Netflix Is Dominating Sports Without Live Rights

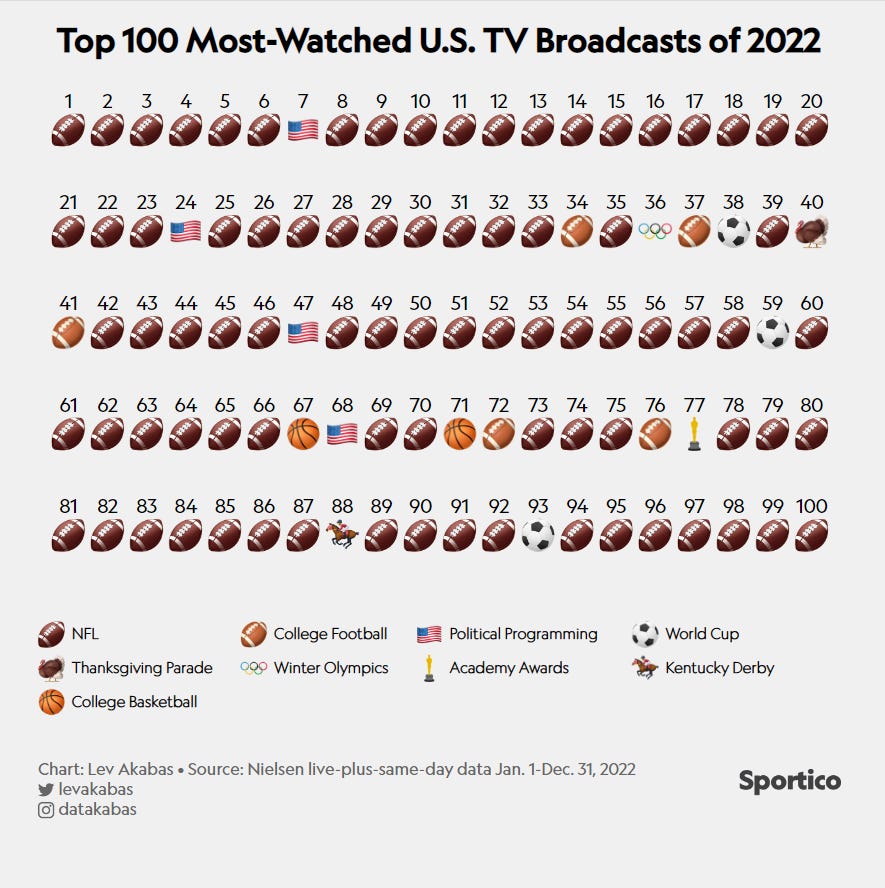

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 93,000+ others who receive it directly in their inbox each week. Today At A Glance:Netflix has confirmed that both Full Swing and Break Point have been renewed for a second season. Between F1, golf, tennis, cycling, and others, Netflix has quickly become a major sports player — all without investing a single dollar in live rights. Today’s newsletter breaks down their strategy, including the quantifiable impact of a viral sports documentary and what the world’s largest streaming service might do next. Today’s Newsletter Is Brought To You By Sorare!Sorare is one of the fastest-growing companies in sports. Backed by superstar athletes like Lionel Messi, Kylian Mbappé, Rudy Gobert, Aaron Judge, and Serena Williams, they have built blockchain technology that allows fans to collect officially licensed NFT-backed player cards. Sorare, which started in Europe with fantasy football games, recently launched exclusive licensing deals with the MLB/MLBPA and NBA/NBPA to create a custom fantasy game for each sport. The concept is simple: Sorare lets you buy, sell, trade, and earn digital trading cards of your favorite players. But rather than just looking at them as a digital collectible, you can use these trading cards to enter fantasy sports competitions for prizes & rewards. So use my link below for a free limited card — it’s free to get started! Friends, With about 35 million households dropping cable TV over the last several years, many believe just two things are holding the cable bundle together: live news and sports. For example, many of you probably know that live sports accounted for 94 of the Top 100 most-watched U.S. TV broadcasts in 2022. And the remaining six slots were filled by political programming, the Thanksgiving Parade, and the Academy Awards. This sports-dependent approach has ignited a war between cable TV providers and streaming services. The dilemma is simple: cable TV providers have to continue paying higher and higher fees for sports rights because it’s the last thing holding their bundle together, while streaming services have started to increasingly try to steal these live sports rights as their balance sheets grow and the opportunity to steal market share increases. For example, Amazon Prime recently agreed to pay the NFL $10 billion over the next decade for exclusive rights to Thursday Night Football. ESPN+ now offers more than 22,000 live events each year, including an exclusive NFL International Series game and pay-per-view access to the UFC. And other services like Paramount+ (Champions League) and Peacock (Premier League and WWE) have also invested billions of dollars. This has been great for sports leagues, of course. The NFL recently doubled the value of its broadcast rights when it signed new agreements with CBS, NBC, Fox, ESPN, and Amazon that are collectively worth $110 billion over 11 years. MLS also recently increased its annual rights fee from $65 million to $250 million through an exclusive deal with Apple TV+, and the NBA is expected to triple its media deal from $25 billion to $75 billion when its current agreement lapses in 2024-25. Annual Rights Fees For Major US Sports Leagues

But still, there is one major streaming service that hasn’t gotten involved: Netflix. Netflix is the world’s most popular streaming service. They have 230 million subscribers in 189 countries. The business generated more than $30 billion in revenue last year. Customers spend an average of 3.2 hours each day consuming content on the platform, and Netflix is responsible for 8% of all video viewing time globally. So many people are surprised that they have sat back and watched their competitors spend billions of dollars on exclusive live sports rights. They have the money, and the consumer demand is clear, so why haven’t they expanded their offering? Well, it’s complicated. Netflix has placed a premium on original content — they’ll spend $7 billion on its own originals in 2023 — and co-CEO Ted Sarandos told Deadline last December that he doesn’t see live sports as a profitable endeavor.

But just because Netflix hasn’t jumped into live sports doesn’t mean the company is not in sports. Instead, they have just taken a different approach. For example, Netflix currently has 55 original sports documentaries available in the United States. That includes original multi-season docuseries like Formula 1: Drive to Survive (5 seasons) and Last Chance U (5 seasons), and it also includes individual award-winning documentaries like The Last Dance and Icarus. Notable Netflix Sports Documentaries

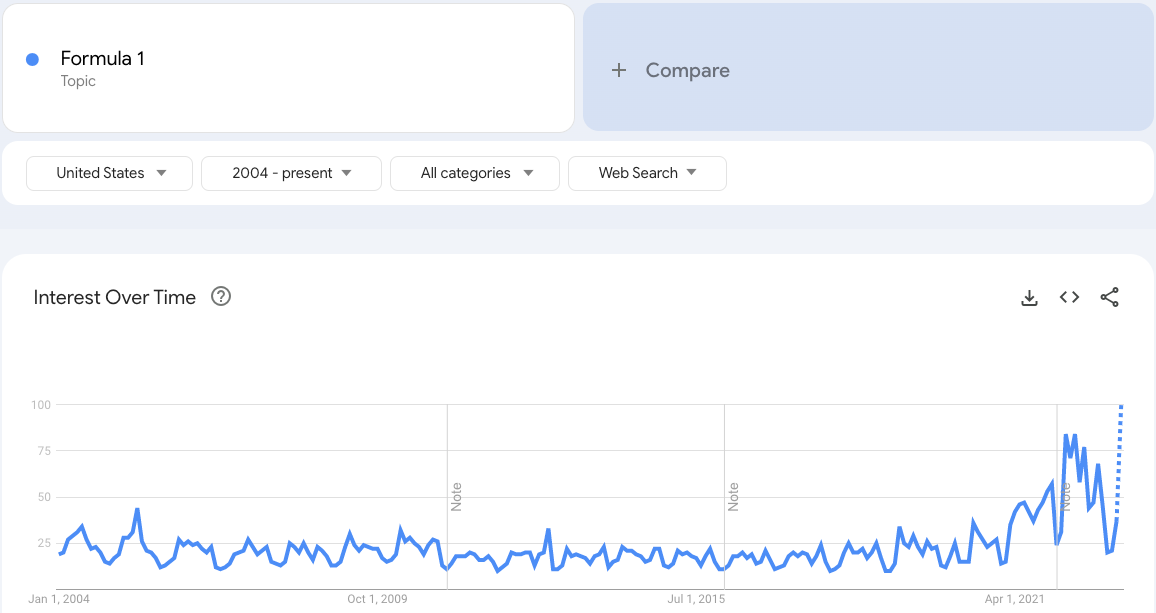

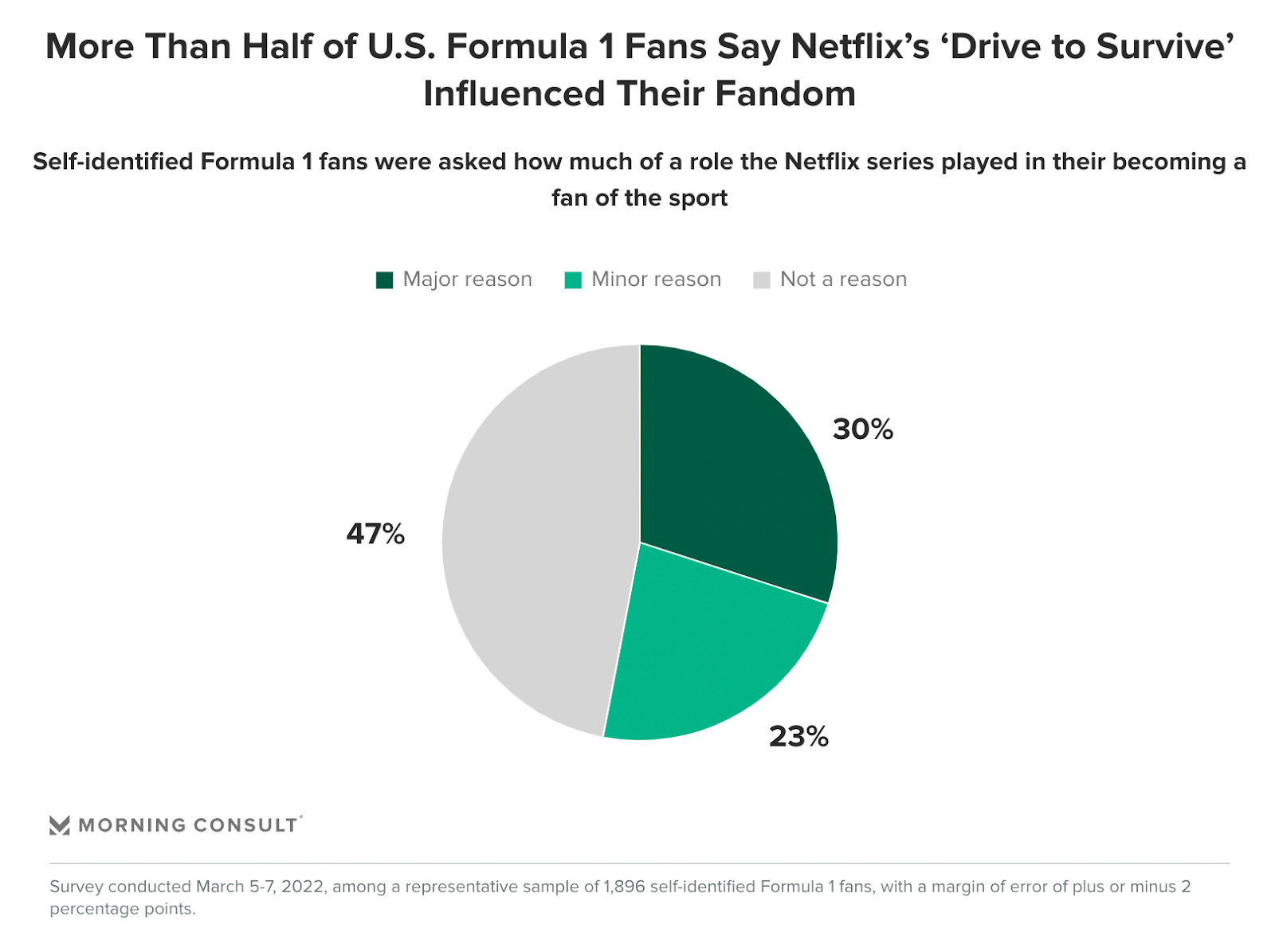

And the beauty behind this style of content is that it creates a win-win, both for Netflix and the individual leagues and teams they are working with. Take Formula 1, for example. The first season of F1: Drive to Survive was released on Netflix in 2019. It provided an inside look at the drivers and their rivalries for the first time ever, and with season 4 of the series reaching Top 10 viewership on Netflix in 56 different countries last year, they are already working on season 6 as we speak. And the impact of this series isn’t subjective; there is plenty of data to back it up. Furthermore, according to a recent Morning Consult survey, 53% of U.S. F1 fans say Netflix’s Formula 1: Drive to Survive influenced their fandom, with 30% of those fans saying the show was a major reason. And the show has directly impacted F1’s financial growth and popularity. For example, F1’s average U.S. viewership has doubled since the release of F1: Drive to Survive in 2019, from an average of 671,000 viewers to 1.2 million viewers per race. F1 Average U.S. Viewership (2017-2022)

This increase in viewership helped F1 secure a new TV rights deal with ESPN worth $75 to $90 million per year — up from $15 million annually. And in-person demand is so high — US Grand Prix attendance has doubled — that F1 has also increased the number of US races from one to three, with races recently being added in Miami and Las Vegas. U.S. Grand Prix Weekend Attendance (2018 & 2022) But most importantly, the average age of a Formula 1 fan has dropped dramatically.

Joe Pompliano @JoePompliano

The average age of a Formula 1 fan has dropped from 36 years old in 2017 to just 32 years old today. That’s better than the MLB (57), NFL (50), NHL (49), and NBA (42). The digital-first approach being deployed by Liberty Media continues to produce impressive results.

1:47 PM ∙ Nov 22, 2021

5,183Likes519Retweets

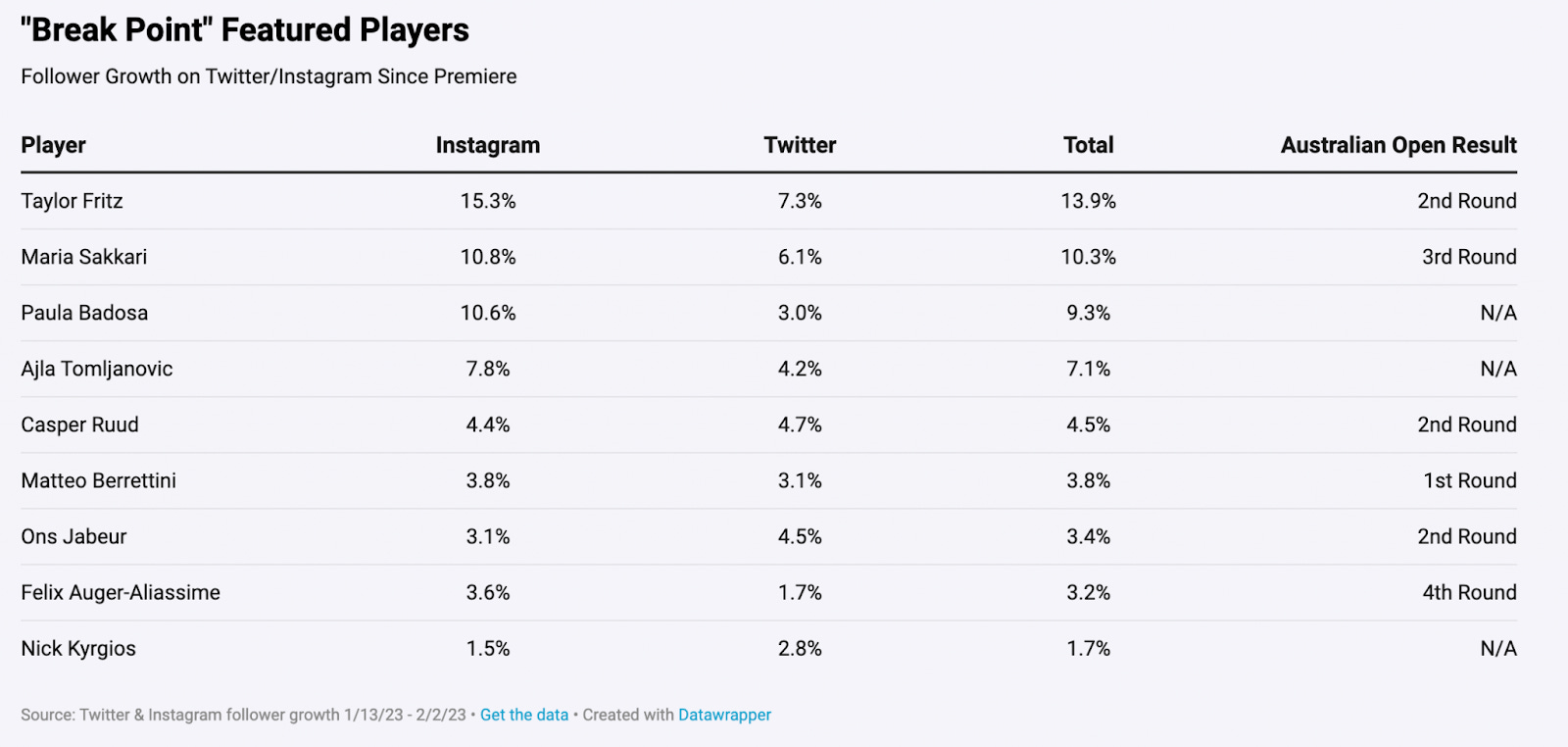

I could go on and on, but I think you get the point: Netflix has worked with Formula 1 to develop compelling content, and it has paid off incredibly well financially. In fact, the content-first strategy has worked so well that many sports are now trying to run the same blueprint. For example, Netflix recently released Full Swing and Break Point, two docuseries similar to F1: Drive to Survive that provide a behind-the-scenes look at the life of professional golfer and tennis player, respectively. The data on these shows is sparse because they are relatively new. But Full Swing has consistently been in the Netflix top 10 worldwide, while Break Point has led to substantial social media growth for its participants, and Netflix has already announced that both shows will be renewed for a second season.

And Netflix isn’t stopping there. They also have an 8-part docuseries about The Tour de France coming out this year, and they recently announced that NFL quarterbacks Patrick Mahomes, Kirk Cousins, and Marcus Mariota were mic’d up the entire 2022 season for a new series called “Quarterback” that will debut on Netflix this summer. So my point is simple: while virtually every other major streaming service is spending billions of dollars on live sports rights, Netflix has quickly become one of the most critical players in sports — all without spending a single dollar on live rights. Of course, these documentaries aren’t cheap to produce, and Netflix is ultimately just driving more viewers to the networks that actually own the live rights. So maybe they eventually try to pair documentary-style content with broadcasting rights (think F1 races and Drive to Survive). But regardless, their strategy is working, and there is no reason to believe Netflix will change it anytime soon. If you enjoyed this breakdown, please share it with your friends! I hope everyone has a great day. We’ll talk on Friday. Interested in advertising with Huddle Up? Email me. Your feedback helps me improve Huddle Up. How did you like today’s post? Loved | Great | Good | Meh | Bad Extra Credit #1: Japan Built One Of The World’s Best BallparksThe Hokkaido Nippon-Ham Fighters of the Japanese baseball league are opening their new stadium this month, and it will instantly be one of the world’s best ballparks. The 35,000-seat ballpark has a retractable roof, brewery, garden, and museum. There is a 12-room hotel in the outfield that goes for $1,000/night, and the stadium was designed by the same firm that did AT&T Stadium (Cowboys), SoFi Stadium (Rams/Chargers), and US Bank Stadium (Vikings). There is also an 80-acre city outside the ballpark, which takes inspiration from Truist Park in Atlanta and Busch Stadium in St. Louis.

Joe Pompliano @JoePompliano

The Hokkaido Nippon-Ham Fighters of the Japanese baseball league are opening a new stadium this month. It includes a 12-room hotel in the outfield that is open year-round, and rooms cost $1,000 per night. But most importantly, the view is INCREDIBLE. (Reddit: u/sofastsomaybe)

11:52 PM ∙ Mar 7, 2023

2,350Likes237Retweets

Extra Credit #2: The Multi-Billion-Dollar Business Behind GatoradeIf you missed Monday’s newsletter, which broke down the multi-billion-dollar business behind Gatorade, I also turned it into a thread that you can read below.

Joe Pompliano @JoePompliano

Gatorade was founded more than 50 years ago at the University of Florida. They now do over $6 billion in annual revenue (4x more than their biggest competitor). And the scientists that invented the drink signed a royalty deal that made them billions. Here’s the story 👇

5:06 PM ∙ Mar 7, 2023

6,583Likes896Retweets

Huddle Up is a 3x weekly newsletter that breaks down the business and money behind sports. If you are not already a subscriber, sign up and join 93,000+ others who receive it directly in their inbox each week.

Read Huddle Up in the app

Listen to posts, join subscriber chats, and never miss an update from Joseph Pompliano.

© 2023 |