Monday Mining Metrics: The Biggest Year in Bitcoin Mining History

Monday Mining Metrics: The Biggest Year in Bitcoin Mining HistoryBitcoin Mining Update – 2/18/2025

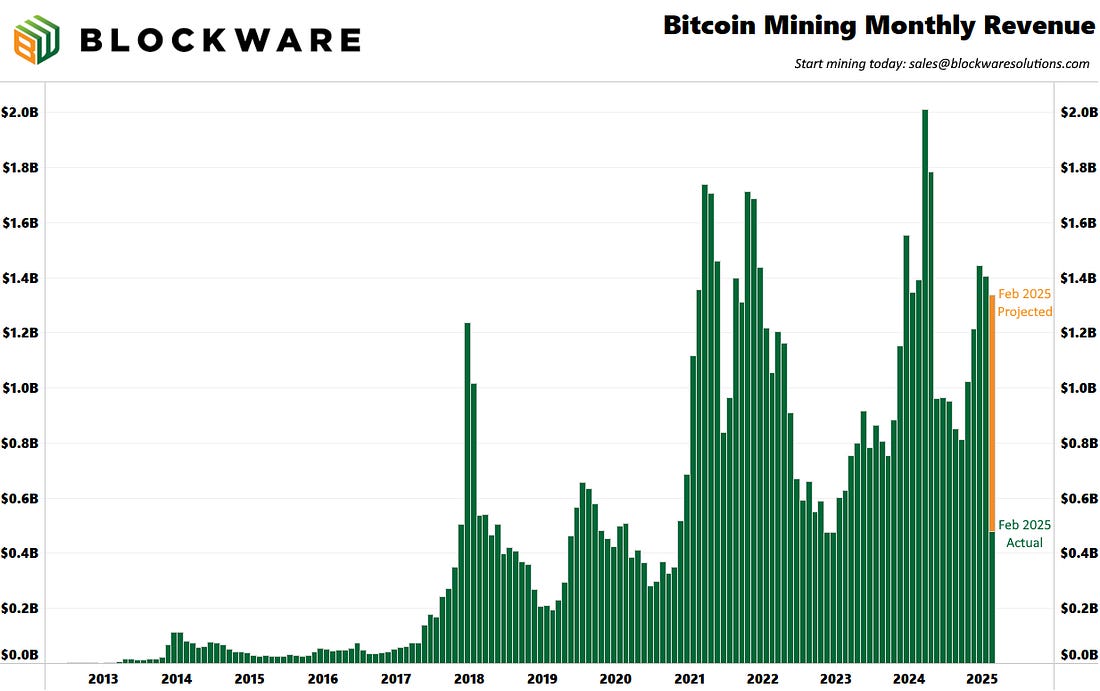

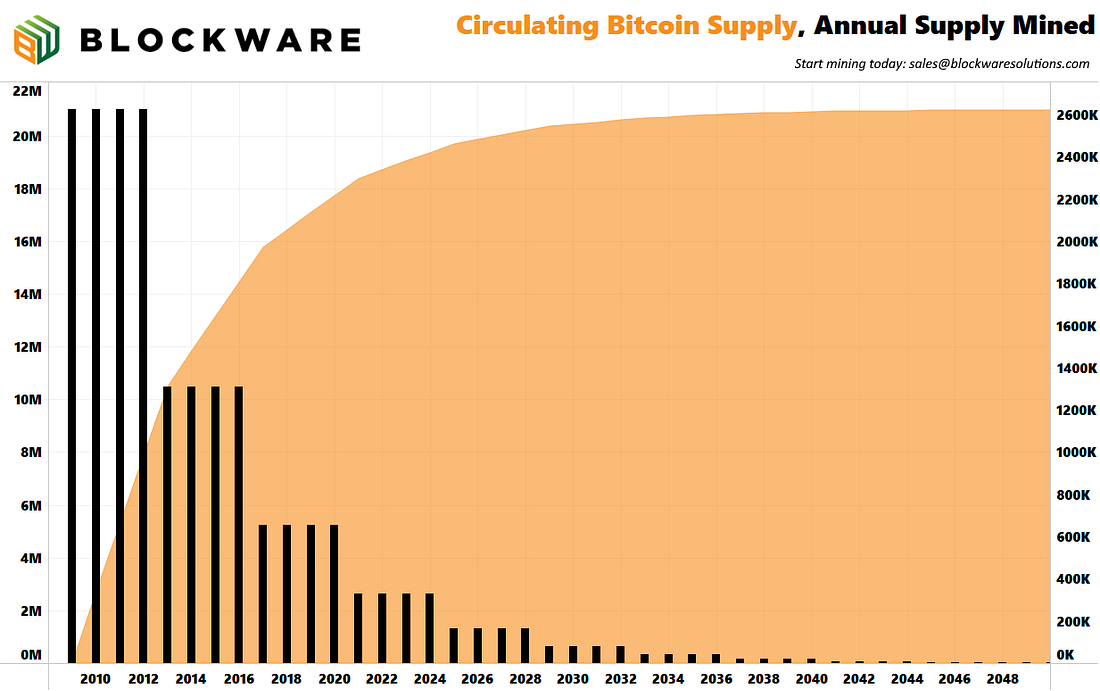

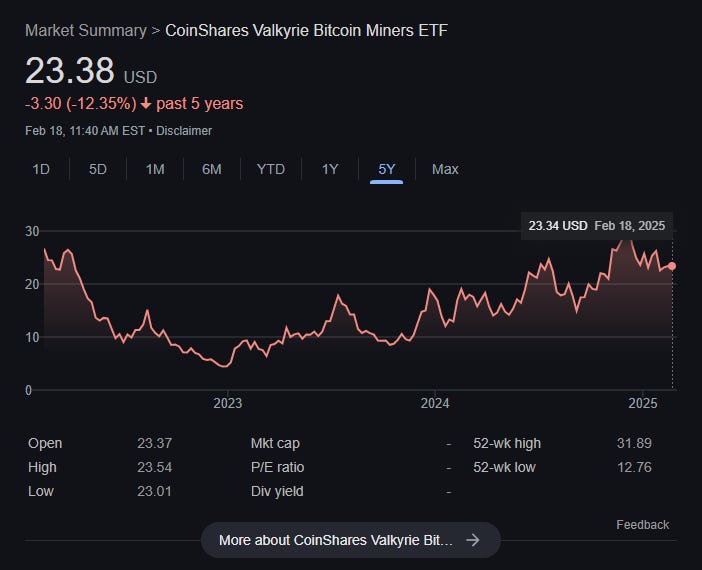

Become a Premium Subscriber This newsletter is FREE for all subscribers. However, if you want to receive an in-depth analysis into ALL things Bitcoin, Stocks, Bonds, Macroeconomics, etc., consider becoming a premium subscriber for $15/month. The Biggest Year in Bitcoin Mining History Many people feel as if they “missed the boat” when it comes to mining – but the data doesn’t support this. 2025 is on pace to be the highest grossing year for Bitcoin mining in history. In January, miners earned a combined ~$1.4 billion in revenue. In fact, future generations will likely look back on this era (2020 to 2036) as the “golden age of Bitcoin mining.” In the early days of Bitcoin, mining was very “rag tag.” It was mostly people running a handful of GPUs in their house. Now it’s a far more mature industry, with world-class data centers dedicated specifically to Bitcoin mining. Moreover, the Bitcoin bounty that miners are competing for is still relatively high (3.125 BTC every ten minutes). After the 2036 halving, miners will be competing for less than half a bitcoin every ten minutes. Between 2025 and 2032, roughly 1,000,000 BTC will enter circulation via mining. After the 2032 halving, it will take more than 100 years to mine the remaining ~328,000 BTC. The next few years are crucial – there’s a lot of Bitcoin up for grabs. Public Mining Stocks vs Private Bitcoin Mining When it comes to getting exposure to Bitcoin mining, the two main options an investor has are to purchase the stock of publicly traded Bitcoin mining companies, or to purchase the actual machines themselves (private mining). The underlying business of Bitcoin mining is fundamentally a “high beta” play on Bitcoin itself. When the price of Bitcoin increases, mining profit margins increase significantly. However, the stock performance of many public Bitcoin mining companies is not reflective of this reality. Bitcoin itself is up nearly 100% since this time last year, but $WGMI, the miner ETF, is up just 28%. While this is good in comparison to the S&P 500 or treasury bonds, it’s bad in comparison to Bitcoin – and it’s definitely NOT “high beta.” Private miners, on the other hand, have performed extremely well over the past year – despite the block subsidy being cut in half last April. In the chart below we track the returns of a private Bitcoin miner with the following set up:

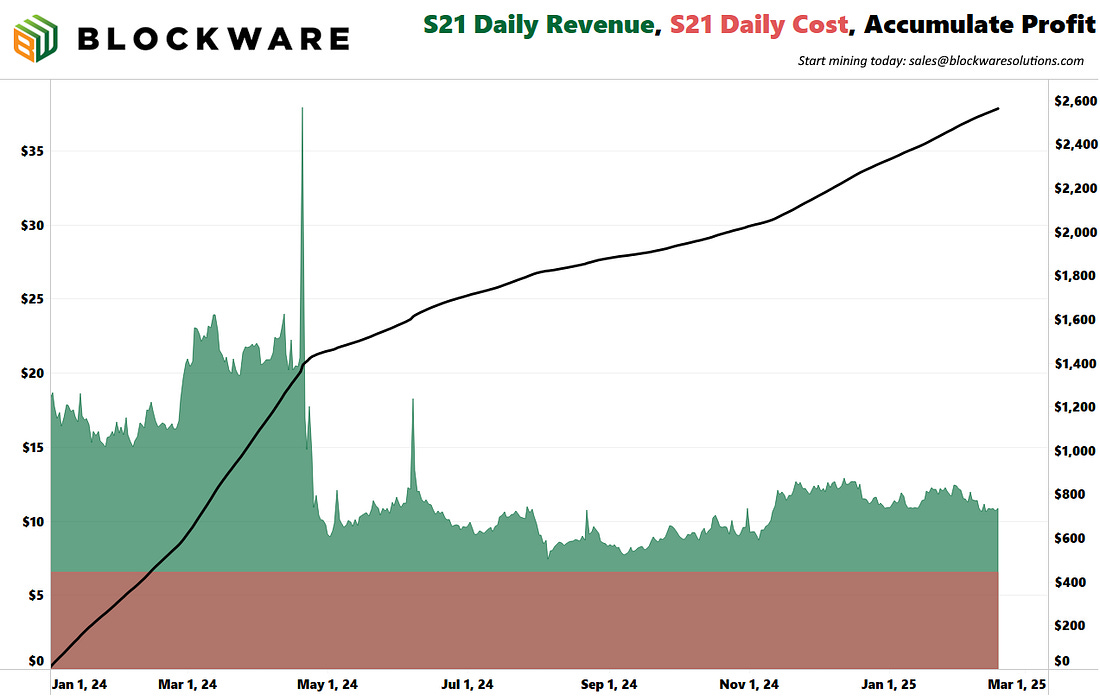

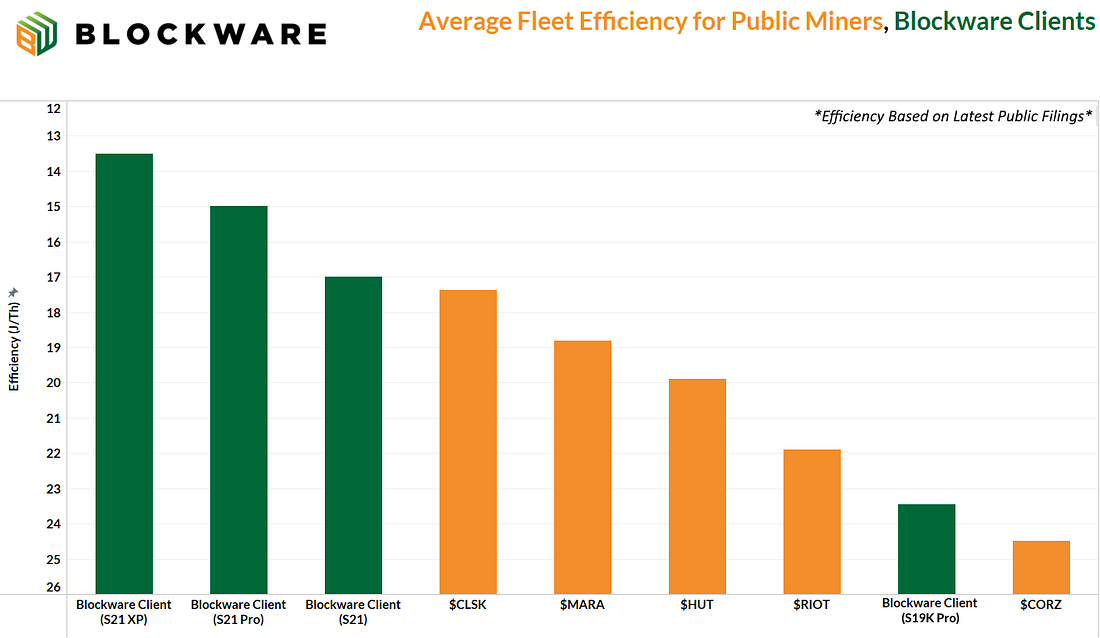

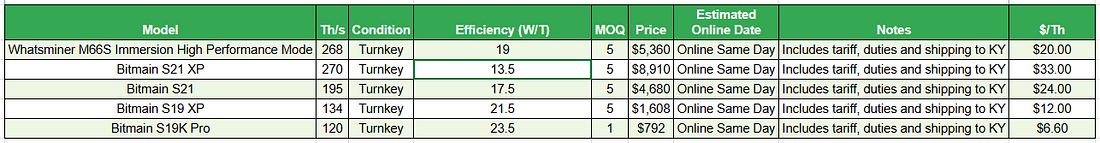

Assuming this miner sold just enough of the Bitcoin they mine every day in order to pay for their electricity consumption, and didn’t sell anymore, over the past 13.5 months they have accumulated ~$2,500 in profit. This means they’ve re-couped 47% of the price they paid for the machine! The numbers are even better when you factor in the re-sale value of the machine. The going-rate for Antminer S21’s right now is ~$4,800. So when you include that into the calculation, you’re looking at ~$7,300 in total assets from a $5,400 initial deployment. This is a phenomenal return in just over a year’s time. With still more than 3 years until the next halving, the S21 will continue to accumulate profits every single day for the foreseeable future. Another area in which private Bitcoin miners have a leg-up on public miners in terms of machine efficiency. Due to the size of public mining operations it is difficult for them to off-load older, less efficient miners. Private miners, on the other hand, have far more flexibility when it comes to the hardware they use. This results in private miners having more efficient mining fleets on average. The chart below shows the efficiency of private miners compared to the average efficiency of public miners. Blockware’s Mining-as-a-Service enables you to start mining Bitcoin, without lifting a finger. Blockware handles everything, from securing the miners, to sourcing low-cost power, to configuring the mining pool – they do it all. With multiple data centers across the US, Blockware is the most reliable mining partner in the industry. Click here to check out our Marketplace where you can see real-time analytics on our miners, and make an immediate purchase using BTC or fiat. If you’d like a more hands-on mining experience, fill out this form on our website. One of our Account Executives will be in touch and they can walk you through our entire product and service offerings! The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here. All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does not consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. You’re currently a free subscriber to Blockware Intelligence Newsletter . For the full experience, upgrade your subscription.

© 2025 Blockware Solutions |