Citadel Wants Crypto Regardless Of What Happens In The Market

Today’s letter is brought to you by Osprey Funds!The Osprey BNB Chain Trust (OBNB) is the first U.S. tradable ticker for BNB and provides secure exposure to BNB right from your brokerage account—no custodial wallets or private keys required. Due to its unavailability on centralized exchanges in the U.S., OBNB offers one of the only paths for U.S. investors to access BNB exposure via USD. To investors, Bloomberg published an article yesterday titled “Citadel Securities Plots Jump Into Crypto Trading After Trump’s Embrace.” The piece explains:

This is a perfect example of the impact a pro-innovation, pro-technology regulatory environment can have. Major players like Citadel were sitting on the sidelines waiting to participate in the best performing financial asset markets because they felt the rules were unclear. Think of how insane that is — Citadel Securities, one of the best capitalized investment firms in the world, could not figure out how to participate in crypto markets without regulators coming after them. Thankfully, the industry now has a tailwind and every market participant is trying to figure out what their crypto strategy will be. You can expect market-making firms like Citadel Securities to drive substantial revenue without having to take significant directional bets on the market. That could be a good decision at a time where the macro economy is in a weird spot. Mets owner and famed investor Steve Cohen recently said he believes economic growth is going to slow from 2.5% to as low as 1.5% — that would be a very big deal. Here were Cohen’s negative comments on the economy: These comments are important because Steve Cohen is one of the smartest investors in the world. He intimately understands financial markets and is well-versed in the complex economic machine. What Cohen is essentially arguing is that government waste propped up financial markets, so removing that waste will be a headwind for economic growth. I don’t disagree with him. Add in the tariffs and you have an even slower growing economy in the short term. So what should the Federal Reserve do? How about the Trump administration? The answer may be right in front of our face. Another article in Bloomberg titled “The Bond Market Isn’t Fully Buying What Musk’s DOGE Is Selling” lays out what Trump, Secretary Bessent, and Elon Musk are currently thinking:

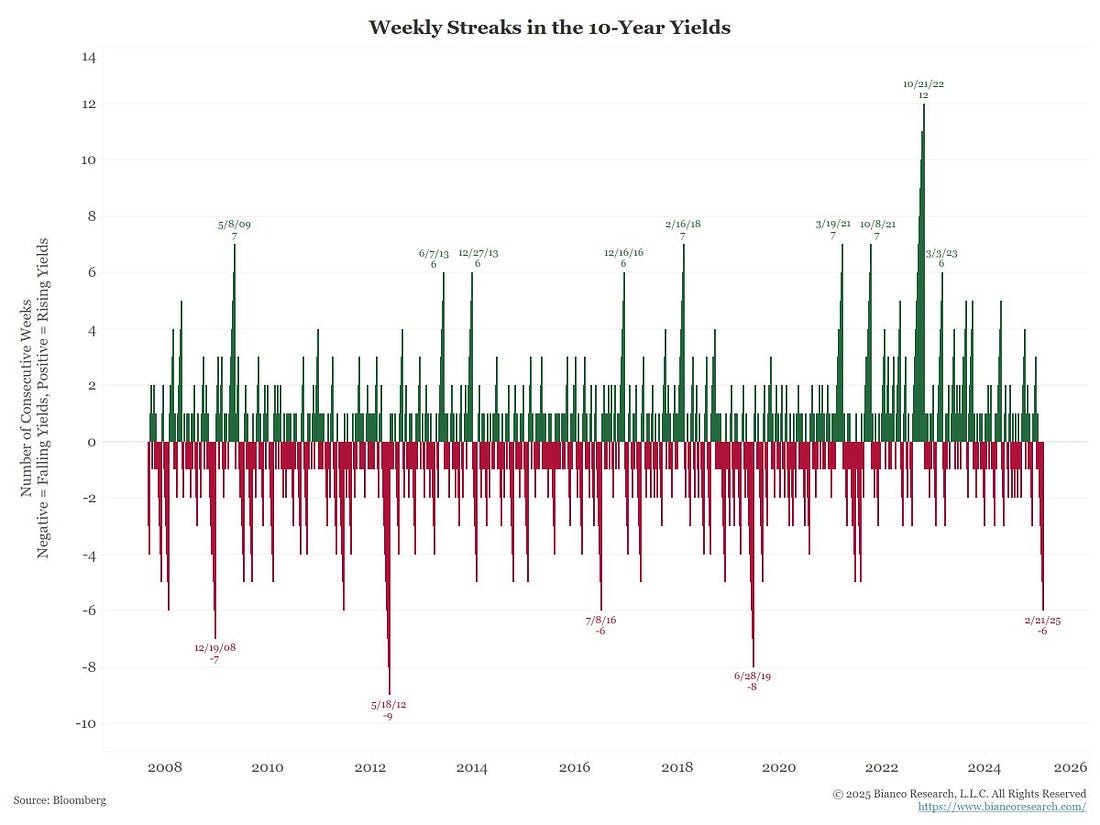

So to recap — Steve Cohen is sounding the alarm on a slowing economic environment and the current administration is doing everything they can to get the 10-year bond yield down, so they can ignite economic growth. This is a battle as old as time. A negative market force vs an aspirational market intervention. The winner will take trillions of dollars with them in their direction of travel. So far, Jim Bianco points out “the 10-year yield is down six consecutive weeks, every week since the inauguration. The longest such streak in 5.5 years.” That may give you a sense of who will end up winning this game. But while the bulls and bears are fighting it out, Ken Griffin and Citadel will be taking home their profits by market-making through all the volatility. The big boys are entering the crypto market now that regulators have given them the green light. There will be pros and cons to this institutional participation, including less volatility over time, but you need institutional adoption if you want true mass adoption. Just be careful what you wish for. When Wall Street is making billions, that money has to be coming from someone else’s pocket. Make sure the pocket isn’t yours. Hope everyone has a great day. I’ll talk to you tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management My Appearance On CNBC’s Squawk Box YesterdayAnthony Pompliano joins Squawk Box to talk bitcoin, regulation, current macro environment, memecoins, and where bitcoin could be headed next. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |