Regulators Krak Down

Where is the next airdrop coming from? Our team has a few ideas… We’ve just updated our Airdrop Guide yesterday with 5 brand new airdrops – it’s where we put all of our predictions for protocols that are likely to have an airdrop sometime soon. If you’re not already a member of Bankless Premium, upgrade now to get immediate access. Dear Bankless Nation, Regulators are on a warpath. This week, they took aim at US-based exchange Kraken in their latest bout of “regulation by enforcement.” For our weekly recap, we dig into:

– Bankless Team 📅 Weekly RecapHere’s a recap of the biggest crypto news from the second week of February. 1. SEC says no to stakingStaking in crypto is carried out in one of two ways: through a centralized crypto firm, or a decentralized protocol like Lido or Rocketpool. With either, the promise is a yield in exchange for a small fee paid to these services. In yet another case of the SEC’s many instances of “regulation by enforcement”, US-based exchange Kraken agreed to pay a $30 million fine and, more importantly, as part of their settlement — shut down their staking-as-a-service program for US customers.

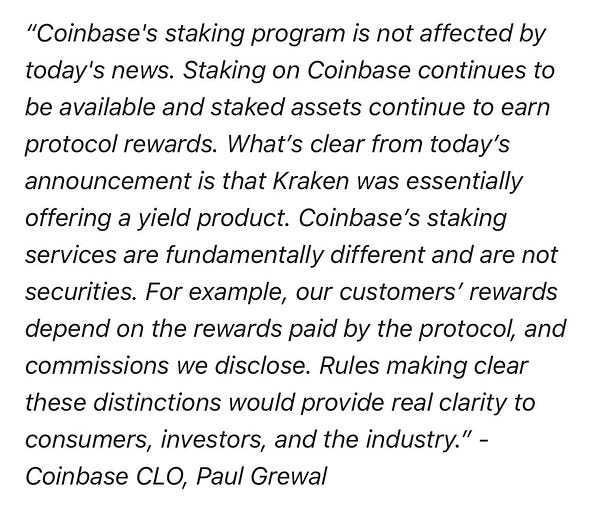

Kraken complied by promptly shuttering its staking service for U.S. customers. Non-US clients can continue to stake as usual. Is the SEC classifying staking per se as a “security”? Lawyer Mike Selig argues that Kraken stepped on the SEC’s toes because its staking yields were derived from pooling customer cryptoassets i.e., an active form of investment. Coinbase has stated that this doesn’t impact their staking-as-a-service program, which has rewards the company claims are consistent with Ethereum’s protocol emissions (unlike Kraken which was offering some higher yields).

Frank Chaparro @fintechfrank

Coinbase says Kraken news will not affect their staking program Sources say they’re willing to fight SEC on this issue

11:06 PM ∙ Feb 9, 2023

1,191Likes224Retweets

In her dissenting post, SEC Commissioner Hester Peirce is calling the SEC’s decision “not an efficient or fair way of regulating” and that the SEC was “shutting down entirely a program that has served people well” in response to a registration violation. A day before the SEC’s actions, Coinbase CEO Brian Armstrong labeled the regulatory decision of banning crypto staking for retail a “terrible path” that would incentivize companies to operate offshore, similar to FTX.

Brian Armstrong @brian_armstrong

1/ We’re hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that’s not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.

11:10 PM ∙ Feb 8, 2023

14,521Likes3,772Retweets

In separate staking-related news, Fintech giant Revolut is about to begin offering crypto staking to European customers. Tokens of liquid staking services – a decentralized form of crypto staking – are also on the up.

Bankless @BanklessHQ

LSD and staking infrastructure governance tokens are responding positively to the news -$RPL is up 15% 📈 -$SSV is up 14% 📈 -$LDO is up 8% 📈 (4/5)

10:04 PM ∙ Feb 9, 2023

92Likes10Retweets

Lido also announced its V2 upgrade which brings its staking router that allows anyone to become a node operator, alongside direct stETH withdrawals from the Beacon Chain.

Lido @LidoFinance

Today Lido contributors are proud to present Lido V2 – Lido’s largest upgrade to date and an important step towards further decentralization. blog.lido.fi/introducing-li…

2:19 PM ∙ Feb 7, 2023

1,086Likes297Retweets

2. Operation Choke Point 2.0American regulators are collectively undertaking a covert operation against the crypto industry by pressuring banks to cut off their financial services. At least that’s the claim by Nic Carter of Castle Island in a bombshell article published this week.

nic carter 🌠 @nic__carter

I don’t want to alarm, but since the turn of the year, a new Operation Choke Point type operation began targeting the crypto space in the US. it is a well-coordinated effort to marginalize the industry and cut of its connectivity to the banking system – and it’s working

3:02 PM ∙ Feb 7, 2023

2,363Likes447Retweets

Carter details a list of regulatory developments in the past two months that points to a continued trend towards stifling the crypto sector. This includes the DoJ’s investigation against crypto-friendly banks Silvergate and Signature, multiple policy statements by the Fed, FDIC, National Economic Council and OCC warning banks against engaging with crypto firms, holding crypto or issuing stablecoins, the Fed’s denial of Custodia’s Federal Reserve membership, Binance suspending USD transfers for retail, and much more.

kamikaz BTC @kamikaz_ETH

Multiple potential black swans in crypto this week (Binance cut off from USD, rumors re: US govt offramp shutdowns, Kraken SEC issue, cbETH shutdown) Holding risk in crypto is insane currently This isn’t “climbing walls of worry” – it’s sitting in a field with mortars going off

9:19 AM ∙ Feb 9, 2023

405Likes49Retweets

Carter is terming this a revival of “Operation Choke Point”, an Obama administration-style strategy in 2013 that threatened regulatory action and pressured banks not to serve industries deemed too risky, such as poker companies, gun dealers, pornography producers and payday lenders. Spurring regulators against fiat on/off-ramps is largely due to the FTX collapse last November. Jake Chervinsky is terming this a kind of “regulation by blog post“.

Senator Bill Hagerty @SenatorHagerty

Regulators singling out business activities should alarm all Americans. It doesn’t matter if it’s cryptoassets, firearms, or any other lawful business, using banking regulators to advance political agendas should not be tolerated.

blockworks.coThe Fed: Crypto Poses ‘Key Risks’ to Banks, but Carry OnThree US financial regulators do not prohibit or discourage banks from providing crypto services to their customers, per a new statemen…

5:37 PM ∙ Feb 8, 2023

1,083Likes233Retweets

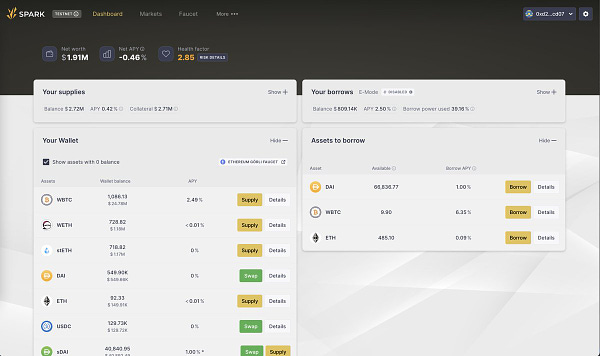

Carter speculates that this will have the impact of driving crypto capital from big to smaller banks, privileging crypto companies with connections to Washington, reducing U.S. crypto competitiveness and hurting crypto businesses that don’t want to deal with the uncertainty of regulatory risk. 3. Maker vs AaveAave’s GHO stablecoin is here on the Goerli Testnet. When Aave announced GHO in July 2022, it sparked concern with Maker stakeholders that GHO would undermine DAI’s competitiveness. Those concerns have led to the launch of Spark Protocol, Maker’s new lending market that is a fork of Aave V3. Spark plans to integrate direct DAI deposits from Maker and aims to launch in April.

Sam MacPherson @hexonaut

I’m super excited to announce the launch of ⚡️ Spark Protocol ⚡️ – a growth-focused arm of the Maker Protocol. Our first product is Spark Lend which builds upon Aave V3 to bring the best lending market features to Maker. 🧵👇

4:59 PM ∙ Feb 8, 2023

398Likes82Retweets

Spark is also integrating with existing DeFi primitives. One such integration is with fixed rate protocol Element Finance’s new AMM DEX Hyperdrive, which lets users take 3-, 6- or 12-month term DAI loans without maturity dates.

Element Finance @element_fi

1/ Hyperdrive is the next research leap from the Element Finance team on variable and fixed rate primitives No preset expiration dates, no fragmented liquidity, and no LP rollovers, aka everlasting liquidity A concept so powerful, you have to experience it yourself Play now 👇

4:30 PM ∙ Feb 7, 2023

191Likes59Retweets

4. Gemini vs Genesis/DCGThe latest developments in the Gemini vs Genesis/DCG is leading to positive news for Gemini Earn customers. Cameron Winklevoss announced on Twitter that Gemini has reached an in-principle agreement with Genesis for Earn users to recover their funds.

Cameron Winklevoss @cameron

1/ Today, @Gemini reached an agreement in principle with Genesis Global Capital, LLC (Genesis), @DCGco, and other creditors on a plan that provides a path for Earn users to recover their assets. This agreement was announced in Bankruptcy Court today.

10:04 PM ∙ Feb 6, 2023

1,678Likes312Retweets

Of the ~$900M owed to users, Gemini will contribute ~$100M. The rest of the recovery funds will come from Genesis liquidating its bankrupt entities and winding down its loan book, and DCG selling shares in its Ethereum Fund, Litecoin Trust, Bitcoin Cash Trust, Ethereum Classic Trust and Digital Large Cap Fund. In addition, DCG will convert the $1.1B promissory note that it gave to Genesis for its failed Three Arrows Capital claims into stock equities, which will be paid to creditors for ~$500M in two tranches. In all, Genesis creditors can expect an estimated 80% of funds recovery.

Andrew @AP_Abacus

UPDATE: DCG/Genesis creditors have been told to expect capital returns of 80%. **beyond that number depends on a convertible preferred equity note and “realized liquidation prices” based on DCG/Genesis assets.

11:14 PM ∙ Feb 6, 2023

213Likes43Retweets

5. CoW Swap hackCoW Swap DEX was hacked for 550 BNB and transferred to Tornado Cash. The exploit stems from the protocol’s “solver”, an external party who posts a slashable bond and whose purpose is to find the best execution routes for traders. The solver in question apparently approved a malicious contract that led to the exploit.

smartcontracts.eth (✨🔴_🔴✨) @kelvinfichter

Ok whew it took like a million tweets but we figured it out. A CowSwap solver goofed and wrote a bug in a helper contract which led to loss of some CowSwap fees. CowSwap solver will likely be on the hook because they’re bonded with Gnosis/CowDAO (apparently $1m standard bond).

smartcontracts.eth (✨🔴_🔴✨) @kelvinfichter

Hmmm looks like CowSwap got exploited for ~$150k. Trying to piece it together, super weird. Time for live hack thread I guess bc I can’t sleep 5:50 AM ∙ Feb 7, 2023

86Likes21Retweets

User funds weren’t impacted.

CoW Swap | Better than the best prices @CoWSwap

Last night, a hacker exploited an external solver and used it to drain the settlement contract, which held 7 days worth of protocol fees. Users are not affected since we never hold user funds (!) Neither Cow Swap is affected: The solver’s bond will pay for all damages. A 🧵👇

9:11 AM ∙ Feb 7, 2023

533Likes121Retweets

Other news:

🙏 Together with 🦊 MetaMask Learn 🦊MetaMask Learn is an educational resource to help people understand what web3 is, why it matters, and how to get started. While you may understand core concepts of this decentralized technology, many don’t—consider adding MetaMask Learn to your onboarding guides if you’re a dapp developer or NFT creator to give your community the welcome they deserve. 📅 Recap for the 2nd week of February, 2022READ 📚METAVERSAL 📚BANKLESS DAO 🏴WATCH 🔊

🎙️NEW WEEKLY ROLLUPListen to podcast episode | Apple | Spotify | YouTube | RSS Feed Job opportunities 🧑💼✨See all listings on the Bankless Job Board✨ 🙏 Thanks to our sponsor MetaMask Learn👉 Add MetaMask Learn to your onboarding guides for your community ✨ Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto) Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This newsletter is not tax advice. Talk to your accountant. Do your own research. Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

© 2023 Bankless, LLC. |