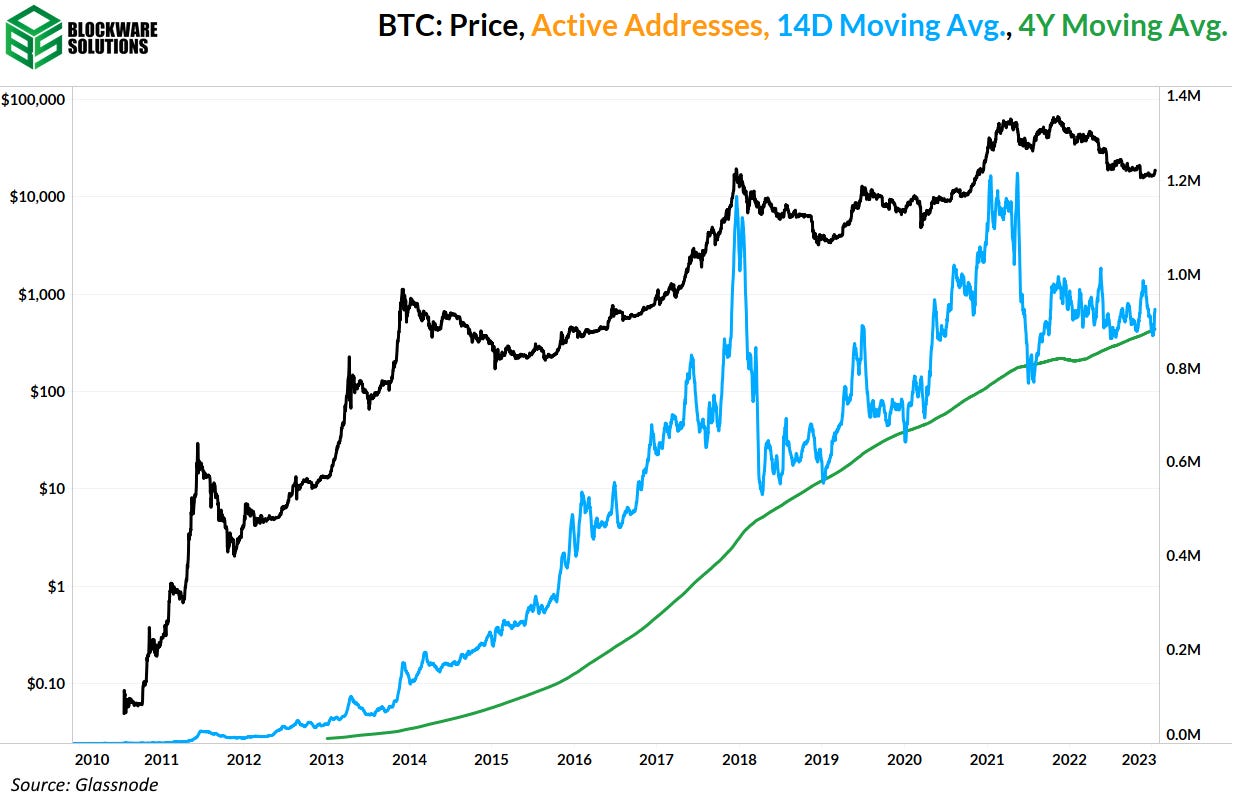

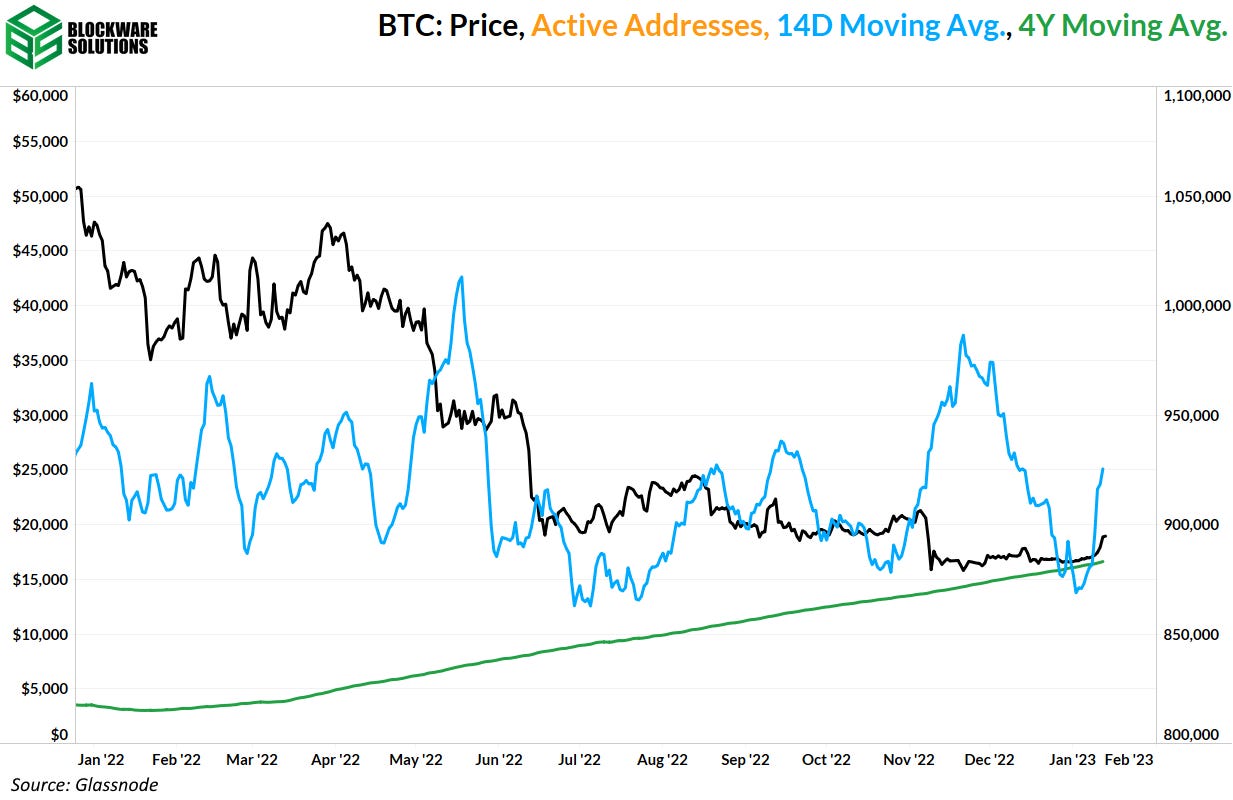

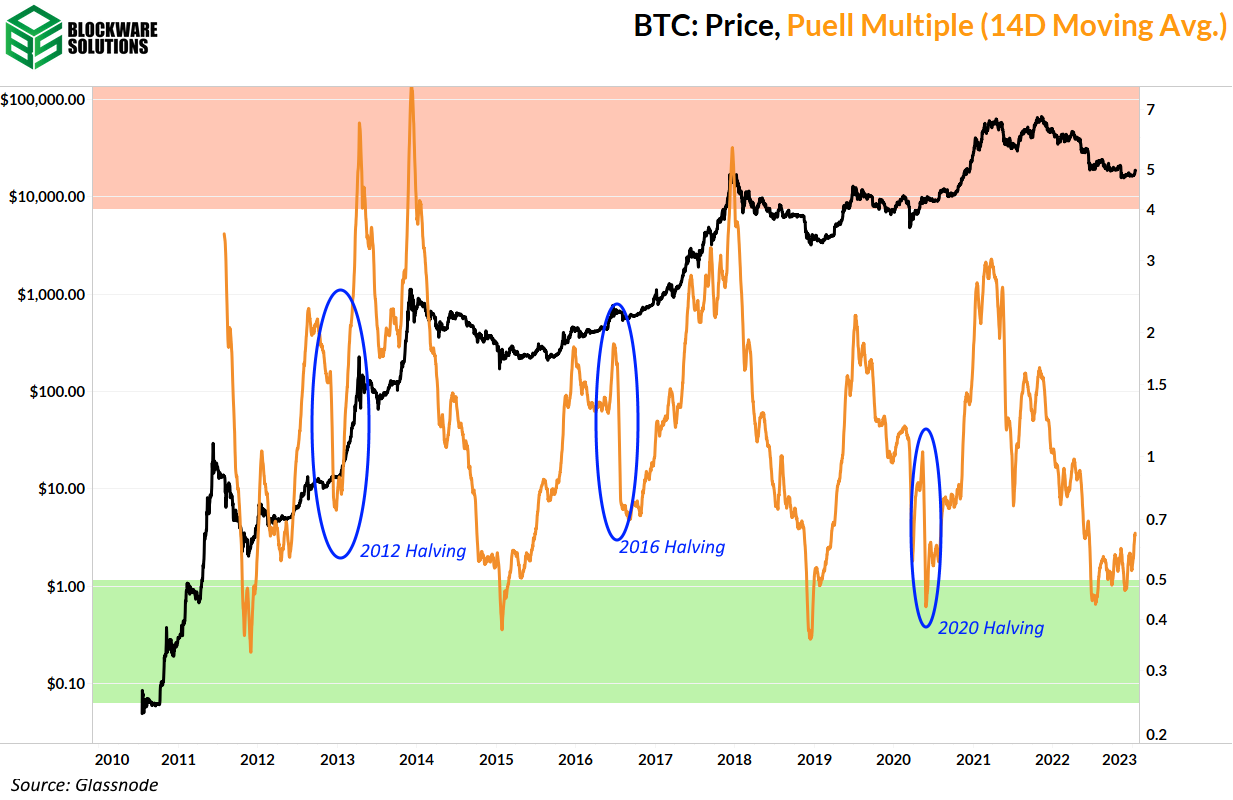

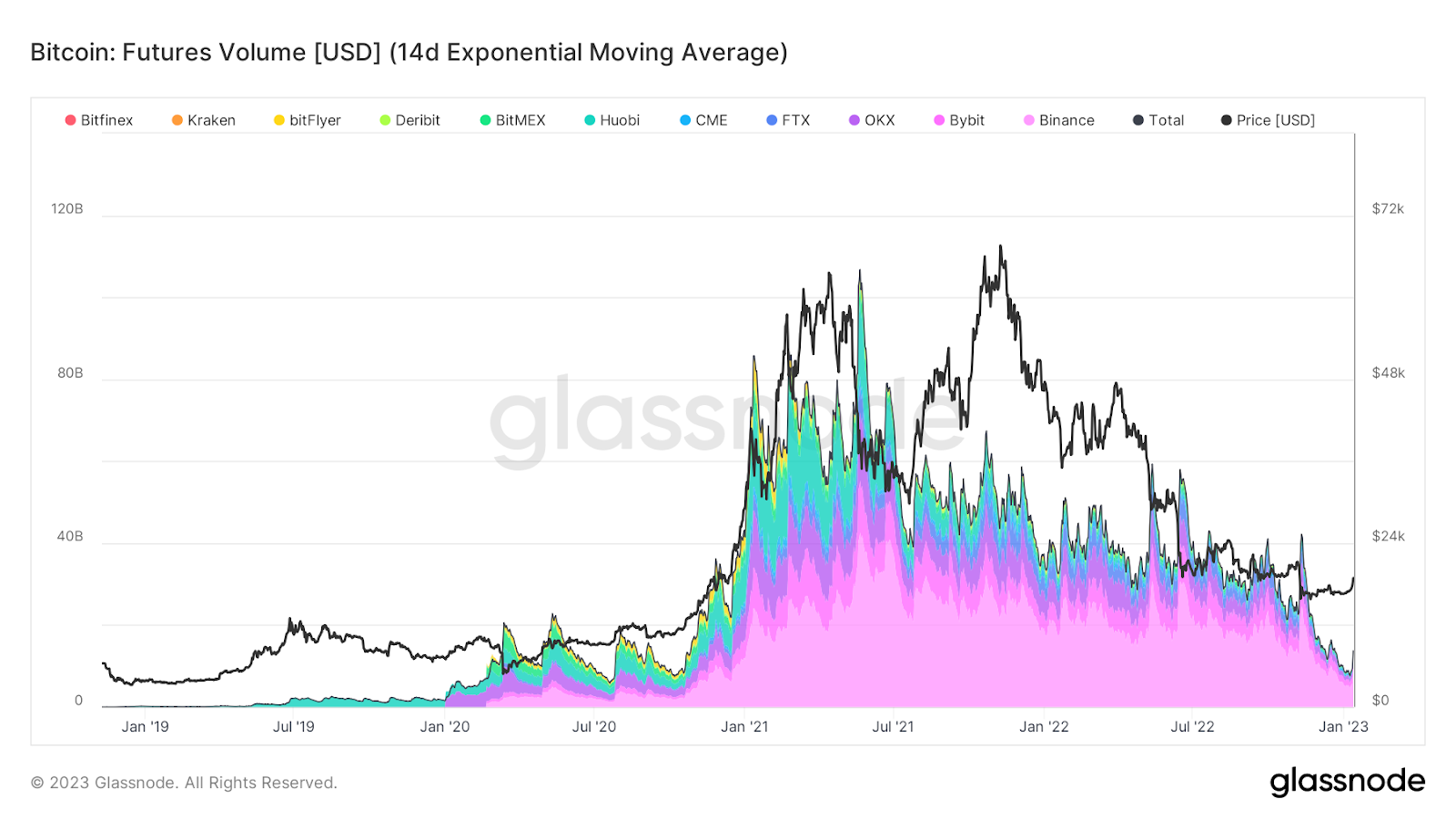

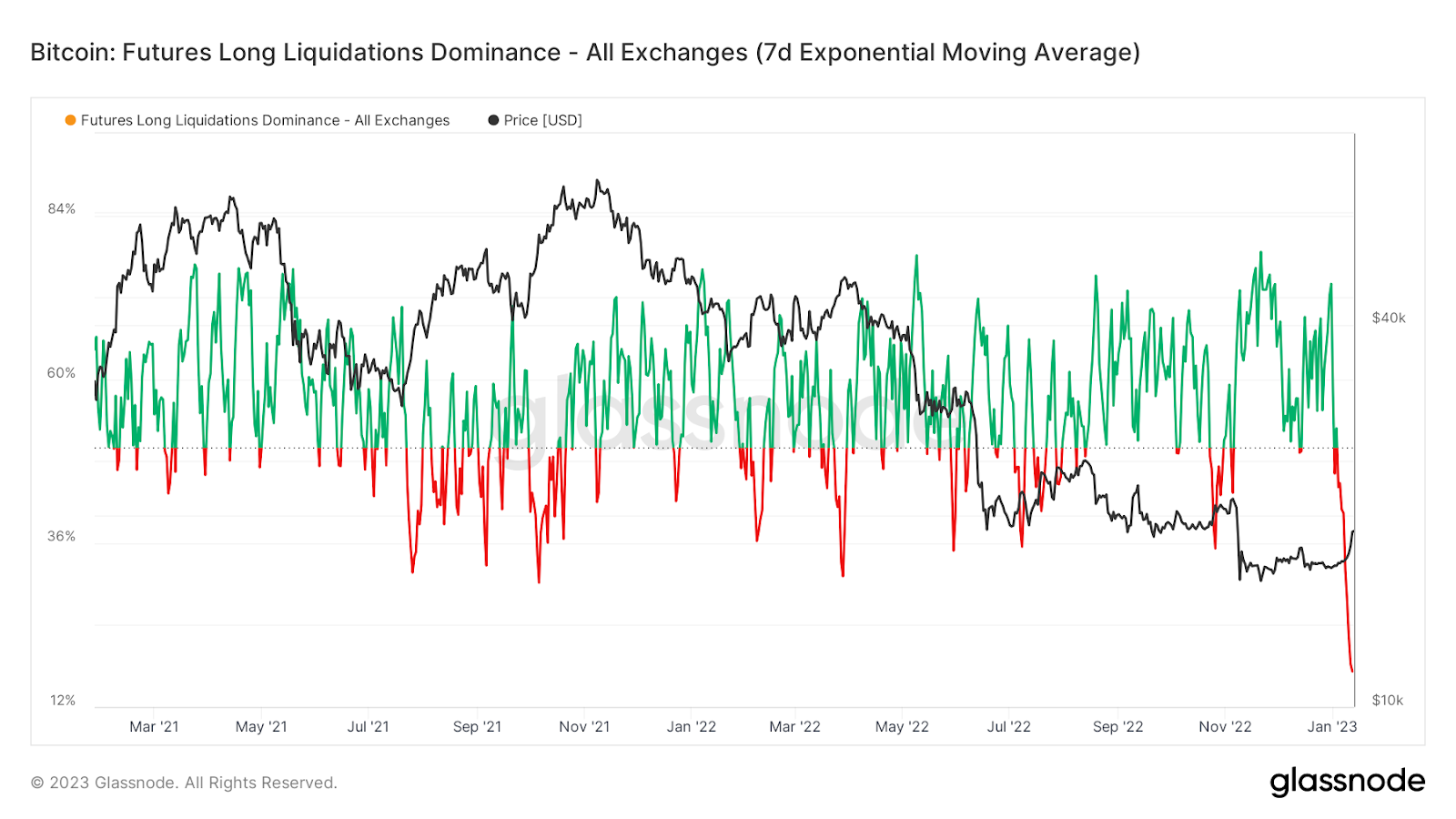

Bloomberg Podcast [screenshot and link] General Market Update After a sideways last couple weeks, we saw an explosion of volatility to the upside this week. At the surface, it would appear that this was front-loading the CPI announcement on Thursday morning. Remember, November headline CPI came in at 7.1% YoY and 0.1% MoM. December’s numbers, released before the open on Thursday, came in at 6.5% YoY and -0.1% MoM for headline, and 5.7% YoY and 0.3% MoM for core. All of December’s numbers were in line with expectations. With CPI inflation now declining from the previous month, it would appear that inflationary pressures are truly subsiding, for now. As we’ve mentioned in this newsletter around the last couple CPI and FOMC announcements, we’re beginning to see a narrative shift in the markets. To recap, the narrative throughout 2022 was that historically high inflation was being fought through tightening financial conditions. In recent months, the market is now moving away from the inflation narrative, and towards a narrative surrounding the recession that may be caused by those tightening conditions. This shift began in mid-June, with a short-term dip in the 10-year’s yield signaling that investors believed that inflation was near its peak. At the moment, they appeared to be right with CPI peaking in July at 9.1%. Yields then rallied, but fell again in October as investors began to see the finish line in sight for rate hikes. The continued rally in the bond market signals to us that investors are now seeking the recessionary protection of owning Government securities. Recent price action in other “recession proof” assets like gold and defensive equities (such as consumer staples) support this theory. Although the market clearly believes a recession is coming, whether we actually get one, or when we get one, is unknown to all. That all being said, CPI coming down shouldn’t be much of a surprise if you’re a consistent reader of this newsletter. In December 2021, the month-over-month change to headline CPI was 0.58%. Because December 2022’s MoM change was less than December 2021’s, the YoY change is declining. In historical recessions, we almost always tend to see at least a slight rise to month-over-month CPI. What makes 2022/23 unique is that we saw some of the most aggressive monthly rises to CPI in the last 50+ years, and now are seeing an extremely quick drop back into monthly declines. Remember that there is a big difference between MoM CPI declining, and actually crossing into negative territory. A decline in MoM growth just signals that inflation is growing at a slower rate, while negative MoM growth means that prices are declining. For example, in August 1973 CPI inflation rose by 1.8% to mark the entrance of the US into recession. MoM CPI inflation then gradually subsided over the 2-year recession, but never crossed into negative territory. However, we saw a similar inflationary environment when high energy prices drove MoM inflation to grow >1% in the 4th quarter of 2005. Although inflation began to subside in mid-2006 as a result of a raised FFR, the market interest rate was held stagnant into 2007. When the FFR was lowered in 2007, it led to another rise in inflation that contributed to the 2008 financial crisis. The theory that the FFR will be lowered in 2023 and lead to another spike in inflation is one that many subscribe to. While this clearly isn’t unprecedented, Fed rhetoric currently indicates that this risk is at the top of their minds. We saw in 2020, 2008, and 2001, that a disinflationary period (a period with MoM CPI <0%) was an indicator of an ongoing recession. Obviously, just because CPI declined from last month doesn’t mean the US is in a recession, as we saw negative MoM growth throughout much of the 21st century. One month of negative CPI growth doesn’t mean that we’re truly in a disinflationary environment, but over time, if CPI inflation is going to continue falling, we could see disinflation mark the beginning of a recessionary period in the US. Remember that if prices are falling, this means that demand is also falling. A decline in demand means less economic activity, and if deep enough, is classified as a recession. However, Fed analysts aren’t seeing declining demand affecting GDP in recent months. The current estimate from the Fed Bank of Atlanta is that GDP grew by 4.1% in Q4 2022. Growing GDP combined with a strong labor market makes it hard to argue that the US is currently in a recession. Just because headline CPI fell on a MoM basis does not mean that the Fed’s work is done. In fact, their work is still far from over. As previously mentioned, December’s CPI numbers were in-line with market expectations. That being said, the primary goal of the Fed hasn’t been to just get inflation to start coming down, it was to crush inflation by driving wages, employment, and credit issuance lower. At this point, we’ve begun to see debt levels fall from the housing sector, but consumer revolving credit levels remain high. Revolving Consumer Credit, 1M (FRED) Although consumer revolving credit has a fancy name, the vast majority of this debt is the credit card balances of everyday Americans. With one of the most common forms of debt still growing alongside high wages and employment, it may create incentive for the Fed to continue tightening longer than expected. Nasdaq Composite, 1D (Tradingview) Following the CPI announcement Thursday morning, we saw heightened volatility intraday that ended with the Nasdaq closing up only 0.64% on the session. We saw several days of strong performance stemming from last Friday’s 2.76% gain for the index. Much of this appeared to be the market pricing in a high probability of another period of subsiding CPI inflation. This likely triggered funds to close some of their short positions, and an influx of speculative long traders. Generally speaking, we saw a similar reaction in the Treasury market. Yields were lower across the board on Thursday, but in-line inflation numbers triggered even more buying for longer maturity Government bonds. US 3-Month/10-Year Treasury Yield Spread, 1D (FRED) The chart above shows the difference between the yields of the 3-month and 10-year Treasury. This spread closed at -1.23% on Thursday, its lowest reading in modern history. There are a few ways of looking at this; first, it shows that investors are continuing to prepare for recessionary conditions as inflation falls. Second, it shows that investors are expecting lower rates in the future. For now, it appears that the bond market was right about peak CPI over the summer. Now are they right again about an incoming recession? Crypto-Exposed Equities With the very strong price action from Bitcoin this week, it is no surprise that crypto-exposed equities have seen an even stronger week. Keep in mind that these companies are essentially riskier avenues for investing in the price of Bitcoin. As a sector that was among the hardest hit in 2022, a reflux of capital into highly illiquid and shorted names will always create large jumps in price. A good example of this week’s short squeeze is Marathon Digital (MARA). As of late December, MARA was among the highest shorted stocks in the market, with over 42% of its float sold short. As of yesterday, that number has dropped into the 30’s, and its share price has nearly doubled. MARA is the highest market cap public Bitcoin miner, and institutions have been unable to hide the shift in sentiment in this name this week. Price is up nearly 72% this week, but this pales in comparison to some lower cap names like GREE (171%), BKKT (109%), BITF (86%), and BTCS (84%). The average crypto-exposed equity is up nearly 26% this week. Investors should be mindful of the volatility and note that these stocks have a LONG way to go to recovery, and that’s assuming that price has bottomed (which is very highly debatable). If prices are going to continue higher here for the long-term, there will be countless areas for safer entries. As always, you can look above to see the weekly price performance of several crypto-equities in comparison to BTC and Valkyrie’s mining ETF. Bitcoin Technical Analysis After going sideways through much of December, we’ve seen the strongest price action of this bear cycle from Bitcoin this week. At the time of writing, BTC is up nearly 13% on the week and nearing its 200-day SMA at $19,500. Bitcoin/US Dollar, 1D (Tradingview) This week we’ve seen 3 green candles in a row that are all supported by volume that’s greater than its 50-day average. Bitcoin hasn’t seen this since September. Now does this mean that Bitcoin has bottomed? At this point it’s anyone’s guess, but we should look at it in the macro context. If you believe that the Fed is going to leave rates stagnant throughout 2023 before pivoting in 2023 or 2024, then you would have a strong argument that BTC has likely bottomed. If your thesis is that rates will be forced to go much higher, you’d likely use this rally as exit liquidity. No matter your thesis, it certainly felt good to see BTC showing outsized strength against the equity indexes. Above you can see Volume Weighted Average Price anchored off the 6/18 lows. As you can see, this spot ($19,350) has become some resistance this morning. This level also roughly coincides with its 200-day SMA at $19,500. This is the area that we likely see BTC run into strong sellers. If BTC is unable to hold around $19.35-19.50k, keep an eye on $18.4-18.5k as the next possible support area. Bitcoin Onchain and Derivatives After months of bearish action, Bitcoin is finally showing life after breaking the first level of on-chain resistance: Short-Term Holder Realized Price (the aggregate cost-basis of BTC belonging to short-term holders.) If this rally can hold then it is a good sign that the bottom *might* be in. Further confirmation will occur if/when price can surpass Realized Price (the aggregate cost-basis of all BTC.) Zooming in to look at the cost basis metrics from past bear markets shows that the 2015 bear market did have a bit of a ‘fake out’ where price broke STH RP temporarily before dropping down again. This is why it’s not yet safe to say the bottom is in, but a sustained breakthrough of RP would be a point at which we could confidently call a bottom. Here’s a snapshot from the 2018 bear market that shows the type of behavior we are hoping to see. Price flipping STH RP from resistance to support followed by RP being flipped from shortly thereafter . Coin days destroyed (CDD) measures the movement of coins on-chain multiplied by the number of days since those coins were last moved. It’s essentially a metric of volume with extra weight given to older coins. The huge spike in the 30D moving average of CDD aligned with the price drop to $16k in November is a signal of major capitulation. A similar spike was seen at the bottom of the 2018 bear market. It’s easy to forget that markets are made up of humans and thus have a seemingly irrational and psychological element to them. It would make sense that the bottom of the bear market would have the worst sentiment and mass capitulation. Comparing the 14-day moving average of active addresses with the 4-year moving average can help us gauge the level of on-chain activity. Active addresses is defined as the number of unique addresses involved in either sending or receiving BTC on any given day. During bull markets it goes parabolic, denoted by the 14DMA extending far beyond the 4Y, as many people are using the Bitcoin network. Activity is lowest during bear markets or local bottoms; you can see this at points when the 14DMA and 4Y intersect. Such an intersection occurred recently. However, zooming in we’ve seen the 14DMA rebound nicely this week; positive momentum in active addresses is a sign of increasing network activity that could pull us out of the bear market. Puell multiple is a measurement of the daily value of the BTC block subsidy in USD terms relative to the 365-day moving average of the daily value of the BTC block subsidy in USD terms. We can derive two important pieces of information from this chart. First, we can see when Bitcoin is at an extreme discount relative to its price action of the past year. This has certainly been the case over the past few months and this metric will continue to trend upwards with flat or positive price action. The second piece of information is in regards to the halving. Because this is a measure of the USD value of the block subsidy, and not just the USD value of all Bitcoin, you can see the sharp drop offs when the halvings occurred. The signal here comes when you notice just how fast the Puell multiple returns to its pre-halving level. Because the quantity of BTC issued in the subsidy literally gets cut in half, the only way for this metric to recoup so quickly is for the price of BTC to rapidly increase. There is plenty of debate surrounding whether or not the halvings will continue to have as strong of an effect/correlation with the cyclical nature of Bitcoin’s price. As of now, the status quo is massive bull runs in the months following the halving. The next halving is estimated for March 2024. That’s not too far away at all. Moving on to derivatives, the total futures volume across all exchanges hit its lowest level since October 2020. This continual decline in volume is further evidence that most traders from the past bull market have left. When so little volume exists in the futures market it’s safe to say that the prevailing sentiment is fear and uncertainty. Note that the last time total futures volume was this low the price of Bitcoin was significantly lower; around $11,000 at the time. The price being 50% higher now, but the futures volume is at the same level, is really indicative of the market’s uncertainty. Long liquidations dominance measures the percentage of long liquidations vs short liquidations. Less than 50% indicates more short liquidations. We’ve seen the most amount of short liquidations relative to long liquidations since this dataset first appeared two years ago. Bitcoin Mining

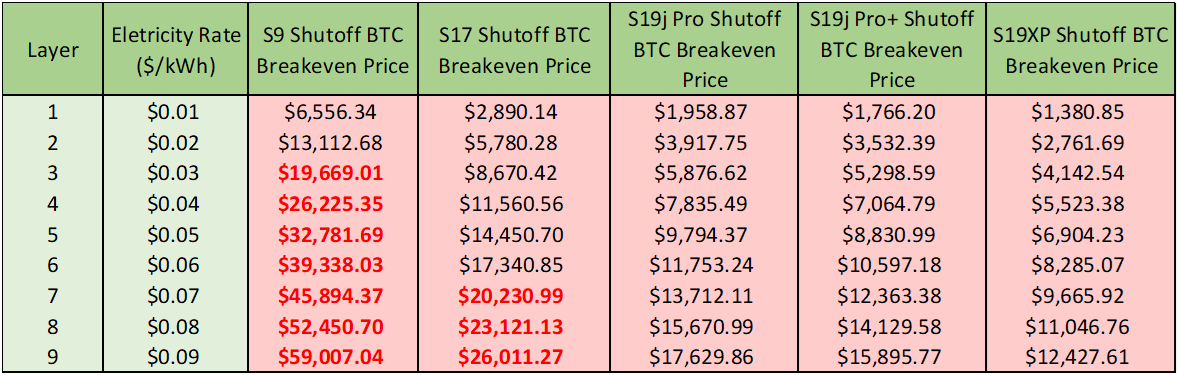

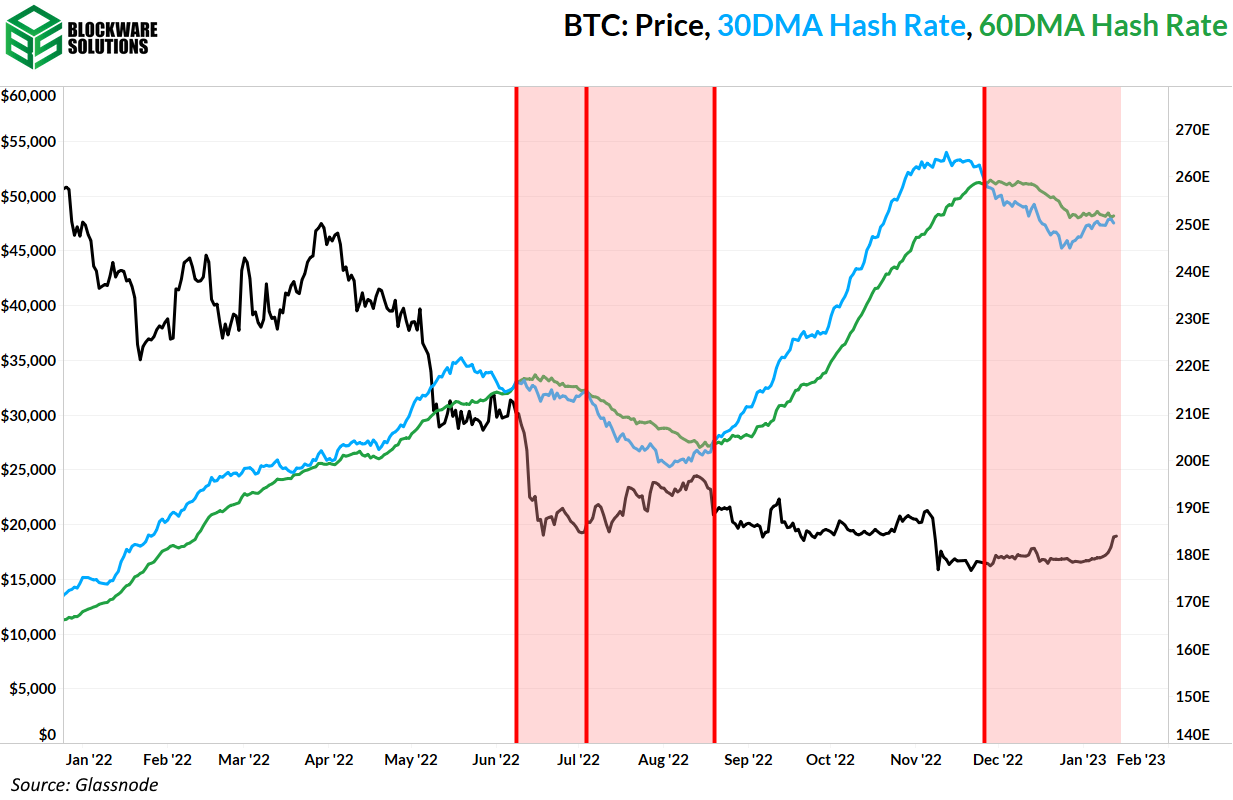

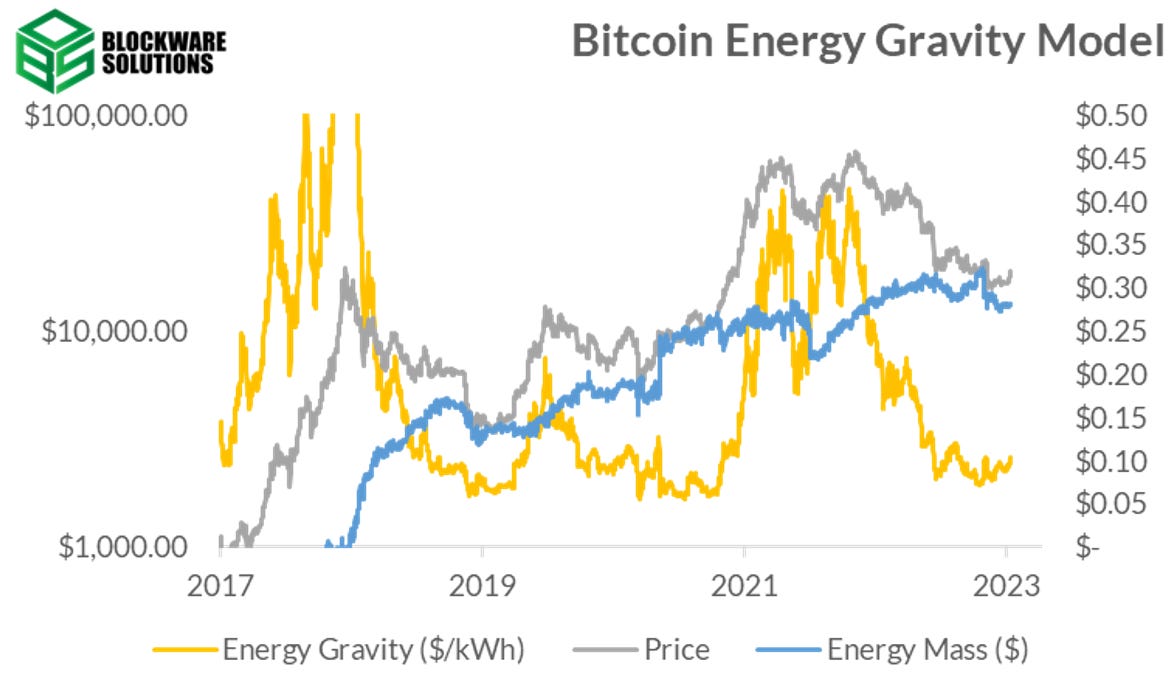

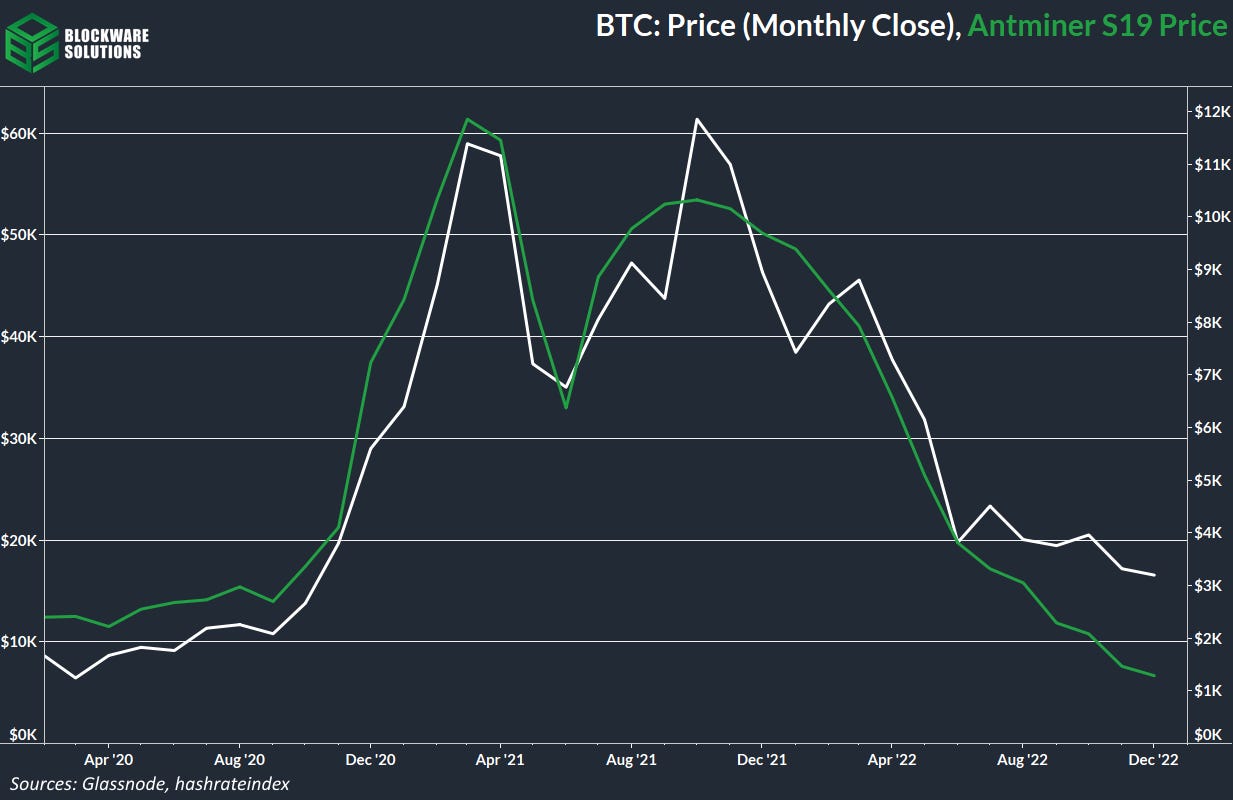

Blockware Solutions is now offering the brand new S19j Pro+ at a price below what you would pay if directly ordering from Bitmain. Because of this unique offer, let’s visualize where this new machine sits in comparison to other Bitmain mining rigs. Miner Capitulation on the cusp of ending As of January 12th at 8 PM EST, the most recent miner capitulation which started back in November 2022 has almost ended. Historically, the end of a miner capitulation marks the potential start of a new bull run. If the macro environment can ease, it seems likely that Bitcoin sits in an attractive position for both new buyers and new miners . Energy Gravity The following chart is based on a previous Blockware Intelligence Report that models the relationship between the price of Bitcoin and its cost of production. The model makes it easy to visualize when the price of Bitcoin is overheated or in the process of bottoming. It continues to reveal Bitcoin is likely in the process of bottoming. S19 and BTC price decoupling Below is the historical market price of an S19 95T (34.2 W/TH) machine according to the Hashrate Index. Over-leveraged miners are actively getting liquidated forcing their creditors to take possession and sometimes sell thousands of used rigs on the secondary market. Given a sustained rebound in the price of BTC, it would be reasonable to expect these machines to maintain a tight beta with spot BTC. All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Read Blockware Intelligence Newsletter in the app

Listen to posts, join subscriber chats, and never miss an update from Blockware Intelligence.

© 2023 William Clemente III |