Markets Love Reflexivity And So Do Investors

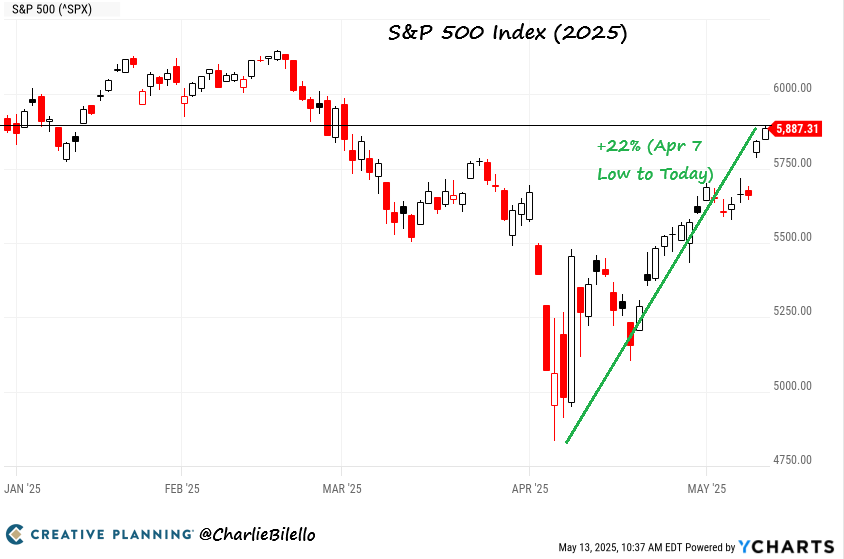

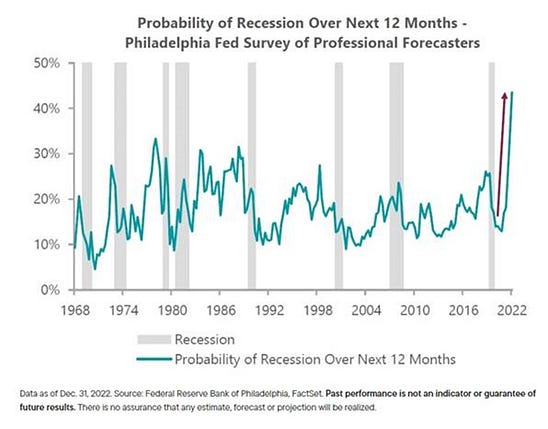

To investors, Humans are full of fear and greed. They get over-excited in the good times and they run in fear during the bad times. This is a story as old as time. You can’t change human nature, therefore you can’t change markets. So the only thing you can do is study history to be prepared for the future. That is why I posted on X on April 6th two words: Study reflexivity. Reflexivity is one of the core concepts embraced by every great investor I know. “Reflexivity can lead to self-reinforcing cycles where positive market sentiment or expectations cause prices to rise, attracting more buyers and further driving up prices. Conversely, negative sentiment or pessimism can lead to price declines, further discouraging buyers and intensifying the downward trend.” This is exactly what we just lived through. Investors became fearful, so they started selling assets. As they sold assets, the fear became contagious and more people started predicting doom and gloom, which led to more selling of assets. But nothing was fundamentally changed about the market or the underlying financial assets. As soon as people perceived good news in the market, the exact opposite played out. Optimism and enthusiasm returned, which led to significant buying, which drove stock and crypto prices higher. What a beautiful thing to watch as a student of investing. Creative Planning’s Charlie Bilello writes “After a 22% rally from the April 7 lows, the S&P 500 is now up on the year. One of the biggest short-term comebacks in market history.” This is interesting to see because it essentially proves the old adage of buy when everyone is scared and sell when everyone is excited. Following the crowd can be a very dangerous strategy. Charlie points this out further by reminding everyone that the probability of a recession hit the highest in history back in 2023, yet we never got the recession that everyone believed was coming. Investing is hard. You are trying to predict what will happen in a complex system that changes dynamically day-to-day. The difficulty involved, plus the objective scoreboard, is what attracts so many smart, hard-working people. They want to capture the economic incentive for figuring out the puzzle. But obviously most people are not good at a difficult game. So be very careful listening to the consensus view. I explained yesterday how I knew the crowd was wrong earlier this year, along what gave me confidence to predict stocks would recover in a breathtaking fashion. The simple idea is that economists were all in agreement about economic pain coming. I have a simple framework — every time economists 100% agree on something, I take the other side. The reason is that economists almost never agree on things, so when they do it generally means that dissent has been outlawed. If dissent is outlawed, then you know the thing being outlawed is probably true. You shouldn’t be a contrarian for the sake of being contrarian. But it does help to have healthy skepticism of academics when discussing markets. They don’t have true skin-in-the-game, so their feedback loop is less than ideal. Market participants on the other hand have a punishment for being wrong. Plenty of people lost money so far this year, but many people were making money as well. Winners and losers in a meritocracy. There is nothing better than capitalism. And now we have stocks in a bull market and bitcoin inching closer to the previous all-time high. I would expect asset prices to continue to do very well through the end of 2025. Sit back and enjoy the positives of reflexivity. We will visit fear and doomsday predicting again at some point in the future, but thankfully that is behind us for awhile. Hope you all have a great day. I’ll talk to you tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management Is Wall Street Surrendering To Bitcoin?Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss bitcoin, the economy, why everyone screaming about tariffs was wrong, what the signals were, China, UK, trade deals, stock market, and future outlook. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |