Crypto Incumbents Are Making Billions — Now Wall Street Wants Some Of It

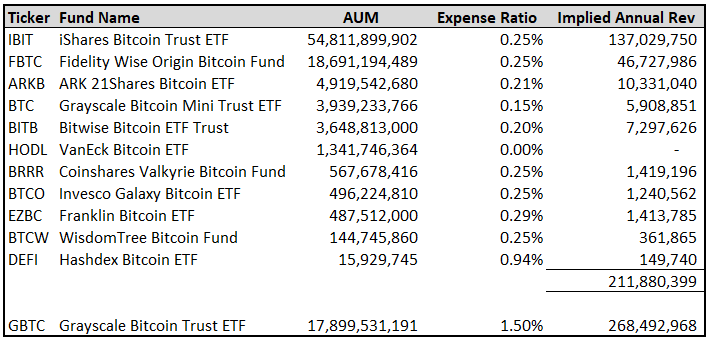

To investors, Many people are drawn to the bitcoin and crypto industry because they want to make money. No one likes to talk about this fact, but that doesn’t mean it is not true. You shouldn’t be surprised though. This is how economic incentives in markets work — people and capital flow to the area where they think a return can be captured. I started thinking about this when I was reading Pirate Wires’ new profile on Tether, the world’s leading stablecoin issuer. The company made $14 billion in profit last year with only 150 employees. Dubbed the “most profitable business per employee in the world,” Tether is creating $93 million in profit for every person that works at the organization. No wonder there are so many stablecoins being created today. They are all chasing one of the best businesses ever built. It will be hard to unseat the leader, partially because of the first-mover advantage, especially when they continue to execute at the highest level. It is not easy to build software, handle regulations, implement physical infrastructure in developing nations, and integrate payment software into every possible corner of the financial system. But there is 14 billion reasons why someone would want to try it. Stablecoins are not the only place where we see this competition underway. ETFStore’s Nate Geraci highlighted that “nearly 16 months after spot bitcoin ETFs launched, GBTC [is] still making more money than all of the other ETFs combined…and it’s not even close.” Think about that for a second — the largest financial firms in the world are spending immense time, energy, and resources to gain as much market share as they possibly can, yet the incumbent (GBTC) continues to pull in more revenue than all of the challengers combined. Sure, ETF assets are sticky. But GBTC has an expense ratio that is 6x higher than their largest competitors. It doesn’t seem to matter. Grayscale continues to print cash while everyone else scrambles to catch them. You are going to see a similar dynamic from banks and stock exchanges in the traditional system. They are going to work diligently to capture market share in crypto. The banks will try to custody the assets, while the exchanges will try to increase trading liquidity. The incentive is clear: crypto brings new revenue, new profit, and new users. My guess is that both groups will struggle to surpass the crypto incumbents in these areas though. It doesn’t mean the legacy companies won’t capture some revenue, profit, and users. It will just be more like a single or double, rather than a home run. A key reason for this difficulty is that the core demographic of crypto users have an “anti-system” bias. If given the choice, these individuals would rather use crypto-native firms or products. So keep an eye on this competition between the legacy finance firms and the crypto incumbents. Both groups agree the future of finance will be digital and decentralized. Now it will be an all-out battle to see who can capture various markets. Billions of dollars in profit are at stake for everyone, so they each deem it a battle worth fighting. Hope you all have a great day. I’ll talk to each of you tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Largest Bitcoin Miner Explains Why Nation States Are Mining BitcoinFred Thiel is the Chairman & CEO of Marathon Digital Holdings (NASDAQ:MARA), a digital asset company that mines cryptocurrencies with a focus on the blockchain ecosystem and the generation of digital assets. This conversation was recorded at Bitcoin Investor Week In New York. In this conversation we talk about what Marathon Digital currently does, AI vs bitcoin mining, evaluating what is happening at the nation state level, gold vs bitcoin mining, hardware in bitcoin mining, and what Marathon Digital plans to do in the future. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |