Inflation Is Coming Down & Fed Needs To Act

Today’s letter is brought to you by Consensus!Consensus is Crypto’s Most Influential Event 20,000 of the world’s most ambitious builders and boldest investors are coming to Consensus to make connections and shape the future of the digital economy in Toronto this May 14-16, 2025. Here’s a glimpse at what’s ahead:

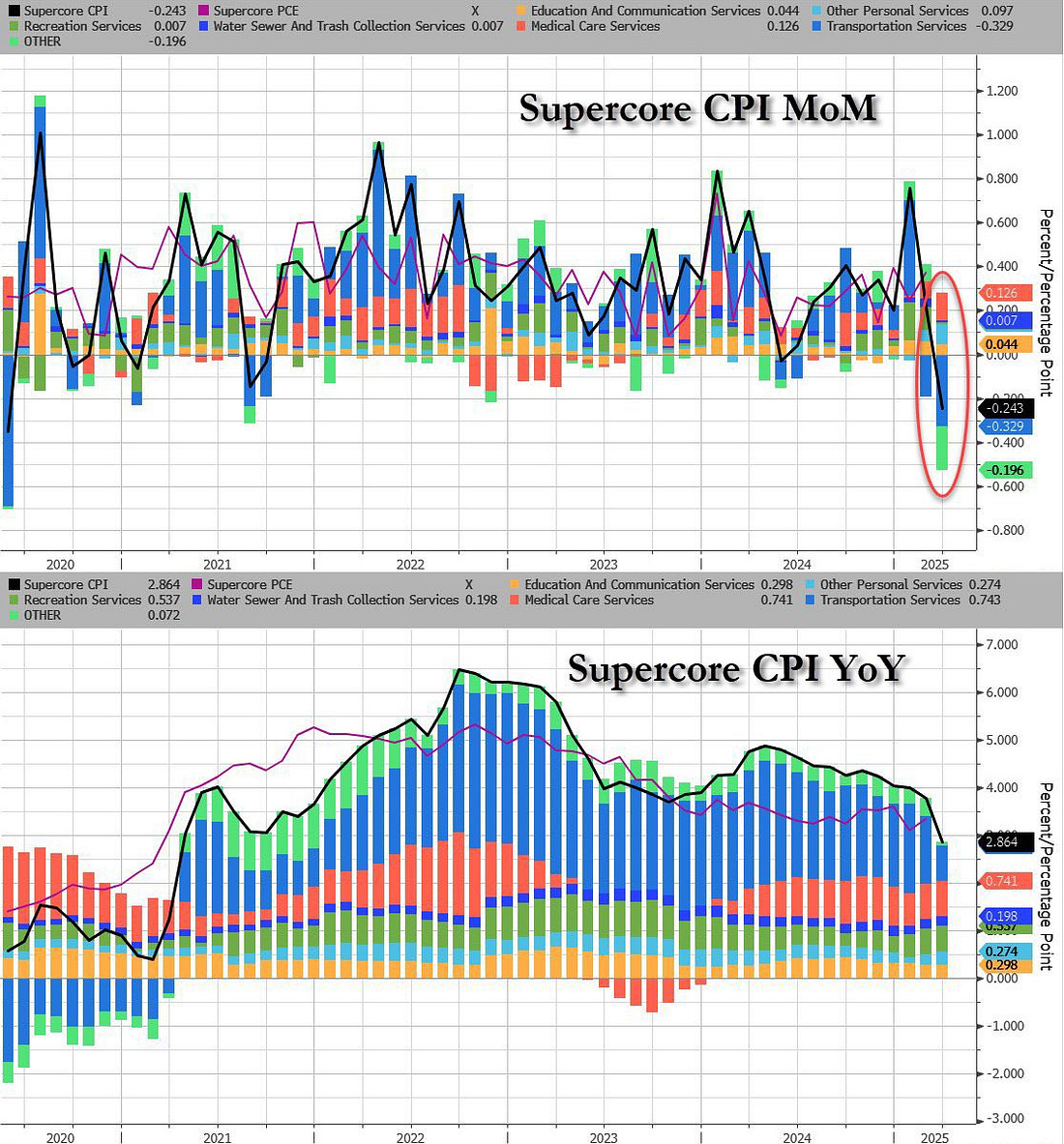

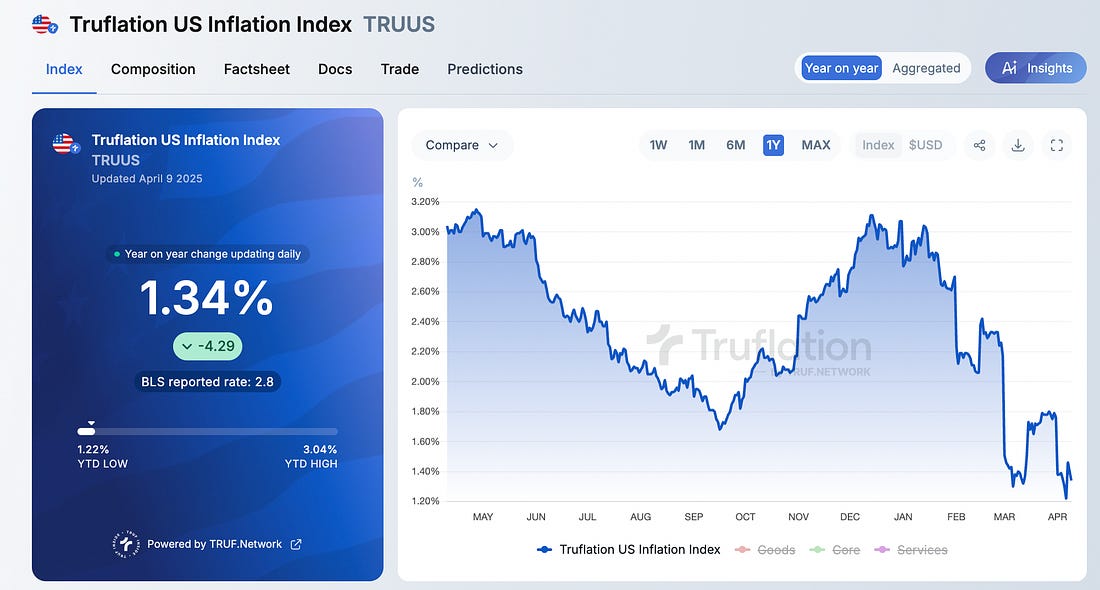

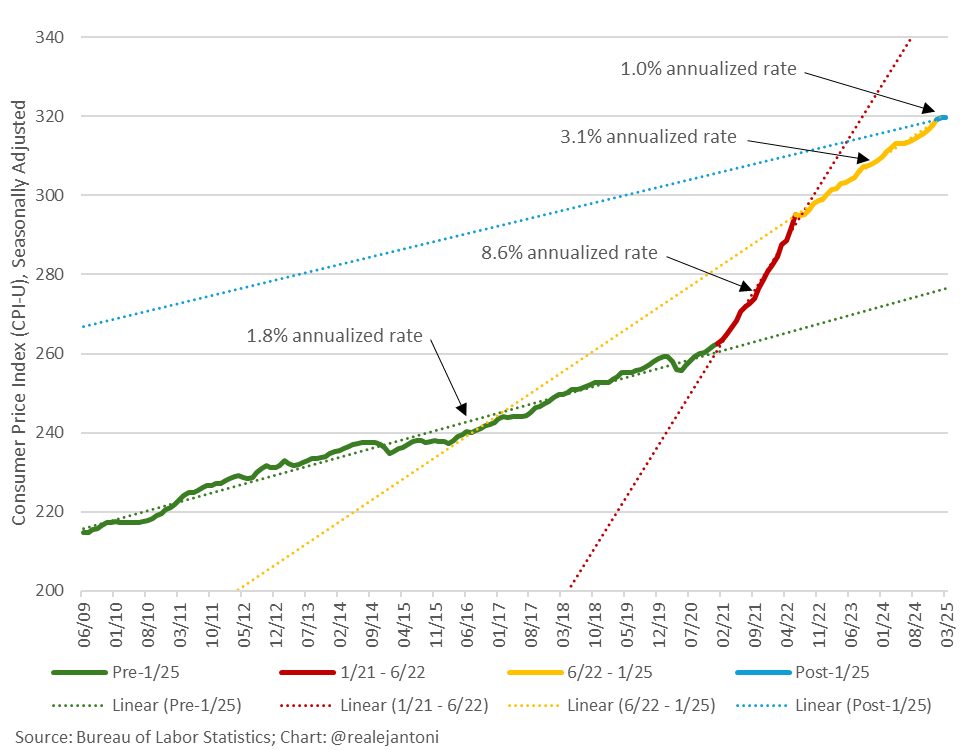

With over ten years of seeing tens of thousands of attendees, Consensus remains your best bet for market-moving intel, meaningful connections, and career-defining deals. You can’t afford to miss it. To investors, The March CPI report was published this morning. As I have been predicting, inflation is crashing. The headline inflation number dropped from 2.8% in February to 2.4% in March. Core CPI inflation fell below 3.0% for the first time since March 2021. And even the weird “supercore CPI”—a specific measure of inflation that zooms in on the prices of services, excluding food, energy, and housing costs—dropped -0.24% month-over-month. That is the lowest number we have seen for the metric since May 2020. According to EndGame Macro, “Supercore CPI MoM (circled) is collapsing that’s a clean signal of demand-side weakness across sticky services, especially discretionary buckets like travel, recreation, and healthcare. That supports the “disinflation is real” narrative.” The prediction that inflation was dropping aggressively was easy. You could see it clearly in Truflation’s measurement, which is a real-time alternative inflation metric. Today the Truflation reading is at 1.3%, which is more than 50% lower than it was in December 2024. Maybe the most important part of this slowdown in inflation is the structural change that seems to be underway. Heritage’s EJ Antoni writes the “average annual inflation rate from ’09 until ’21 was 1.8%, then Biden drove it up to 8.6% for a year and a half, then it rose steadily at 3.1% for the rest of his term; but now Trump is averaging a mere 1.0%.“ The current administration has only been in office for a few months, and there is still a long way to go in their term, but this material change to inflation is a welcomed development. Remember, the last 5 years has been brutal for the average American. Charlie Bilello lays out the numbers for various goods or services:

And those are just the official government metrics. The true damage is probably even worse. So the good news is inflation is falling. The risk is that the Fed refuses to act in a timely manner, which leaves the economy exposed to a potential economic slowdown. We should all hope an interest rate cut is on the way. Have a great day. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Darius Dale Explains Tariff Impact On US EconomyDarius Dale is the founder & CEO of 42Macro. In this conversation, we discuss tariffs, risk assets, blue collar vs. Wall Street, and what could happen next. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |