Major League Soccer Expansion Fees Reach $500 Million

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 100,000+ others who receive it directly in their inbox each week. Today At A Glance:Major League Soccer announced a $500 million agreement with Egyptian billionaire Mohamed Mansour last week to bring an expansion team to San Diego. So today’s newsletter breaks down the details, including who’s buying the team, why expansion fees have increased so much, and the league’s future financial outlook. This newsletter is also available via podcast on Apple or Spotify. Enjoy! This Newsletter is Sponsored By ButcherBox!I’ve been ordering from ButcherBox for a few years now, and it’s the single best solution I’ve found to save time while guaranteeing the quality of your food. ButcherBox delivers 100% grass-fed grass-finished beef, free-range, organic chicken, humanely raised pork, and wild-caught seafood directly to your doorstep. Yes, it’s literally that easy — and it tastes incredible! So ditch the butcher lines today and guarantee the freshness of your meat with ButcherBox. And here’s the best part: If you sign up today, ButcherBox is offering all Huddle Up readers 2 lbs of ground beef for FREE every time they order over the next year. So sign up using the link below, and everyone in your household will thank you later. Friends, Major League Soccer has reached a $500 million agreement with Egyptian billionaire Mohamed Mansour to bring a team to San Diego, California. This will be MLS’ 30th team, and they will begin play in 2025 at the new 35,000-seat Snapdragon Stadium. Snapdragon Stadium Overview

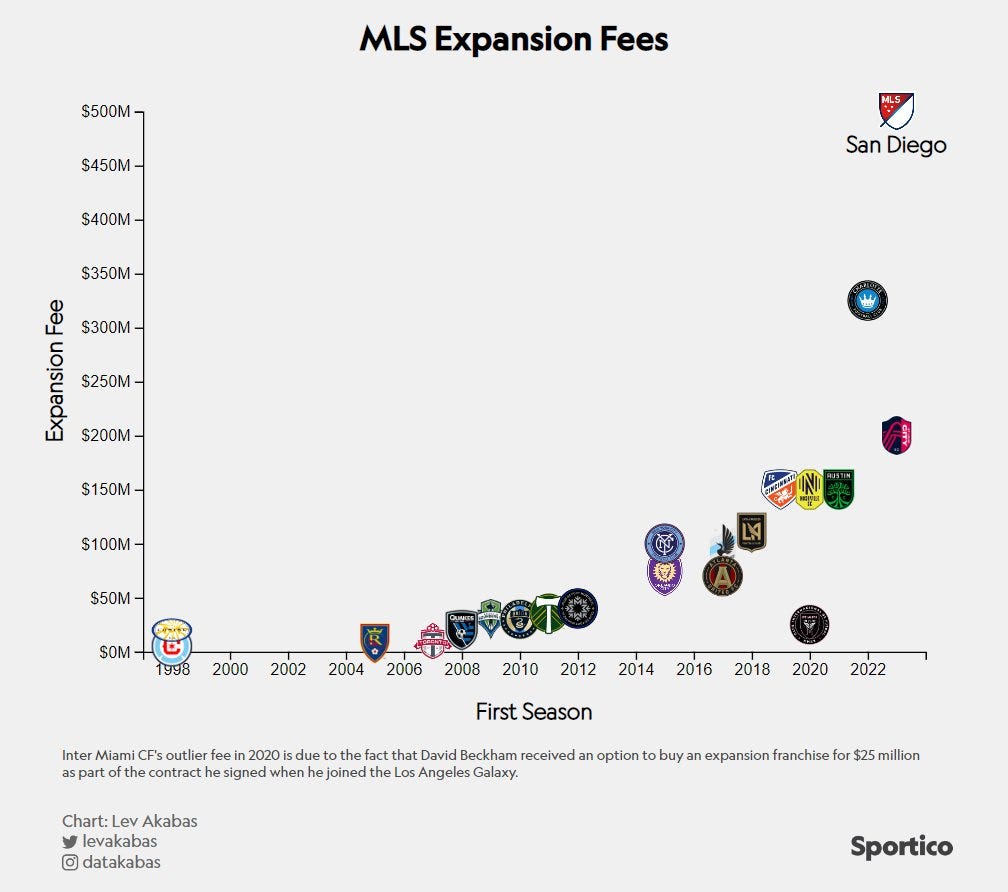

San Diego’s ownership group also includes the Sycuan Band of the Kumeyaay Nation — an Indian tribe living in San Diego for 12,000 years — and Manny Machado, an All-Star third baseman for Major League Baseball’s San Diego Padres. “We are thrilled to welcome San Diego to Major League Soccer as our 30th team,” MLS Commissioner Don Garber said on Thursday. “For many years, we have believed San Diego would be a terrific MLS market due to its youthful energy, great diversity, and the fact that soccer is an essential part of everyday life for so many people.” And while the newest MLS expansion team doesn’t currently have a crest or colors, team CEO Tom Penn said its name would be FC San Diego or San Diego FC. Now, we all knew MLS expansion was coming. The league has added 12 teams since 2015 alone, and commissioner Don Garber has routinely said their goal is to reach 30 to 32 teams eventually. And San Diego seems like a logical choice, too. The area is a hotbed for youth soccer. Last September, the San Diego Wave of the NWSL smashed the league’s attendance record with 32,000 fans at SnapDragon Stadium. And the Sycuan Band of the Kumeyaay Nation has been working with MLS for years to convert profits from its casino and hotel business into equity ownership of a San Diego-based expansion team. So MLS found them a partner in Mohamed Mansour — and the deal got done. Mansour is an Egyptian billionaire (living in London) who serves as Chairman of the Mansour Group, a family-owned global conglomerate with 60,000 employees, a presence in more than 100 countries, and total annual revenues exceeding $7.5 billion. But the interesting part of this announcement isn’t necessarily the details behind the owners, team, or city — it’s the economics behind MLS’ approach to expansion. For example, a $500 million expansion fee instantly makes San Diego’s MLS team more valuable than Premier League clubs like Newcastle United ($440 million), Leeds United ($380 million), Aston Villa ($370 million), and Crystal Palace ($335 million) — despite San Diego not having its own stadium or ever playing a competitive match. And San Diego’s $500 million expansion fee is 2.5x more than the $200 million fee St. Louis City SC paid last year, 5x more than the $100 million fee New York City FC paid in 2015, and 50x more than the $10 million fee Toronto FC paid in 2007. And when you add in the fact that San Diego will also have to spend another $100 million on a new training complex, many people are questioning the $500 million expansion fee. I mean, think about it this way. Not only does San Diego’s MLS team not own their own stadium — they are paying a lease to San Diego State University. But 68% of MLS teams (19/28) lost money last year, and the league’s $2.5 billion national media rights deal with Apple pays each MLS club just $8 million annually — a fee that won’t be increasing for at least another nine years (until the Apple deal is up).

So what exactly is going on here? If MLS teams aren’t making any money, and media rights are fixed for the next decade, why are team valuations increasing so much? Well, it comes down to a few different reasons. First, the average Major League Soccer team currently trades at a 10x revenue multiple, which is significantly higher than the NBA (8.4x), NFL (7.6x), MLB (7.4x), and NHL (5.0x). This means investors are willing to pay a premium for MLS assets because they believe MLS has a higher (long-term) financial upside than the other leagues. Secondly, MLS is a closed system. So, unlike the Premier League, which sends its bottom three teams down to the second-tier division every year, each MLS team is guaranteed their sport for the foreseeable future, regardless of performance. Naturally, this creates scarcity in the asset. But more importantly, it ensures future revenue streams and puts a financial cap on long-term costs like player salaries. For example, when a team is relegated from the Premier League to the Championship after finishing in the bottom three, it’s estimated to cost them more than $200 million in revenue the following season, most of which comes through a loss in TV revenue. But most importantly, there are strong tailwinds for US soccer. Youth participation has increased by more than 10% over the last decade, with nearly 25 million people in the US playing some form of soccer last year. And with the World Cup coming to North America in 2026, many investors are betting this trend will only get stronger. If you enjoyed this breakdown, please consider sharing it with your friends. My team and I work hard to consistently create quality content, and every new subscriber helps. I hope everyone has a great day. We’ll talk later this week. Interested in advertising with Huddle Up? Email me. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Want More Detailed Sports Business Breakdowns? Subscribe To JPS.The Joe Pomp Show is a 3x weekly podcast where I break down the business and money behind sports. Think of it as the same high-quality work you read here, just deeper. There are also exclusive interviews with people like Dana White, Lance Armstrong, and Troy Aikman, and you’re guaranteed to learn something new. Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 100,000+ others who receive it directly in their inbox each week.

© 2023 |