Onchain-ing Everything with RWAs

Born in 2011, Kraken is the industry-leading crypto exchange in security and transparency. Verify the backing of Kraken’s reserve assets thanks to regular Proof of Reserves audits. Dear Bankless nation, After a breakthrough bull run for crypto, the industry has turned a bit insular as times have gotten bearish — but there are still a multitude of untapped opportunities outside our trustless comfort zone. Today, the Bankless team digs into the catchall of Real World Assets (RWAs), which represent an incredibly broad suite of off-chain investments ripe for tokenization — and a potentially massive opportunity for DeFi. We imagine a future where everything goes on-chain, read on. – Bankless team Onchain-ing Everything with RWAs

Real World Assets (RWAs) have always been the black sheep of DeFi. To many industry pundits, including some of my esteemed fellow analysts at Bankless, the thought of incorporating trust assumptions into crypto protocols is a nauseating, gut-wrenchingly horrid abdication of crypto values. Lenders have minimal transparency into firms borrowing from unsecured facilities and must rely on the assessments of loan underwriters. Real estate collateral backing many RWA loans is infinitely less liquid than even the smallest cap crypto tokens. Tokenization of stocks, bonds, deeds, mortgages, and whatever other TradFi instrument you can think of just isn’t very sexy and bridging them on-chain requires even more trust assumptions! A recent series of unfortunate defaults has plagued the industry’s largest credit protocols, including TrueFi and Maple Finance, leaving RWA bears invigorated that maybe just maybe this is the time crypto finally swears off the sector writ large. Unfortunately, I’m here to quash these silly dreams: not only are RWAs here to stay, they will come to dominate the crypto industry. For the uninitiated looking to better understand unsecured lending protocols (a major component of this article), I suggest catching up with Bankless’s Ultimate Guide to Undercollateralized Lending in DeFi before diving in! Nothing Actually FailedAlameda is due to repay over $12M to lenders on TrueFi today. Spoiler alert: they won’t!

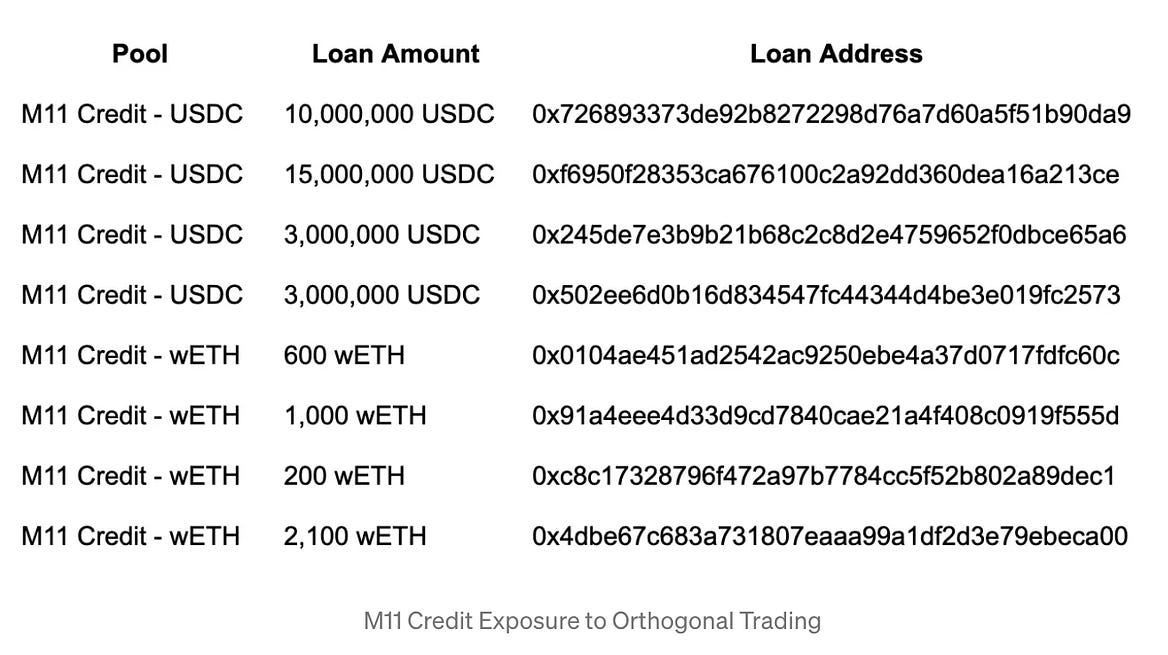

M11 Credit moved all of its outstanding Orthogonal Trading loans on Maple Finance into default after discovering material misrepresentation of the crypto hedge fund’s financials. These loans totaled to 31M USDC and 3.9k WETH, worth a combined $36M at the time of analysis.

While these two incidents of default are the most high-profile, they are not the only ones. A litany of less notorious borrowers have defaulted over the course of 2022.

TrueFi @TrueFiDAO

TrueFi $BUSD Pool Update: TrueFi issued a notice of default to Blockwater for non-payment on its $3.4m restructured loan NWH/Invictus entered a Cayman voluntary liquidation proceeding and may not repay its $1.0m loan due 10/30 Bastion has repaid its $10m loan due 10/4 in full

8:05 PM ∙ Oct 9, 2022

55Likes7Retweets

Yet I claim that nothing went wrong… Have I lost all of my credibility yet, anon? Stay with me here! While this statement may seem ludicrous at face value, really digest what I am saying: Default is EXPECTED on unsecured loans. Lending money to borrowers who do not pledge collateral in exchange is a fundamentally risky activity! DeFi is typically associated with the overcollateralized flavor of lending protocol (i.e., Aave and Compound). We EXPECT these protocols to liquidate unhealthy positions every time, without fail. Bad debt incurred by Aave as the result of a CRV short blow-up by the unexpected release of a whitepaper for an in-house stablecoin was 👌’uge👌 news.

Aave @AaveAave

2/6 A large CRV borrow that had been building up for the last week was mostly cleared by the protocol liquidation process. However, the position was not covered entirely & 2.64M CRV (≈ $1.6M at current value) remains. This represents < 0.1% of the borrows on the protocol.

9:34 PM ∙ Nov 22, 2022

144Likes9Retweets

Aave was never in jeopardy of insolvency and was able to easily bridge over the bad debt. Yet, the result was an onslaught of governance risk adjustment proposals intended to prevent similar, more extensive incidents in V1 and V2 non-permissioned deployments; AVAX V3 FRAX, MAI, and LINK markets; and long tail asset, DAI and USDC Ethereum V2 markets. Unsecured lending protocols are not like Aave and there is no need for them to react in a similar fashion! Loans go into default daily. This does not imply global credit markets are broken. It does mean that lenders must demand interest rates commensurate with the borrower’s probability of default and loss-given default. Credit-based lending has the highest probability of default, due to adverse selection, and loss-given default, due to the lack of collateral, of any category of loan, meaning that lenders must demand the highest interest rates. It is not only possible, but EXPECTED that in aggregate, lenders to unsecured borrowers in both trad and crypto spheres will not recover 100% of their outstanding principal. Appropriate interest rates compensate lenders for this potential loss and incorporate the default risk of the borrower. RWAs Today: Mid As F***Let’s face it: while RWAs haven’t technically failed, they have certainly disappointed from an adoption and growth standpoint. Why?

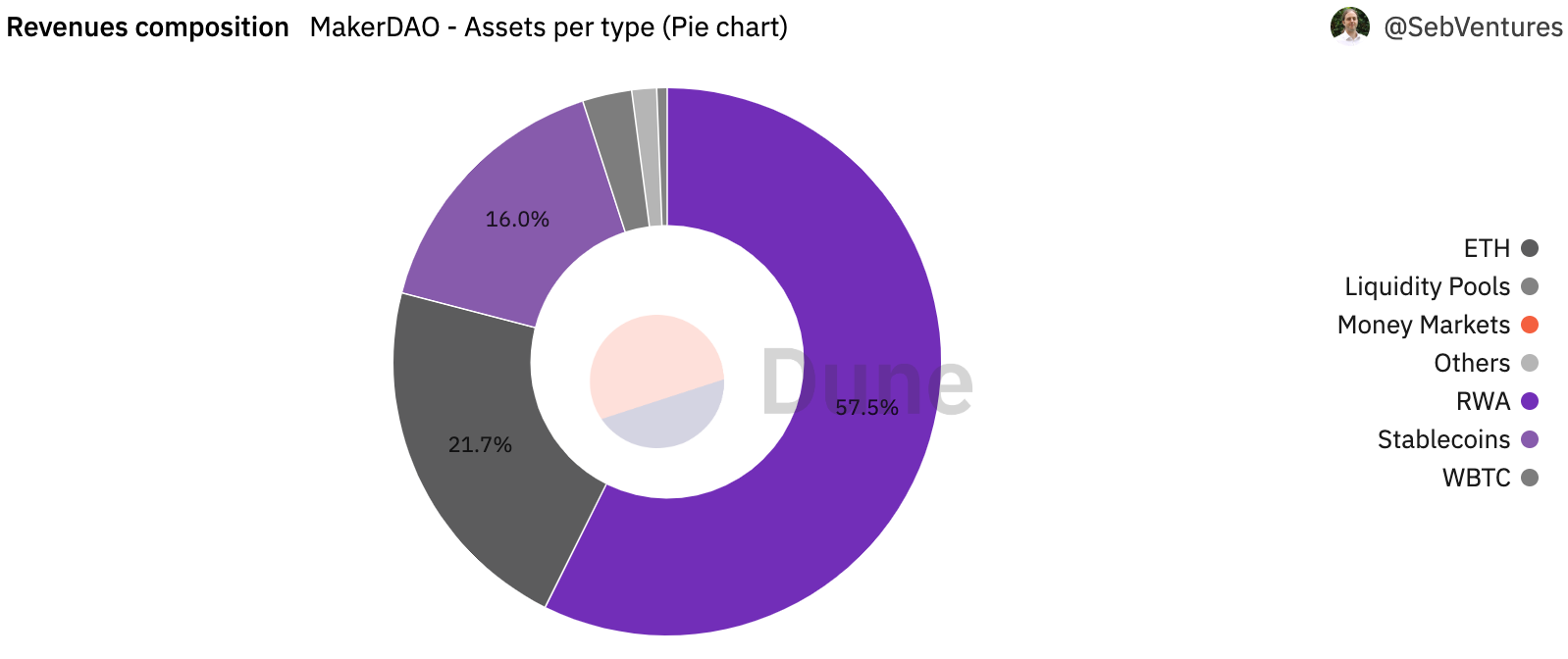

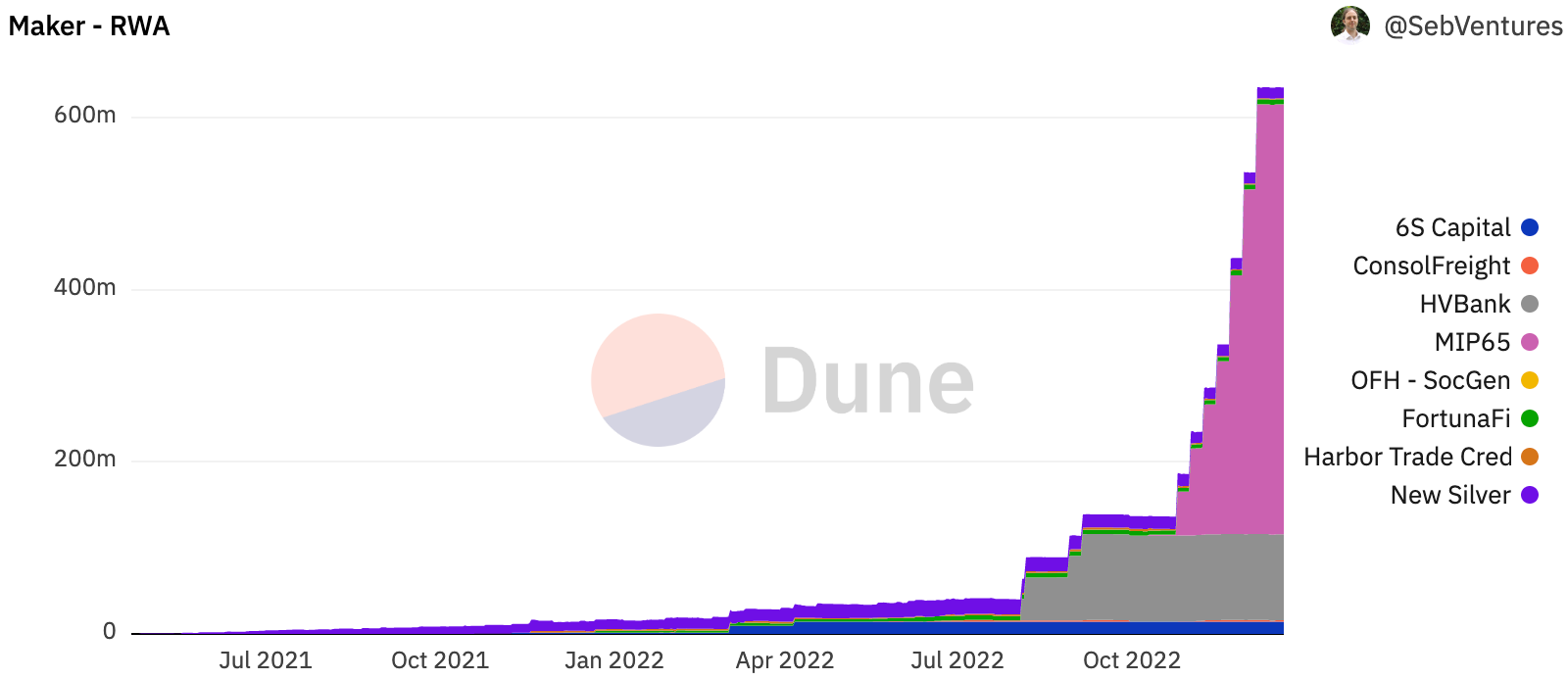

Despite these shortcomings, RWA primitives and implementations have allowed crypto protocols to provide users with uncorrelated sources of yield from diversified investment opportunities, while also serving as public goods by providing lower-cost sources of funding to firms in emerging markets. Yield Generation and Investment DiversificationMakerDAO is one of DeFi’s most prominent RWA pioneers. Over $635M (12%) of outstanding DAI supply is collateralized by real world assets and RWAs generate well over half of the protocol’s revenue.

Excited to cash in on that sweet 1% DAI Savings Rate? Feel free to thank MIP65! Since October, Maker’s Monetalis Clydesdale collateral vault has put nearly $500M of idle collateral to work, earning yield by investing in short-term bond ETFs.

Other MakerDAO RWA relationships include its partnership with New Silver, which leverages Centrifuge, a protocol designed to facilitate decentralized financing of RWAs on-chain, to provide fix-and-flip loans to US borrowers and acts as another source of yield. A first loss, junior tranche position is taken by New Silver, buffering Maker’s collateral value. Huntingdon Valley Bank and Société Générale can pledge portions of their loan books to Maker in exchange for DAI-denominated loans. By increasing the TVL of RWA vaults and diversifying the borrower set, Maker can build a more resilient DAI — the collateral backing the stablecoin becomes less susceptible to market fluctuations as diversification increases. Innovative stablecoin lending schemes built to utilize RWAs are revolutionizing financial markets and provide inflows of uncorrelated yield for crypto natives, while securing crypto assets with relatively stable collateral. Public GoodsGoldfinch is a protocol aiming to generate high yields while also providing relatively low-cost funding solutions for firms based in emerging economies. The Protocol’s self-stated mission is “to expand access to capital by creating a single credit marketplace” for firms of every size in every market. It offers lenders the opportunity to enter into fully collateralized loans, enforceable off-chain with legally binding agreements. RWAs should not simply be valued for their yield generation capabilities. Providing emerging market participants access to decentralized credit markets CAN allow borrowers to lower their cost of capital, helping to spur development and narrow systematic wealth inequalities. I say CAN because I remain somewhat skeptical of these claims. While I want to believe that decentralizing lending marketplaces can meaningfully reduce the cost of capital in emerging economies, mispriced loans may allow the costs of funding to appear well below market, while in reality, lenders are simply not appropriately compensated given the risk profile of borrowers. There are some barriers to acquiring financing in developing nations that increase borrowers’ costs of capital that are not present in developed markets. Protocols like Goldfinch are working to eliminate these. There is also a significant amount of marginal risk in lending to borrowers in developing nations. Often, these loans are denominated in US dollars due to instability in domestic currencies, meaning borrowers face additional foreign exchange risk, in addition to operating in less reliable markets with higher degrees of volatility. Be wary of claims that decentralized technology is a game changer for emerging market funding! Decentralized marketplaces offer underserved borrowers a novel method to acquire financing at lower rates, however, it is highly possible that a large portion of these cost savings are passed through to the lender or subsidized by the Protocol’s token inflation. If you intend for contributions to Goldfinch pools to be investments, conduct your own research on the borrower beforehand! The Future, On-ChainFinally! We’ve arrived. Are you ready to become an RWA bull, anon? The scene: The world has been onboarded to the blockchain. You are finally Bankless. Ethereum flipped Bitcoin a decade ago. SBF still has another century left on his prison sentence. Confused how I deduced this? The first part at least… Today, the legacy analogue systems of yesteryear are long gone, yet beneath the slick hood of your favorite fintech frontend is a beat-ass jalopy — people will make the switch to crypto eventually because it is a fundamentally better system. So what happens in this on-chain future?For starters, you can tell the annoying mouth breather sitting in the corner to suck it because DeFi transactions now have “real” value. Beyond that, every single asset is represented on-chain. Deeds of ownership to any real property (from homes to cars to industrial manufacturing plants to livestock ranches in Montana) will be recorded on-chain. Just as stock ownership has progressed beyond a piece of paper, it will soon progress beyond the walled gardens of Wall Street brokerages. All financial instruments will be issued natively on-chain! Companies will no longer be forced to seek the services of investment bankers to IPO. They will raise in hyper-competitive, open markets accessible to any KYC’d individual. Investors in Nigeria will have the same opportunities to invest in American tech companies as their peers around the globe, while companies in Nigeria will be able to IPO in the same markets and receive equal consideration to their American counterparts. The corporate entity is no longer represented by an LLC, but by a soulbound token or similar primitive. Corporations will never reveal their books, so privacy infrastructure will have to advance to provide complete on-chain anonymity. The solvency and financial standing of any entity can be audited in real time with zk-proof technology, solving contemporary complications to unsecured lending in DeFi. Because ALL assets are issued on-chain and ALL liabilities are assumed on-chain, the solvency of any bank, exchange, pension, insurance plan, private fund, or individual borrower tied to a unique identifier is immediately known. The job security of accountants is no longer guaranteed! Zk-proofs allow audits to be run in seconds, if not minutes, and will be more accurate in their findings and less susceptible to human manipulation. Primitives that we develop for the fun little crypto kiddie pool we call “DeFi” will be applied to the world. Innovative governance approaches will be adopted by corporations and potentially some governments. The principles that we have learned from LPing and yield farming will be applied to tokenized commodities, equities, real estate, MBS securities, and US Treasuries alike. Transaction costs will be greatly reduced. Markets will have greater certainty in their counterparties. New investment opportunities have been discovered. A growing number of individuals are empowered to take control of their own finances and can FINALLY access yield opportunities previously reserved for accredited investors. We begin to break down the arbitrary institutionalized barriers erected around the financial system, designed a century ago by a fraction of the tiniest slice of society. How Do We Get There?By making the trust assumption today. At the end of the day, we could throw out the entire crypto economy in its present form 10x over and barely put a dent in the $119 trillion global debt market or the $111 trillion publicly traded global market cap. Could we lose hundreds of millions or potentially even billions of dollars lending to firms who default on their DeFi debt obligations? Yes. But, we cannot onboard the world to the blockchain if we cannot get the institutional gatekeepers comfortable with our technology. Crypto must meet the market where it is and show it why we have the better system. Once we begin to port sizable real world liquidity on-chain, the disadvantages of remaining insulated in trad markets grow larger, incentivizing even greater blockchain adoption and setting off a flywheel of network effects. This is how Ethereum scales like the internet, Vitalik. Instead of piling onto the RWA hate bandwagon next time, anon, recognize that defaults do occur. Ideally, they never happen, but every “failure” of an unsecured lending protocol represents another learning opportunity. This is crypto. Shit happens all of the time that erases wild amounts of money, be it another ponzi-algo-stablecoin or institutionalized fraud. I simply will not allow you to dismiss the one integration point DeFi has with the real world as just another scam. Action steps

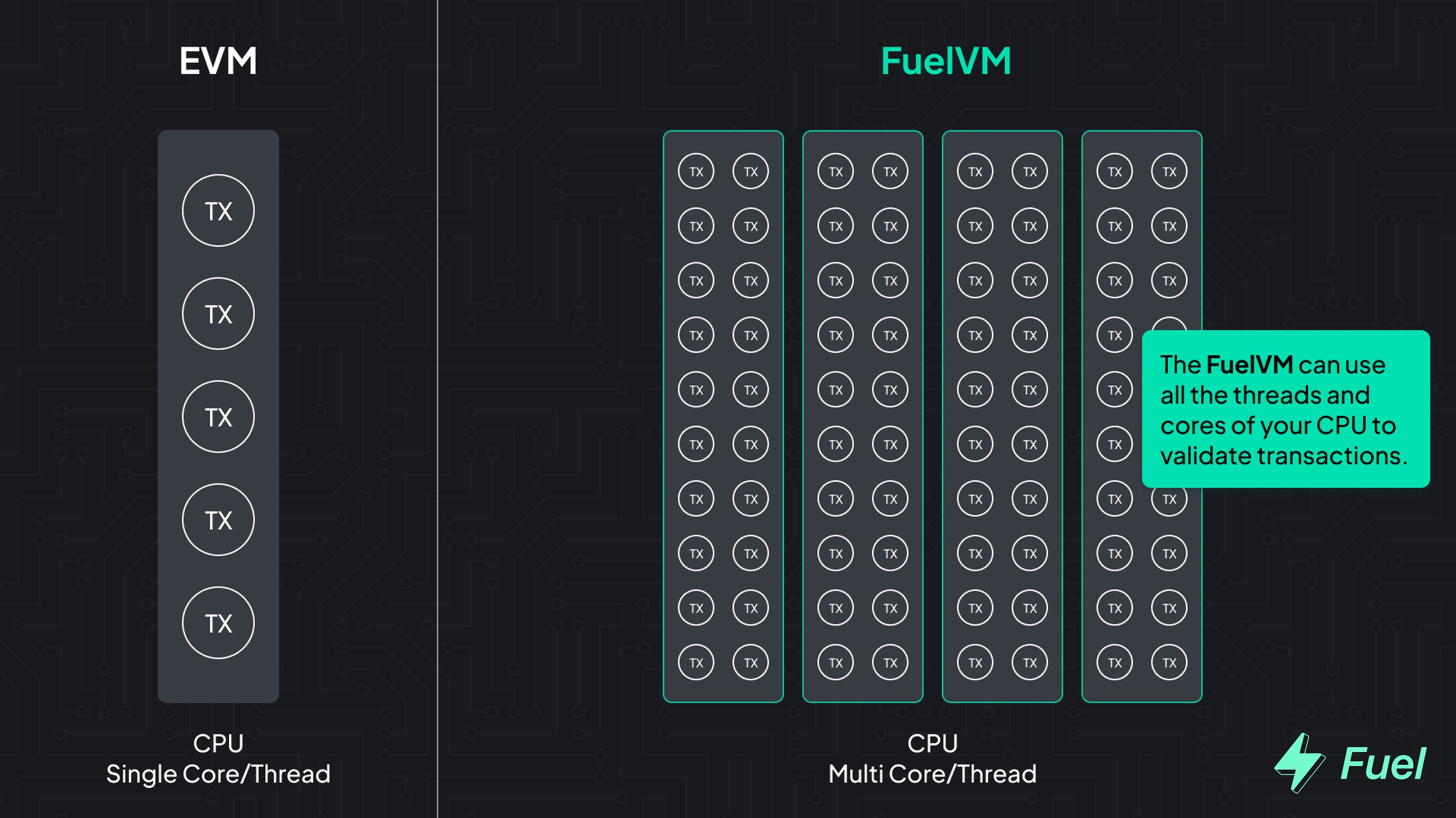

🙏 Together with ⚡️FUEL⚡️Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput. 👉 Go beyond the limitations of the EVM: explore the FuelVM Author BioJack Inabinet is an analyst at Bankless. Prior to working at Bankless, Jack was a Commercial Real Estate Analyst at HAL Real Estate. He’s currently studying Business & Finance at the University of Washington and has been involved in crypto for 2+ years. Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge. 🙏 Thanks to our sponsor FUEL👉 Explore the FuelVM and discover its superior developer experience! Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read Bankless in the app

Listen to posts, join subscriber chats, and never miss an update from Jack Inabinet.

© 2022 Bankless, LLC. |