Shocking Stats About Your Purchasing Power And The US Dollar

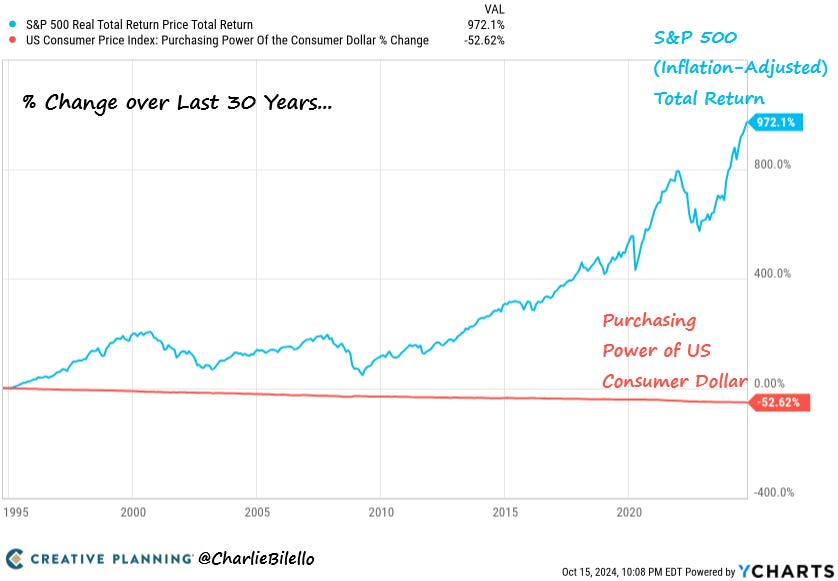

Today’s letter is brought to you by REX Shares!Whether you’re bullish 🐂 or bearish 🐻 on MicroStrategy, T-REX ETFs are your gateway to dynamic market plays. Get exclusive access to leveraged exposures with the first ETFs designed specifically for MicroStrategy stock. To investors, Creative Planning’s Charlie Bilello posted this eye-opening chart earlier this week. It is probably one of the most important visualizations in finance.

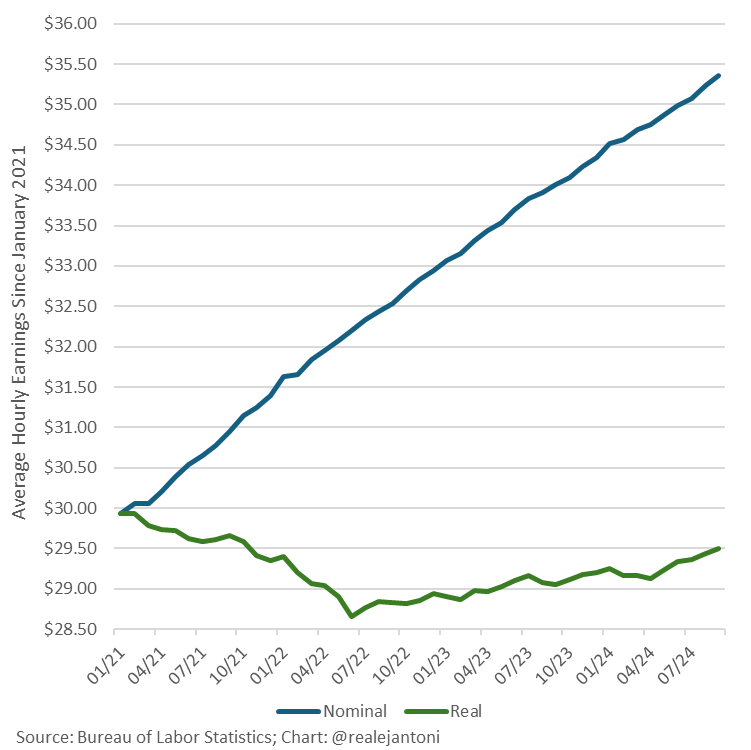

This is insane to think about — a 50% drop in the US dollar purchasing power in a single generation. It is obviously difficult for anyone to protect their hard-earned economic value if the native currency is devalued at such a rapid pace. As if that was not bad enough, Heritage’s EJ Antoni explains what is happening on an hourly wage basis:

Add in the fact that some goods and services are still skyrocketing and you can see why the problem is getting worse for many people. Ivory Hill’s Kurt Altrichter highlights the following increases:

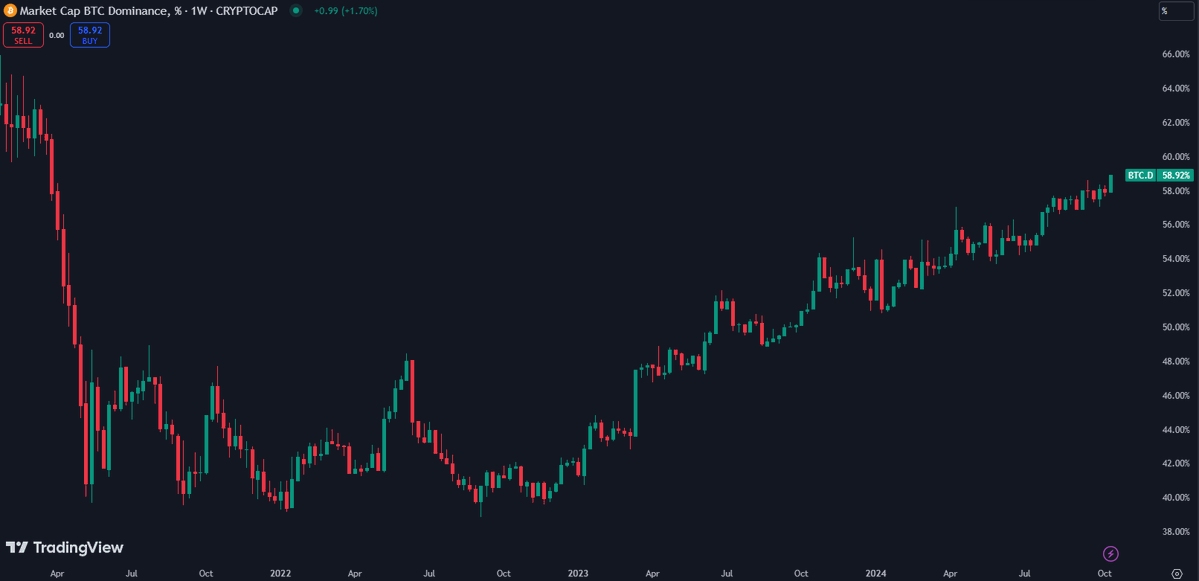

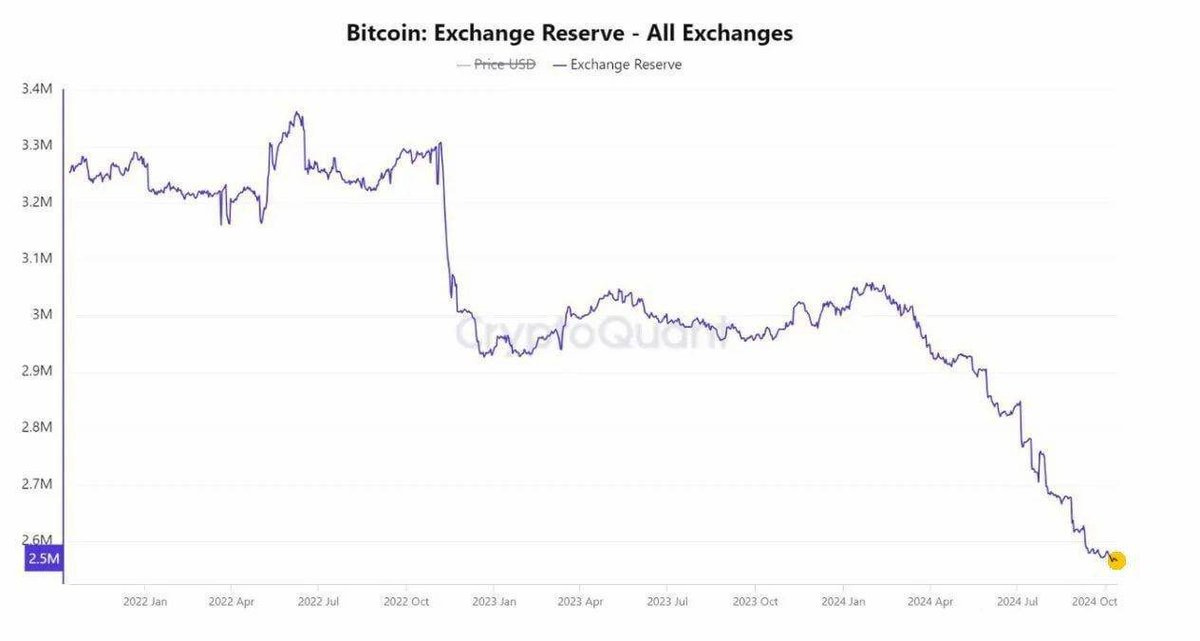

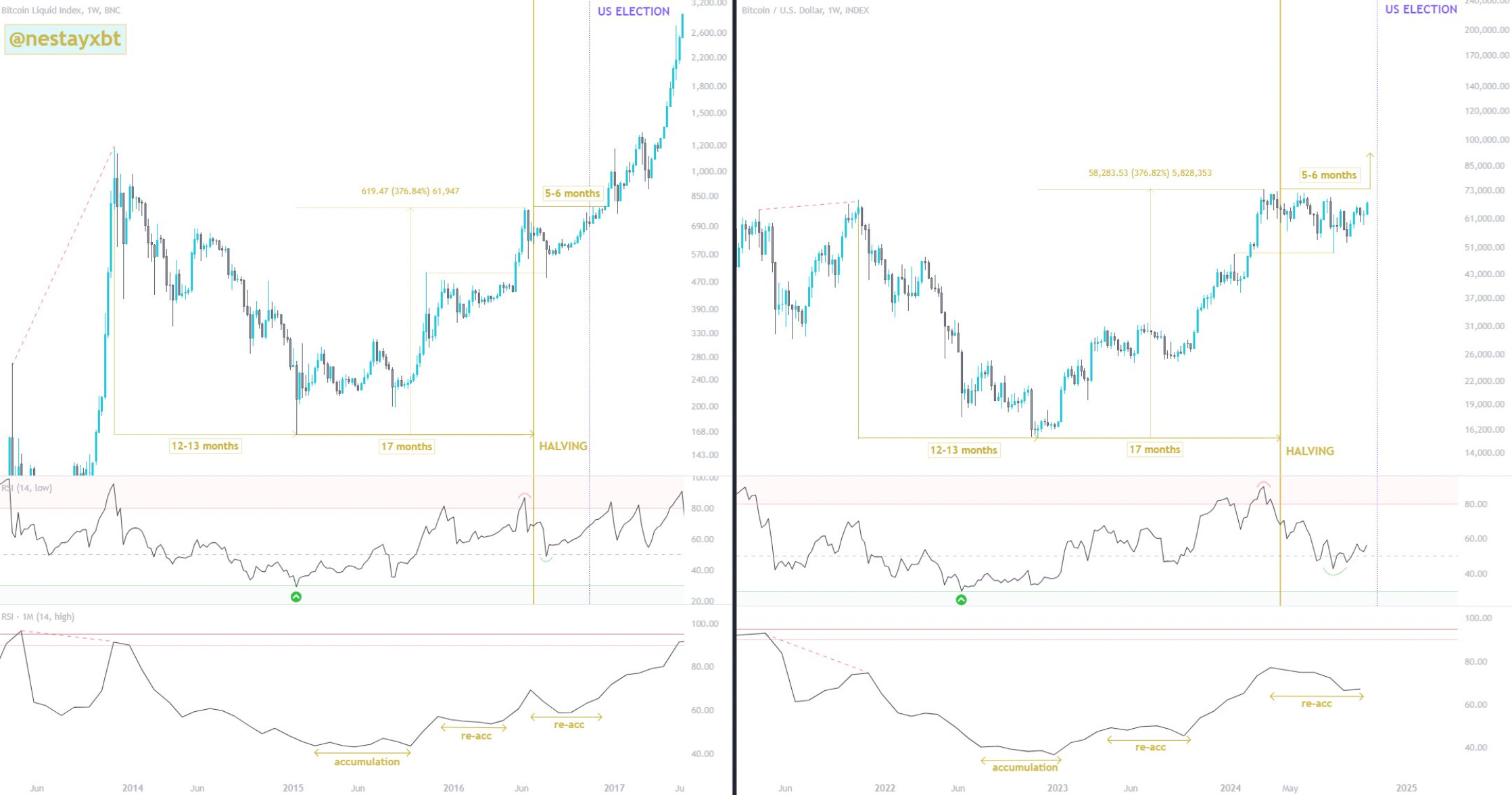

These data points are hypothetical sucker punches to the financial health of every American citizen. It shouldn’t surprise anyone that tens of millions of these people are seeking out a different store of value. Bitcoin’s market dominance just hit a new cycle high of nearly 59%. This reiterates the point that investors are choosing to pour more capital into bitcoin than other crypto assets. Investors are not only buying bitcoin, but they are taking the bitcoin off exchanges. Marty Party explains that “bitcoin reserves on centralized exchanges hits all-time low.” Lastly, Nestay and other crypto analysts have been pointing out the similarities between the 2016-2017 bull market and the current 2024-2025 bull market. I am highly skeptical of these chart comparisons, especially when they selectively pick different bull markets to compare to each other. I do think they are important to be aware of though because they suggest what is possible more than what is actually going to happen. We are entering a very interesting time for bitcoin — the asset is starting to price in the bitcoin halving that occurred earlier this year, interest rates are being slashed around the world, M2 money supply is expanding, investors are becoming more bullish, and there is a 50/50 chance that former President Trump comes into office to enact various policies aimed at pushing asset prices higher. Put all this on the backdrop of where we started this letter — the US dollar has lost 50% of its purchasing power over the last 30 years and the average hourly wage is down after adjusting for inflation — and it becomes easy to see why bitcoin is the trade for an entire generation. The next few weeks should be fun. Hope everyone has a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management 🚨 Talk or Hang Out With Anthony Pompliano 🚨I want to meet you. In order to get the meeting scheduled, you have to purchase a certain amount of my new book, How To Live An Extraordinary Life. You can do one of the following:

You can use this link to purchase up to 100 books and then use this link for a discount on bulk buys over 100 books. Here is how it works:

I have already done a few calls with people and spoken at different events. It is just as fun for me as for you, so I look forward to meeting many of you as well. My CNBC Appearance From This MorningI spoke to CNBC’s Squawk Box about bitcoin being the modern savings account and stablecoins being the modern checking account. This framework will make it easier to see why bitcoin and the US dollar complimentary moving forward. All boats rise together in this scenario. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.

© 2024 |