Finding the Centralization Sweet Spot

Finding the Centralization Sweet SpotWe talk to Erik Voorhees about crypto reaching ‘maximum decentralization’

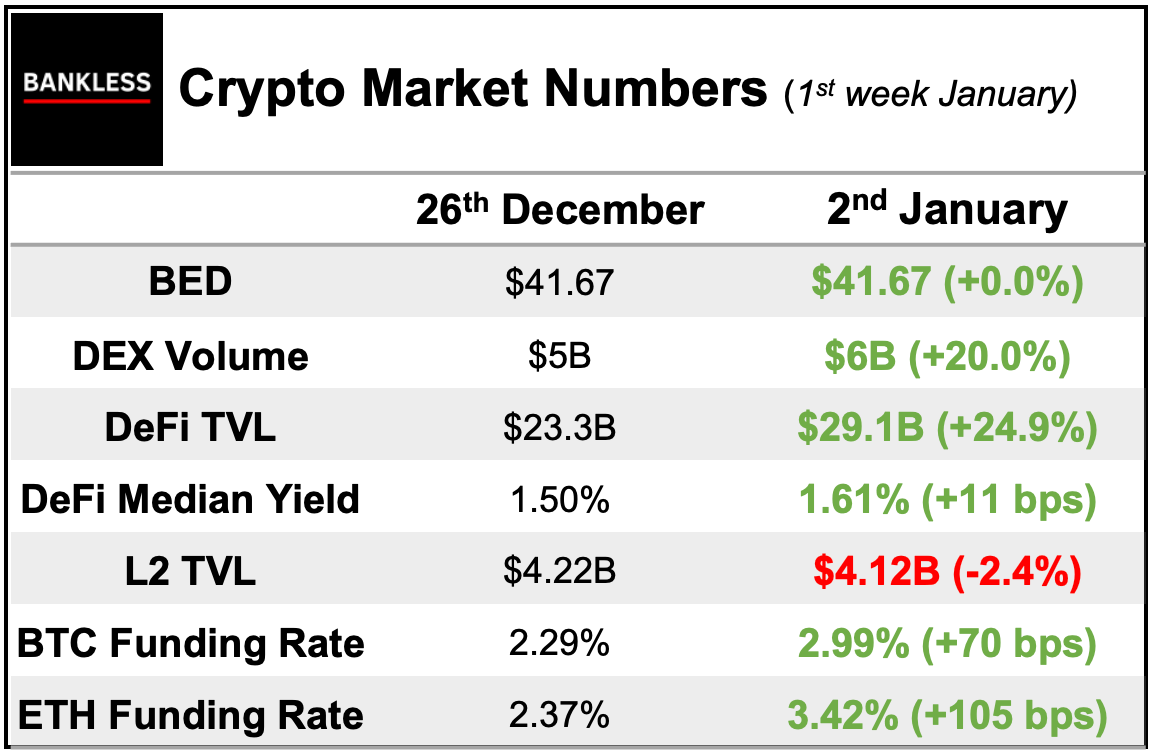

Have you seen the updated Token Ratings we’ve released? As always, the first rating is available for all Bankless readers, but to get access to the rest (and the Bankless Token Bible) you’ll need to upgrade to Premium. Dear Bankless Nation, Happy New Year! For our first Monday of the year, we dig into a fun podcast conversation with Erik Voorhees on why we’re all still here in 2023 and how crypto can realize more of its potential. – Bankless team

|

|

||||||||||

© 2023 Bankless, LLC.

440 Monticello Ave Ste 1802, PMB 63569

Norfolk, Virginia 23510

Unsubscribe

If you have questions, check

If you have questions, check

Prayers for Hamlin

Prayers for Hamlin