Monday Mining Metrics: Hashrate Growth is Slowing

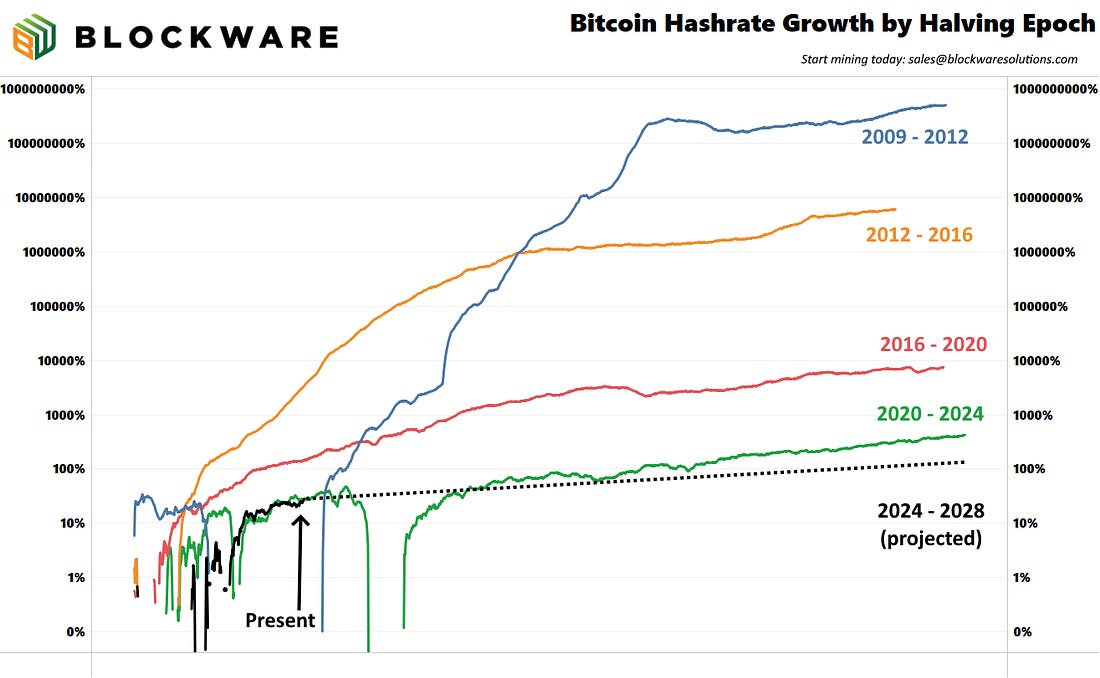

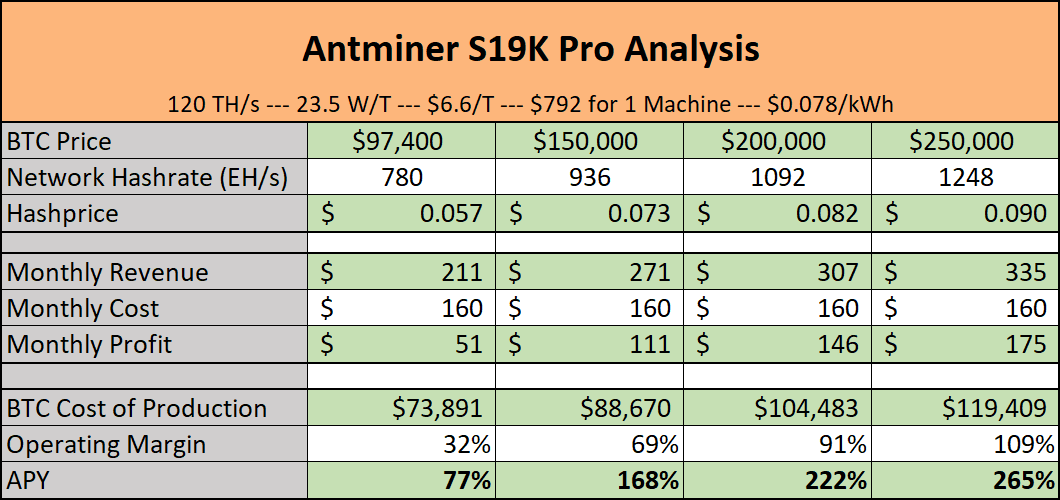

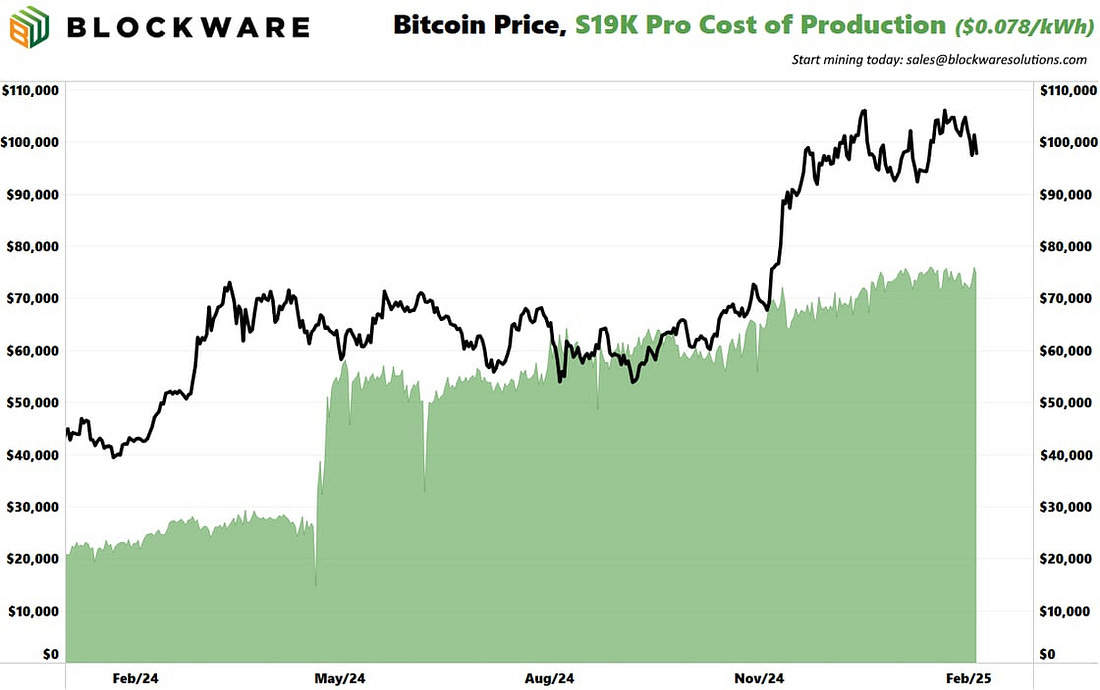

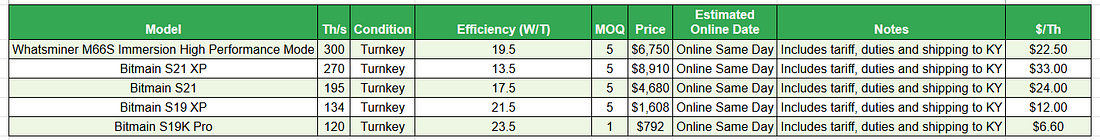

Hashrate Growth Slowing Down The Bitcoin hashrate has increased by ~29% since the halving in April of 2024. This halving epoch is on pace for the lowest increase in difficulty across all epochs. Hashrate growth is slowing and here’s why: > Marginal efficiency gains in ASICs are diminishing > Energy production is the primary limiting factor for hashrate growth > AI / HPC as an alternative method of energy monetization This trend is BULLISH for Bitcoin miners. Less hashrate growth = less competition = higher profit margins for miners. In Q3 of 2024 we published a report which provides an in-depth analysis of this trend, the relationship between the Bitcoin price and Bitcoin hashrate, and how this impacts Bitcoin miners. Click the link below to download and read that report. https://mining.blockwaresolutions.com/report “Buy When There’s Blood in the Streets” This is arguably the best ‘Deal of the Week’ offer in the history of the Blockware Marketplace. A distressed seller has listed hundreds of Antminer S19K Pro’s at $6.6/T. – $6.6/T – $792 per unit – $74,000 BTC Breakeven Price While the efficiency of the K pro pales in comparison to newer hardware like the S21 XP, the low up-front cost makes this a very attractive opportunity. Here’s a breakdown of the K pro based on current BTC price, difficulty, and an electricity rate of $0.078/kWh: With an APY of 77% under current market conditions, this is the best deal in Bitcoin mining right now. If Bitcoin hits $150,000 by the end of this year (assuming a 1% increase in mining difficulty for every 2% increase in the Bitcoin price), these K Pro’s will achieve a full ROI in 2025. The trade-off is that these machines have slimmer operating margins; 32% under the current market conditions. However, if you’re bullish on BTC over the next twelve months, then you should expect these margins to increase. Even if you’re concerned about BTC price action in the near-term, these machines have plenty of breathing room profitability-wise. In order for these machines to operate at a loss, mining difficulty would have to increase by more than 30% without any move up in the Bitcoin price. At $0.078/kWh, the S19K Pro is profitable so long as hashprice remains above $0.043/Th/Day. Since the 2024 halving, hashprice has only spent a handful of days at or below that level. Blockware’s Mining-as-a-Service enables you to start mining Bitcoin, without lifting a finger. Blockware handles everything, from securing the miners, to sourcing low-cost power, to configuring the mining pool – they do it all. With multiple data centers across the US, Blockware is the most reliable mining partner in the industry. Click here to check out our Marketplace where you can see real-time analytics on our miners, and make an immediate purchase using BTC or fiat. If you’d like a more hands-on mining experience, fill out this form on our website. One of our Account Executives will be in touch and they can walk you through our entire product and service offerings! The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here. All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. You’re currently a free subscriber to Blockware Intelligence Newsletter . For the full experience, upgrade your subscription.

© 2025 Blockware Solutions |