Inside Netflix’s $150 Million Bet On Christmas Day NFL Games

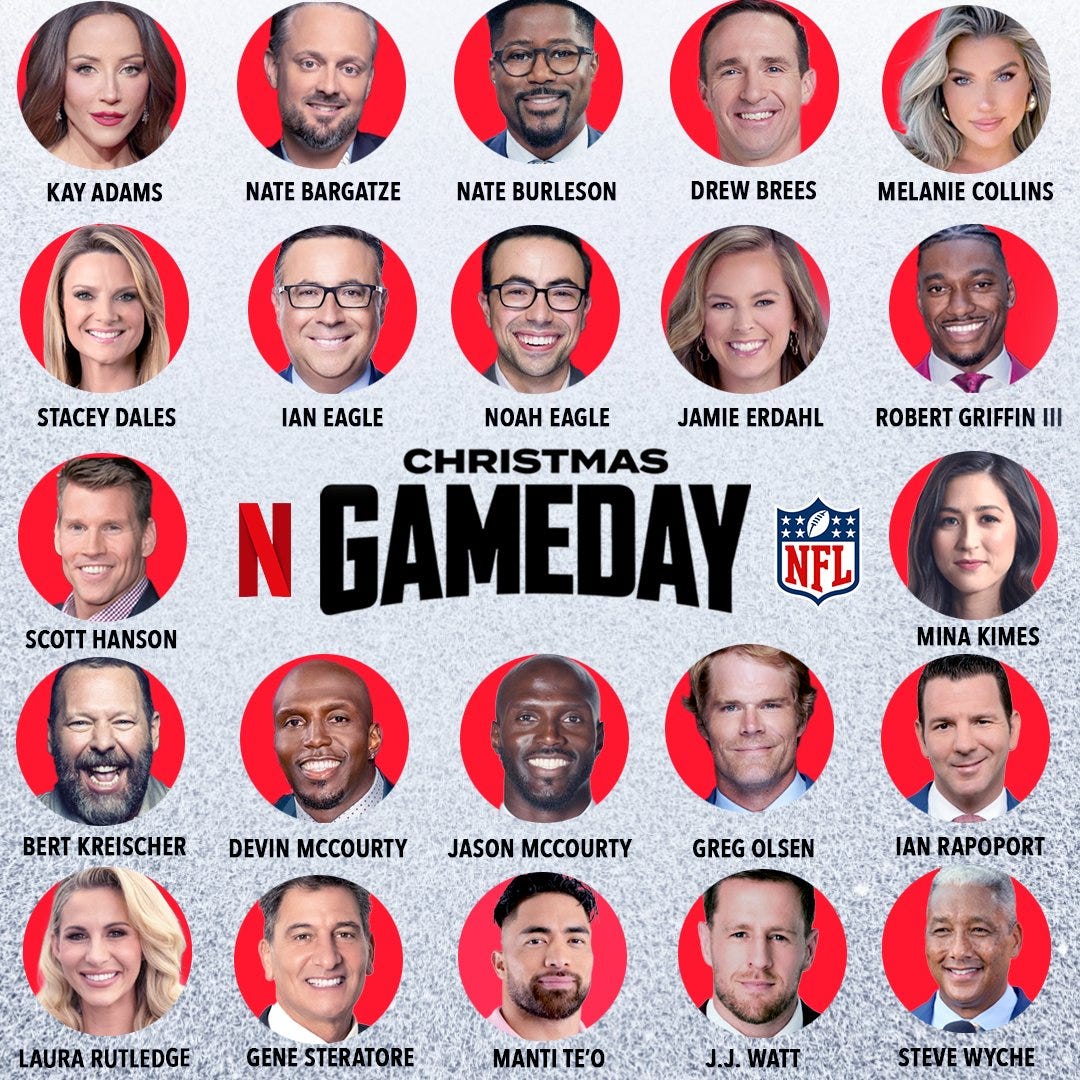

Everyone has spent the last several weeks discussing NBA ratings. Down more than 25% year over year and 48% since 2012, NBA viewership appears to be in free fall despite recently signing a new media rights deal worth $76 billion over 11 years. There is no shortage of opinions. Some will say analytics have destroyed the game, while others will tell you that the season is too long and that the rise of streaming has made it too complex and costly for fans to watch the games they care about. While all of these factors play a role, the reality is that the NFL’s continued rise in popularity has damaged the NBA just as much, if not more. Think about it this way: The NBA used to own Christmas Day. As a kid, I watched Christmas Day games from noon until midnight. Celebrities were showing up at Madison Square Garden. The Lakers and Celtics were always on television, and the league’s media rights partners went all out on production to make it feel special. But then the NFL decided to flex its muscles. After respecting the NBA’s holiday for most of the last 50+ years, Christmas Day in 2022 fell on a Sunday. So, the NFL put on three games, deciding to compete directly with the NBA on its most important day. These NFL games averaged an absurd 21.6 million viewers. The NFL did it again the following year, averaging 28.4 million viewers across three games in 2023. And while Roger Goodell and the league office tried to downplay the rivalry by saying the NFL wouldn’t host games on Christmas Day unless it fell on the league’s regular schedule, money talks, and the NFL has already gone back on its word less than two years later. Netflix has acquired the exclusive rights to two Christmas Day games this season as part of a three-year deal with the NFL. The world’s largest streaming company is paying $150 million for these games, similar to what it would spend on a mid-tier movie. And while these matchups will be available for free on broadcast TV in each team’s local market, Netflix will be the only option globally for all other NFL fans. The NBA will try to combat the NFL’s attack with a handful of games and some of its biggest stars, including LeBron James, Steph Curry, Nikola Jokic, Jayson Tatum, Kevin Durant, Anthony Edwards, Luka Doncic, Jalen Brunson, and Victor Wembanyama. But it won’t matter. Last year, the NFL averaged 10x more viewers per game than the NBA—28.4 million to 2.85 million—and many fans won’t be switching back and forth this year because the process of going from streaming to cable is too cumbersome. Netflix’s first NFL broadcast will begin at 1 p.m. Eastern Time when the Pittsburgh Steelers host the Kansas City Chiefs. The Baltimore Ravens will then travel to Houston to play the Texans for an afternoon kickoff starting at 4:30 p.m. Netflix has hired 22 media personalities for these two games. That includes on-air commentators like Ian Eagle, Nate Burleson, and JJ Watt for the Chiefs-Steelers game and Noah Eagle, Greg Olsen, Jamie Erdahl, and Steve Wyche for the Ravens-Texans game. It also includes a ton of pre and post-game studio analysts, like Kay Adams, Drew Brees, Robert Griffin III, Manti Te’o, and Mina Kimes in a Los Angeles Studio, as well as Laura Rutledge and the McCourty twins on-site for the game in Pittsburgh. The Athletic is reporting Netflix is paying talent between high five and low six figures depending on the role, with on-air game commentators getting paid on the higher end. Netflix is also spending millions more on its halftime shows, paying Beyonce and Mariah Carey for live and pre-taped performances in Pittsburgh and Houston. Netflix wants its NFL Christmas Day games to feel special, like a Super Bowl. But this is also the perfect example of the company’s changing strategy toward sports. Netflix has long said it wasn’t interested in live sports rights. At this point, there are a million quotes out there, but the consensus within the company was that these media rights were too expensive and did not help with long-term profitability. Instead, Netflix danced around the corners. Sure, they held live sporting events, but these were one-off competitions designed to promote its existing slate of content. For example, last year, Netflix held a golf match between PGA Tour golfers and Formula 1 drivers in Las Vegas, promoting new seasons of Full Swing and Drive to Survive. Then came a live media rights deal with the WWE for Monday Night Raw, a blockbuster fight between Jake Paul and Mike Tyson, the NFL Christmas Day deal, and even an exclusive rights deal for the 2027 and 2031 FIFA Women’s World Cups. These deals look and feel differently than an exhibition golf match because they are different. After watching its subscriber growth stall for several consecutive quarters, Netflix introduced an ad-supported subscription tier to its larger offering last year. Netflix is still not interested in streaming random NBA or MLB games on Tuesday nights that draw a few hundred thousand viewers. But paying up for premium events like Christmas Day NFL games is perfect because they will generate tens of millions of viewers and already have advertising built into the viewing experience, allowing Netflix to show commercials to both ad-supported and regular subscription members. Netflix will earn a decent chunk of its money back by charging brands hundreds of thousands of dollars for 30-second commercials. The company will then use the remaining ad inventory to promote some of its other content, like season two of Squid Game, which conveniently (and intentionally) debuts the day after Christmas. This is great for the NFL because they get to perform a test with Netflix before committing to a larger media rights deal, and they also don’t lose much distribution, as Netflix now has more U.S. subscribers (85 million) than cable television (68 million). Netflix’s U.S. subscriber base is still smaller than that of broadcast television, but Netflix has significantly more reach when you add international subs (282 million). The big question on everyone’s mind is if Netflix can handle the traffic. The Jake Paul vs. Mike Tyson fight last month was consistently interrupted by streaming issues, and many people turned off the fight before it even began due to frustration. This is the worst-case scenario for the NFL. Sports fans are already upset enough that leagues have continued to bifurcate content while chasing profit, and that frustration will only grow if these streaming services produce worse broadcasts than fans expect. Netflix says it learned a lot from the Paul-Tyson fight and is ready for its $150 million NFL slate. The streaming company is also outsourcing game production to current NFL partner CBS, and NFL Media will handle the pre-halftime and post-game shows. My guess is that everything will run smoothly. Netflix has brought in the right partners to make it happen, and they have invested too much money to be plagued by the same issues in two consecutive events. However, investors may not even care. Despite poor production for the Jake Paul vs. Mike Tyson fight, Netflix’s stock saw a six percent bump the day after the event. This meant that one live event added over $20 billion to Netflix’s market cap. And it told us all we needed to know — Wall Street was more impressed with Netflix’s ability to attract 60 million households than it was with the company’s production problems. Ultimately, this is why the NFL is doing this deal. The $150 million price tag gets all the headlines, but the NFL is really using this to determine whether Netflix should receive a larger package of games when it renegotiates its media rights deal in 2030. If you enjoyed this breakdown, share it with your friends. Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not a subscriber, sign up and join 127,000+ others who receive it directly in their inbox each week. You’re currently a free subscriber to Huddle Up. For the full experience, upgrade your subscription.

© 2024 |

The Year in Memecoins

The Year in Memecoins