How to Protect Against Stablecoin Blowups

How to Protect Against Stablecoin BlowupsWorried about a depegging fiasco? Peep our tactic for Y2K Finance.

Happy New Year, Bankless Nation 🎉 We’ve got A LOT planned for 2023, and we want all of you along for the ride. In case you haven’t heard, for the next week we’re hooking you up with 10% off Bankless Premium for all of 2023. Don’t miss out on:

Upgrade to Bankless Premium, and get the best coverage in crypto all year long. Dear Bankless nation, Stablecoins are supposed to be stable, but they aren’t always. If you knew a depeg was incoming, what could you realistically do about it other than dumping your coins? Y2K Finance is a protocol on Arbitrum that lets you bet on or hedge against these occasional “once in a lifetime” crypto events. It’s the kind of financial product you hope you don’t need but may be very happy you did use. Today, we take you under the hood of Y2K. – Bankless team 🙏 Together with ⚡️ACROSS⚡️Across is the bridge you deserve: fast speeds, low fees, great support, no hacks, and we love our users. Try it once and you’ll understand why Across users love us back and have bridged $billions with it. Yield farmers will also find attractive yields for providing bridge liquidity! 👀 👉 If you have questions, check Twitter or the Discord! How to Protect Yourself Against Stablecoin Depegs

As we learned in 2022, stablecoins are not always so stable. Throughout the year that shall not be named we had full-blown stablecoin collapses (UST), as well as numerous, large de-pegs (MIM and USDT).

Other than by shorting these assets on money markets like Aave, there was no real way for the market to protect themselves or profit from these de-peg events. Enter Y2K Finance. Y2K is a new Arbitrum-based protocol that enables users to speculate or hedge on stablecoin de-peggings. Sounds like something that could come in handy? If so, read on to learn how to use Y2K.

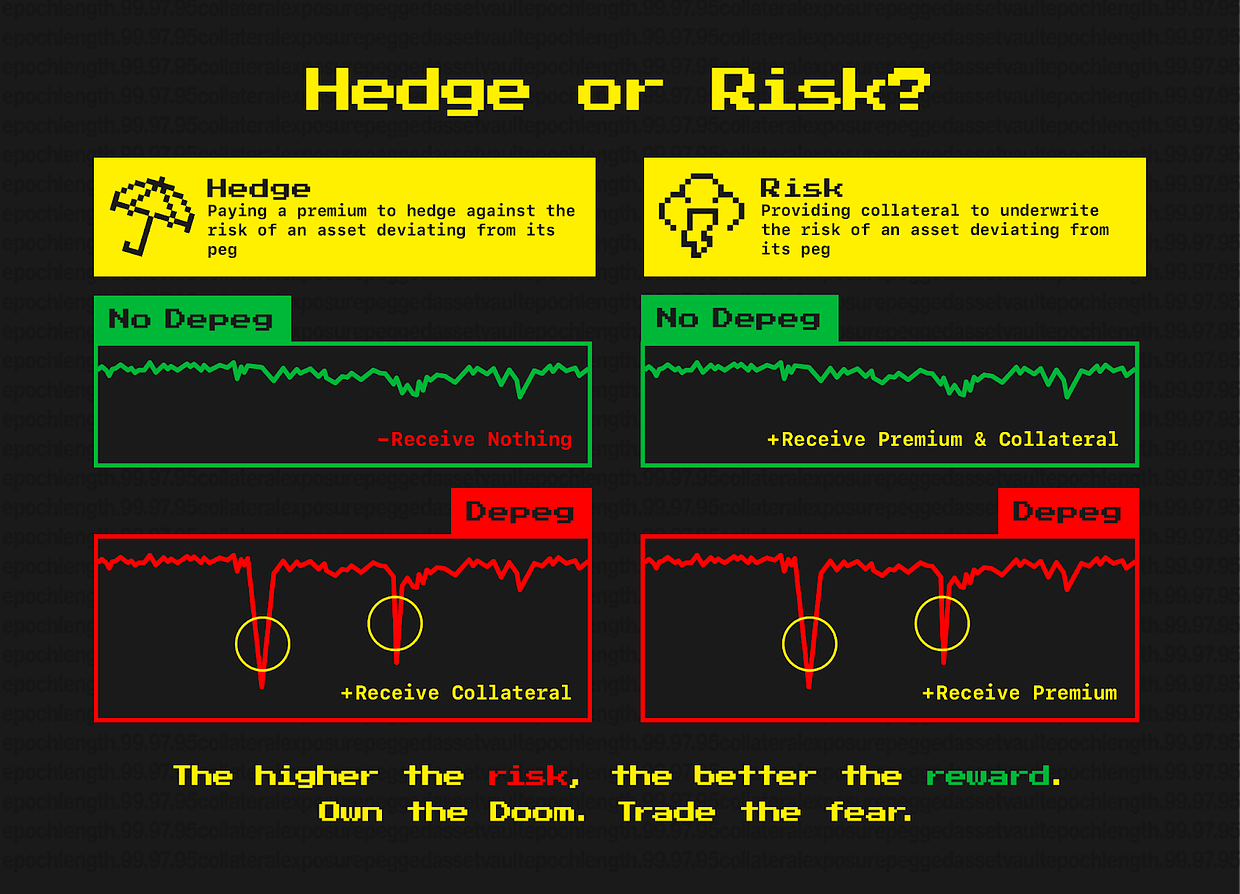

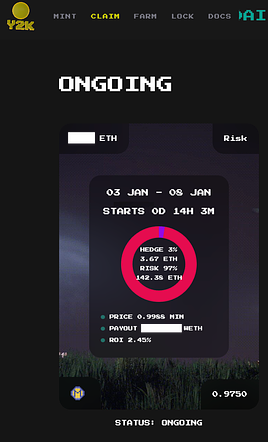

Y2K 101 🙃Before we dive into how to use Y2K, let’s give an overview of how the protocol, known as Earthquake, works under the hood. Y2K utilizes a model akin to catastrophe bonds in the insurance industry. These instruments let holders protect themselves against, or traders speculate on, and LPs to underwrite the risk of stablecoin de-pegs by depositing into one of two vaults: The “Hedge Vault” or the “Risk Vault.” The Hedge Vault is intended for users who wish to purchase insurance for, or bet on, a given stablecoin de-pegging to or below a certain threshold known as the strike price. To do so, Hedge Vault depositors will pay premiums to depositors in the Risk Vault, the counterparty that underwrites the de-peg risk. To see how strike prices and premiums are calculated, check out the Y2K docs. If the price of a stablecoin does not reach the strike price (i.e. it doesn’t de-peg) during an epoch, the period of time in which coverage is being provided, then Risk Vault will earn premiums at the expense of Hedge Vault. In this scenario, Risk Vault underwriters will also be able to reclaim their deposits. Suppose the stablecoin depegs and it reaches (or falls below) the strike price. In this scenario, Risk Vault LPs will still earn premiums. However, depositors in the Hedge Vault will receive a payout in the form of the collateral inside of the Risk Vaults. There’s a lot of minutiae under the hood of Earthquake. Once again, I’d highly recommend you read their docs and Medium posts. But the tldr is this:

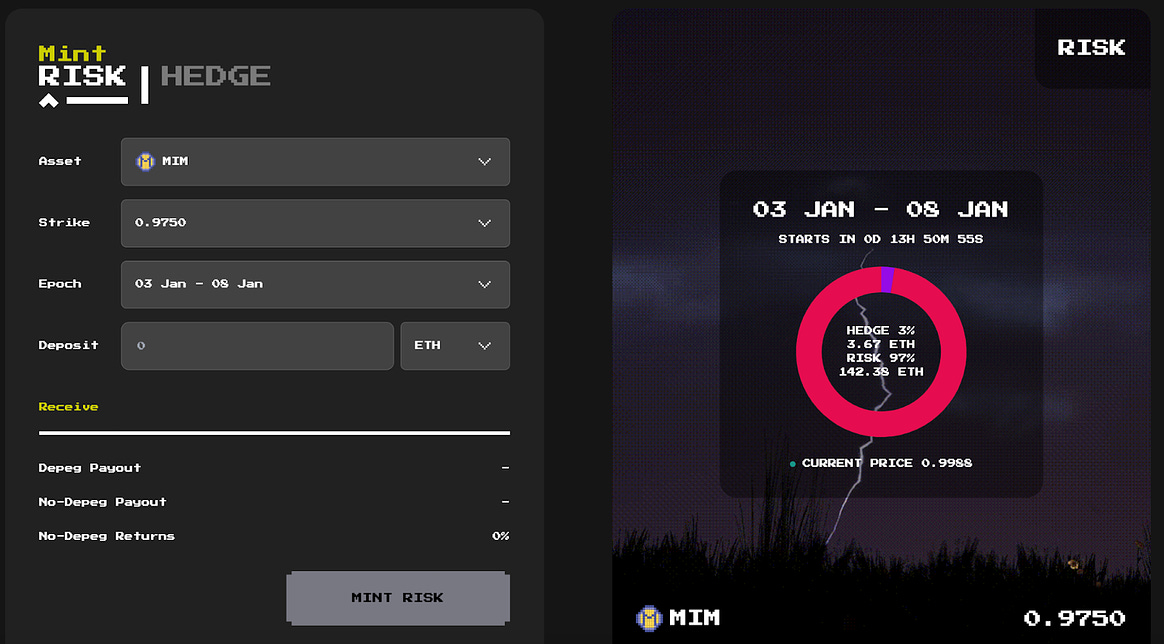

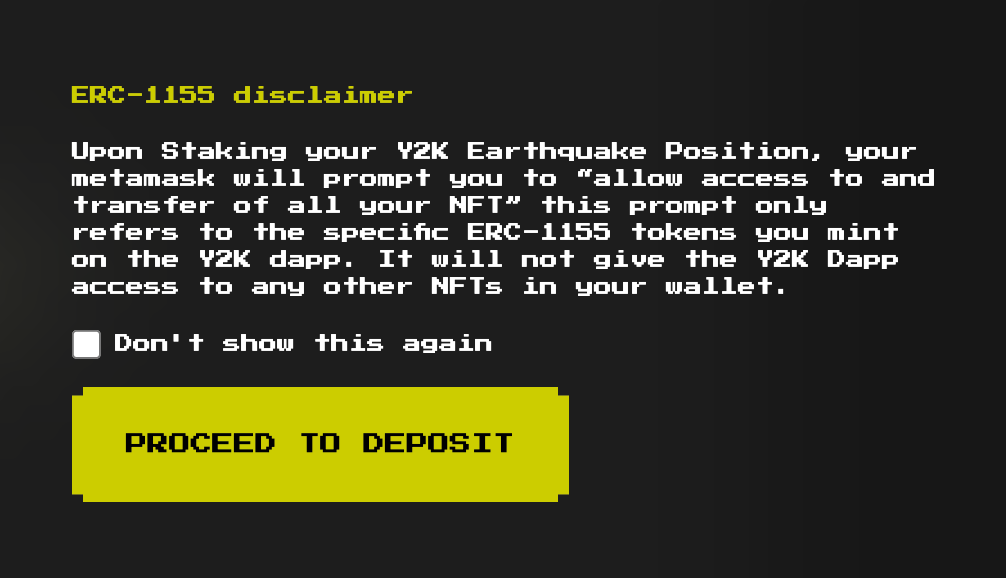

How To Enter Risk or Hedge VaultsNow that we understand the basics, let’s walk through how to actually ape into the risk and hedge vaults. The process for entering both is similar, with users selecting the same parameters for each. Let’s go through the steps for doing so below:

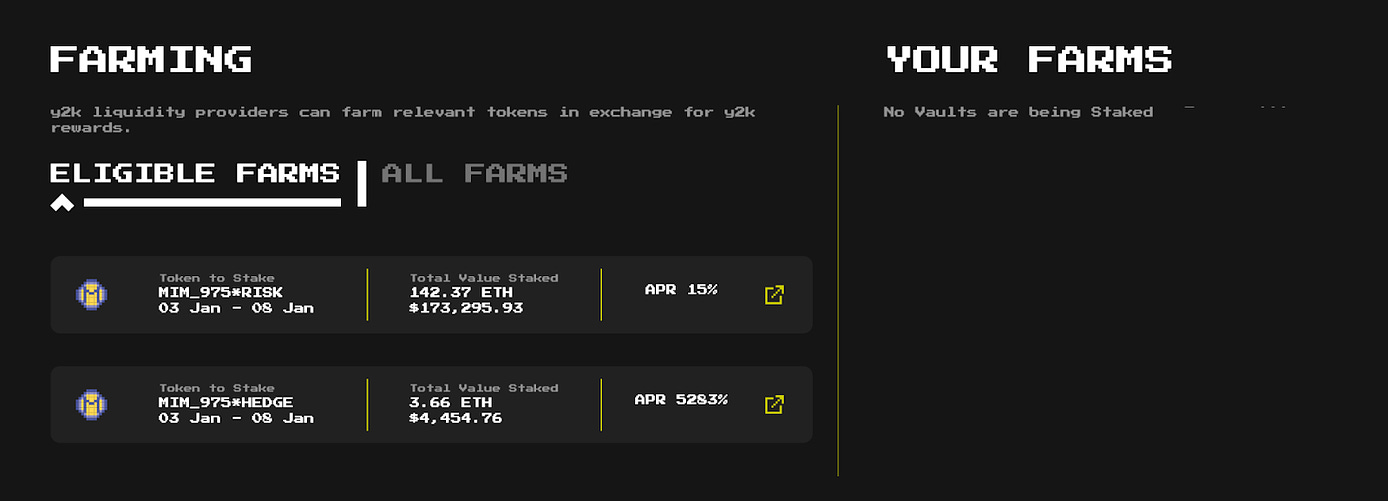

How To Farm $Y2KThere are opportunities for both hedgooors and riskooors to increase their returns by staking their vault tokens to earn additional rewards in Y2K, the protocol’s native governance token. Let’s go through how to do so below:

ConclusionY2K is a valuable new protocol that lets users hedge, speculate, and underwrite the risk of stablecoin de-peggings. With the exception of opportunistic Hedge Vault depositors, we’re likely all hoping markets stabilize and downside volatility subsides. But should there be more tumult on the horizon, you can now protect yourself (and profit from) stablecoin Armageddon with Y2K. Action stepsAuthor BioBen Giove is an analyst for Bankless. He’s the former President of Chapman Crypto and an analyst for the Blockchain Education Network (BEN) Crypto Fund, a student-managed crypto fund built on Set Protocol. He’s also a proud member of the Bankless DAO and methodologist behind the GMI index. Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor ACROSS👉 Across.to is the bridge you deserve! Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read Bankless in the app

Listen to posts, join subscriber chats, and never miss an update from Ben Giove.

© 2023 Bankless, LLC. |