How to Use Decentralized Stablecoins

How to Use Decentralized StablecoinsOur guide to getting familiar with Liquity’s LUSD and Reflexer’s RAI.

Tax season is here again but it doesn’t have to be a nightmare. Sort out your crypto taxes with Crypto Tax Calculator, a software supporting 300,000+ currencies across various L1s and L2s. Dear Bankless Nation, Everything that’s called decentralized in crypto isn’t always so. But when it comes to stablecoins, players like Reflexer and Liquity are putting the work in to maximize decentralization. Today, we spotlight a couple of these truly decentralized stablecoins and show you how to take advantage of them. – Bankless team 🙏 Together with ⚡️KRAKEN⚡️Kraken, the secure, transparent, reliable digital asset exchange, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. Your account is covered with industry-leading security and award-winning Client Engagement, available 24/7. 👉 Visit Kraken.com to learn more and start your experience today. How to Use Decentralized Stablecoins

Stablecoins are among the early DeFi ecosystem’s biggest attractions, yet not all stables are created equally. This Bankless tactic will walk you through the basics of navigating two of the best decentralized stablecoins around, Liquity’s LUSD and Reflexer’s RAI.

A beginner’s guide to decentralized stablecoins

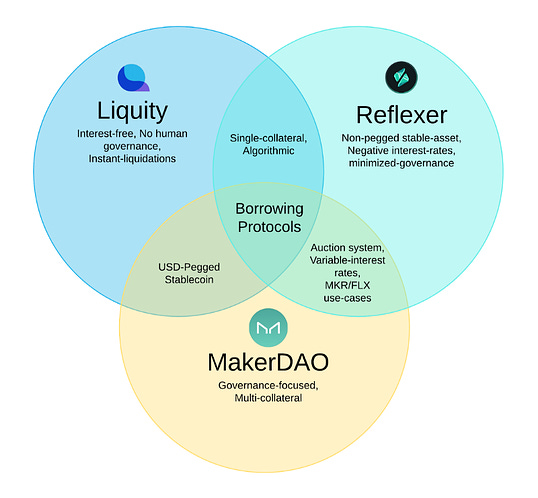

First, why stablecoins matterStablecoins are digital assets that are designed to be extremely stable in value. Most commonly, this price stability comes courtesy of a peg to a fiat currency. USDC and USDT, which are pegged to the value of the US dollar, are prime examples here. Unlike fiat though, stablecoins are borderless, accessible to anyone with an internet connection, and fast and inexpensive to transfer. These advantages have made stablecoins boom in popularity lately. For example, in 2022 stablecoins are estimated to have settled $7 trillion USD worth of transactions. $7 trillion!

The different types of stablecoinsStablecoins can come in a range of different styles. The main types seen today are:

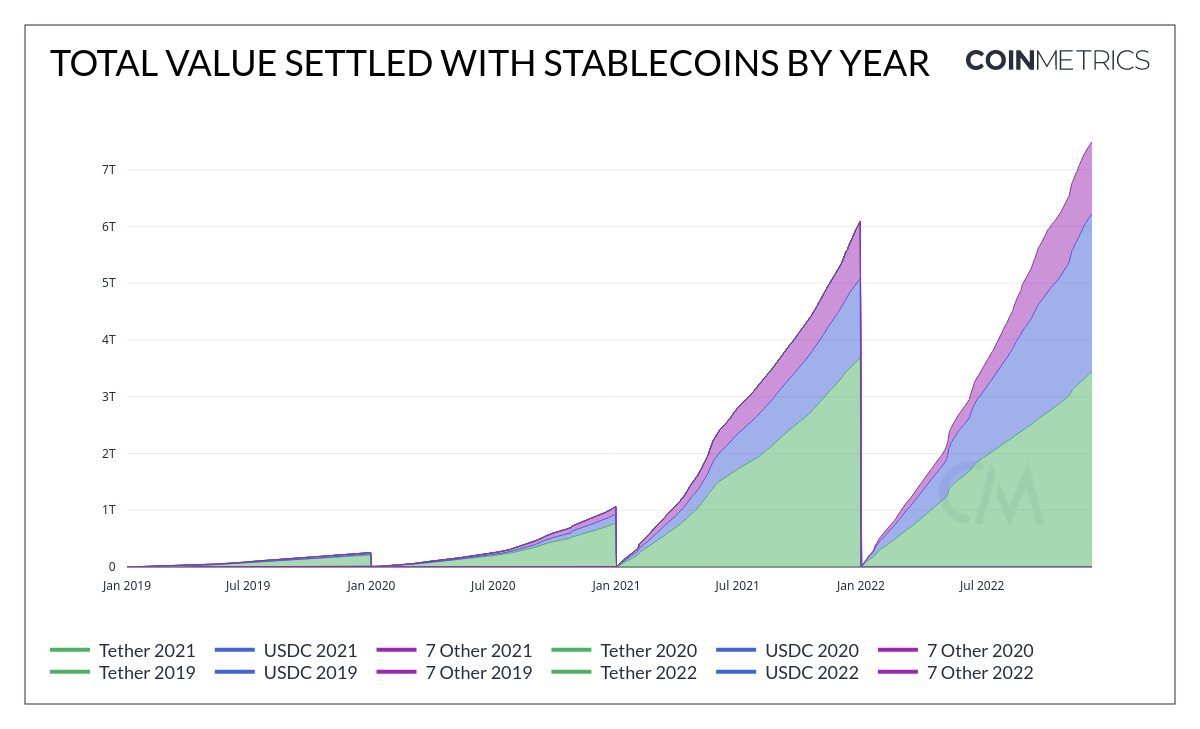

Since stablecoins can come in various forms, then, it’s also important to keep in mind that there’s a spectrum of how centralized or decentralized they are. Another way to understand this range is through the “Resilience Spectrum” — per TokenBrice in this graphic:

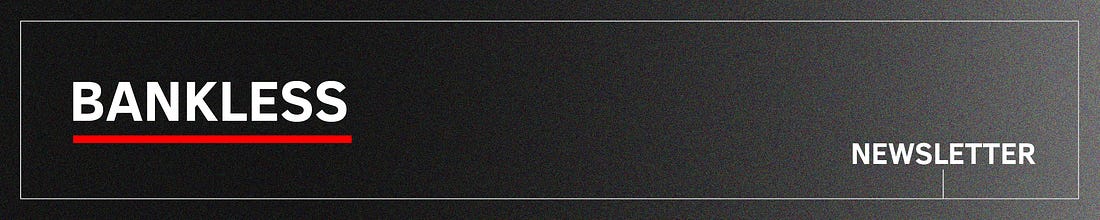

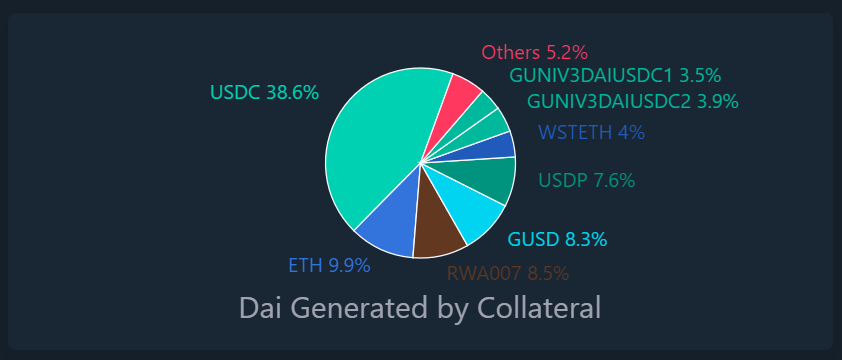

Here TokenBrice is ranking DeFi protocols, but the same concept can be applied to stablecoins generally. On the left side of this spectrum would be fully centralized projects like USDC and USDT, which are ultimately censorable by their operators. These tokens are fine for many people and their operators don’t censor balances willy-nilly — yet their underlying designs entail certain counterparty risks like fractional reserve systems gone wrong, unauthorized third-party compromises, or undue governmental pressure. Since you can’t fully rule these risks out, stables like USDC and USDT don’t ace our “resilience” check. That said, in the middle of the decentralization spectrum are projects like MakerDAO’s dollar-pegged DAI stablecoin. You can deposit cryptocurrencies like ETH to Maker and borrow against them to receive DAI, though around ~40% of all DAI in existence today has been generated from USDC, which is centralized.

As such, with regard to counterparty risk DAI is fairly resilient, but since much of the money behind it currently is ultimately censorable, and since Maker can evolve significantly through governance, DAI isn’t ironclad. This brings us ’round to the subject of today’s post: stablecoins that are on the “most decentralized” end of the spectrum. The importance of decentralized stablecoinsThere are two fundamental reasons why stablecoins that are effectively decentralized are so powerful: out of all the projects in the stables landscape, they have 1) the least external dependencies, and 2) the best self-custody guarantees. Two stablecoins that fit this bill are Liquity’s governance-free LUSD and Reflexer Finance’s governance-minimized RAI. These stables are narrowly designed in order to run reliably and self-reliantly in indefinite fashion. With no or negligible administration or governance demands, these tokens eliminate counterparty risk for holders, which is a huge advantage.

Accordingly, with no external dependencies you can hold and use these tokens for the long-term knowing full well that you and you alone can maintain total control of them via self-custody. This durability lets these stablecoins enjoy superior reliability for their core use cases, like non-volatile crypto payments, on-chain savings, and remittances. For example, hypothetically let’s say you save up a significant nest egg in BUSD over the next few years, but then the next U.S. presidential administration installs a hawkish official at the Treasury Department who goes nuclear in expanding OFAC enforcements. Their new rules have you targeted for using Tornado Cash back in the day, so Paxos is forced to reclaim your savings back. That’s definitely a worst case scenario, and it may be unlikely, but these sorts of possibilities can’t be completely ruled out. Decentralized stablecoins shine in contrast, then, because they’re comparatively anti-fragile and censorship-resistant. These strong guarantees are pretty cool, right? Well it’s time to learn how to get them for yourself. Below, let’s zoom in and specifically walk you through the basics of navigating the LUSD and RAI stablecoins: A quick guide to LUSD

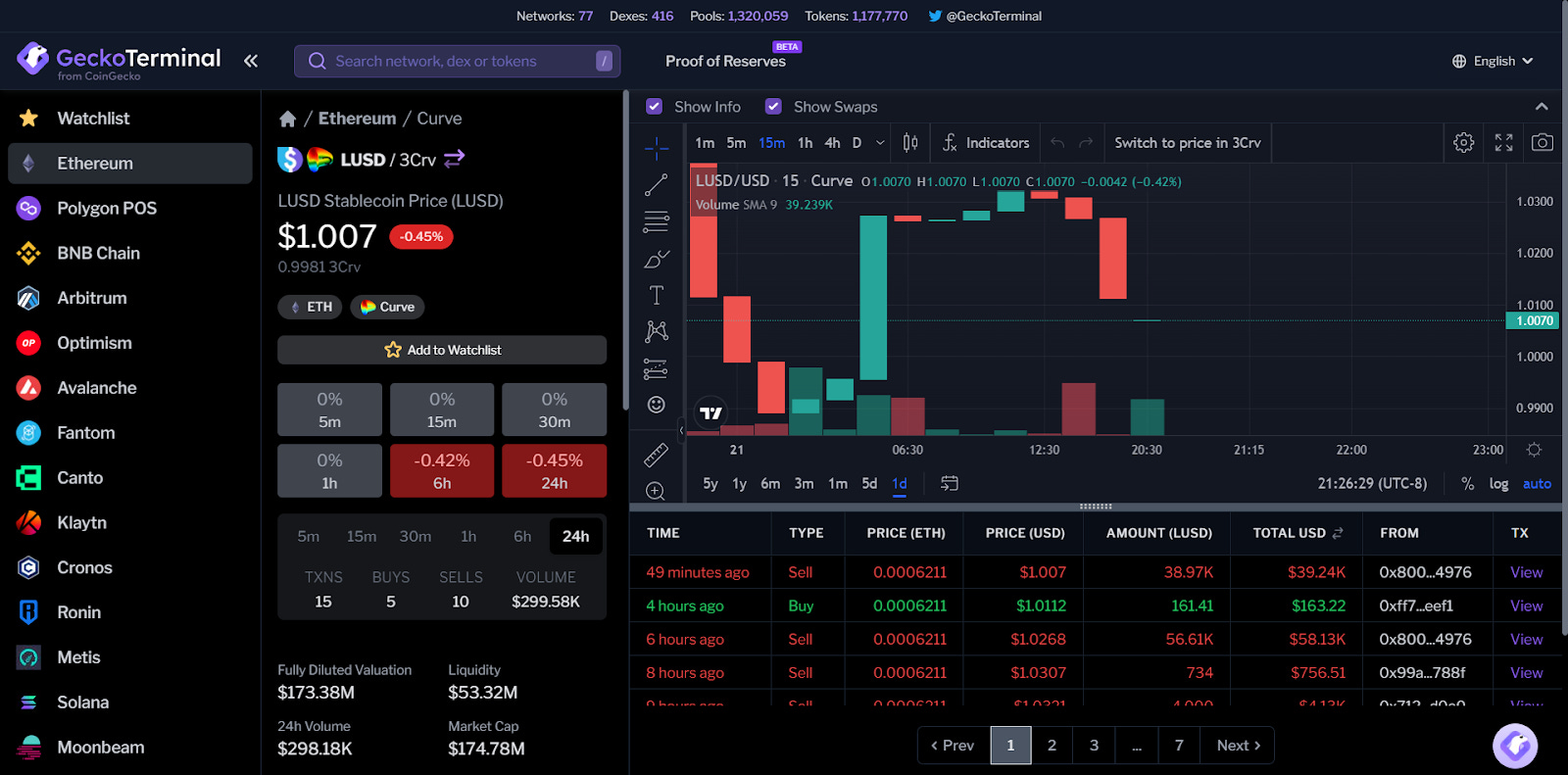

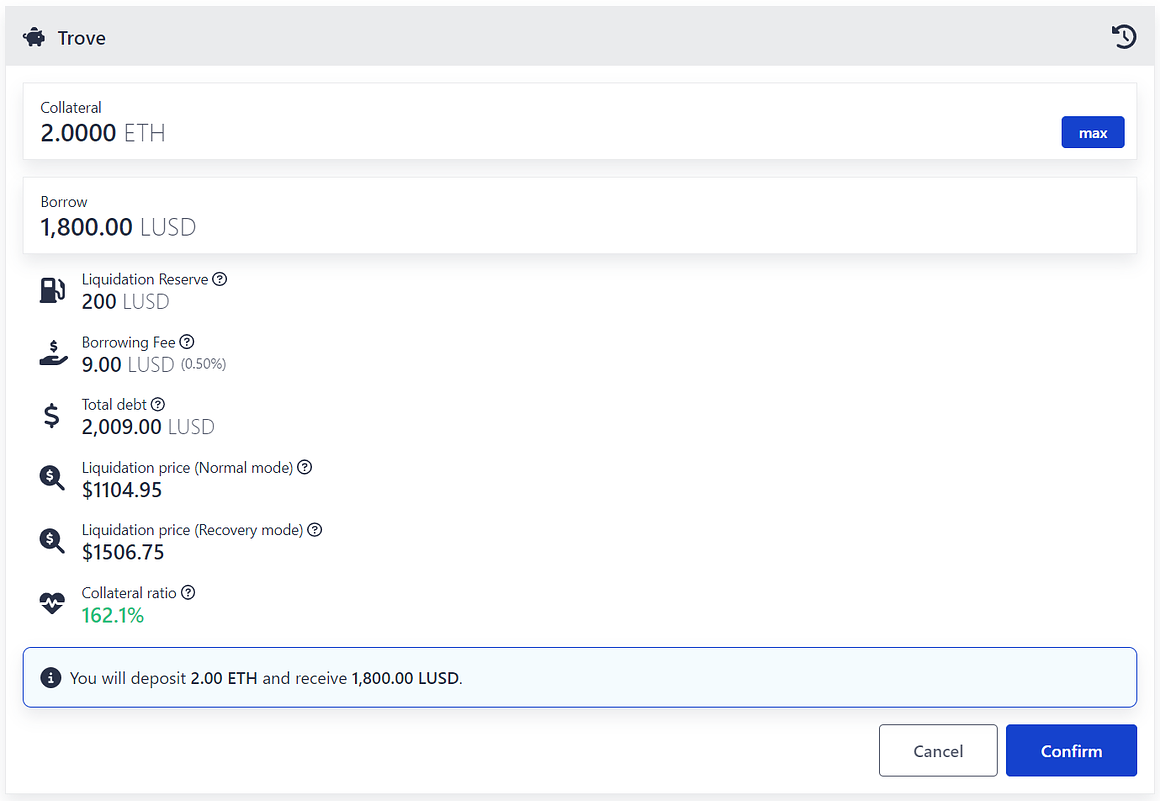

Inspired by the original rendition of MakerDAO that only allowed DAI to be generated with ETH deposits, Liquity is a decentralized borrowing protocol for facilitating interest-free loans against ETH deposits. With no admin keys or governance involved, Liquity is designed to work in this way in perpetuity. Rather than DAI though, Liquity pays out its loans in the protocol’s native dollar-pegged LUSD stablecoin. And rather than the 150% collateralization rate you commonly see around DeFi, Liquity only requires you maintain your LUSD loans with a 110% minimum collateralization rate. Note too, that any LUSD you draw out can be redeemed for your underlying ETH at any time, and keep in mind there’s no official front-end so there are a variety of different community UIs you can use to interact with the protocol as you please. All that said, you can access LUSD in two ways, namely buying some from a decentralized exchange or borrowing some from the Liquity protocol. If you’re just interested in allocating as easily as possible, then simply buying LUSD from a DEX is best. To get a bird’s-eye view of the top LUSD trading pools in DeFi right now, I recommend going to GeckoTerminal and doing a search for “LUSD.” For example, GeckoTerminal shows that Curve’s LUSD/3Crv pool has +$53M USD worth of liquidity right now, so if you want to go to the largest LUSD pool at the moment this would be your target. Swap in and then you’d be good to go!

As for borrowing LUSD, if you don’t mind managing a debt position you would follow these steps:

A quick guide to RAI

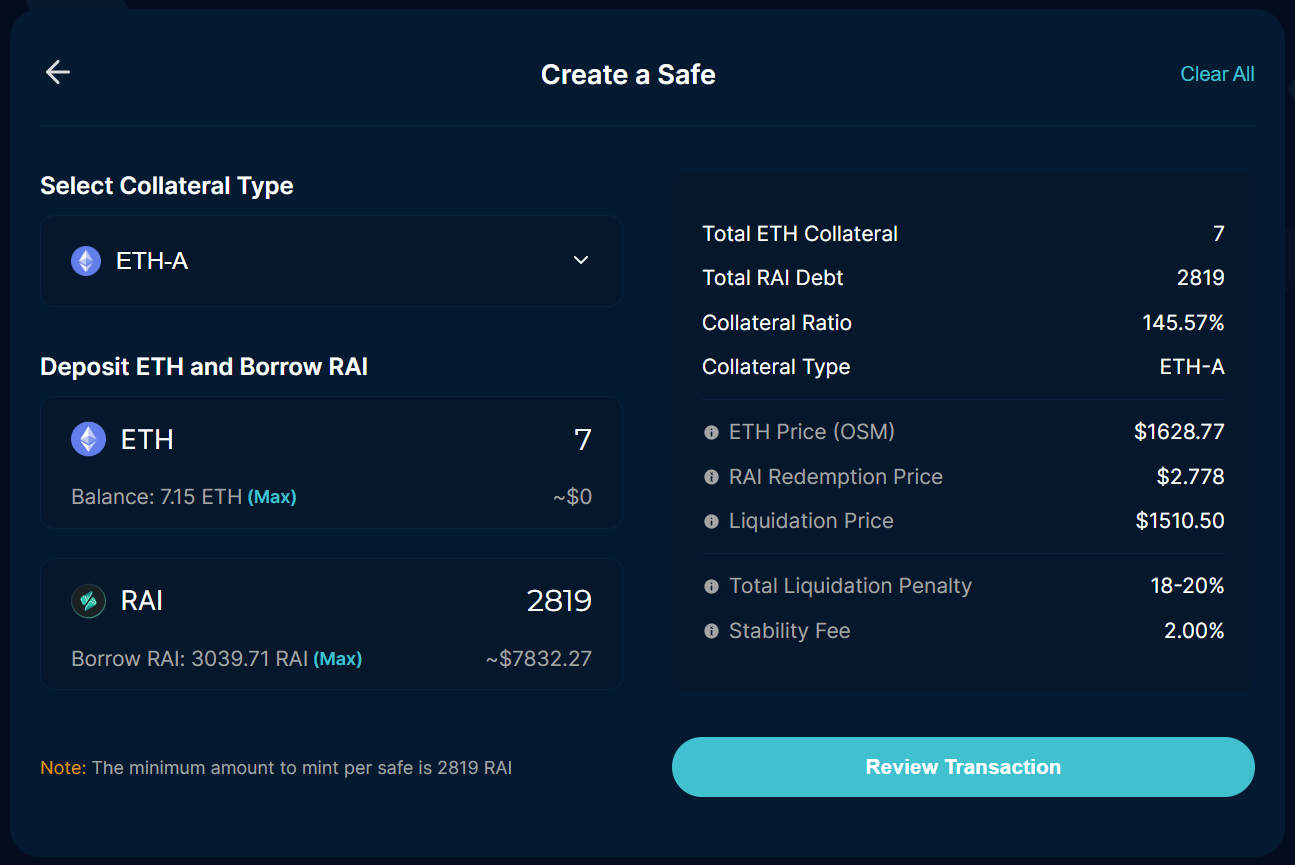

The other decentralized stablecoin we’re looking at today is the one-of-a-kind RAI, which comes to us by way of Reflexer. RAI is unique because it’s the only stablecoin in the cryptoeconomy today that isn’t pegged to the value of any specific asset — not dollars, not gold, not nothing. As Bankless’s Ryan Sean Adams once explained, the algorithmic RAI is “DeFi money backed by ETH with code + incentive mechanisms to maintain a stable price.” As such, the value of RAI freely and steadily floats in line with supply and demand fluctuations. At the time of this post’s writing, 1 RAI was worth the equivalent of $2.78 USD. The more the RAI market price drifts from the ever-updating target RAI redemption price, the more the underlying algorithm adjusts interest rates to incentivize people to arb the two prices back closer together. 1 RAI = 1 RAI then, and this non-pegged stablecoin’s value as expressed by the exchange rate to USD will depend on the current algorithmic supply-and-demand conditions. With that introductory context out of the way, when it comes to acquiring RAI you’ve got both buying and borrowing options like with LUSD. With regard to buying, you know the drill: find a pool with decent liquidity, e.g. the RAI/DAI Uniswap V3 pool, and swap in as needed. Then hold, save, make payments, whatever you want, however you want it. When it comes to borrowing RAI, instead of depositing ETH into a “Vault” or a “Trove,” this stable’s debt positions are known as “Safes.” The minimum mint amount is 2,819 RAI (~$8,000) right now, so if that’s in your ballpark you could open your own Safe by following these steps:

LUSD and RAI are built toughDecentralized stablecoins like LUSD and RAI are important for DeFi because they offer strong reliability guarantees. Unlike centralized stables, which are backed by centralized organizations and can be subject to regulatory pressure, decentralized stables are not controlled by any single entity and are thus resistant to censorship and organizational abuse. Accordingly, when you combine this level of reliability with the accessibility, affordability, composability, and speed that tokens can offer, decentralized stablecoins represent the very best of young DeFi’s world-changing potential. Action steps

Author BioWilliam M. Peaster is a professional writer and creator of Metaversal — a new Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond! Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor KRAKEN👉 Kraken has been on the forefront of the blockchain revolution since 2011 ✨ Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read Bankless in the app

Listen to posts, join subscriber chats, and never miss an update from William M. Peaster.

© 2023 Bankless, LLC. |