Investors Have Been Using Stocks To Hide From Inflation

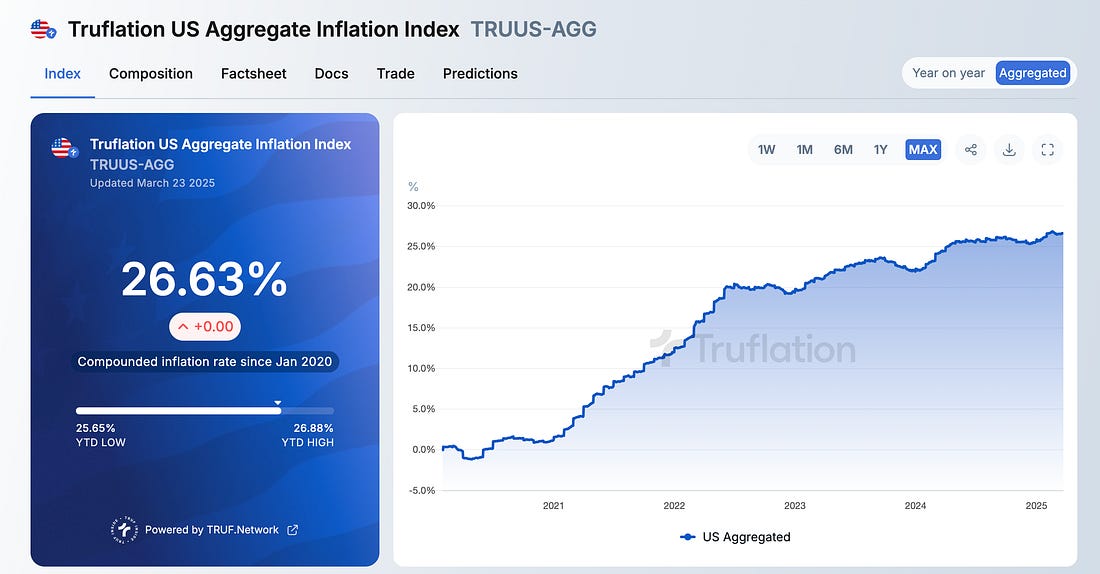

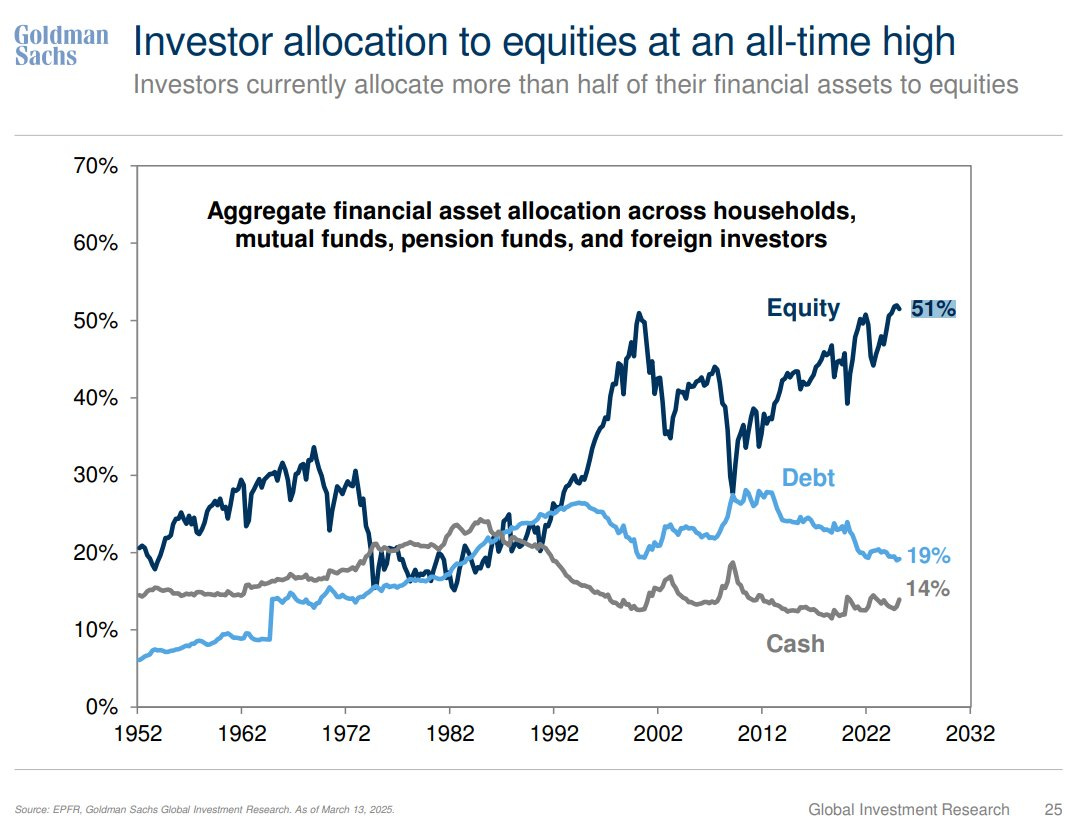

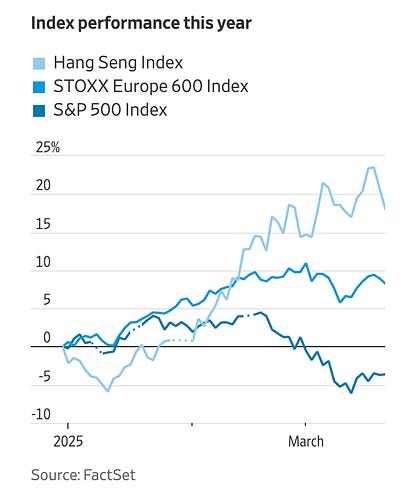

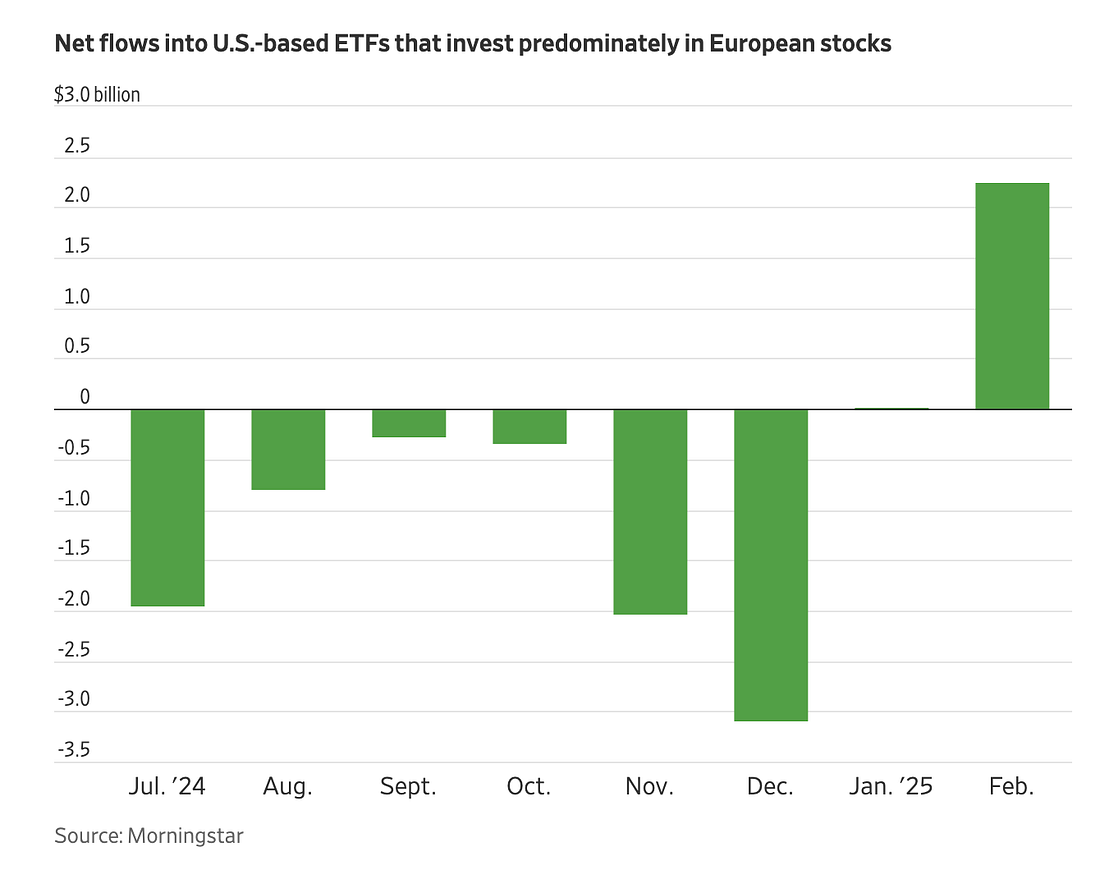

To investors, Ray Dalio said the famous phrase “cash is trash” on national television in 2020. He was warning market participants that inflation was coming and anyone sitting in US dollars would be destroyed by the currency debasement. Take a listen: Ray Dalio was right in hindsight. The Federal Reserve kept interest rates artificially suppressed at 0% for too long, while the government continued to print trillions of dollars in an effort to stimulate the economy. Inflation spiked to over 9% and the cumulative inflation since January 2020 has now topped 26%, meaning that $1 from 2020 can only buy $0.74 of goods today. This is the hidden tax that has destroyed the financial lives of many American families. According to Perplexity, approximately “40% of Americans have no investable assets, meaning they do not own stocks, bonds, mutual funds, or other financial instruments outside of cash or retirement accounts.” This 40% of Americans are the ones who got hurt the most when the dollar devalued by more than 25% over the last few years. They were sitting in cash and took the inflation on the chin. Brutal. This brings us to the other side of the story — Mike Zaccardi highlights that investor allocations to public equities is at an all-time high. So in a weird way, investors—both individuals and institutions—were listening to Ray Dalio and the other famed asset managers who were issuing warnings back in 2020. Capital has relentlessly poured into the public equity market and now more than 50% of aggregate financial assets are allocated to the stock market. This is good for the people holding stocks because they benefitted from the out of control inflation over the last half decade. But while asset owners were winning, those sitting in cash have been falling further behind — this is why the income inequality gap continues to widen. Rich get richer, poor get poorer. Things may be changing quickly though for these stock investors. Owen Tucker-Smith wrote an article in the Wall Street Journal over the weekend titled “Investors Who Were All In on U.S. Stocks Are Starting to Look Elsewhere.” He points out that non-US markets have been outperforming the S&P 500 year-to-date. Investors are going to chase performance. Momentum is a hell of a drug. And Tucker-Smith shows the recent inflows to US-based ETFs that invest in European public equities — investors are shoveling capital into these funds like their financial lives depend on it. So one of the big questions right now is whether investors should be allocated to US stocks or international equities. Depending on who you talk with, you will get a very different answer. Which brings me to the current conversation about stock valuations, tariffs, and the economic policies of the new administration. Could the stock market be overvalued right now? Maybe. Could a recession come? Maybe. Could the stock market recover and take-off to new highs like it did in 2020? Maybe. No one knows the future. It is all noise in my opinion. There will always be short-term gyrations in the market, but stocks are structured in a way where they have to keep going up over the long run. Don’t get distracted by the fear-mongering or the doomsday predictors. A broken clock is right twice a day. The dollar will lose purchasing power over decades. Assets like stocks, bitcoin, and real estate will keep pushing to new all-time high after all-time high. I like the K.I.S.S. method — keep it simple, stupid. Wall Street and finance like to make things confusing and complex. Don’t be one of the victims to complexity. Your portfolio will thank you in the future. – Anthony Pompliano Founder & CEO, Professional Capital Management Is A Recession Coming Soon? with Jordi VisserJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we discuss the Fed’s interest rate decision, stock market outlook, Tesla, AI, Nvidia, and how investors are approaching April 2. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |