Retail Investors Are Pouring Capital Into The Market Like Crazy People

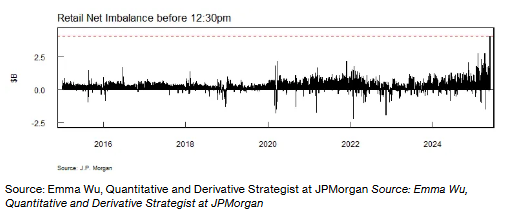

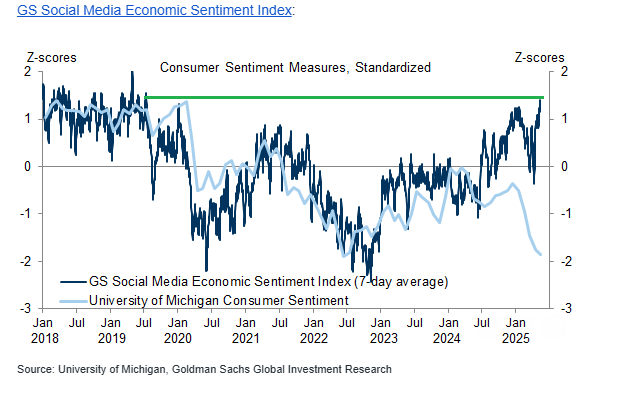

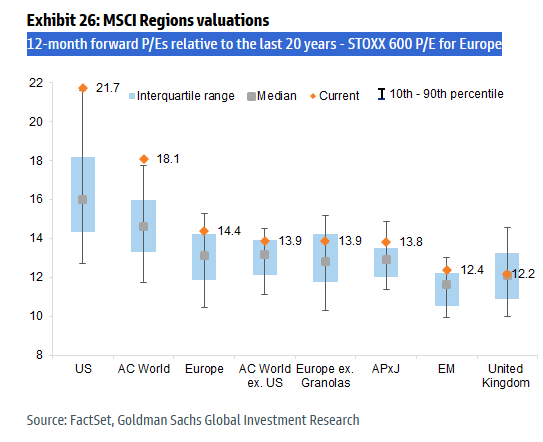

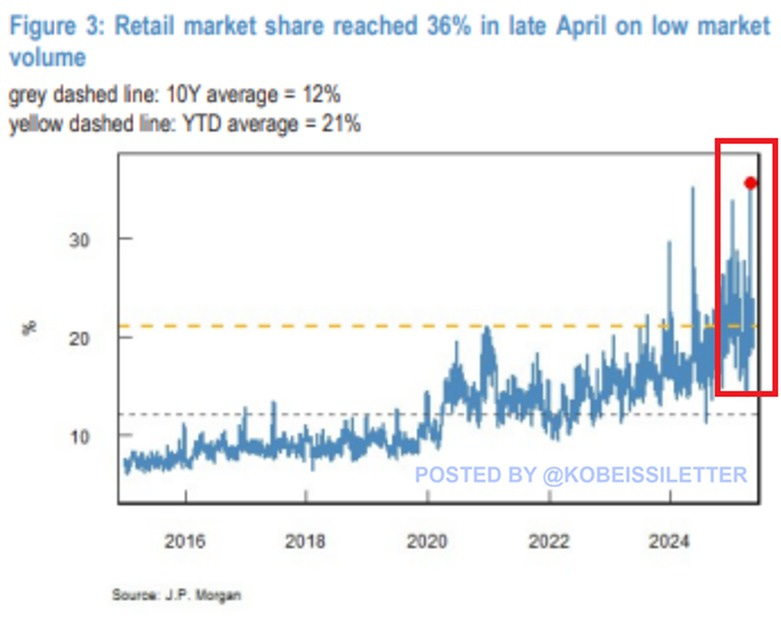

To investors, Retail investors have long been thought of as the “dumb money” in financial markets. The hedge funds and large institutions were the sophisticated money. They had the Ivy League degrees, lots of technology at their fingertips, and they were paid millions of dollars per year to find the edge to create massive profits. But multiple data points in recent years suggest individuals on the internet are catching up to the institutions in terms of intelligence and sophistication. Here are some examples — individuals beat institutions to understanding and buying bitcoin, the best performing asset in the last 15 years. Individuals understood the structural imbalance in Game Stop a few years ago and exploited it, while bringing one of the largest hedge funds to their knees. Individuals bought the dip in 2020 from the pandemic and they bought the dip in April of this year thanks to the tariff uncertainty. And individuals bought Tesla and Palantir stock early when most institutions didn’t believe the companies could thrive. Just because retail is getting smarter and driving better results doesn’t mean the institutions are dumb. In fact, the opposite is true. Wall Street is full of incredibly intelligent, hard-working people who are obsessed with finding an edge when allocating capital. But what is also true is that independent investors now have access to more information than ever before. The playing field is becoming more level, which disproportionately helps the little guy. Due to this increased success of independent investors, it has become increasingly important to pay attention to what retail capital flows look like. Yesterday we saw this group of investors trade $4.1 billion in the first 3 hours of trading. This is the largest capital inflow from retail in history. Amit is Investing shows JPMorgan data that reports the two biggest stocks during that time period? Palantir and Tesla. Palantir saw more than $430 million of inflows, while Tesla saw $675 million. Even more interestingly, single stocks were $2.5 billion of the purchases while ETFs comprised $1.5 billion. Simply, retail investors are optimistic and they are deploying capital into the market like their financial lives depend on it. This coincides perfectly with social sentiment exploding higher. Mike Zaccardi shows the Goldman Sachs Social Media Sentiment Index hit its highest level since July 2019. Mike also points out that while retail investors are going long, the P/E ratio of US stocks has returned near the highs of 21.7x. Does that spell danger? Maybe. No one actually knows yet, but the data is overwhelming that retail investors are jumping headfirst into the market. So what is the “smart money” doing during this time? They are caught offsides on this recovery rally. Institutions and hedge funds have the lowest allocation to US equities since May 2023 right now. Stocks have been going up, yet the big pools of capital are not participating at the same rate that independent investors are. Why could that be? An account on X called The Short Bear had an interesting take:

This is ultimately one of the big differences in how institutions and retail will diverge in their allocation decisions for the coming years. Institutions are managing capital with a focus on not being fired by their clients. Retail is managing capital with a focus on making as much money as possible. Neither strategy is right or wrong — they can both work. But it is important to remember the different motivations from each group. And if you are ignoring retail’s rise, I think that will be a mistake in hindsight. As I shared yesterday, retail investors saw their share of the market hit 36% in April. That is more than 1 out of every 3 dollars coming from independent investor already, which probably will continue to accelerate in the future as well. You love to see the independent little guy getting a seat at the table. Let’s just hope they continue to do well in their investments over the coming years. Have a great day. I’ll talk to everyone tomorrow. – Anthony Pompliano Founder & CEO, Professional Capital Management READER NOTE: We launched a new product this weekend to help investors manage their financial lives. The product uses AI models to track your net worth, analyze your portfolio, answer any questions you have about your finances, and make suggestions on how you can improve. You can add public stocks, private investments, crypto assets, cars, houses, investment properties, collectibles, and any other assets you own. You can text, email, or call the CFO too which is really cool. The CFO, called Silvia, now has more than $1.8 billion in assets connected on the platform. You can sign up for the product completely free here: https://www.cfosilvia.com/ Sign Up For Silvia For Free Here Jordi Visser Talks Bitcoin, Tariffs, Bull Markets, and Artificial IntelligenceJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we evaluate economic data, bitcoin, stocks, inflation, acceleration of AI, and the global economy. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2025 |