Goldman Sachs Thinks We Will Have A Decade-Long Bear Market — I Disagree With Them

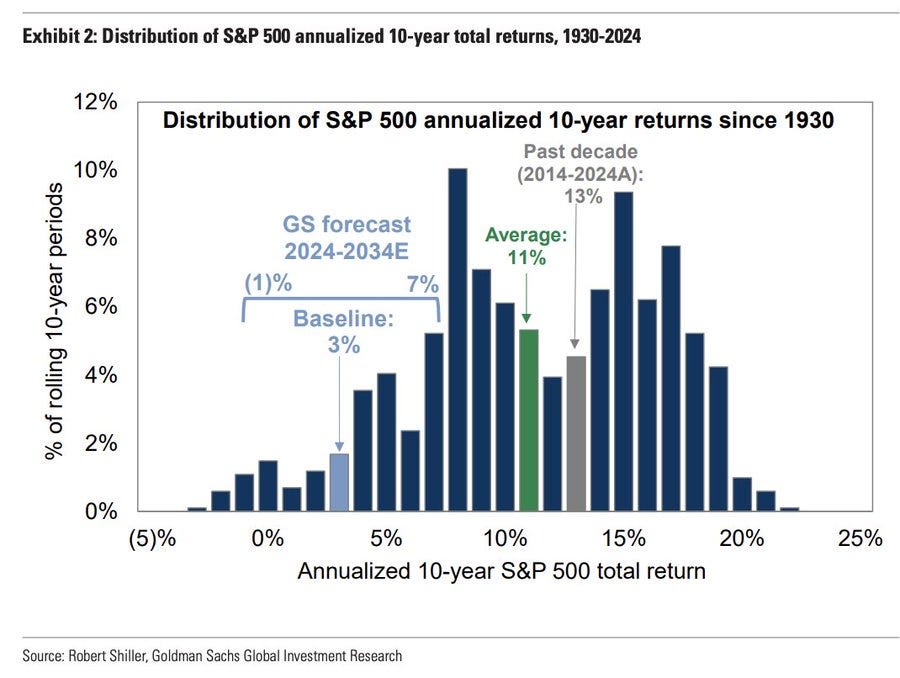

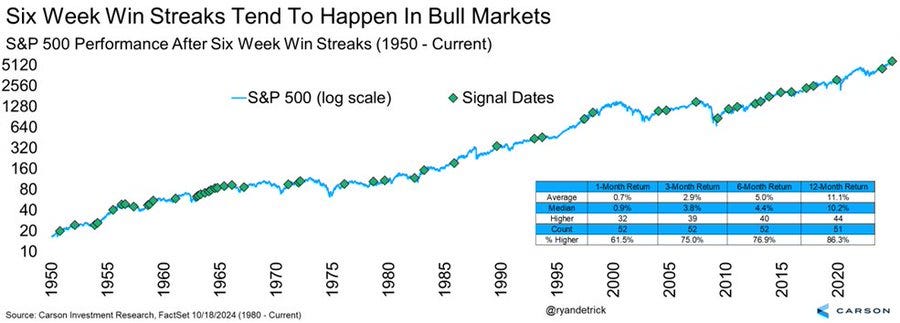

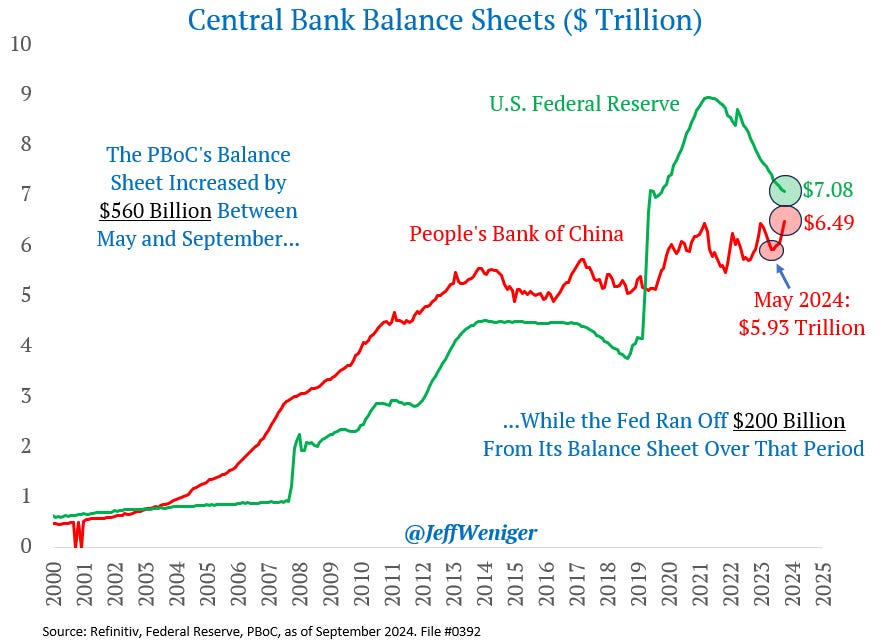

To investors, We live in an abundance of information. There is information coming at us fast and furious on a daily basis. If you focus too hard on a single data point, you’ll miss the bigger picture. This is why I was surprised when I saw the recent prediction from Goldman Sachs and Apollo that the S&P 500 would return 3% annually for the next decade. They wrote “we estimate the S&P 500 will deliver an annualized nominal total return of 3% during the next 10 years (7th percentile since 1930) and roughly 1% on a real basis.” Why is this so shocking? Goldman and Apollo are essentially predicting a decade-long bear market which will make the largest companies in the US suffer. The problem with that thought process is the data suggests we are likely in a bull market. Carson Group’s Ryan Detrick writes “The S&P 500 is up 6 weeks in a row for the first time this year. I found 51 other times it did this and stocks were higher a year later 86.3% of the time and up 11.1% on avg. Both are better than the any-time returns. Yet another clue this is a bull market.” Bull markets can turn into bear markets, but this showdown of data is essentially predictions vs history. I’ll take history every time in that matchup. In order to understand this bull market, you have to look globally at the full story. WisdomTree’s Jeff Weniger explains:

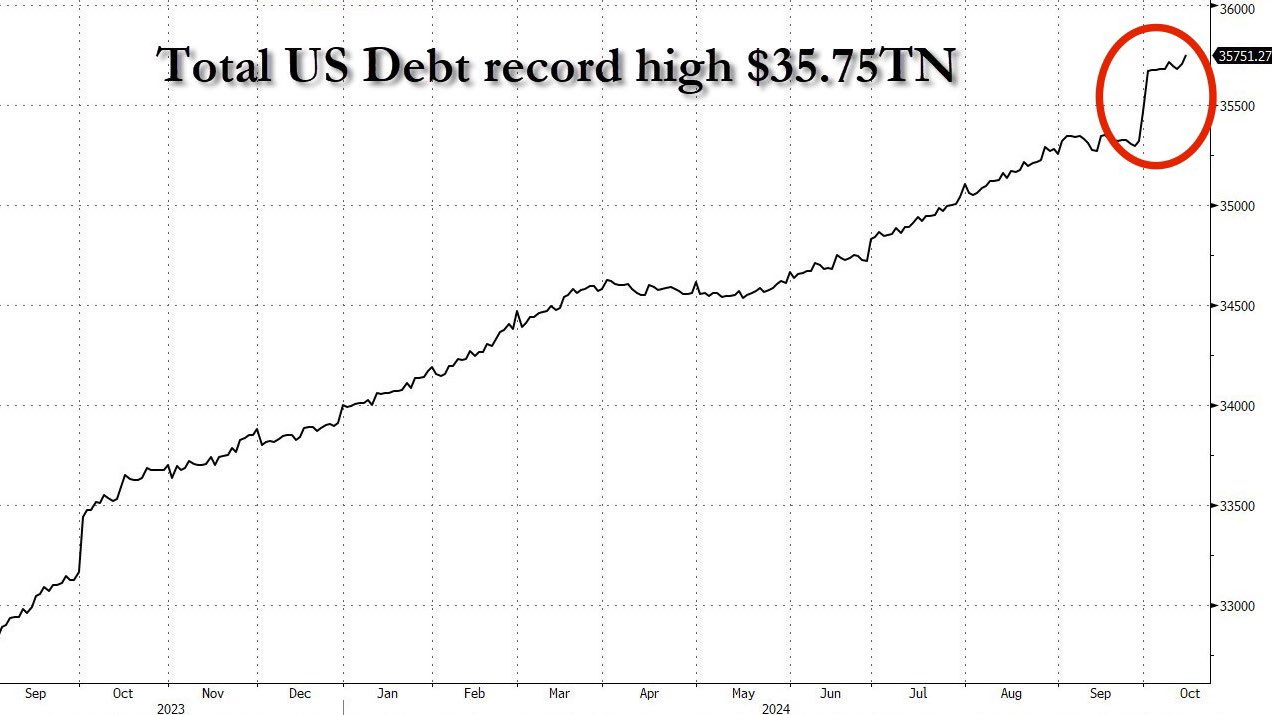

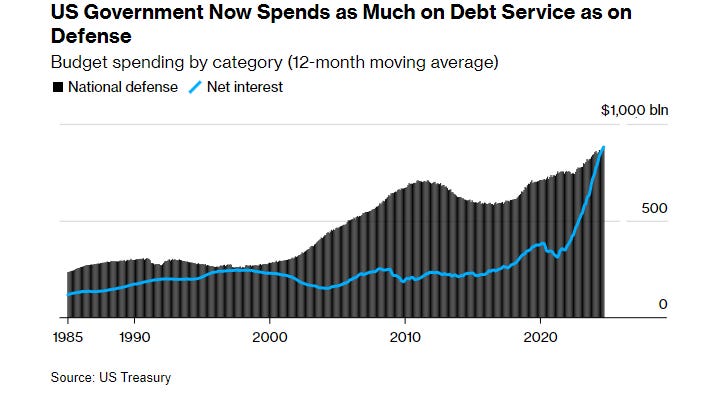

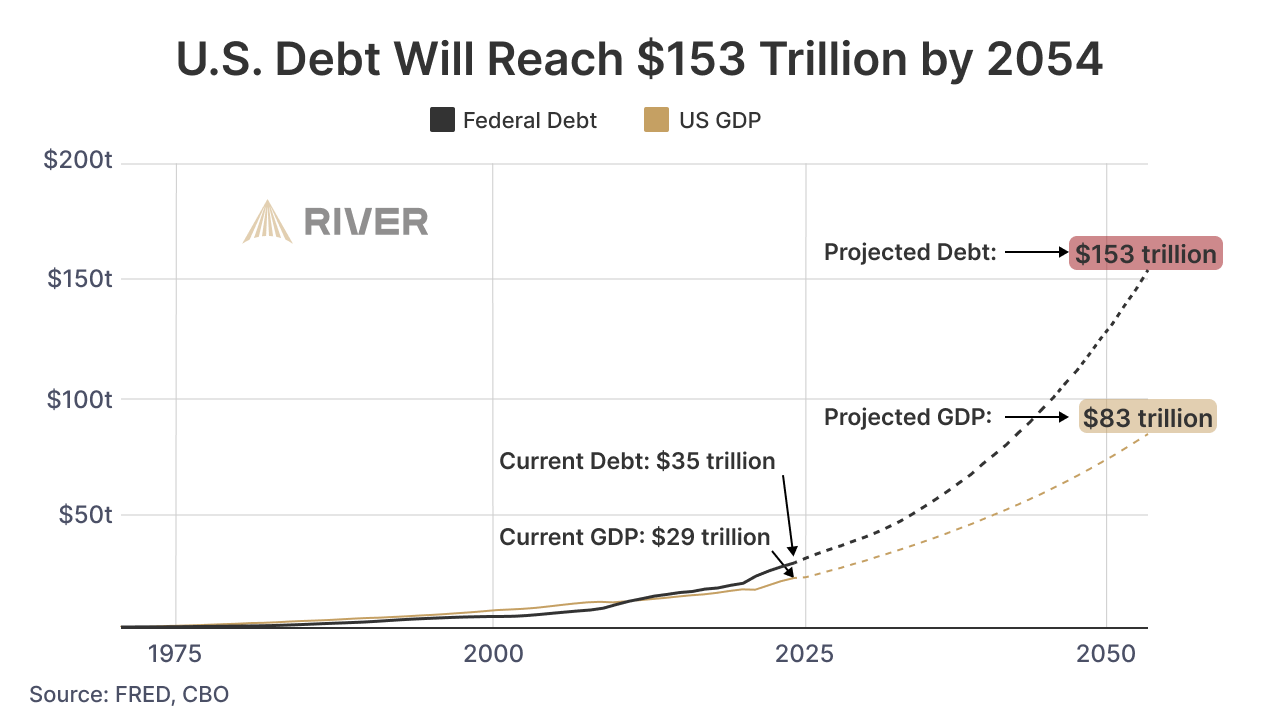

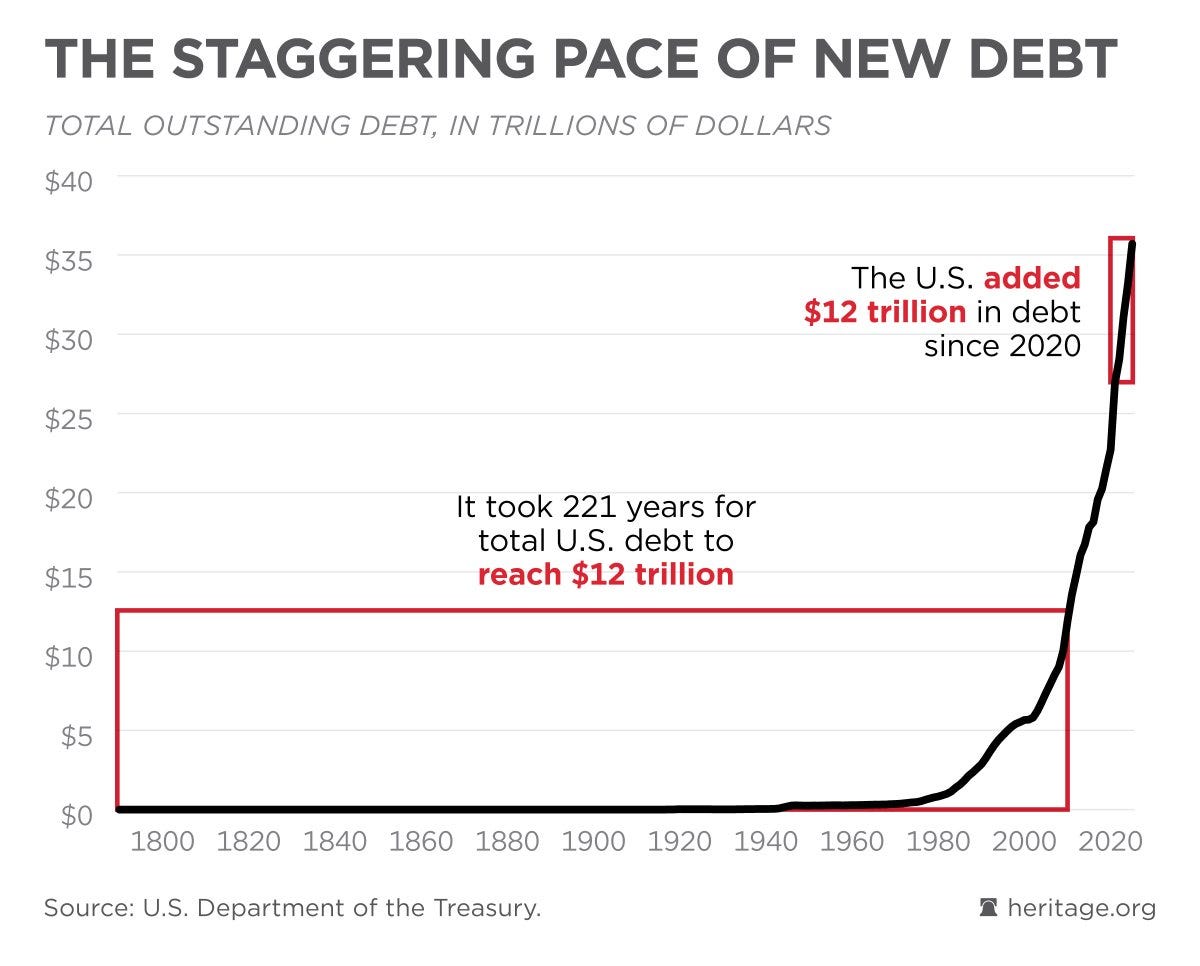

The United States may have a central bank that is selling off hundreds of billions of dollars from its balance sheet, but the federal debt has been exploding higher since the new fiscal year started at the beginning of October. We have added more than $300 billion in 22 days. And the US is spending just as much on interest payments on that debt as we are paying for defense expenses. Insane! That is not the end of the story though. Things are likely to get worse. Sam Baker, a research analyst at River, points out “the Congressional Budget Office expects federal debt to reach $153 trillion in 30 years. Since 1970, the federal debt has grown 78x, outpacing economic growth by 300%.” Remember, it took us 221 years for the US debt to reach the first $12 trillion. We added another $12 trillion in the last 5 years. What does all this have to do with S&P 500 returns for the next decade? Everything. The United States is on an unsustainable path. The national debt is going to grow to the sky and the currency is going to be debased at a rapid rate. If you think inflation is only going to be 3% per year for a decade, I have a bridge in Brooklyn to sell you. Valuations don’t matter nearly as much as currency debasement. Earnings don’t matter nearly as much as currency debasement. Market sentiment doesn’t matter nearly as much as currency debasement. It is all one big trade and we are going higher. Much higher over the next decade. As Warren Buffett is fond of saying, never bet against America. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management 🚨 READER NOTE: I am co-hosting a conference with Lance Lambert and ResiClub on residential real estate in NYC on Friday November 8th. We have many industry experts speaking about the housing market, impact of interest rates, effects on the US economy, and what investors should know moving forward. The event has been quite popular, so remaining tickets are limited. If you would like to attend, please grab your tickets: Click here Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2024 |