Blockware Intelligence Newsletter: Week 86

Blockware Intelligence Newsletter: Week 86Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 4/29/23-5/5/23

Blockware Intelligence Sponsors

Blockware Intelligence Podcast On this week’s episode of the BWI podcast, Robert Breedlove joined us to discuss his journey down the Bitcoin rabbit hole, the future of Bitcoin, consequences of a broken monetary system, and more! Check in at 2pm EST for the live premier!

Congratulations to Blockware’s own Blake Davis @BlakeDavis50! We would like to issue a congratulations to our Macro Analyst Blake Davis as he is graduating this weekend from Indiana University with his Bachelor Degree in Finance! As such, there is no Macro section this week. Stay tuned for next week as Blake will be back to discuss all things Macro. We look forward to Blake joining Blockware full time as an Account Executive, as well as continuing to publish Macro and Bitcoin equities research for Blockware Intelligence. Summary:

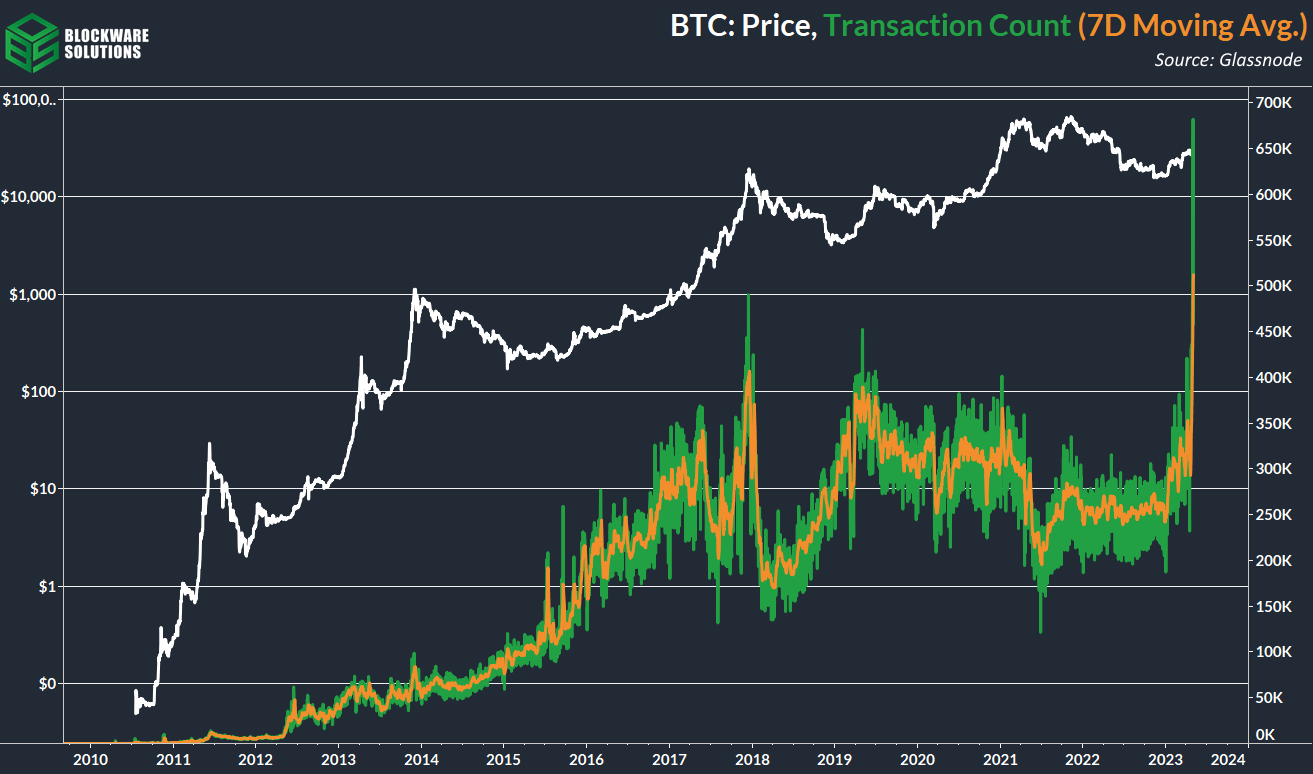

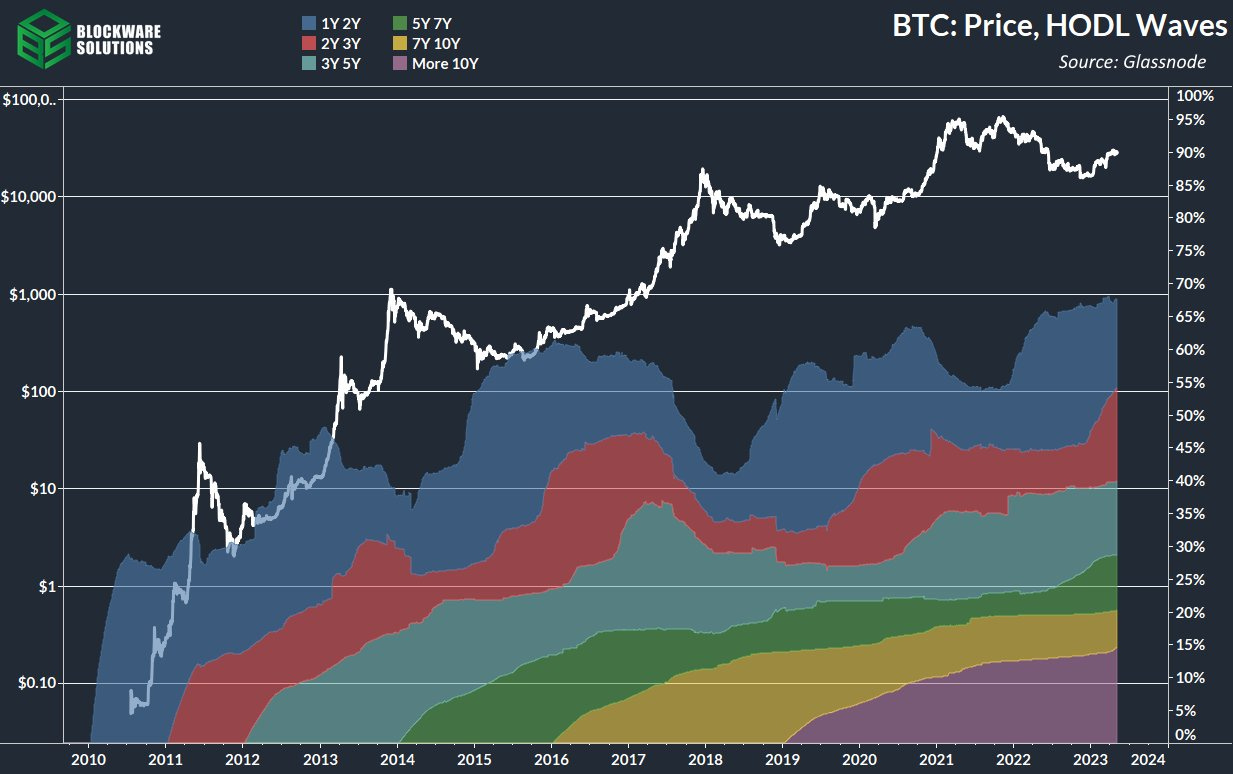

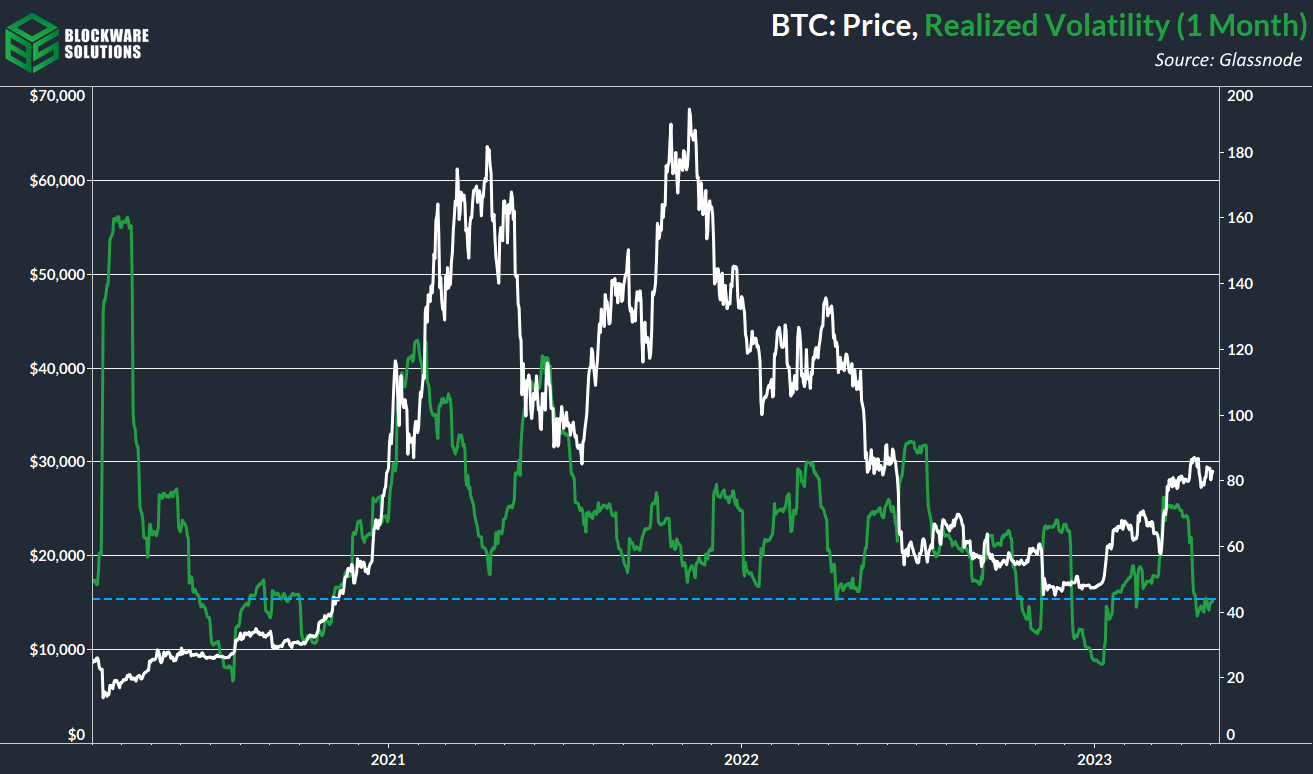

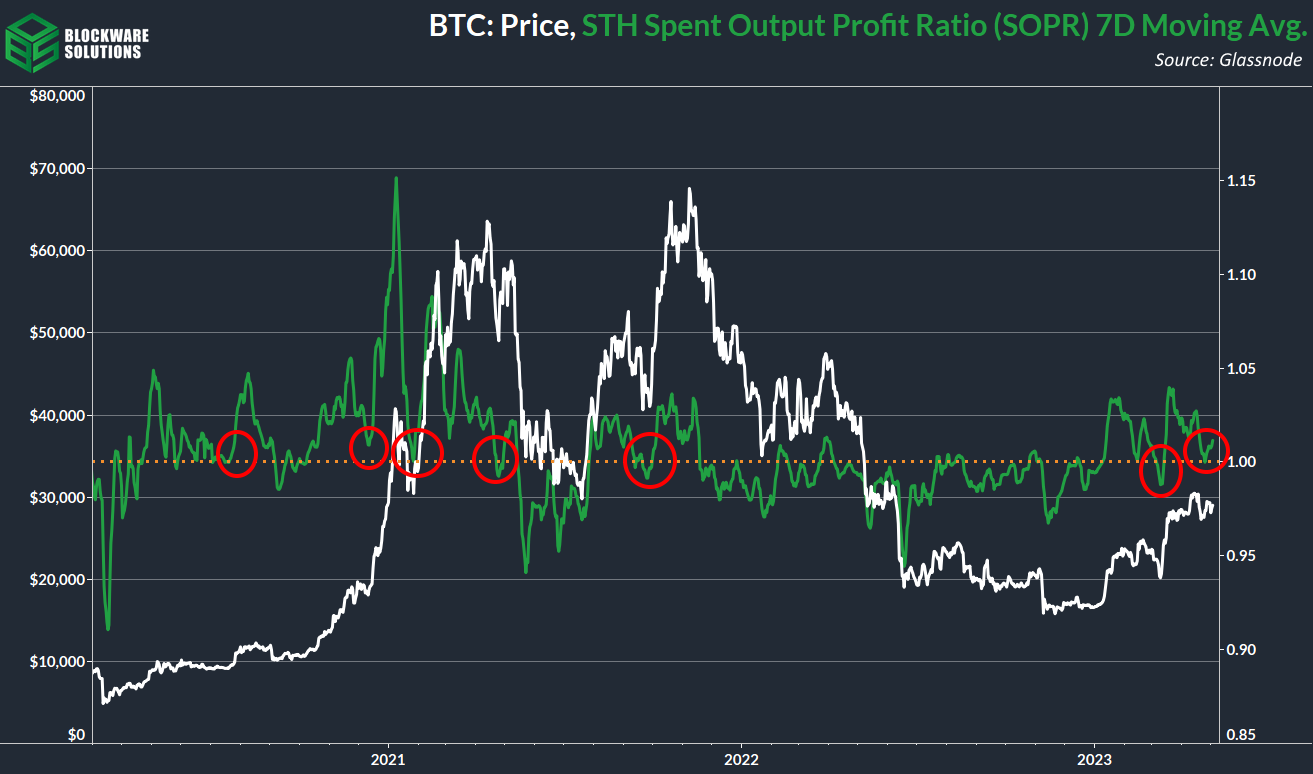

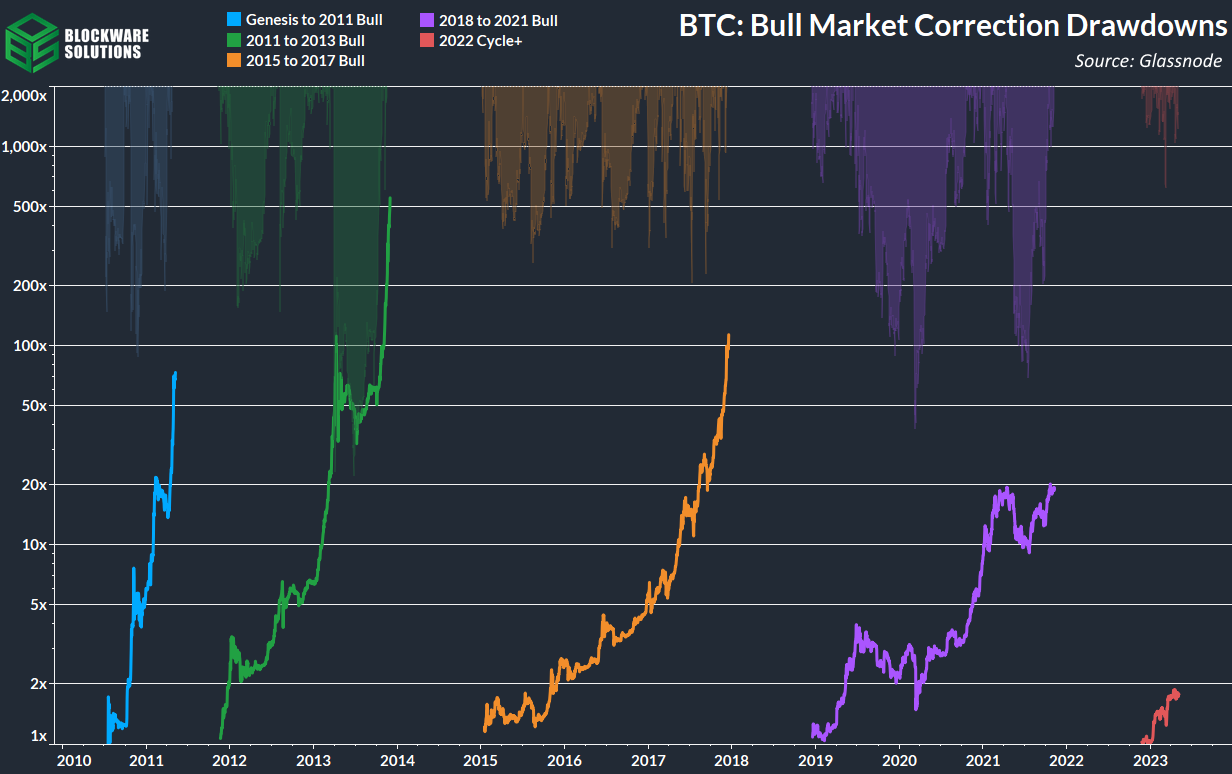

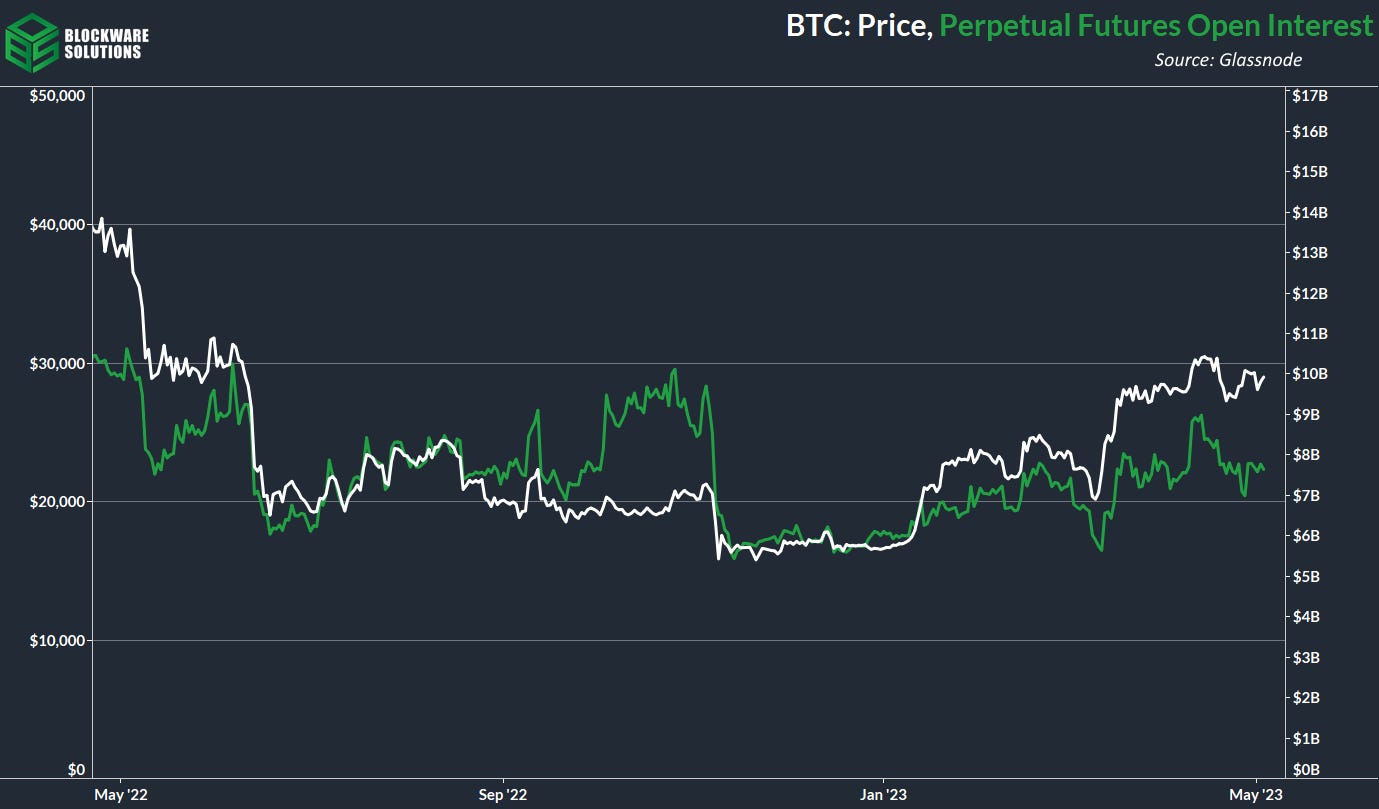

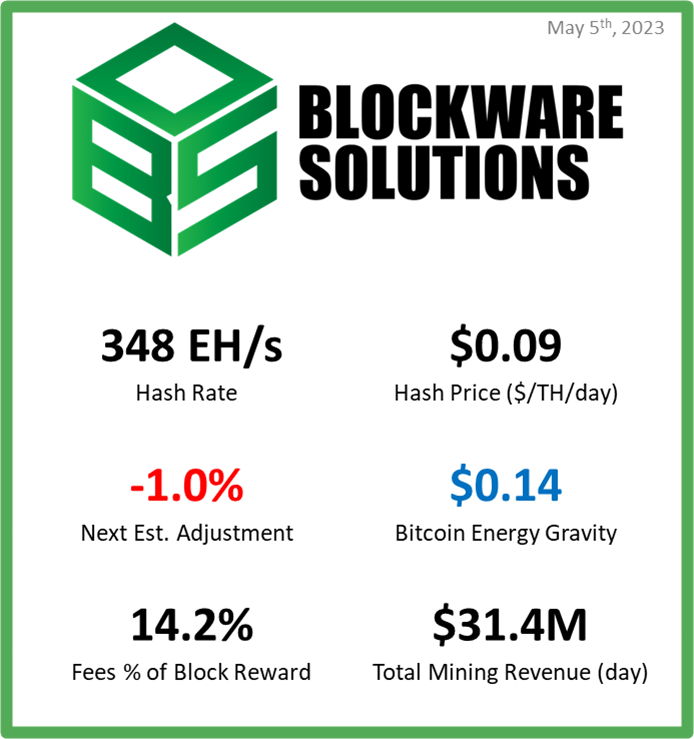

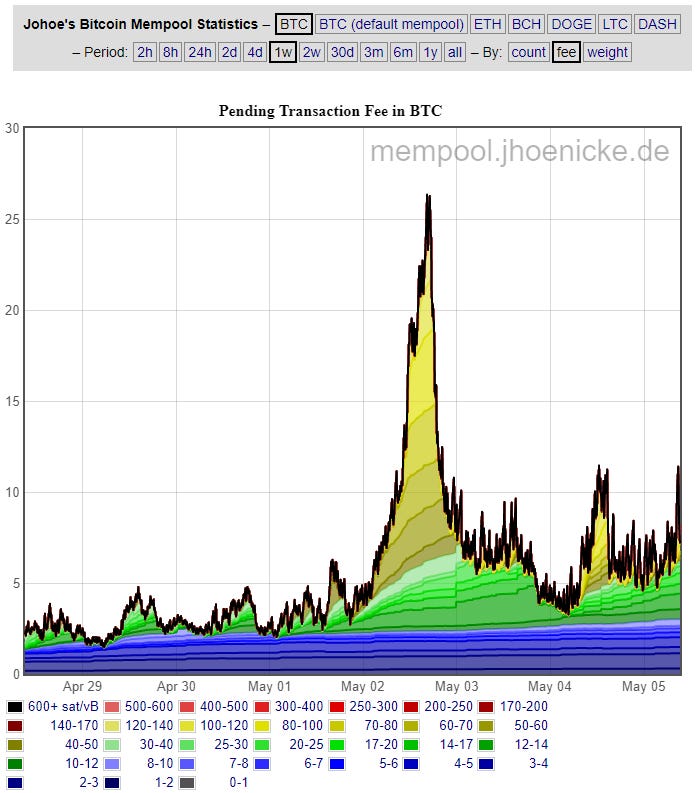

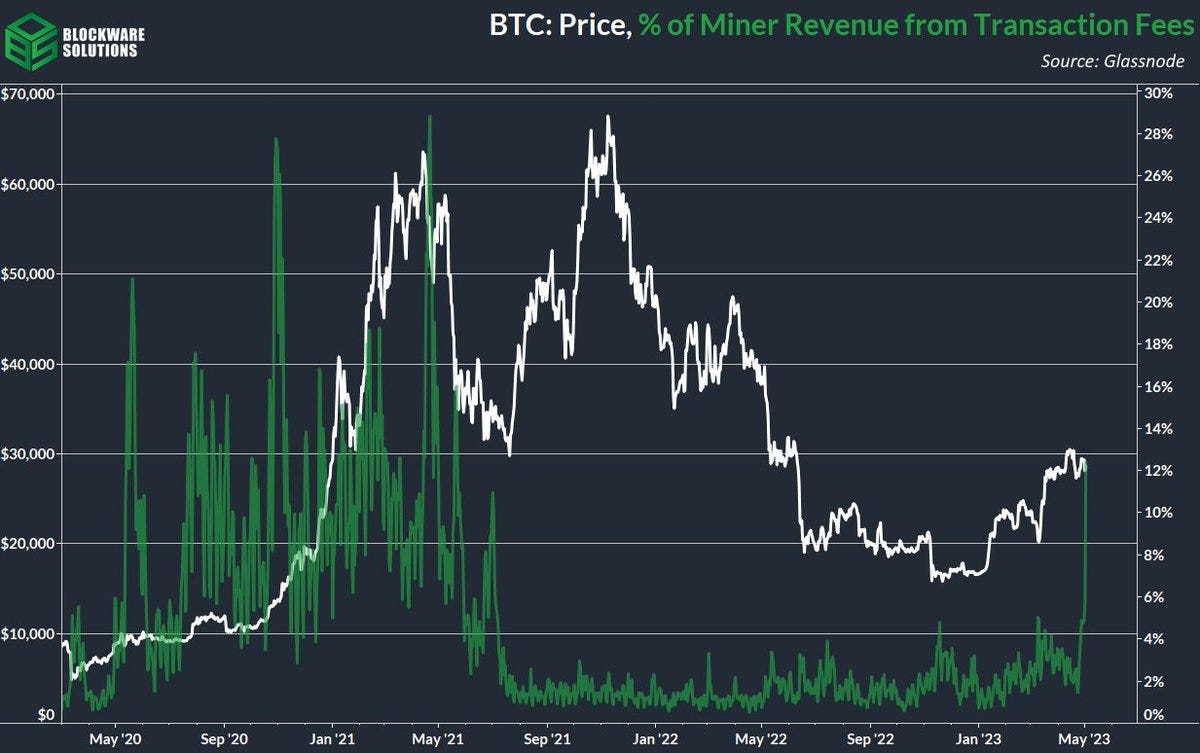

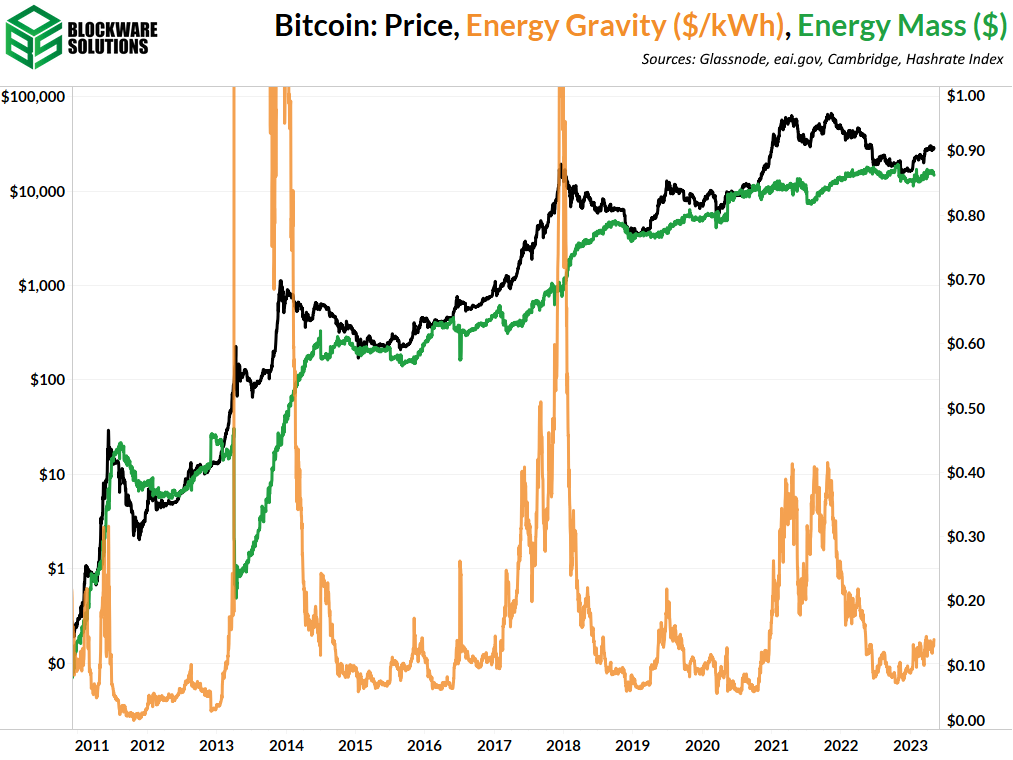

Bitcoin On-chain and Derivatives The highlight this week was a new all-time high in on-chain Bitcoin transactions, with demand for on-chain settlement soaring past the highs of both the 2017 and 2021 bull markets. A prominent feature of the “recovery phase”, in which Bitcoin shifts from a bear market to a bull market, is a surge in on-chain transactions. As demand for Bitcoin the network increases, so does demand for BTC the asset. We’ve yet to see a supply side reaction to the increase in demand. ~67.5% of the Bitcoin supply has not moved in at least one year. While growth in this metric has slowed down, we have yet to see it pause or roll over. We will keep tabs on the HODL waves as we approach the 1-year mark since the contagion fueled the drop to $20,000 in June of 2022. It will be interesting to see what percentage of the supply was accumulated in the wake of that event and HODL’ed since. 1 month realized volatility is at its lowest level since February; prior to the onset of the banking crisis. Low realized volatility across shorter time frames tends to signal that we are due for some action. Given there’s been no significant change in the broader landscape on-chain (supply remains tight, demand is increasing, and leverage ratios continue to decline), it is likely that the next period of volatility will be another leg up. During bull markets, short-term holder SOPR (spent output profit ratio) often finds support at a level of 1, which coincides with local bottoms. A SOPR of 1 means that coins moving on-chain are doing so at the same price at which they were acquired. Short-term holder SOPR only includes coins last moved within 155 days, which, given that price is set at the margin, clues us in as to what is likely to happen in the short-term. Regardless of short-term signals, BTC is an asset with tremendous long-term upside. Attempting to trade short-term volatility will likely result in fewer net-accumulated BTC than were you to buy and hold, or mine BTC. Furthermore, this newly added glassnode chart illustrates BTC’s downside volatility that occurs even in bull markets. While all on-chain indicators signal that the price of BTC most likely bottomed in November of 2022, that does not mean we are done with price corrections. It is not unprecedented to see drawdowns as high as 50% during the middle of a bull market. BTC’s year-to-date correlation coefficient with $SPX is now at 0.16. The year began with heavy correlation, even during the rally off of the lows and up to $20k. However, since the fractional reserve banking system began crumbling earlier this year, BTC has started separating itself from risk-assets, at least in the short-term. On the derivatives side, this week was fairly tame. Perpetual futures open interest (both nominal and market cap adjusted) has moved sideways. Open interest remains down from it’s April highs in which leverage traders piled in as BTC railled past $30,000. Bitcoin Mining Fees Are Back! Bitcoin transaction fees have reached levels not seen since early 2021. This week, Bitcoin users have been paying more than 100 sat/vbyte to ensure their transactions are included in the next block. For a simple Bitcoin transaction, this equates to around $5 today. The responsibility of including Bitcoin transactions in a block lies with Bitcoin miners, as long as the transactions abide by the rules set by Bitcoin nodes, and the block size is below the limit imposed by nodes. Miners typically prioritize the highest paying transactions to maximize their profits. Looking back over a longer time period, transaction fees were relatively low from mid-2021 to May 2023. This was a challenging period for miners as fees were small, the price of BTC was mostly decreasing, and mining difficulty continued to rise. Intel Exits the Bitcoin ASIC Market Intel’s foray into Bitcoin mining hardware occurred in 2022. Unfortunately, their entrance into the market was poorly timed, as Bitcoin was in the midst of a crash, causing demand for the specialized ASIC hardware to plummet. Intel’s entry into the Bitcoin ASIC market was an attempt to capture a share of this cyclical specialized market. However, as Bitcoin’s value dropped, demand for mining equipment also decreased, leaving Intel with a limited customer base. Intel’s chips were also still less efficient than Bitmain, the leading manufacturer of Bitcoin ASICs. Energy Gravity The presented chart, which is based on a Blockware Intelligence Report, depicts the correlation between Bitcoin’s production cost and its market price. The model facilitates the identification of overbought or oversold market conditions for Bitcoin, making it a valuable tool for visualizing price trends. All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Blockware Intelligence Newsletter is free today. But if you enjoyed this post, you can tell Blockware Intelligence Newsletter that their writing is valuable by pledging a future subscription. You won’t be charged unless they enable payments.

© 2023 Blockware Solutions |